Resources

1. You Need the Stock Market

Who needs the stock market? You do! That is, if you want to retire some day. Or if you have children and you'd like to help them pay for college. Or if you have a future dream/goal/plan that requires more money than you have now.

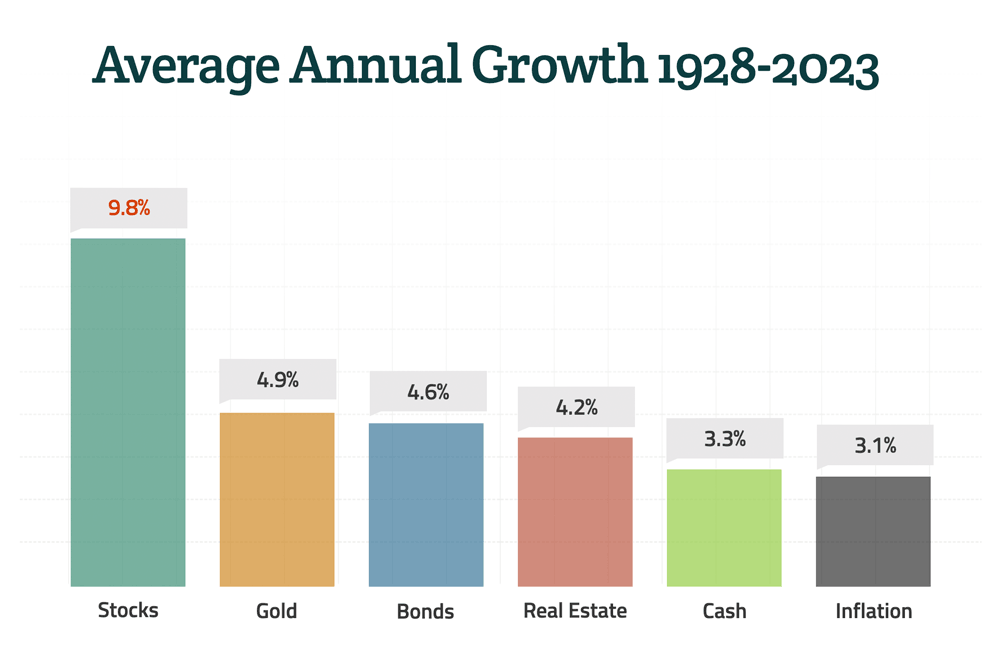

For as long as people have been keeping track of such things, the stock market has provided the best long-term returns of any asset class. As you can see in the chart below, the stock market's long-term average annual return is better than bonds, gold, housing, and cash.

Sources: Performance data for Stocks, Bonds, Gold, Real Estate, and Cash are from Aswath Damodaran at the Stern School of Business at New York University. "Stocks" reflects the performance of the S&P 500 (dividends included). Gold returns were calculated from price information obtained from the World Gold Council and the London Bullion Market Association (LMBA). "Bonds" refers to returns on the 10-Year US Treasury Bond. Real Estate returns were derived from housing data compiled by economist Robert Shiller. "Cash" returns reflect the performance of US 3-Month T-Bills. The average Inflation rate over the 1928-2023 period was calculated from the U.S. Government's Consumer Price Index.

Sources: Performance data for Stocks, Bonds, Gold, Real Estate, and Cash are from Aswath Damodaran at the Stern School of Business at New York University. "Stocks" reflects the performance of the S&P 500 (dividends included). Gold returns were calculated from price information obtained from the World Gold Council and the London Bullion Market Association (LMBA). "Bonds" refers to returns on the 10-Year US Treasury Bond. Real Estate returns were derived from housing data compiled by economist Robert Shiller. "Cash" returns reflect the performance of US 3-Month T-Bills. The average Inflation rate over the 1928-2023 period was calculated from the U.S. Government's Consumer Price Index.