Resources

7. You Can Beat the Market

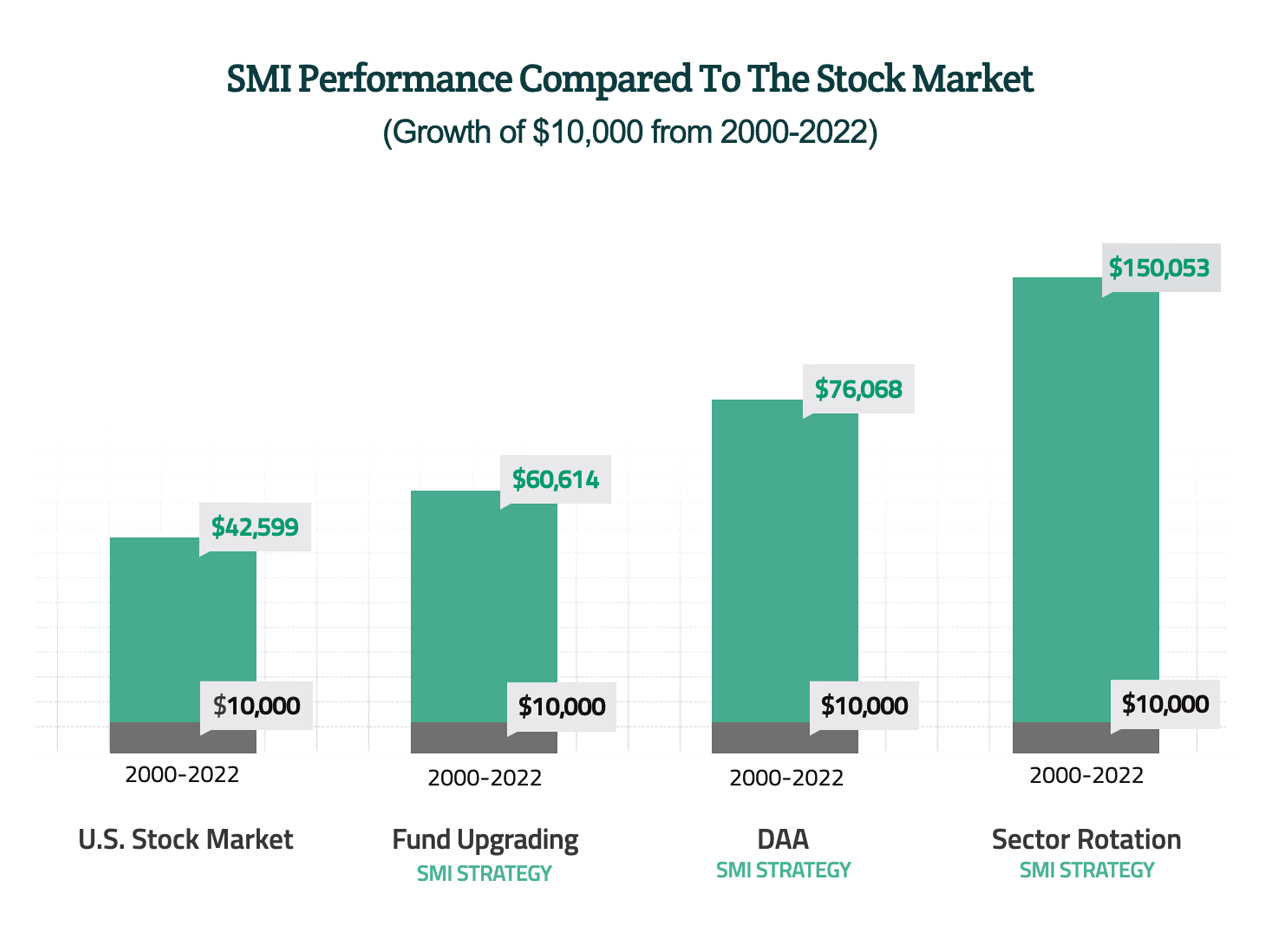

Even though we don't believe in market timing, we do believe in outperforming the market — and that's what our strategies have done over time. Consider the period from 2000-2022.

SMI's Fund Upgrading strategy produced an average annual return of 8.1%.

Dynamic Asset Allocation (DAA) strategy did even better, generating an average annual return of 9.2%.*

Sector Rotation, our optional strategy designed for use with just a portion of your portfolio, generated an average annual return of 12.5%.**

Compare those SMI's returns to the overall market's annualized performance of 6.5%.*** And bear in mind that our strategies produced market-beating returns without any attempt to predict what the market will do next!

The graphic below compares how a hypothetical investment of $10,000 would have fared over the 2000-2022 period depending on how it was invested.

*DAA results before 2013 are based on backtests using the same methodology now employed in DAA.

*DAA results before 2013 are based on backtests using the same methodology now employed in DAA.

**Sector Rotation results before Nov. 2003 are based on backtests using the same methodology now employed in SR.

***"Overall market" refers to the Wilshire 5000 index, the broadest measure of market performance.