Asset allocation is sometimes referred to as “your most important investing decision.” However, it is not a magic bullet that always protects a portfolio from loss, nor does it guarantee market-beating returns. Let’s take a closer look at exactly what asset allocation can — and can’t — offer investors.

Asset allocation describes the process an investor goes through in dividing money among various types of investments (also called “asset classes”). This typically begins with a decision about how to divide a portfolio between stocks and bonds, but it may also involve including other broad asset classes (such as gold, real estate, and others). Academic studies indicate that these asset-allocation decisions play a larger role in determining investment returns than do the specific investments chosen within each asset class.

Done properly, asset allocation enables an investor to build a portfolio that balances risk and reward. The most common way to do this is based primarily on the investor’s age. The younger the investor, the more appropriate it is for the portfolio to be heavily, if not completely, concentrated in stocks (and other “invest-by-owning” types of investments). While a portfolio consisting primarily of stocks and stock funds will experience significant ups and downs, such an approach has rewarded the long-term investor better than any other asset class.

However, as an investor ages, he or she has less time to ride out market losses. So, it’s wise to gradually decrease portfolio volatility by reducing one’s stock-based investments and increasing allocations to safer investments, which traditionally has meant more bonds.

What asset allocation can’t do

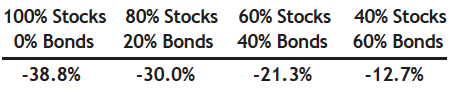

Perhaps the greatest myth of traditional asset allocation is that it will eliminate losses. Diversifying across different asset classes can decrease the volatility of a portfolio, but there are occasions when almost all asset classes move down together and losses are inevitable. This was true in 2008. Although bonds generally made money, virtually everything else plummeted. However, that year provides a good illustration of how asset allocation can affect how much an investor loses.

Consider the table on the right. An investor who was 100% invested in SMI’s Stock Upgrading strategy lost -38.8% in 2008. Shifting the allocation mix to 40% stocks and 60% bonds limited losses to just -12.7%. (Note: these numbers don’t account for the newer Upgrading 2.0 defensive protocols, which would have limited losses significantly.)

Of course, this works both ways. As the market recovered after the bear market, the 100% stock investor enjoyed much larger gains than those with more conservative allocations.

To fix or to flex?

The process we’ve been discussing so far is known as strategic asset allocation. This form is what SMI long emphasized: begin with your risk tolerance and season of life, and build a more-or-less permanent asset allocation plan based on those factors.

For strategic asset allocation to work, however, it requires investors to stick with the allocation through good markets as well as bad. Normally, the only changes made to the allocations are to rebalance the portfolio annually in order to bring it back into alignment with the initial allocation schedule.

The problem with strategic asset allocation is that investors’ emotions frequently get the best of them. They may start out with the best of intentions to stick with their long-term allocations “through thick and thin,” but eventually the fear created by steep market losses causes them to shift to a more conservative portfolio (that is, they sell stocks mid-bear market). This usually locks in existing losses at the worst possible time. When the market eventually rallies, the recovery of such investors’ portfolios is slowed by their new, more conservative allocation.

Understanding tactical asset allocation

As market declines steepen, emotional stress grows. SMI’s nearly 30 years of experience has made clear that many investors are going to do something in an effort to relieve the emotional pain at those pressure points.

This emotional-stress dynamic is partially responsible for the changes SMI has made to its strategies in recent years — specifically building defensive protocols right into the regular operating procedure of two key strategies, Dynamic Asset Allocation (DAA) and Stock Upgrading 2.0. This allows investors to respond protectively within the context of their long-term plan and long-term strategy mix, without sabotaging their long-term results. By keeping these changes within the confines of a structured, mechanical system, the hope is that emotional reactions which might ultimately damage their long-term investing returns can be avoided.

Making allocation changes in response to market events is known as tactical asset allocation. Such an approach offers a particular set of strengths and weaknesses just as strategic asset allocation does.

Critics sometimes dismiss tactical asset allocation as “market timing,” and depending on the way it is carried out, it can be just that. But there are different approaches to tactical asset allocation, ranging from making incremental adjustments to an otherwise unchanging asset allocation (as Upgrading 2.0 does by gradually shifting stock holdings to cash during bear markets), to making more significant ongoing changes based on various factors, as DAA does.

Conclusion

The asset-allocation aspect of setting up a portfolio used to be more straightforward when all SMI investors started with the traditional allocation process based on age and risk tolerance. Now, the asset allocation process an SMI member uses depends on which strategies he or she chooses. In other words, SMI used to take all new members through the asset-allocation process first, then had them select which strategies they would use. Now, we select the strategy (or strategies) first, then deal with asset allocation second.

This change is due primarily to our DAA strategy, which relies solely on tactical asset allocation. So if DAA is a person’s only strategy, there’s no need to go through the asset allocation process at all — DAA will take care of it as part of the strategy’s ongoing process. If, on the other hand, an SMI investor is using either Fund Upgrading or Just-the-Basics for part (or all) of a portfolio, the traditional strategic asset-allocation process is applied. This involves taking SMI’s risk-tolerance quiz and using our Seasons of Life chart to determine the portion of Upgrading and/or JtB to devote to stocks versus bonds.

While this has required SMI’s “getting started” process to change a bit, it’s worth it. The new tactical asset-allocation tool, as implemented within DAA and Upgrading 2.0, strengthens one’s ability to respond to — and to weather — market storms. We believe these defensive improvements to our portfolios will be vital in the years ahead.

When it comes to investing, emotional decision-making typically leads to poor performance. While the fixed asset allocations of the past have been partially replaced by a more flexible approach driven by SMI’s mechanical strategies, these objective, measurable processes for dividing your portfolio among diversified asset classes provide an important defense against future bear markets — and your own emotions.