Anybody feeling tired yet?

As we enter the eighth month of this bear market, I’m feeling the exhaustion creeping in. That’s amplified by the fact that we’ve had this head-scratching rally that keeps...running...higher, which is painful when we’re largely positioned for more downside.

So while there are a hundred little details I’m tempted to delve into, I’m going to do my best to keep this focused on the big picture.

Nothing has fundamentally changed

We came into 2022 with a clearly defined thesis: Higher inflation was going to force the Fed to tighten financial condidtions despite (or "into") a slowing economy. History clearly tells us that this is the worst possible combination for investors. So before you were hearing that anywhere else, or even before the S&P 500 index had even peaked yet, you were reading that very clear description in SMI.

As we take stock of the situation 8.5 months after that was first laid out in the January issue of SMI, what has changed?

The last inflation print showed CPI at 9.1%, the highest in 40 years.

The Fed is still tightening at an extremely rapid clip, albeit off extremely low levels. Consider this tidbit from Chase Taylor of Pinecone Macro, who points out there have only been three 75 basis point interest rate hikes by the Fed in the past 30 years, and two of those have happened in the past 45 days.

And nearly every day we get a new economic report of some sort showing that not only is the U.S. economy slowing, but economic conditions all around the globe are slowing rapidly. A few months ago, it was an open question whether the U.S. would slip into a recession or not. Now the debate has shifted to whether the U.S. has already slipped into a recession (with the answer being pretty clearly yes, given that two consecutive declining quarters of Real GDP — as was reported last week — has a perfect track record of eventually being labeled a formal recession over the past several decades).

Put it all together and we find...high inflation is causing the Fed to tighten financial conditions into an economic slowdown. Exactly what we were concerned about at the beginning of the year.

It’s reasonable to question whether the -20% to -30% decline the stock market has already experienced has sufficiently adjusted for all these factors. I’m not convinced, primarily because history also tells us that bear markets that are accompanied by recessions tend to last significantly longer and cut deeper. And while "bubbles" are squishy to define and an obviously small sample size, the fact that we started this bear market at historic extremes in terms of market valuation in virtually every asset class, it’s hard for me to believe a below-average bear market in terms of length and severity is somehow going to be all we get. But time will tell.

Fed policy works on a "long and variable lag"

Circling back to that Chase Taylor point regarding two of the largest rate hikes of the past 30 years occurring in the past 45 days, it’s really a critical insight. The famous economist Milton Friedman observed way back in 1961 that attempts by the Federal Reserve to stimulate or slow down the economy via changes in interest rates take time to work their way through the economy. The "long and variable lag" was long thought to be 12-18 months, and while I’d suggest that the rapid dissemination of all new information these days has likely cut that period shorter, I’m quite confident it hasn’t cut it to 45 days.

While the Fed waited way too long to get started tightening financial conditions, the fact is they have made aggressive changes recently. Those changes have not yet been fully felt in the broader economy. This lag is why the Fed so often overdoes their policy moves in both directions — by the time they can actually gauge the true impact of their policy changes, so much time has gone by that they’ve already made several additional moves.

Bigger (and scarier) point: Not only does the Fed not know what the "neutral rate" is (the rate that is neither stimulating nor restricting the economy), nobody else does either. It was Powell’s remark last week about the neutral rate being around 2.5% that sent the stock market racing higher again, because investors assumed he was suggesting the Fed would quit hiking around that point.

Admittedly, it was a silly thing for him to say. But with inflation at 9.1%, anyone who claims to know what that rate actually is today is fibbing. This process is going to be trial and error all the way, with the slight problem of the impact of today’s policy choices not being fully evident for many months down the road. In other words, this ride could get bumpy.

Unfortunate and potentially confusing comments like Powell’s "neutral rate" gaffe aside, I don’t believe this Fed is going to quit tightening financial conditions until inflation comes down meaningfully from today’s levels. Ironically, big stock market rallies act to loosen financial conditions, and in so doing sow the seeds of their own demise, as they force the Fed into additional tightening down the road.

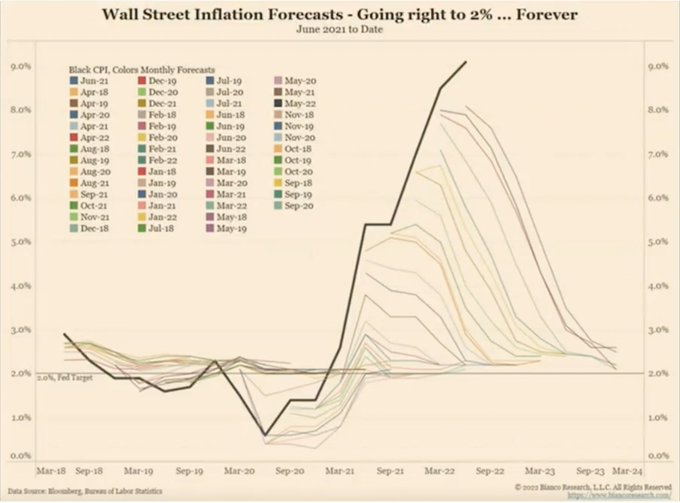

(Sidenote: the Fed has a long history of projecting inflation will move directly to 2% from wherever it is today, whether it’s running below that level as it did for most of the past decade, or way above it at 9.1% as it is today. Regardless of the starting point, they’re always convinced it will move directly to 2%. Powell’s 2.5% "neutral" estimate last week was simply him doing that yet again and then adding a half-point buffer, which is normally assumed to be appropriate for the Fed funds rate over the inflation rate. This chart, from Jim Bianco, shows this tendency to assume inflation is heading directly to 2% no matter where they are starting from.)

Bear market rallies are intense

Have you ever wondered why bear markets take so long? They don’t necessarily have to. Buyers and sellers can collectively reprice markets pretty quickly, as we saw in March 2020 when it took roughly one month for investors to decide the stock market was worth -35% less in light of the new COVID threat.

But much more common is that bear markets drag out much longer. We noted in June that the last six bear markets averaged 16 months, and if you throw out the 1-month COVID bear and the 1987 crash, the other four averaged 22 months. Almost two years on average for the typical grinder. We’ve been in this bear for seven months and it already feels like forever. So why does it take so long?

It’s largely about investor sentiment, which swings from despondent to "exceedingly optimistic" and back again. By mid-June, investors as a group were really pessimistic. Boom, temporary bottom and the market has been climbing for 6-7 weeks since. Arguably, based on the way investors have responded to the Fed news last week, it seems to me that we’re shifting back to the optimistic side of the boat now. But as we’ve often told you, sentiment (like valuation) aren’t necessarily reliable short-term timing indicators. Sentiment (good or bad) can persist for a while even when seemingly at extreme levels.

This is where it’s helpful to know two things. First, SMI’s strategies are watching the longer-term trends, which is how we avoid most of these whipsaws within bear markets. While the market has experienced an impressive bounce higher since mid-June, it hasn’t been enough to flip any of the primary trends back positive. That’s not to say it can’t happen, just that we’ve purposely designed the systems to allow for these counter-trend rallies without disturbing our positioning.

The second thing that’s helpful to know is why we’ve designed the systems that way. Simply put, history shows us that dramatic bear markets rallies are par for the course. We’ve shown several variations of the chart linked to in the June Editorial above, detailing the % moves of the various declines and advances within the past two big bear markets. Summarizing those numbers, we find that the average counter-trend rally in the 2000-2002 bear market was about +15%, while in 2007-2009 the average was about +12%. Both of those bears saw rallies over +20% that failed and rolled over to lower lows.

This lends some important perspective to the current rally of +13.4% from the June low (S&P 500). What was the average rally during the prior two big bear markets? Look at that... roughly +13.5%.

History is history, averages are averages, and nobody knows for sure what this current rally is going to do. Many investors are optimistically beginning to position as if the bear market is over. The past dozen years has taught them that market downturns are brief and it pays to be in "risk-on mode" all the time. This type of thinking is exactly what keeps bear markets going so long.

Nothing we’ve seen yet in this bear market has been unusual market behavior. Bear markets always produce rallies like this.

Given that our rationale coming into the year is unchanged, and nothing historically unusual has happened to make us question that this market is ultimately heading lower, I continue to believe we’re in an unfolding bear market and our current positioning is appropriate. Though, admittedly, currently a bit uncomfortable.

SMI strategies won’t let us stay wrong for long...once the longer-term trends are actually breached

Importantly, we don’t simply talk ourselves into a position and then stubbornly refuse to change it. We’ve already had one example (at the end of March) where a counter-trend rally had us briefly reverse course and add back stock exposure. If the market rallies through August and ends the month higher than we are today, we’ll likely have that happen again.

That’s okay, because just as we acted incrementally to get more conservative as the market fell into the bear market earlier this year, we’re willing to follow the market’s primary trends and adjust that back the other way if we need to. I don’t expect that, based in part on the fact that August and September are historically the market’s weakest two months, so I think there’s a confluence of events coming that will likely end this bounce soon. But admittedly, I was totally wrong about my expectations for July and the beginning of earnings season, so who knows? This is why we follow the primary (longer-term) trends and don’t make an effort to time the little monthly wiggles of the market.

I’m going to wrap this up here. Just remember, the testing of these models and strategies always looks neat and clean when we report the results in historical tables. But the reality is that each and every bear market felt exactly like this at some point (and actually worse — imagine if this rally goes to +21% or +23% — the largest rallies of the past two bears), yet ended up going lower before finding the eventual bottom. With the economy just starting to weaken and corporate earnings just beginning what is typically a 3-4 quarter process of correcting from historically extreme profitability to...something less...there’s every reason to believe we’re still in the early-to-mid innings of this bear market. Patience, endurance, and sticking with the well-defined strategies will be our keys to getting through this bear with the type of relative performance we expect.