Medicare Advantage, which offers Medicare-approved health plans sold by private insurers, has grown by leaps and bounds since being authorized by Congress as "Medicare Part C" in 1997. Today, more than half of Medicare beneficiaries choose Medicare Advantage (MA) over "traditional" Medicare, according to the Kaiser Family Foundation.

But even though Medicare Advantage has been an overall success, one type of Medicare Advantage plan has struggled to attract plan sponsors and users. Now, it is almost gone: The Medicare Medical Savings Account (MSA).

Offering Medicare beneficiaries more flexibility and choice

The structure of the Medicare MSA is the same as the Health Savings Account (HSA) available to under-age-65 Americans enrolled in a high-deductible health plan. The main difference is that the entity making the annual contribution to the savings account is the U.S. government (via the health plan provider) rather than an employer.

Here is more from the federal government's Centers for Medicare and Medicaid Services (PDF).

A Medicare Medical Savings Account...combines a high-deductible health plan with a medical savings account. Enrollees of Medicare MSA plans...use their savings account to help pay for health care, and then will have coverage through a high-deductible insurance plan once they reach their deductible....

The plan deposits money from Medicare into the savings account at the beginning of each year.... Medicare Part A and Part B expenses count towards the MSA plan deductible....

Any money left in an account at the end of the year will remain in the savings account. If enrollees stay with the plan the following year, the new deposit will be added to any leftover amount.

Ideally, a user with a Medicare MSA plan would seek to keep expenses as low as possible by comparison shopping among providers, even those outside the user's local area. Since the funding for expenditures (up to a certain level) would come from the MSA rather than an insurance company, the user wouldn't be restricted to providers that were part of a health plan's HMO (health maintenance organization) or PPO (preferred provider organization).

In addition, MSA users who were healthy and had relatively low health expenses in a given year could roll over remaining MSA funds to the following year, thus building a tax-free, interest-bearing healthcare "nest egg" for future expenses. Further, once the money in the account exceeded a designated threshold (typically $2,000), the account holder could invest amounts above that threshold in mutual funds, potentially earning greater returns.

One significant drawback: Unlike other Medicare Advantage plans, Medicare MSA plans can't include prescription coverage, so users must purchase a separate drug plan (Medicare Part D) or pay for prescriptions out of pocket.

'Poised for popularity'

Unfortunately for consumers, most insurance companies offering other types of Medicare Advantage plans turned up their noses at Medicare MSAs. Only a handful of companies made them available, and in only a few states.

Then, five years ago, Pennsylvania-based Lasso Healthcare rolled out Medicare MSAs in 17 states. Later, it boosted the total to 35 states plus DC, as shown in red on the map below.

Source: Lasso Healthcare

At last, it appeared that the breakthrough for Medicare Medical Savings Accounts had arrived.

In 2019, PBS Newshour published a column about Medicare MSAs titled "Why These Unique Medicare Advantage Plans Are Poised for Popularity." The piece noted that such plans "could cover most routine medical spending for healthy enrollees and thus act as a less expensive way to insure against catastrophic health risks."

However, the expected popularity never occurred, prompting Lasso to pull the plug on Jan. 1, 2024. The company has discontinued all its Medicare MSA offerings nationwide. "These plans no longer align with our revamped mission and strategy," said a spokesman for Lasso's parent company, Zing Health.

Translation: Medicare MSAs haven't generated much profit for the company, and the situation is unlikely to change. The few other insurers that once offered Medicare MSAs seem to have reached the same conclusion. Companies shuttered MSAs in Vermont and New York in 2023. Now, according to Q1Medicare, only one company in the entire U.S. still provides Medicare MSA plans, and only in Wisconsin (PDF).

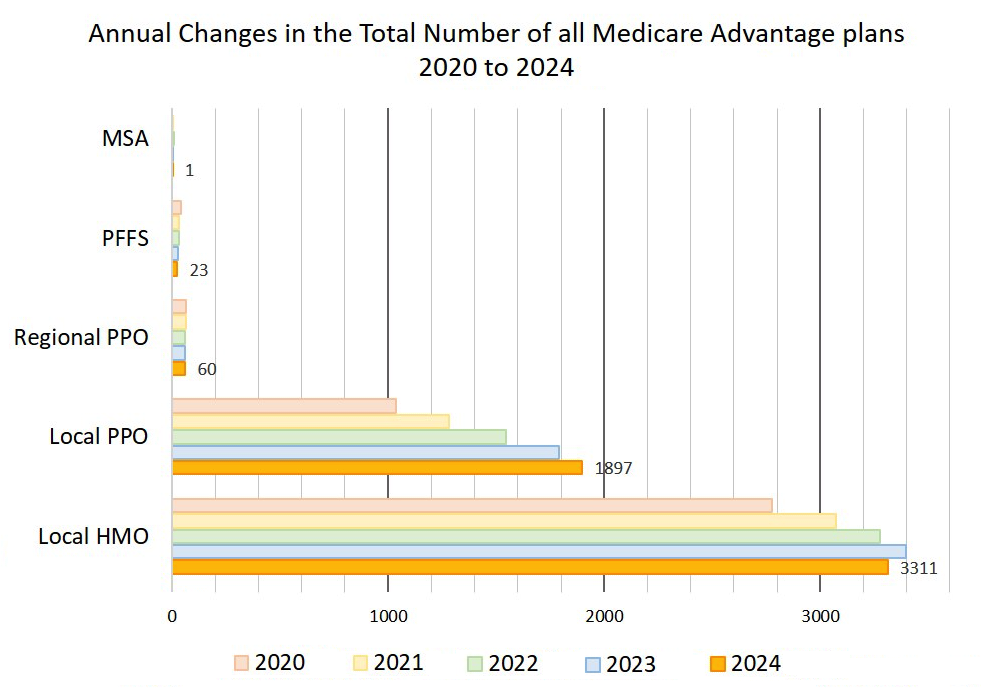

As shown below, Medicare MSAs — though "poised for popularity" five years ago — are today almost non-existent.

Source: Q1Group. (Note: PFFS are Private Fee-for-Service Plans.

Like MSAs, they have failed to gain traction in the Medicare Advantage marketplace.)

Sorry, we're not interested

In theory, Medicare Medical Savings Accounts should have been an attractive option for price-conscious seniors wanting more control over managing health expenses and choosing providers.

But Lasso Healthcare's failed five-year experiment — and the unwillingness of other companies to offer Medicare MSAs — suggest that only a tiny percentage of seniors are interested in the product. Therefore, plan providers can't find a way to make them financially viable.

So, even as Medicare Advantage grows, the Medicare Medical Savings Account remains an idea whose time has not yet come — and perhaps never will.

Exit question: Did you ever use or consider a Medicare MSA plan?