When you think about saving for retirement, you probably think about your workplace retirement plan or an IRA. But there’s another option for which some people are eligible that deserves to be considered in the same light, and using it in conjunction with traditional retirement-savings vehicles can provide uniquely powerful benefits.

What is it? A Health Savings Account, or HSA.

A little background

To be eligible for an HSA, you must have a high-deductible health plan (HDHP), whether provided by an employer or purchased directly. In 2023, that means an individual plan with at least a $1,500 deductible, or $3,000 for a family plan. Users of such plans are essentially self-insured for routine and relatively minor medical expenses. (Under the law, the high-deductible plan’s out-of-pocket maximum — deductibles, co-pays, and co-insurance — can’t be more than $7,500 for an individual and $15,000 for a family).

Money contributed to an HSA can be used to cover the deductible, co-pays, and a wide variety of health care products and services. In 2023, the maximum that an individual is allowed to contribute to an HSA is $3,850, $7,750 is the max for a family, and an additional $1,000 catch-up contribution is allowed for people age 55 or older.

Uniquely powerful

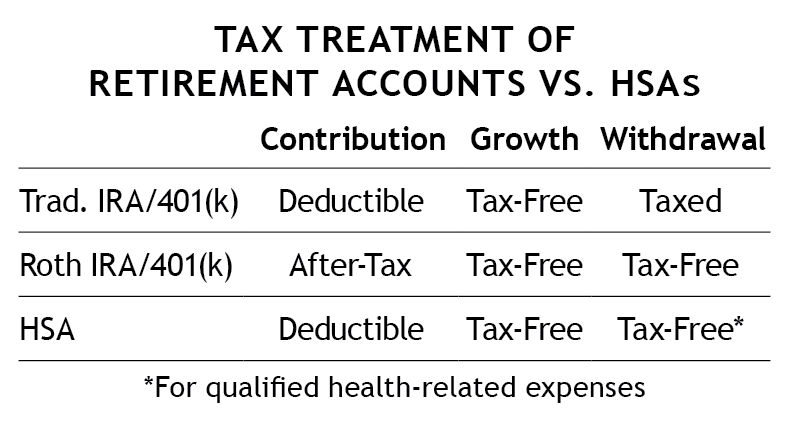

Health Savings Accounts are sometimes referred to as “super IRAs” because they are triple tax-advantaged: No taxes going in, no taxes on account growth, and no taxes when money is withdrawn to pay “qualified health expenses.” In contrast, workplace retirement accounts and IRAs are merely double tax-advantaged, as shown in the nearby table.

Now or later?

In past articles about Health Savings Accounts, SMI has recommended that, if possible, HSA users cover current out-of-pocket health care costs with non-HSA money. That way, money in the HSA can be saved — or, more importantly, invested — for later-life health care needs.

Not all HSA custodians offer access to investments, but many do. At Fidelity, for example, money in Health Savings Accounts can be invested in any of the vast array of investments the company offers — mutual funds, exchange-traded funds, individual stocks, and more. That makes it easy to implement SMI’s strategies within an HSA. Another popular HSA provider, Lively, offers access to Schwab’s investing platform.

If you invest via SMI Private Client — a separate but affiliated company from the SMI newsletter — Private Client’s professional managers can implement the SMI strategies in your HSA upon request.

Coupled with the freedom to invest HSA money are two other powerful benefits. First, HSA account balances may be carried forward year after year. That stands in contrast to Flexible Spending Accounts, where each year’s account balance must be used by the end of the year (or a few months into a new year) or the money is forfeited. Second, any qualifying health care expense covered with non-HSA money today can be reimbursed with HSA money down the road — even many years down the road (more on this shortly).

Bear in mind that using an HSA for current vs. future medical costs is not an either/or proposition. You could use a portion of your balance for current needs and set aside a portion for the future. If you do that, keep short-term HSA money in liquid holdings, such as a money-market fund, while investing the long-term money.

One limiting factor is that once you enroll in Medicare (typically at age 65), you are no longer eligible to contribute to an HSA. However, HSA balances may continue to be maintained, invested, and used to pay qualified health care expenses.

Coordinating retirement accounts

For many years, SMI has recommended prioritizing retirement savings this way: If your workplace plan offers a match, first contribute enough there to get the full match, then max out an IRA (taking advantage of its broader investment options that enable you to easily implement SMI’s strategies), and then, if you still need or want to save more for retirement, contribute more to your 401(k) plan. If your workplace plan doesn’t offer a match, max out an IRA first and then turn to your workplace plan.

Researchers at the consulting firm Willis Towers Watson estimate that, in most cases, “an individual who starts saving by age 40 can accumulate sufficient savings in an HSA to cover the cost of health care in retirement.”

However, because the tax benefits of an HSA are so compelling, and because health care costs are likely to be a significant part of retiree budgets, our ideal for those eligible to fund an HSA is slightly different. (Keep in mind, the following suggestions are for HSA holders able to pay most or all of their current healthcare costs with non-HSA money, thus permitting them to grow a Health Savings Account for maximum use in later years.)

If your workplace plan offers matching contributions, continue to start there, contributing enough to get the entire match. Then max out an HSA. Next, max out an IRA. Finally, if you still want or need to save more for retirement, contribute more to your 401(k) plan.

If your workplace plan doesn’t offer a match, we suggest maxing out an HSA first. Next, fund your IRA, and finally, turn to your workplace plan.

For a “decision tree” that can help you choose the order of 401(k)/IRA/HSA funding that best fits your situation, visit the Downloads section of our SMI's Resources page.

Optimizing the HSA’s tax benefits

Here’s another helpful thing about HSAs. If it turns out that you need additional money for non-health-care costs in retirement, you can use money from your HSA. At age 65, the “qualified health expenses” restriction ends. At that point, withdrawals can be used for any purpose, making an HSA akin to a traditional IRA.

Only withdrawals used to offset qualified health expenses will be tax-free, however. Money withdrawn for other purposes will be subject to ordinary income taxes. (Be aware that while premiums for Medicare Advantage plans are considered qualified health expenses, premiums for supplemental “Medigap” plans are not.)

Fortunately, there is a way to avoid those taxes if you plan ahead and keep good records. Because HSAs have no deadline for claiming health-related expenses, saved receipts — even if years old — can transform what would generally be a taxable withdrawal into a non-taxable withdrawal.

Here’s an example. Suppose that at age 66, you withdrew $15,000 from your HSA to buy a car (a non-health-related expense). As long as you had $15,000 in receipts for not-yet-claimed health expenses, even if you had incurred those expenses years before, the receipts could be used to offset the entire withdrawal, effectively making it tax-free.

An uncommon solution for a common concern

Understandably, health care looms large for many people preparing for retirement. How long will their health hold up? Will they face catastrophic expenses? Taking full advantage of the triple tax benefits HSAs offer can help alleviate those anxieties.

Researchers at the consulting firm Willis Towers Watson estimate that, in most cases, “an individual who starts saving by age 40 can accumulate sufficient savings in an HSA to cover the cost of health care in retirement.” That conclusion assumes the individual contributes the total permissible amount each year into an HSA and earns a 5% annual growth rate, which is well below the market’s historical average. The researchers said their projection would hold even if the individual used a small portion of his HSA money to cover current health expenses.

For more on HSA rules, search for “Publication 969” at www.irs.gov.