It may seem like a strange assertion that now is a good time to start investing in stocks. After all, the stock market is in a bear market, inflation remains stubbornly high, the Fed seems intent on raising interest rates further, and a recession is widely anticipated.

Taken together, these factors paint a somewhat scary picture for anyone thinking about getting started with investing or adding to their investment accounts.

Nonetheless, now is a good time to start investing in stocks — or to continue investing if you’re using an automated plan such as a 401(k). The reason has nothing to do with current market conditions or an expectation of what the market will do next. Rather, it’s because the primary obstacle new investors typically need to overcome is inertia. Simply getting started — and establishing the habits and structures to keep investing — is the most important issue.

This is true even if the initial timing turns out to be less than ideal. Some folks delay because they’re waiting for “just the right time.” The truth is that anytime is a good time for the long-term investor, and the sooner the better.

Launching into a storm

But what if you get started just before a major sell-off? It’s true that your opening investment will take a bit of a hit, but your subsequent monthly investments will be gobbling up more and more shares as prices fall. If you won’t be withdrawing your money for a decade or two, you should want bear markets to come along. That’s when stocks temporarily “go on sale” and you get more shares with your monthly purchases.

To illustrate this, consider the example of a young husband and wife who started investing one year before the most savage bear market of the past 90 years was about to begin. Most people would consider this to be about the worst time possible to start investing, which is why we’re using it as an example.

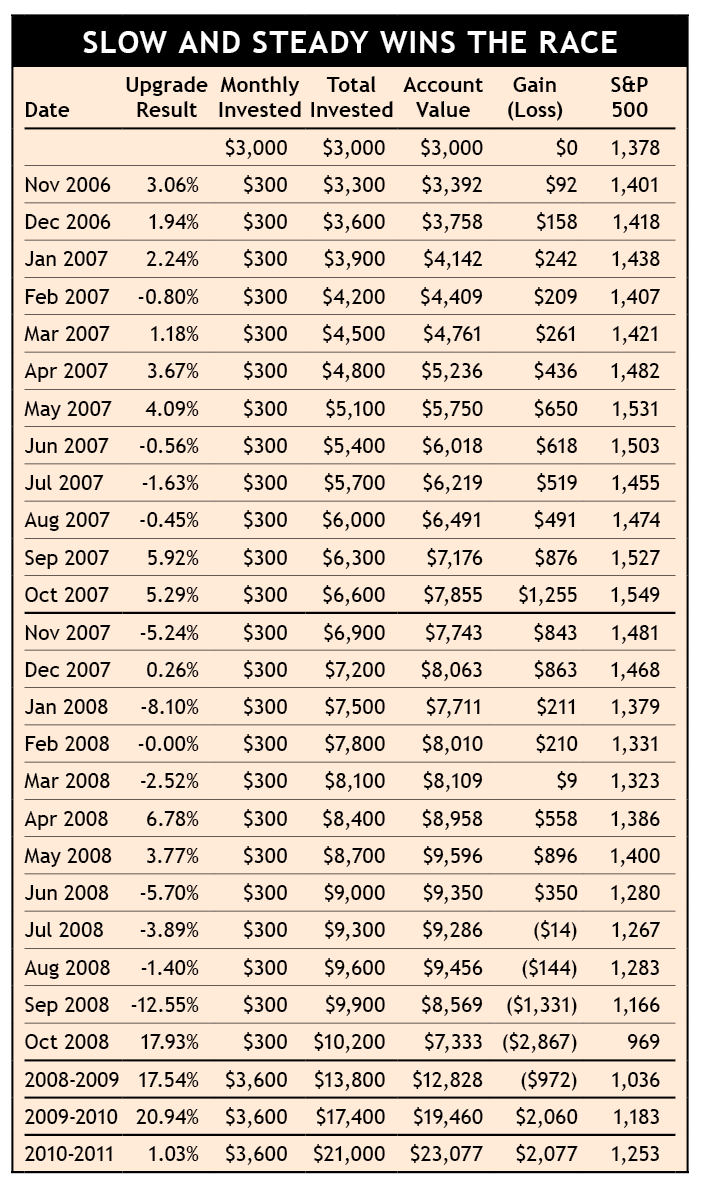

We’ll assume our young couple had saved up $3,000 in an IRA and committed to adding $300 a month going forward. They didn’t know then what we know now — that the bursting of the housing bubble and the Great Recession lay straight ahead and stocks would be lower five years later than they were at the time. Specifically, the benchmark S&P 500 stock index, which ended October 2006 at 1,378 would close out October 2011 at 1,253, down about 9% for the entire five-year period (having fallen as low as 666 in March 2009!).

Click to zoom

Pity that young couple for taking our advice, right? Not at all.

The table on the right shows the theoretical results from their dollar-cost-averaging approach (where the same dollar amount is invested every month regardless of market conditions), assuming their money was invested using SMI’s Upgrading strategy.

Month after month, they invested their $300 regardless of what the headlines and “experts” were saying. As the table shows, the market treated them well for the first 12 months. Then the bottom fell out. After two years, they had invested a total of $10,200 and their account value was only $7,333, meaning they were more than $2,800 in the red. Obviously, that’s not what they had hoped for. But they persevered.

Due to the large number of shares they were buying each month at discount prices, they were well positioned when the market rebounded over the following years. Five years later, at the end of October 2011, although the S&P 500 index was still lower than when they began their investing, they were back in the black. On total investments of $21,000, they had a $2,077 gain.

The bigger risk

This example illustrates how dollar-cost-averaging helps reduce the damage from falling markets. By holding the dollar amount of your monthly investment constant, you buy more shares when prices move lower and fewer shares as prices move higher. In effect, you are buying more at bargain prices and relatively little at what might be considered high prices. This should help you see that even a poorly timed beginning can still turn out well. The bigger risk is that you never get started at all. (See, Going Steady: The Advantages of a Systematic Investment Plan.)

It’s worth noting that Fund Upgrading used to operate a bit differently during bear markets than it does today. In our example, all new money was invested in stock funds right away. Today, Fund Upgrading has defensive protocols that shift some of its investments to cash during bear markets. This has the potential to diminish the dollar-cost-averaging effect, but should make it even easier emotionally to keep investing every month, as a portion of that investment may stay in cash waiting for the system to signal it’s an opportune time to buy stock funds again. By making your regular monthly contributions throughout the bear market, that money is ready and waiting when the system says, “Go!”

The time to begin a stock-oriented investing strategy is as soon as your foundation is laid — i.e., you’re free of consumer debt and have a contingency fund to help protect you from the uncertainties of life. Your investing decisions should be based on where you are now, and where you need to go.

So, if your foundation is in place and it’s time to begin investing your monthly surplus, then now’s a good time for you.