An exclusive dating relationship was once called “going steady.” That phrase may not make the cut anymore when it comes to designating one’s “relationship status.” Still, it’s a helpful way of describing another serious and sustained commitment: making regular investments.

The “going steady” approach to investing involves having a predetermined amount of money regularly transferred from your bank account to an investment account. Investing the same amount on a recurring basis is known as dollar-cost averaging.

Here are six advantages of automating your investing in this way:

Self-discipline

A systematic plan causes you to factor long-term investing into your budget. You are setting aside regular “installment” payments toward your future financial security.No time like the present

Automated investing eliminates the need to ask the question, “Is this a good time to buy stocks?” That question (unanswerable except in hindsight) tends to act as a barrier to making investing commitments. A “going steady” plan assures you’ll invest consistently, even when the market is falling.More for your money

When fund prices are low, your monthly investment will stretch farther and you’ll buy a greater number of fund shares. When prices are high, you’ll buy fewer shares. While this dollar-cost averaging approach doesn’t protect you against losses, it will push down the average cost of your shares.Efficiency — if purchasing fractional fund shares

If you invest via traditional mutual funds, every cent of your systematic investments will be put to work right away. That’s because traditional funds are sold in fractional shares. For example, if you invest $100 in a fund selling for $17.42 a share, the fund organization will credit your account with 5.74 shares ($100.00 divided by $17.42 = 5.74).

In contrast, exchange-traded funds (ETFs) typically must be purchased in full share amounts. So while your $100 would buy five whole shares (assuming the $17.42 price mentioned above), you’d have $12.90 remaining that couldn’t be invested until you added more money. (Fidelity is among a handful of brokers now allowing fractional-share purchases of ETFs and stocks. However, Fidelity doesn’t permit ETF or stock purchases via automatic investment.)Peace of mind

Making small monthly commitments is more comfortable emotionally than putting a lot of money at risk all at once. If the market falls after your monthly purchase, you can take it in stride, knowing that if the downturn persists, you’ll be able to buy a greater number of shares the following month. If the market rises after your monthly purchase, you’ll feel good about having made an immediate profit!Ease of getting started

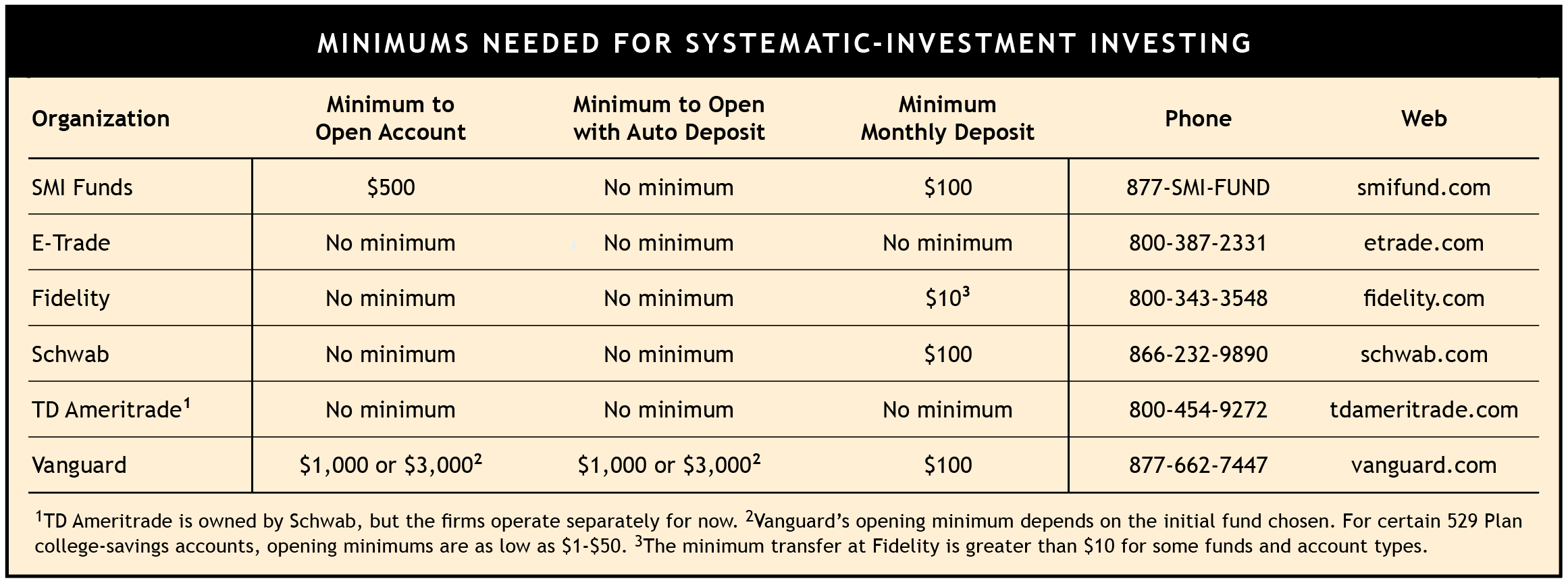

At most brokerage firms and fund companies, you can open an investment account with a relatively small amount or with no upfront money at all. Further, the minimums for monthly transfers are modest (see table).

Click Table to Enlarge

Systematic investment and the SMI strategies

The SMI strategy most compatible with the “set it and forget it” nature of systematic investing is Just-the-Basics. Since the JtB recommendations don’t change, you can make systematic investments directly into the JtB funds (if using our non-ETF recommendations).

In contrast, Fund Upgrading and Dynamic Asset Allocation recommendations are subject to change as they attempt to stay in tune with market trends. So systematically investing into these two core strategies is slightly more challenging.

Fortunately, there’s a simple solution. SMI Advisory Services, a company affiliated with the SMI newsletter but operated separately, offers mutual funds (“funds of funds”) that implement the SMI strategies. By making systematic transfers to the SMI Funds, you can dollar-cost average into the strategy (or strategies) of your choice — no matter what changes may occur in underlying recommendations. (The SMI mutual funds are available via brokers, but investing directly with the Sound Mind Investing Funds will avoid transaction fees.)

For a do-it-yourself approach to systematic investing with DAA and Upgrading, it’s best to use a two-step process. Step 1 is the recurring transfer from your bank account to your investment account. However, rather than being deployed directly into DAA or Upgrading funds, the money would simply be deposited as cash. Then, in Step 2, you would invest the cash into SMI’s recommendations each month when the new strategy recommendations are released.

Yes, it is possible to automate these subsequent fund purchases by providing your broker with instructions (“On the third day of each month, take x amount from my cash account and buy these particular funds”), but that approach is problematic. Since SMI’s Upgrading and DAA recommendations are subject to change, it is likely that, at some point, you’ll inadvertently invest in a fund we’re no longer recommending. Further, if the fund carries an early-redemption fee (such as “2% if held less than 60 days”), your money could be stuck in an investment that is lagging in performance.

So while automating money transfers to your investment account is a great idea, it’s better not to automate the actual Upgrading or DAA fund purchases within your account.

Nuts and bolts

Setting up recurring transfers from your bank will require filling out a broker-supplied authorization form. If you’re starting from scratch — i.e., both opening an account and setting up an auto-transfer — you may have to complete a printed form and mail it in (call the brokerage firm for details). If you already have an investment account, you’ll likely be able to set up your recurring transfers online.

Whatever options you choose for implementing systematic investing, get started as soon as you can so that you can put the power of compounding to work for as long as possible. One day, you’re sure to look back and smile, remembering when you decided to start going steady.