SMI’s Personal Portfolio Tracker has been updated with performance data through April 30, 2021. We’ve posted the May edition of our monthly Fund Performance Rankings (FPR) as well. It also features the latest month-end data.

For those new to the Tracker and FPR, here is an overview:

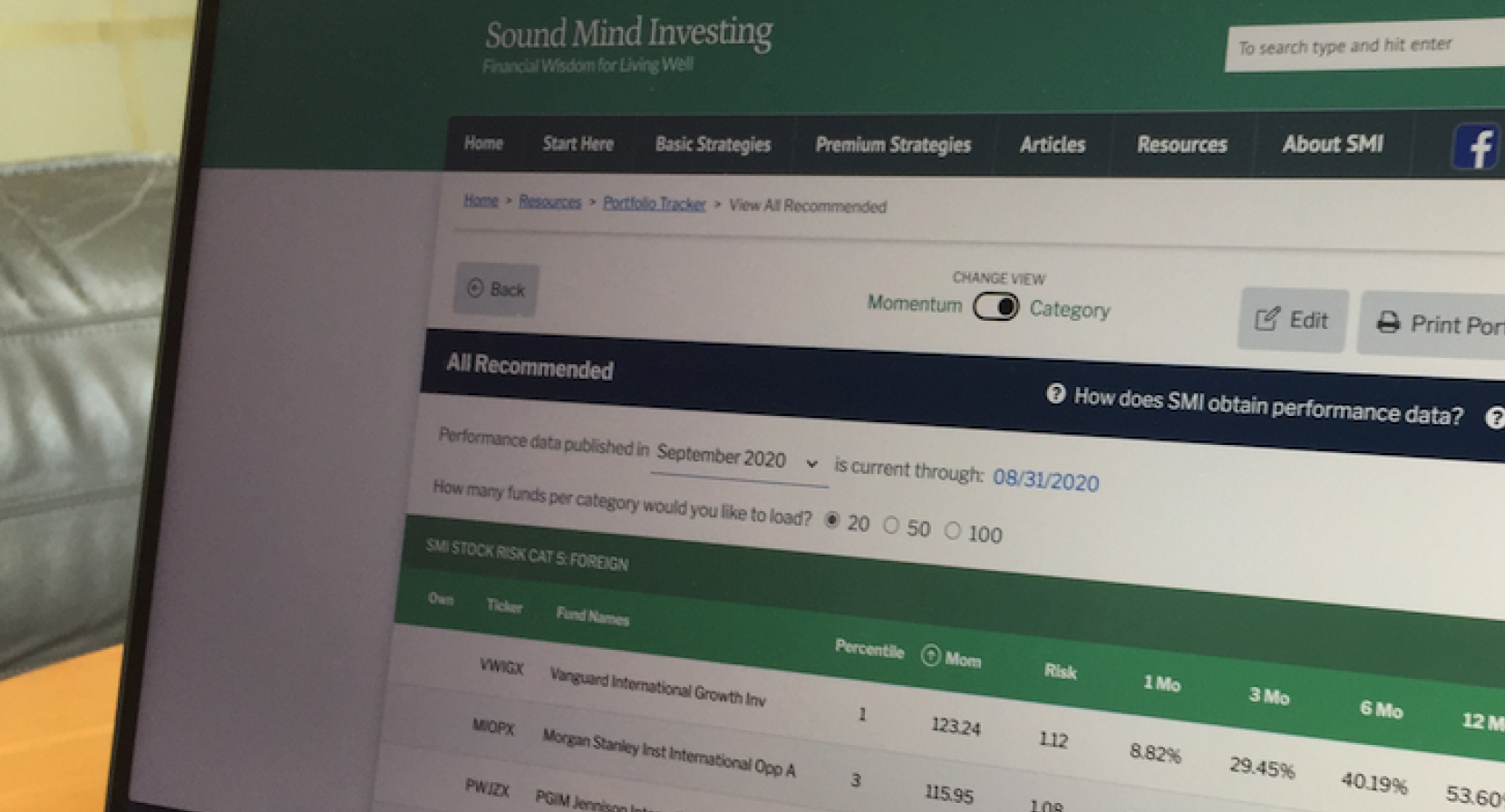

• The Tracker: SMI’s fund-performance database tracks the monthly returns of thousands of traditional mutual funds and ETFs. The Tracker can filter that large amount of data and produce a concise report covering only the funds available via your employer-sponsored retirement plan, thus making it easier to apply our Fund Upgrading strategy to a 401(k), 403(b), or similar plan.

Important: There are differences between the fund categories used in the Tracker and those used in the SMI newsletter.

The newsletter’s Upgrading formula for domestic funds guides users toward either growth or value funds as appropriate, rather than maintaining both growth and value allocations at all times. Accordingly, the newsletter uses only two domestic categories: Large Company and Small Company.

Tracker portfolios, however, classify holdings according to four domestic stock-fund categories: Large/Growth and Large/Value plus Small/Growth and Small/Value. This helps members who use alternatives to our "official" fund recommendations gauge (based on the Tracker’s percentile-ranking column) how each fund they own is performing relative to its same-category peers. Because Upgrading calls for selling a fund when it drops below the 25th percentile, having a clear view of a fund’s relative performance is important to maintaining that selling discipline.

Also, unlike the newsletter, Tracker portfolios show a separate Foreign category. In the newsletter, Foreign is a subset of the "Situational" category.

The Tracker will display any fund that doesn’t fit within the five categories mentioned above (Large/Growth, Large/Value, Small/Growth, Small/Value, and Foreign) in a category labeled "Other Funds."

If you are new to the Tracker, watch our tutorial videos. Go to the Tracker page and click the Video Tutorials tab.

• Fund Performance Rankings (FPR): The FPR report is a 37-page downloadable PDF file featuring performance data and SMI’s momentum rankings for more than 1,600 no-load traditional funds and ETFs.

We choose which funds to list in the FPR based on asset size, brand familiarity, and brokerage availability.

The Fund Performance Rankings report displays the bulk of domestic stock funds (both traditional funds and ETFs) across four common categories: Large/Growth, Large/Value, Small/Growth, Small/Value. Like the Tracker, the FPR also uses the Foreign category. Other FPR categories include Bond funds, Target-Date funds, and Sector funds.

Check page 2 to learn how to use the FPR report. Page 3 includes a listing of 70+ risk categories that will help you compare "apples to apples." (Each category shown on page 3 is hyperlinked, enabling you to jump to specific sections within the rankings quickly.) Page 4 of the FPR has explanations of the various data-column headings.

End of preview. Please subscribe to read more.

Already a subscriber? Log in here.

Continue reading plus get access to our

objective, time-tested investing strategies.

Get access to Sound Mind Investing’s articles and investing

strategies RISK FREE for 60 days

Not Quite Ready to Become a Member? No Problem, We Still Have Something for You!

Watch our FREE 20-minute video workshop

and learn how to secure profits and achieve

peace of mind, even amidst market volatility.

What You'll Learn:

Start securing your future today.

This free workshop is the perfect place to start.