SMI’s Fund Upgrading strategy is being “upgraded” this month for the first time in many years. The market has changed dramatically in recent decades and the specifics of Upgrading’s implementation must adapt.

The changes implemented this month will allow Upgrading’s powerful momentum-based engine to thrive by providing it with a more flexible and trend-responsive framework.

The incredible technological changes of the past three decades have altered daily life in ways unimaginable not long ago. Consider that as recently as the early-1990s, personal computers were just beginning to push their way into most households and white-collar jobs for the first time.

Of course, most of what we think of as “computing” today wasn’t possible with those machines, as connecting to the Internet wouldn’t happen for most people until toward the end of that decade. Even at that point, slow dial-up connections dramatically limited its usefulness until broadband became more widely available in the early-2000s.

Another quantum leap forward came in 2007 with the introduction of the first smartphones. Today, billions of people around the globe walk around with more computing power in their pocket than was available to put a man on the moon!

It’s no surprise that the financial markets have changed dramatically in recent decades as well. When SMI’s Fund Upgrading strategy was introduced in 1992, and modestly altered to its more-or-less current form in 1996, it was based largely on markets as they existed at the time. That structure served us well initially, with Upgrading experiencing a “golden era” between 1999-2007, beating the market nine consecutive years and producing returns nearly quadruple the market’s total return over that span. But Upgrading’s performance has been less impressive over the past decade. Much of that can be tied to structural changes in the market itself.

In response, we’ve taken Upgrading back into the “SMI Laboratory” to improve its robustness in light of the market’s present structural realities. The result is an updated form of Fund Upgrading that retains its momentum-driven, trend-following DNA, but adapts how Upgrading interacts with a significantly altered market landscape.

How the market has changed: Rise of passive investing

It’s not news that computer-driven “algorithmic” trading has become a driving force in the modern market, but the degree to which such trading has taken over may be. In 2019, investment bank J.P Morgan estimated that automated orders have grown to comprise as much as 80% of the stock market’s trading volume.

Driving this surge in automated orders has been the rise of passive investing, or “indexing,” which has grown to a remarkable degree over the past 25 years. This is such an important factor in the market’s transformation that it’s worth quickly exploring how this change came to be. (Mike Green of Logica Funds has become the most eloquent voice on the rise of passive investing and its implications. Much of the detail that follows is based on his work.)

First, a couple of definitions. “Active” stock investing is selecting securities, and changing them as needed, with the goal of outperforming the market in general. “Passive” stock investing does not attempt to pick “winners.” Rather, it simply buys and holds a broad range of securities based on an index or industry. This approach avoids frequent trading of the securities within a portfolio and thereby keeps costs down.

Now for some recent history. In the mid-1990s, index funds made up only around 2% of invested assets. That began to change in 1994 after the U.S. Securities & Exchange Commission changed its rules regarding stock index futures. For our purposes here, it’s not necessary to understand anything about futures. The important point is this easing of restrictions — which allowed index funds greater use of market futures — had two major effects: it simplified the investing process for index funds, as they no longer had to invest directly in all the holdings of the underlying indexes, while it simultaneously helped such funds eliminate the tracking error between the funds and the indexes they were supposed to track.

While that may not seem significant, it was this regulatory change that kick-started the indexing era. The share of passively invested assets grew substantially over the next decade, before taking another giant leap forward after enactment of the Pension Protection Act of 2006. This Congressional legislation introduced two specific changes for 401(k) retirement plans.

First, the Act allowed employers to auto-enroll employees in these retirement plans for the first time (i.e., the former system where the employee needed to pro-actively opt-in became one where they would need to pro-actively opt-out instead).

The second change was that the legal risk to employers was greatly reduced if they used certain default investment choices within their plans, specifically including index and target-date funds. (A target-date fund is a predefined blend of underlying index funds that shifts to become more conservative as an investor’s “target date” for retirement approaches.) Before the Pension Protection Act, most retirement plans used a money-market fund as the default investment option, but those defaults rapidly shifted to passively managed target-date funds over the next few years.

Consider the impact of this legislation as reported by Vanguard in 2016, celebrating the 10th anniversary of the PPA: “As of year-end 2015, 41% of Vanguard plans had adopted automatic enrollment, up from just 10% of plans a decade ago. Of those plans, 70% featured automatic annual increases. Last year [i.e., 2015], 63% of new Vanguard participants were hired under automatic enrollment, versus 12% in 2006.... Target-date fund use has nearly doubled since the passage of the PPA, with 90% of Vanguard plan sponsors offering target-date funds at year end 2015. In aggregate, 98% of participants now have access and 70% of participants use target-date funds” (emphasis added).

Subsequent guidance from the Department of Labor in 2012-13 strengthened the grip of target-date funds as the default option within most company retirement plans. The importance of these changes to the legal landscape cannot be overstated. In less than 20 years, target-date funds went from non-existent to collecting roughly 80% of all 401(k) inflows today. Further, Mike Green’s research indicates roughly 60% of 401(k) plans today offer target-date funds as their only investment option!

Cash flows overpower fundamentals

What are the implications for investors of this massive surge in passive investing over the past ~15 years?

The primary implication is this constant flow of new passively invested money distorts market prices. The money is simply given to an index fund that automatically invests it in the current components of whatever index it mimics, regardless of price or valuation. This means no analysis is made to identify good companies from bad, overvalued from undervalued, honest reporting from fraudulent behavior, etc.

Stocks that are included in the major indexes get most of the new market inflows. And because of the way most indexes are constructed, the bigger the company, the larger its share of the inflows. This causes a self-reinforcing loop where the big get ever bigger as money is added to index funds. In this way, overvalued stocks become even more overvalued.

This self-reinforcing cycle has been at the center of the dominant market story in recent years: the main attraction of the large growth stocks best exemplified by FAANG (Facebook, Apple, Amazon, Netflix, Google). Investors need to recognize that the largest companies in the indexes have been the big beneficiaries of this trend.

The second implication is this: Because the trend toward passive investing is driven by demographic factors, index funds will continue to grow as a market force. The flow of new money coming into the market from the workforce is going overwhelmingly into passive investments. The flow of money going out of the market is coming predominately from active investment vehicles as older people (who tend to hold most of the actively managed investments) are gradually selling these assets to cover living expenses.

In other words, money is coming in from younger investors while money is going out to retirees. So, there’s a powerful dynamic of dollars increasingly moving from active investment vehicles (where efforts are made to ascertain appropriate pricing) to passive ones (where investments are blindly made regardless of pricing).

Fund Upgrading’s response

If that review of the market’s evolution inclines you to throw up your hands and decide to become an indexer, don’t despair quite yet. Buried within those market trends are keys we can use to our advantage as active investors.

First and foremost, there’s good news: the idea of using momentum to follow the market’s trends still works. We’ve continued to see that in the returns of the individual risk categories within Upgrading in recent years. More often than not, Upgrading’s recommended funds have beaten their specific peer groups, even as Upgrading as a whole has lagged the major indexes that are dominated by the returns of the largest growth stocks. So what we need is a sharpening of our sword, not a wholesale change in approach.

That being said, there’s no question that beating the market has gotten more difficult over the past 20 years. Many of the ways active managers used to gain an edge in the markets no longer work or don’t work as well as they used to. This is broadly evident in the way active management (mutual funds, hedge funds, etc.) has struggled over the past decade to keep up with the indexes. Some of this underperformance is related to the specific recent market environment, but it’s also true that active managers have to work harder than ever for a smaller advantage over the market.

More good news: We’re confident that after much study, thinking, and testing, we’ve come up with an improved approach that should give Fund Upgrading a solid chance of outperforming the market moving forward. As we’ll explain in detail, the biggest change is replacing the rigid risk-category allocations of our old system with more flexible ones that shift between different parts of the market over time. However, because diversification is such a crucial principle, we’re taking steps to bolster diversification within this new framework by including broader index funds. Importantly, these index funds will be selected by and subject to our rigorous momentum-driven process.

When we set out months ago to determine if there was a better way to implement our Upgrading approach, we were trying to address the following issues:

Strengthening Upgrading so that it once again has a reasonable expectation of beating the market over time.

Reconfigure Upgrading’s structure to take advantage of the “new money flows” dynamic described earlier, rather than having those flows work against us.

Still, we need Upgrading to retain the flexibility to be able to pivot away from that “default posture” when conditions warrant. This is vital, because it’s unlikely that larger, growth-oriented companies will always be in favor, regardless of recent changes in market structure. There will always be cycles in the markets, and we need to be able to take advantage when conditions favor smaller, value-oriented, and foreign stocks again.

Importantly, we also wanted to keep Upgrading simple for those implementing it manually. Ease-of-use remains central in the design of all SMI strategies.

A new framework takes shape

Based on all we’ve discussed to this point, it would be natural to assume that the primary dividing line between which investments have been working in recent years and which haven’t would be large companies vs. small ones. There’s an element of truth to that. But what we found as we dug deeper is that the growth/value divide is a better axis to pivot on than large/small.

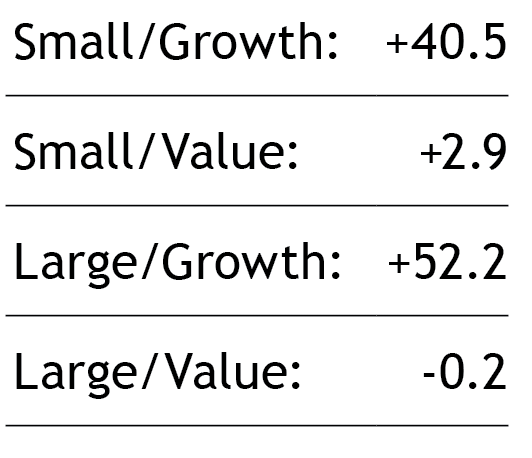

Consider the recent momentum of the four domestic asset classes Upgrading has used in the past (table nearby). At the end of October 2020, these were the SMI momentum scores of the four Russell index funds that correspond to SMI’s four U.S. fund risk categories. Even in a year as extreme as 2020, when the media narrative has been that only an extremely narrow group of FAANG and other work-from-home stocks have thrived, we can clearly see that a certain group of small-company stocks has done just fine. The real split has been along growth/value lines, not large/small.

One logical reason for this is that while many investors only have eyes for the S&P 500 index, the target-date funds and army of financial advisors that allocate money into index funds diversify those flows across the company-size spectrum. So a reasonable portion of new indexing money ends up directed into smaller-company stocks via the small-cap (and total-market) indexes.

What those target-date funds and financial advisors typically don’t do is diversify specifically between growth and value. Those are management-style designations. While there are index funds that track those growth/value distinctions, they are not the ones commonly used by retirement plans and target-date funds. The growth/value style designation is primarily an active management concept. That makes sense, because unlike company size, style requires some sort of qualitative judgment regarding each company to classify it in one camp or the other.

So the first major change to the new Upgrading framework is we will be using SMI’s momentum formula to guide us between the growth/value camps as appropriate, rather than maintaining permanent allocations to both groups at all times.

Specifically, this means we are reducing our domestic risk categories from four to two, eliminating growth/value as permanent allocations. When you look at the new Recommended Funds page this month, you’ll find just two domestic groups: Large Company and Small Company. Sometimes the recommendations will focus on growth funds, other times value funds.

Blending index and active funds

The second significant change to Fund Upgrading is we’re incorporating index funds into the core of the process. This will help with the diversification of the overall portfolio, while simplifying its maintenance over time, as the index funds change less frequently than the active funds.

To do this, we’ll be using ETFs that track the four Russell indexes mentioned earlier. Our research found we could obtain strong results by Upgrading between the small/growth and small/value indexes, as well as doing the same between the large/growth and large/value indexes. This extension of our normal Upgrading process allows us to add significant diversification via these index funds that own hundreds of different stocks, without sacrificing returns.

Specifically, this means there will always be a recommended index fund in the Small-Company section, and there will always be an index fund in the Large-Company section. These will switch periodically between the “growth” and “value” versions of those indexes, based on momentum. Basically, we will be upgrading separately between the small/value and small/growth indexes and the large/growth and large/value indexes. This process is independent of the active funds in each risk category: the index funds are not mixed with the active funds for this purpose.

One surprising wrinkle that emerged from our research was that these benefits were not evenly distributed. This “Upgrading the indexes” approach produced stronger results when applied to the large-company indexes than the small-company indexes. This became particularly evident when we compared the results of our slightly modified Upgrading process for each group’s actively managed counterparts.

While the new Upgrading process tilted in favor of indexing for the larger companies, the exact opposite was true of the smaller companies, where Upgrading among the active funds produced stronger returns. (That said, there were enough exceptions over the years to this overall trend that it makes sense to include some index and active funds in both the small and large groups).

As a result, you’ll find that the various recommended funds are no longer evenly weighted as they have been for the past five years. Instead, we now include an “Allocation” column showing how much of your Stock Upgrading total to invest in each fund. In the large-company group, that allocation is larger for the recommended index fund (currently large/growth), with a lower allocation to the single large company active fund recommendation.

In contrast, the recommended index fund in the small company section has a lower allocation than the actively managed funds recommended there. We include two active recommendations in the small company section because these funds typically are riskier, and we’re allocating more money in total to these active funds. At present, we’re suggesting a total of 30% in small company active funds, which is more than we’re comfortable putting in a single fund. So we’re splitting that 30% into two recommendations instead.

Upgrading among active funds

One goal of these new Upgrading changes is to make us more responsive to shifting trends between the growth and value styles, and allow us to take full advantage of those trends as they occur. The way we do this with the index funds in both the large- and small-company groups is straightforward, switching between them based on the standard momentum formula.

Upgrading the active funds is a bit more involved. That’s partly because most active funds aren’t as “pure” as the indexes, meaning they don’t invest strictly in pure growth or value stocks. As a result, it’s not unusual for an active fund to continue to excel for a while after the underlying growth/value indexes have signaled a shift to the other style.

To maintain this flexibility, the Upgrading process for active funds is being expanded. We will continue to upgrade funds when they fall below the quartile of their specific risk category (using the old four domestic categories framework, which remains in the monthly Fund Performance Rankings report). We want to maintain a strict selling discipline within a narrow peer group to keep us in the best performing funds.

However, we will also re-evaluate currently recommended funds for replacement when the indexes signal a change in trend. An example may help. The current recommendations in the Large Company group are the large/growth index fund (IWF) and a top active fund from the large/growth risk category (CPOAX). Assume that the indexes signal a change in trend to large/value at some point. If the current active fund recommendation (CPOAX) remains highly ranked within the large/growth category, we won’t automatically sell it in favor of a value fund. Instead, we’ll compare it to the top options in the large/value category and only replace it if a better option is available.

Don’t be alarmed if this process doesn’t seem crystal clear at this point. As always, simply following the recommendations each month is sufficient — it’s not required to understand all the detail behind every change.

“Situational” investing

Another change to the new Upgrading structure involves Foreign funds. In the past, we’ve maintained a constant allocation to foreign stocks. Under the new system, we will be more opportunistic, owning foreign stocks only when their momentum warrants it, and avoiding them when it doesn’t.

On the Recommend Funds page, you’ll find a new category where Foreign used to reside. We’ve labeled this section “Situational” because it includes foreign funds, as warranted, but it also will include other investment types. When foreign funds are not currently recommended, you’ll find a domestic index-fund ETF included in this section where an international fund would have been listed if the foreign stock trend had shown sufficiently strong momentum.

In addition to foreign funds (and their domestic ETF alternates), we will sometimes include other investment types here if they warrant inclusion in the Upgrading portfolio. We wanted to build flexibility into the Upgrading framework to incorporate these opportunities when they are especially compelling. The first of these — a commodities fund — is listed there this month. You’ll find a separate article here detailing this recommendation (and commodities more broadly as an asset class).

Portfolio allocations and the Fund Performance Rankings

The new Upgrading framework has been designed to provide us with greater flexibility to follow the market’s trends more closely than in the past. Another aspect of that flexibility involves resuming the old practice of adjusting Upgrading’s portfolio allocations as appropriate. This was long a part of Upgrading until we switched to static allocations in 2016 in a nod to simplicity. These allocation adjustments have provided Upgrading with a significant advantage at times in the past, and we think another of those occasions may be at hand again now.

A “neutral” posture under our new framework would lean toward overweighting large companies relative to smaller ones. That’s because our benchmark, the Wilshire 5000, is weighted roughly 75% in favor of large companies. However, our 2021 tilt toward small company stocks reflects the same 40%-40% ratio SMI typically has used in the past. This actually overweights small companies in comparison to the Wilshire 5000 but is similar to Upgrading’s historical pattern.

This overweighting of small companies will likely be a relatively short-term tactic. Based on all of the factors discussed in the first half of this article, we anticipate that Upgrading’s allocations will normally skew toward favoring larger companies over the course of the full market cycle. However, SMI has always tilted Upgrading’s portfolio allocations to favor small company stocks when the economy is emerging from recession. This significantly boosted Upgrading’s returns in 2003 and 2009 following the last two recessions, and we think it’s wise to do so again heading into 2021.

The new allocation columns will also be useful should Upgrading’s “2.0” defensive protocols trigger again in the future. The optimal way to apply these defensive principles to Upgrading’s revamped structure remains under review.

Another difference in the new Upgrading structure is the elimination of multiple recommendations to choose among within each risk category. Stock Upgrading now includes seven official stock fund recommendations — we recommend owning all seven according to the allocations listed. This is how Upgrading’s performance will be calculated. The Bond Upgrading process remains unchanged. The steps to implement Fund Upgrading using the official January 2021 stock and bond recommendations are described in detail here.

However, we recognize that there are occasions when a reader may be unable to buy a particular fund at their broker or may want to select a lower risk fund. The Fund Performance Rankings (FPR) is provided for any such substitutions. If you need/want to find an alternate fund, simply go to the appropriate section of the FPR (section numbers are noted on the Recommended Funds page) and choose from the funds currently ranked near the top of the appropriate risk category.

Conclusion and review

The market has changed dramatically since Upgrading was introduced in 1992, and our process is adapting to respond to these new dynamics. Our testing shows this updated approach, grounded in Upgrading’s same core principles, will enable us to thrive in periods like the past decade when these new market dynamics dominate, while still retaining the flexibility to outperform if/when the trends shift in favor of value and foreign stocks, as was the case throughout much of 2000-2007. A number of factors lined up that make a shift like that plausible. We’re confident in Upgrading’s ability to respond and outperform in either market environment.

This new approach would have performed very well historically. Focusing specifically on the most recent period when Upgrading has lagged (2008-present), this new system would have performed much better than historic Upgrading while also beating the broader market.

To quickly review the main Upgrading changes:

The number of domestic risk categories has been reduced from four to two by eliminating permanent allocations to the value and growth styles. Growth vs. value will now be determined within the small-company and large-company categories based on current momentum.

Index funds have been added to the Upgrading strategy. Both domestic risk categories (small-companies and large-companies) will each include a recommended index fund (growth or value) as well as one or more recommended actively managed funds.

The Foreign risk category has been replaced by a “Situational” category that may include foreign, commodities, domestic, active, passive, etc.

Allocations are no longer evenly-weighted between all of the recommended funds and are subject to change in the future (as they were before 2016).

There are now seven official recommendations in Stock Upgrading. Members should own all seven (or suitable alternatives) in the allocations listed.

As we’ve worked on the best way to “Upgrade Upgrading,” we’ve had to wrestle with — and ultimately find affirmative answers to — several process-oriented questions. Does this approach allow us to upgrade successfully using the new index funds? Does the new mix of (fewer) funds allow us to boost returns without increasing portfolio risk? Critically, how does this new approach perform during periods dominated by large/growth new investment flows (like 2018-2020) as well as periods when small/value/foreign rotate back into favor?

We’re excited about the new approach being introduced this month. As with any change, there will inevitably be a learning curve for SMI members as they transition and implement it. We’re confident that effort will pay off in terms of better returns and easier maintenance in the future.