Even experienced investors have felt a bit jarred by this year’s market activity. After reaching an all-time high on February 19, the nearly 11-year-old bull market hit a wall. In record time — just 16 trading sessions — the S&P 500 crashed through the -20% level typically used to define a bear market. From there, the market continued sliding until it found itself down -35% from its February high by March 23.

Then, almost as stunningly, the market rocketed upward, regaining 61% of those losses by April 29. But the market remains volatile, with its most recent moves to the south.

As Mark and I wrote in the April newsletter editorial, each market crash has unique causes — and similar investor responses, including a tendency for many investors to panic. One other important similarity across all previous market crashes is that the market has eventually recovered. And therein lies one of the most important lessons about investing: It’s important not to let a falling market scare you away from stocks.

That’s exactly what seems to have happened to a surprisingly large number of investors during the last significant downturn, the bear market of 2007-2009.

That bear market was costly not just in terms of the depth of the portfolio losses (-57% from peak to trough) or how long it lingered (18 months), but in terms of how many investors seemed to give up on stock investing for good as a result. According to Gallup, before the downturn, in April of 2007, 65% of U.S. adults had money in the stock market, including stocks held through mutual funds in 401(k) or other retirement accounts. Two years later in April 2009, when the bear market had ended, just 55% did.

A shift in sentiment

In large part, Gallup blames the decline in stock ownership on the emotional pain inflicted on investors. In 2017, well into the market’s recovery, Gallup senior editor Jeffrey M. Jones, wrote:

It appears the financial crisis and recession may have fundamentally changed some Americans’ views of stocks as an investment. The collapse in stock values in 2008 and 2009 seems to have left a greater impression on these people than the ongoing bull market that has followed it, as well as research showing the strong historical performance of stocks as a long-term investment.

While the stock market recovered from that bear market and went on to soar higher in the decade that followed, the number of stock market investors did not. Today, the percentage of U.S. adults with money in the market still stands at 55%.

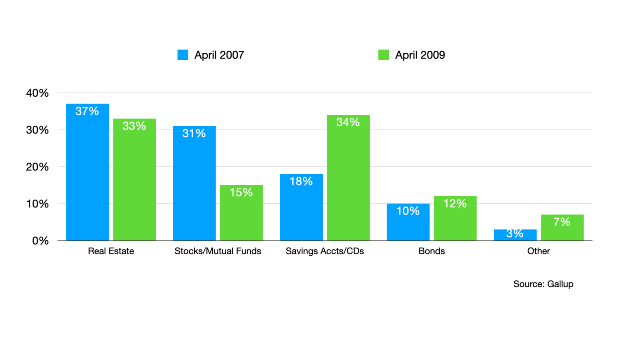

Where did all those former stock market investors go? A good guess can be made based on the shift in answers to the following Gallup question from April 2007 to April 2009: “Which of the following do you think is the best long-term investment?”

That’s a remarkable change in sentiment, with the popularity of stocks/mutual funds essentially trading places with savings accounts/CDs. (Regarding real estate, Gallup didn’t specify whether it meant rental real estate or the respondent’s own home. If respondents assumed the option pertained to their own home, that’s a whole different issue — read Is Your Home An Investment?)

The more things change…

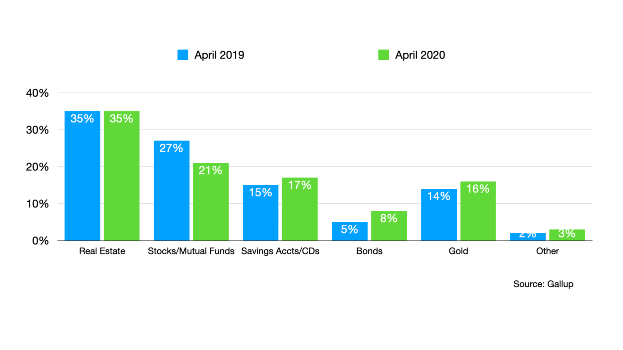

Today, something similar seems to be playing out once again. When Gallup surveyed people during the first half of April this year, asking for their opinion about the best long-term investment, the percentage of people choosing stocks/mutual funds had declined noticeably from a year ago, and the number of people choosing savings accounts/CDs had increased. (Gallup added gold as an option in its more recent surveys.)

Stocks are certainly not the only viable long-term investment. Some people have the unique expertise to succeed investing in their own business, rental real estate, and other investments. And there’s much to be said for lowering your exposure to the market as you get older. However, for most people, stocks are the best long-term investment — especially when compared to savings accounts and CDs. That’s a long-term conviction that shouldn’t change with the market’s ups and downs.