The economy is moving in slow motion and unemployment is soaring, but don’t call it a recession.

The government is showering businesses and individuals with money, but don’t call it a stimulus.

The stock market is far below its most recent high, but don’t call it a bear market? Wait, what?

Choosing words carefully

As I noted a couple of weeks ago, St. Louis Federal Reserve President James Bullard has been careful about the words he uses to describe the pandemic-hammered economy and the government’s response. It isn’t a recession, he says; it’s a “planned, organized partial shut down of the U.S. economy." And all the money being infused into the economy isn’t a stimulus; it’s “maintenance” or “support.” (Read Will It Be Different This Time?)

Should the same thinking be applied to the stock market?

The secular/cyclical distinction

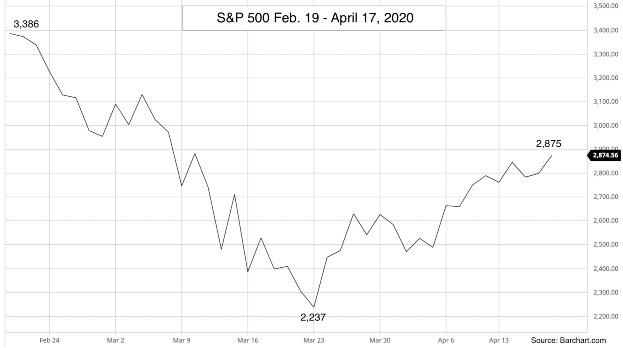

The widely accepted definition of a bear market is when the market falls at least 20% from its most recent high. The S&P 500 crashed through that marker when it fell from its February 19 all-time high of 3,386 to 2,481 on March 12, a breathtaking decline of nearly 27% in a record-fast 16 trading sessions. From there, the market continued sliding to 2,237 on March 23 — down 34% from its February 19 high.

The death of the bull market was widely reported, with “everyone” agreeing we are now in a bear market. Not only had the market fallen to the objective level that defines a bear market, but it exhibited other signs normally associated with bear markets. High volatility. Numerous sharp up days — five of them, in fact, as the market trended down to its March 23 low.

Since then, however, those up days have been creating what appears to be an upward trend. At the close on Friday, April 17, the S&P 500 stood at 2,875 — up nearly 29% since the March 23 low. In just 18 trading sessions, it regained 56% of its losses.

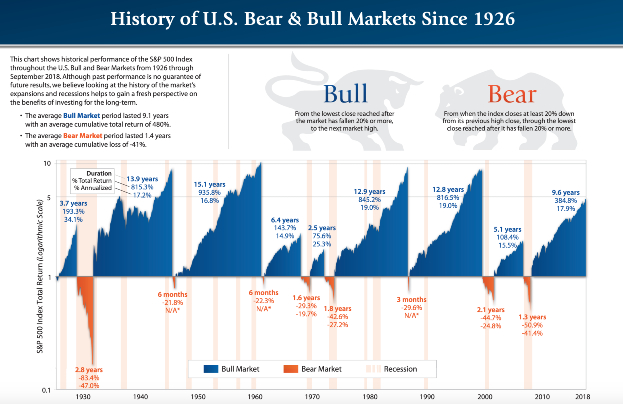

This is leading some to believe that the long-running bull market never really ended. For example, Ritholtz Wealth Management CEO Barry Ritholtz says it’s plausible that the secular (long-term) bull market simply bumped up against a cyclical (short-term, event-driven) bear, leaving the longer-term bull trend still intact. (Watch this discussion between Barry Ritholtz and Michael Batnick of Ritholtz Wealth Management.)

In a separate post, Batnick noted that “stocks also fell 34% in 1987 and yet you never hear people talk about the bull market of 1982-1987 and the bull market of 1987-2000. They talk about the bull market of 1982-2000.”

Apparently, the folks at First Trust Advisors didn’t get that memo because they labeled the three-month downturn Batnick is referring to as a bear market.

All this to say there is more discretion involved in using the labels “bull market” and “bear market” than you may realize, and labels matter because they can impact investor sentiment and behavior.

The economy is not the stock market

As each day brings new headlines about the pandemic, another distinction that’s important to keep in mind is the difference between the economy and the stock market. They are not one and the same. In fact, as counterintuitive as it may seem, the market typically leads the economy, not the other way around.

Forbes contributor John Jennings said that phenomenon was on full display as the last bear market and Great Recession ended 11 years ago.

The economy was still contracting in March 2009 and didn’t reach the trough of the recession until four months later in June. Yet, the market low was on March 9 and from there, the S&P 500 climbed over 500%, including dividends, during the next nearly 11 years....

In the current crisis, we don’t know whether the stock market has already bottomed or whether is will head lower. What we do know is that the market will bottom at some point, and the next bull market will start while the financial news is still dire.

Rob Arnott, chairman of investment firm Research Affiliates, is expecting the same thing to happen in today’s environment. ”Stocks will begin to recover long before the pandemic is on the wane," he said. "The strongest bull markets are not built on a foundation of good news, but on diminishing bad news.”

Why does it matter?

One of SMI’s guiding principles is to teach everything one needs to know about investing, not everything there is to know. While some of the above may sound like just so much navel-gazing, it’s all important for wise investing.

Knowing the simple truth that bear markets are to be expected probably would have kept more investors in the market during the last bear market. In early 2007, 65% of U.S. adults had money invested in the stock market, according to Gallup. Today, just 55% do.

Knowing there’s some subjectivity to the label “bear market” should help more of today’s investors keep from becoming frightened or discouraged and abandoning their plan. We’ve heard from numerous readers who are wondering if they should take some risk off the table right now, even though doing so would likely mean participating in the eventual recovery to a lesser degree than they participated in the decline.

And knowing that the market tends to recover before the economy should provide some helpful context as investors take in what is likely to be more and more bad economic news. As Warren Buffett wrote during the financial crisis in 2008,

I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up.

So if you wait for the robins, spring will be over.

Whether this turns out to be one of the shortest bear markets ever or a long slog, this is not the time to check out or cash out, and it is not the time to succumb to fear (or greed). This is the time to keep a steady hand on the wheel — to trust God, stay with your plan, and continue to wisely steward the resources God has entrusted to you.