Homeownership carries risks. Your house could burn to the ground, for example, or get demolished by a tornado. In addition to the structural loss, the personal property in your home could be damaged or destroyed.

Fortunately, worst-case disasters are rare, affecting only a small percentage of homeowners. Still, insuring against the worst by buying homeowners insurance is wise, given that your house is probably your most valuable single asset.

Although mortgage lenders require homebuyers to purchase coverage, it’s up to the buyer to select an insurer and choose the specific coverage amounts — beyond required minimums — that a policy provides.

The conventional wisdom is that you should have enough insurance to rebuild your home, replace your belongings, and provide for living expenses while waiting for your home to be rebuilt. Data company Core Logic, which tracks home values for insurers, estimates that about 60% of American homes are underinsured.

When calculating how much insurance you need, focus on the cost of rebuilding, not on how much you paid. Multiply the square footage of your house by the average per-square-foot cost of residential construction in your area. (Square-foot cost data by state is available here. For more precise estimates, contact your state or regional home builders association.)

This "ballpark" approach to projecting the cost of rebuilding will provide a starting point for the amount of “dwelling coverage” to purchase. An insurance company’s coverage recommendation, in contrast, will be based on average construction costs plus the specific features of your house, including the house type, building materials used, and the number of bathrooms.

If your cost-to-rebuild estimate is significantly lower than the insurance company’s recommendation, ask the insurer to explain the difference. With some back-and-forth negotiation, you may be able to arrive at an amount that supplies adequate coverage but costs less than what the insurance company initially recommended.

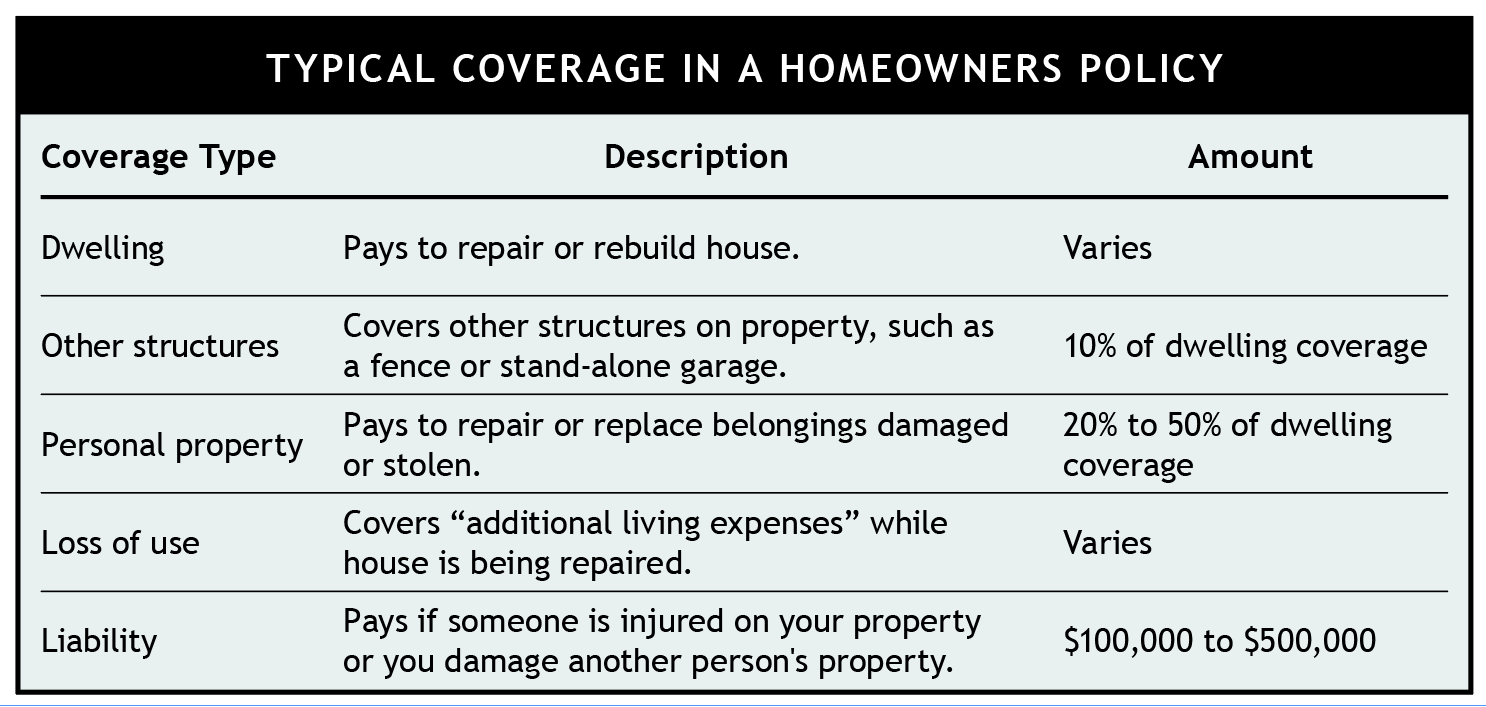

Homeowners policies also include coverage for household belongings. The personal-property coverage limit is commonly set at 20% to 50% of the dwelling coverage amount.

Dwelling and personal property coverage limits will increase automatically from year to year to keep up with rising costs. As limits rise, your premiums will rise too, unless you specifically request a reduction in coverage or make other policy changes, such as increasing your deductible.

Two types of policies

Most home policies in the U.S. carry the insurance-industry designations “HO-3” or “HO-5.” Both types cover damage to a dwelling from any cause not expressly excluded in the policy documents. Typical exclusions include earthquakes, landslides, sinkholes, and flooding — including flooding from drain and sewer backup. For more on flood insurance, see Should You Buy Flood Insurance?)

The main difference between HO-3 and HO-5 policies relates to a home’s contents. HO-3 policies cover personal-property losses only if caused by “named perils” identified in the policy document. Such perils typically include (among others): fire, smoke, windstorms, vandalism, explosions, and theft.

HO-5 policies, in contrast, offer “open perils” coverage — i.e., they cover personal property losses for a broader range of hazards. HO-5 policies generally are available only for well-maintained homes in low-risk areas.

What you can expect from claims

In the event of dwelling-related damage, most policies will pay out what it costs to restore the house, up to the coverage limits stated in the policy.

Some homeowners policies offer an additional inflation buffer known as “extended replacement cost/value for dwelling coverage.” This type of coverage will pay out more than the face value of the insurance (up to a specified limit) to help cover spikes in the cost of building materials and labor that commonly occur when demand is high, such as during a period of recovery after widespread storm damage.

As for personal-property damage, some policies cover goods only for “actual cash value” — i.e., the depreciated value of belongings at the time of loss. In contrast, other policies offer “replacement cost coverage,” meaning the insurance settlement will be based on the cost of replacing covered items, including furniture, clothes, and electronics.

(Click Table to Enlarge)

Other provisions

If damage (or reconstruction) makes your home unlivable for a while, most homeowners policies will pay for “additional living expenses” — up to specific dollar amounts and for a certain period. Covered expenses typically include hotel bills and meals.

Even if you never have a worst-case situation such as a devastating fire, lesser losses might occur — such as structural damage from a falling tree or the theft of household belongings. Homeowners insurance covers those types of situations, too — including the theft of items you may have been using away from home, such as a camera or a computer.

Many homeowners policies also cover liability claims. The policy will pay (limits typically from $100,000 up to $500,000) if you’re found legally responsible for someone being injured on your property, such as a neighborhood child suffering an injury on your trampoline or a house guest getting hurt at your pool.1 Liability coverage also pays if you accidentally damage another person’s property, such as knocking over and breaking a neighbor’s expensive vase.

Additional coverage

Most homeowners policies are customizable with various “riders” (endorsements) and “floaters.” Riders add or expand types of coverage — such as adding coverage for drain backup, lawn damage, and increased payout levels for theft. Floaters, in contrast, increase or extend coverage to specific items. For example, a floater might provide enhanced coverage for an expensive ring.

It’s important to note that while mobile phones and computers are covered under the personal property section of homeowners policies, such items are covered only for certain types of loss — such as theft or destruction by fire. Accidental breakage and water damage don’t qualify as covered events. However, you may be able to extend coverage for such items via a policy floater for less than the cost of buying a stand-alone “electronic devices” policy or signing up for a service contract with your phone provider.

Keeping costs down

It’s not wise to skimp on homeowners insurance, but there are ways to save. One is to increase your deductible. The higher the deductibles, the lower the premium. Deductibles typically range from $500 to $5,000. Some policies state the deductible as a percentage, rather than as a dollar amount, for certain types of losses.

(Bear in mind that homeowners deductibles are “per claim.” If more than one covered event occurs during your coverage period — for example, you have items stolen and your house suffers storm damage — you must pay the deductible for each claim.)

You also may be able to reduce premiums, especially for an older home, by installing smoke alarms, deadbolts, and a home security system. Be sure to tell the insurance company you have done so.

Another way to keep costs in check is via multi-policy discounts. Most insurers offer discounts (typically at least 10%) for customers who purchase multiple products, such as home and auto policies. In addition, some insurers offer “longevity” discounts for customers who have kept their coverage for five years or more, and some companies offer “mature homeowner” discounts for customers over age 55.

Perhaps the best way to keep premiums in check is to shop around at least every other year to see if another insurance company can offer a better deal than you’re getting from your current insurer. Homeowners insurance should never be a “get it and forget it” kind of thing.