Taking up a collection for people in need is a time-honored approach to benevolent giving. Whether the cause is disaster relief, food for the hungry, or clean water for a remote village overseas, the needs of the relatively few can be met by pooling the resources of the many.

Interestingly, this “let’s all pitch in” model, perhaps nearly as ancient as human history, has become an increasingly popular method of meeting healthcare expenses in the 21st century.

Ten-year-old pitcher Luke Collier had the opposing batter in the hole on an 0-and-2 count. He got the sign and served up what he hoped would be the strikeout pitch. It wasn’t. Seconds later, Luke lay on the ground, dazed and disoriented. The batter had hit a screaming line drive that struck Luke square in the face, just below his left eye. The crowd gasped, then fell silent. Luke’s dad rushed from the stands.

A hospital examination showed that the impact damaged Luke’s eye, and he had two broken bones. Treatment and recovery, which involved hospitalization and a dozen follow-up visits with specialists, dragged on for months. Although Luke’s father, Eric, was grateful for his son’s progress, he worried about the mounting bills. A few months before the injury, Eric had abandoned his family’s costly traditional health insurance and signed up with a “health care sharing ministry” known as Medi-Share. Its members voluntarily help each other cover large medical bills. Would his fellow members come through? Would health care sharing work?

The answer, as Eric was relieved to discover, was “yes.” Almost all of Luke’s medical bills were covered by fellow Medi-Share members.

Sharing ministries are “a modern-day version of what the church started back in the book of Acts,” Eric says, referring to passages in the New Testament describing how early Christians provided for each other’s needs. He describes the ministry as “a community of like-minded believers who pray for each other, supported by an organization that provides health education and promotes biblical living.”

This story recounted above is true. We know — because Eric is a portfolio manager at SMI Advisory Services, a company affiliated with but separate from the SMI newsletter. His positive experience with health care sharing influenced several others in the SMI family to sign up. (Some, like Eric, joined Medi-Share. Others have chosen other sharing ministries.)

However, the purpose of this article isn’t to endorse or promote any particular health care sharing ministry (HCSM) or even to recommend that SMI readers choose an HCSM over traditional health insurance. But we want you to be aware of these organizations and their crucial role in helping people afford health care. It’s up to you to decide if joining an HCSM is suitable for you and your family.

Each health care sharing ministry has its particular membership requirements and detailed sharing guidelines. This article provides only an overview. We encourage you to visit a ministry’s website and study its policies carefully before deciding to become an HCSM member.

Background

Some religious groups, notably Mennonites, Anabaptists, and the Amish, have long shared health costs within their faith communities. But in recent decades, broader-based health care sharing ministries have come on the scene, opening up their membership to Christians from various denominations and communions.

Until the Affordable Care Act (ACA) became law in 2010, most HCSMs remained small. But one side effect of the ACA, known colloquially as “Obamacare,” was to spur the growth of health care sharing. Initially, this may have been because the ACA required all Americans to have health insurance or face a fine unless a person qualified for an exemption. The legislative language exempted members of health care sharing ministries from the mandate.

At the time of the law’s passage, an estimated 200,000 Americans participated in health care sharing ministries. Today, a little more than a decade later, that number has swelled to roughly 1.5 million, a more than sevenfold increase — even though Congress ultimately repealed the ACA fine.

People continue to turn to health care sharing ministries because HCSMs provide coverage at a much lower cost than traditional health insurance. A report last fall from the Congressional Budget Office, the federal agency that provides financial information to Congress, suggested traditional insurance is increasingly unaffordable for many people. Among them, those who 1) aren’t covered by an employer-provided health plan and 2) earn too much income to qualify for premium subsidies available through government-run health insurance exchanges.

To be clear, health care sharing ministries are not providers of low-cost insurance. Instead, they are voluntary cooperatives that facilitate sharing health care expenses among members — much like taking up a collection to assist someone in need. Each HCSM acts as an administrator, matching those who give with those who have incurred health expenses they can’t cover from their own resources. Unlike insurance companies, HCSMs do not guarantee coverage or maintain financial reserves to pay claims, nor are they bound by law to cover pre-existing conditions (more on this later).

To qualify as an HCSM under federal law, an organization must be recognized as a nonprofit (under Section 501(c)(3) of the IRS code), conduct an annual audit “performed by an independent certified public accounting firm,” and have been in operation since Dec. 31, 1999. (This “grandfather” provision, included in the Affordable Care Act, allowed existing HCSMs to continue operation but precluded the creation of others.) Further, group members must “share a common set of ethical or religious beliefs” and “share medical expenses among members in accordance with those beliefs.”

Federal law also requires such ministries to retain members “even after they develop a medical condition.” In other words, an HCSM can’t cancel a person’s membership due to an emerging health issue.

How HCSMs work

Although health care sharing ministries are not insurance companies, many aspects of HCSM programs mirror typical insurance plans. For example, members have either an “unshareable amount” (annual or per-incident) similar to a deductible. This is the amount a member will pay out-of-pocket before other members are asked to help.

HCSM members also contribute a monthly dollar amount (their “share”), much like paying a premium for an insurance policy. The size of the monthly contribution is based on 1) whether a membership covers a single person, a couple, or a family, and 2) which share plan a member chooses. Some sharing ministries also consider a member’s age in setting the monthly share amount. (Under current law, monthly-share contributions to HCSMs are not tax-deductible. Also, health sharing may not be used in conjunction with tax-advantaged Health Savings Accounts.)

When a member has a “sharing request” — similar to an insurance claim — he or she submits details of the expense to the HCSM, which determines if the request falls within the ministry’s sharing guidelines. Money to meet approved needs then comes from the contributions of other members. Some sharing ministries ask members to send money directly to fellow members (via check or online transaction). Other HCSMs act as a go-between for the payments, helping ensure that sharing requests are met.

Bear in mind that health sharing ministries are voluntary. Although members pledge to be faithful in making contributions and paying any other fees, there are no legal contracts or guarantees (and, therefore, no guaranteed coverage). Any member who fails to fulfill a ministry’s requirements (including making monthly contributions) is removed from membership.

According to the Alliance of Health Care Sharing Ministries, a trade association, more than 100 health care sharing ministries are in operation in the U.S. Most are small organizations that restrict membership to particular faith groups. At present, only nine offer open membership. This article discusses four of those nine — the four largest: Christian Healthcare Ministries, Medi-Share, Samaritan Ministries, and Liberty Healthshare.

Christian Healthcare Ministries

The nation’s oldest broad-based health care sharing organization is Christian Healthcare Ministries, founded in 1981 under the name The Brotherhood Newsletter. The ministry’s early growth was jumpstarted by Christian financial teacher Larry Burkett, who showcased the organization several times on his daily national radio program. Today, CHM has more than 300,000 members.

Membership is open to any Christian who lives by “biblical principles” (including attending worship regularly if health permits) and agrees to abide by the group’s published guidelines. Although CHM “has no restrictions based on age, weight, geographic location, or health history,” sharing limitations apply for pre-existing conditions (specifics are available in the ministry’s guidelines).

Pricing is done by “unit” — a single person constitutes one unit, a couple is two units. However, all children in a family comprise only one unit. So, for example, a mom and dad with four children would be considered three units, not six.

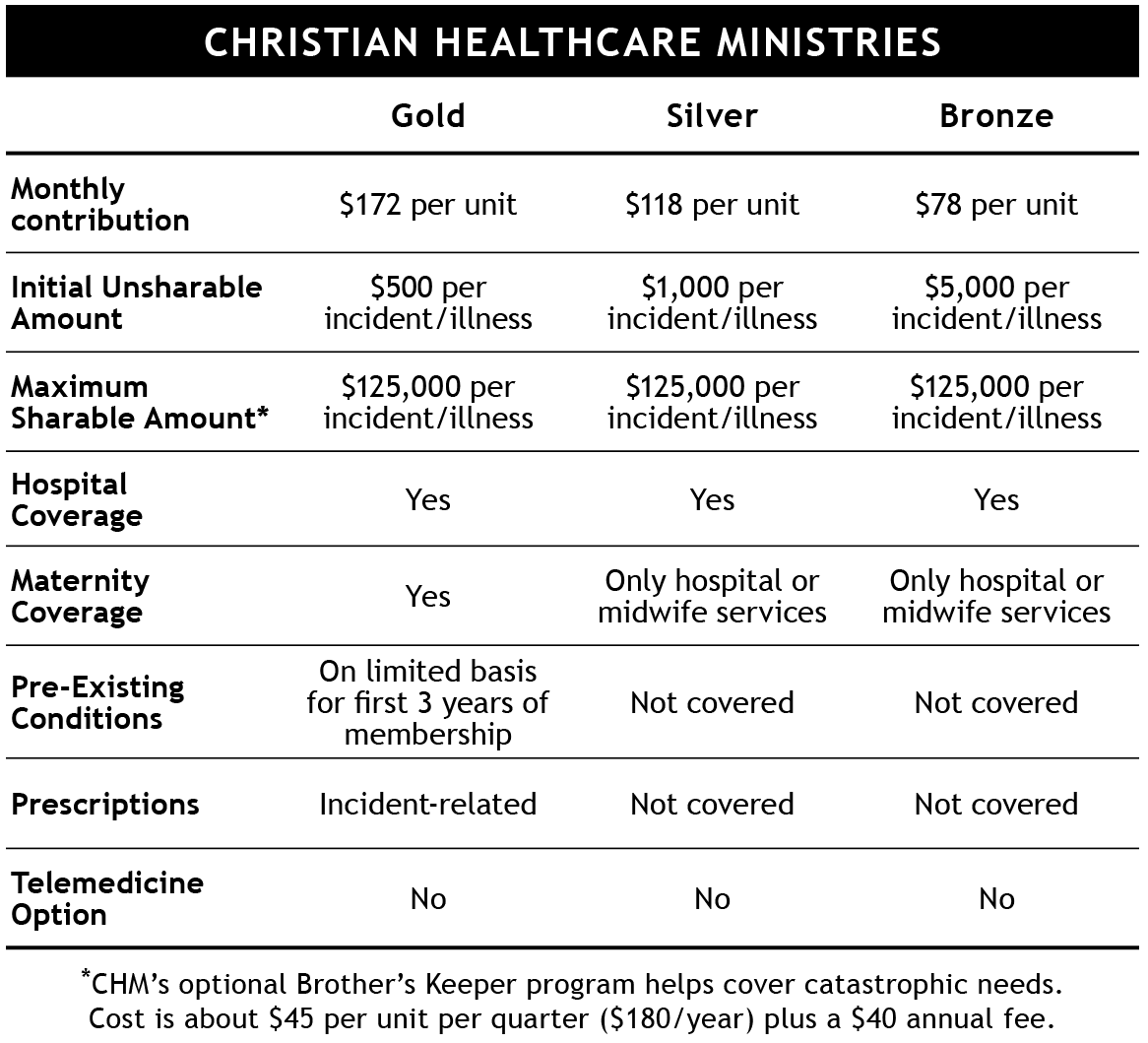

CHM offers three levels of membership: Gold, Silver, and Bronze (see table below for monthly contributions at each level). Pricing remains the same across all age groups — e.g., a 60-year-old member pays the same as a 30-year-old member.

Members send their contributions to CHM, which in turn forwards the money to members who’ve submitted needs. (Other HCSMs take a more hands-off approach to transferring funds from members to members, as explained in the following sections.)

As one moves down CHM’s Gold/Silver/Bronze scale, the unshareable amount — CHM calls it a member’s “personal responsibility” — increases (see CHM table below). At all three membership levels, the maximum share request per “any medical incident” is $125,000, although members can opt-in to CHM’s “Brother’s Keeper” program that provides higher levels of support for catastrophic bills.

CHM members are free to choose their doctors, labs, and other providers, rather than being restricted to providers within a particular network. Patients are responsible for negotiating the best deal they can get from providers, although the ministry does offer coaching to help members negotiate more effectively. Once a price is negotiated, the bill is submitted to CHM for processing.

While waiting for a share request to be fulfilled, the member may have to go ahead and pay the bill in full or set up a payment plan. The sending of money in response to a share request can take “up to 120 days.” That’s not quick, but it’s not much different than the timeline for the payment of traditional health-insurance claims. CHM sends money directly to the member, who pays the provider (if the bill hasn’t been paid already).

For more detailed information about Christian Healthcare Ministries, visit www.chministries.org.

Click Table to Enlarge

Medi-Share

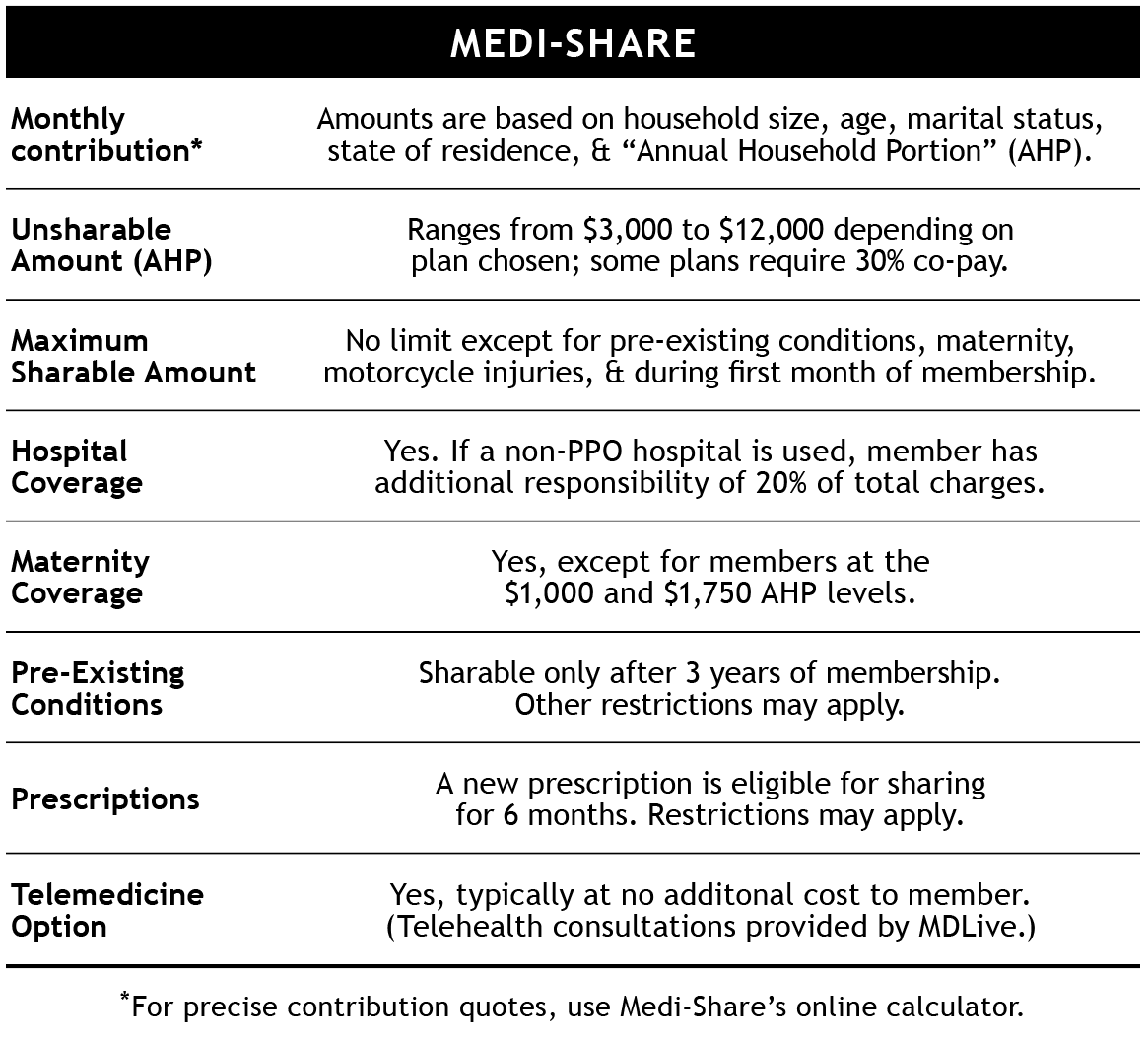

Medi-Share, founded in 1993, bills itself as the “nation’s largest health care sharing community” (more than 400,000 members), and it boasts of “98% customer satisfaction.” An applicant must agree to Medi-Share’s statement of faith and “have a Christian testimony indicating a personal relationship with the Lord Jesus Christ.” Members must also refrain from using tobacco and illegal drugs and not engage in sexual contact outside of man/woman marriage.

Among the major HCSMs, Medi-Share looks the most like traditional health insurance. For one thing, Medi-Share steers its members toward medical providers that belong to a large nationwide PPO network. (Members typically will pay more if using a provider outside the network.)

If a member uses an in-network provider, the provider submits the bill directly to Medi-Share. The Medi-Share staff reviews and discounts the bill and sends the member an Explanation of Sharing (similar to an insurance company’s Explanation of Benefits). If the member hasn’t met his or her “annual household portion,” the member pays the provider directly. Otherwise, the need is shared among other members.

Another insurance-like feature is that Medi-Share members pay $35 out of pocket for a doctor’s visit and $200 for emergency-room treatment.

Medi-Share has no per-incident maximums (as Christian Healthcare Ministries does) but rather an “Annual Household Portion” (AHP), similar to a yearly deductible in a traditional health insurance plan. Monthly share amounts are based on the AHP a member has chosen — AHPs range from $3,000 to $12,000.

A member can reduce the required monthly share by choosing a 70/30 “co-share” option, in which 70% of an eligible need is shared while the member covers 30%. In addition, Medi-Share members who are in good health (no obesity, no high blood pressure, etc.) are eligible for a “Health Incentive Discount” of up to 20% off the usual monthly share.

Pregnancy and childbirth are covered but with some restrictions. Pre-existing conditions are not covered until a member has been with Medi-Share for 36 months.

For seniors, Medi-Share offers an option other HCSMs don’t: a low-cost plan that supplements Medicare Parts A and B — i.e., a health care sharing version of a Medigap plan.

The actual sharing among Medi-Share members is done using individual member accounts at America’s Christian Credit Union. Medi-Share has a limited power of attorney that allows it to move funds from one member account to another.

Learn more about Medi-Share at mychristiancare.org.

Click Table to Enlarge

Samaritan Ministries

America’s third-largest HCSM is Samaritan Ministries, founded in 1994 with only 10 families. Today, Samaritan’s membership stands at 300,000 members across more than 90,000 households.

Membership requirements include regular church attendance (which must be confirmed by a pastor). Applicants must pledge to limit consumption of alcohol to “moderate amounts,” not take illegal drugs, and “abstain from any sexual activity outside of traditional Biblical marriage.”

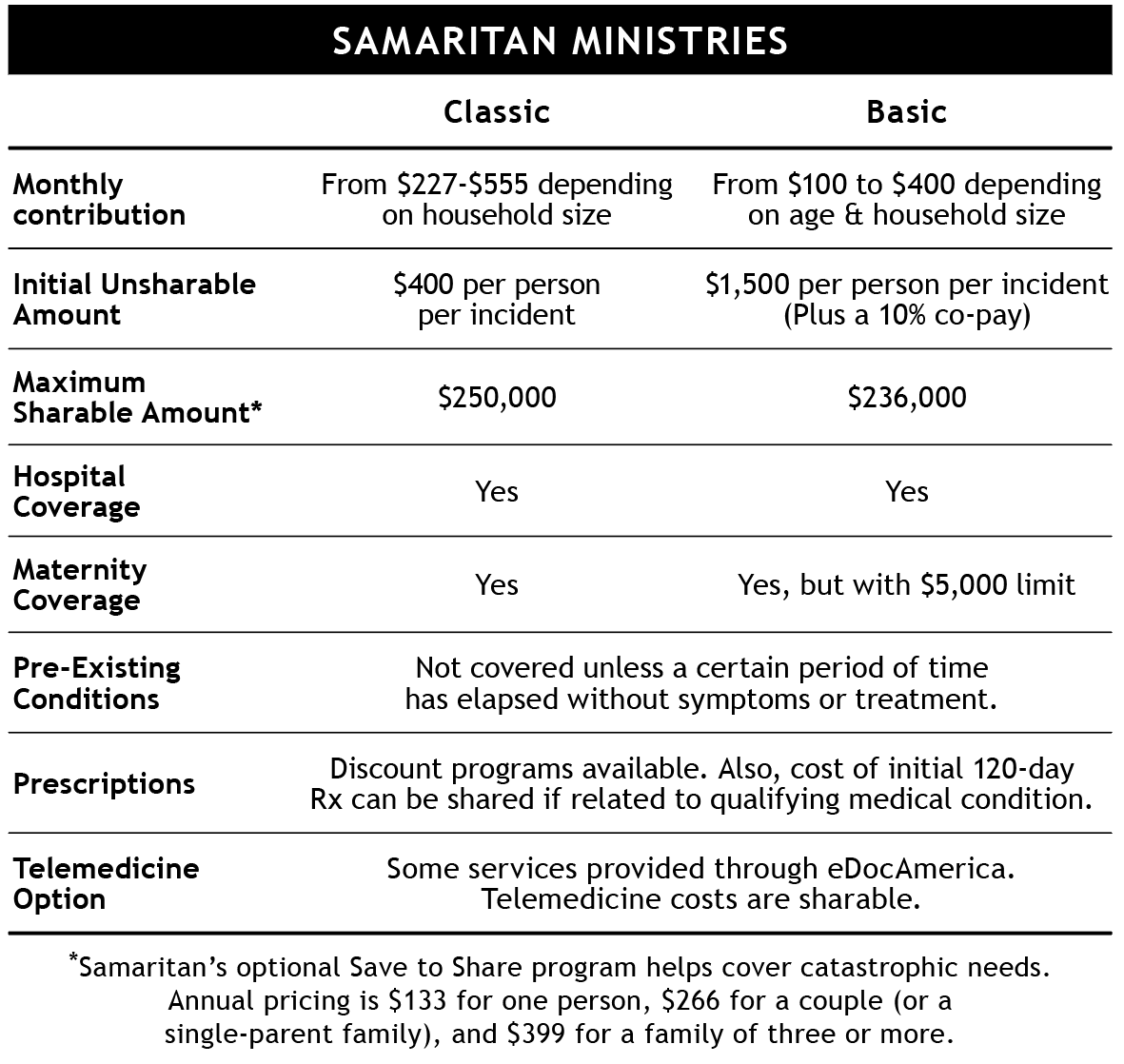

At present, Samaritan offers two levels of membership, “Classic” and “Basic,” although it is beta-testing a third app-based option (“Samaritan Given”). Samaritan’s optional “Save to Share” program helps cover catastrophic costs.

The monthly share required to participate in Samaritan’s Classic program ranges from $227 for a single person to $555 for a household of eight or more. Special rates are available for young adults and single parents.

Share amounts for the Basic program are less overall, but they rise as age increases. For example, a young couple (under 30) pays $200/month for Samaritan Basic, while a couple in their early 60s pays $320/month.

Like CHM (and unlike Medi-Share), Samaritan has no provider network. The ministry encourages members to use doctors and other providers of their choice and to negotiate prices. To assist members in finding the best prices, Samaritan provides online access to the cost-comparison “Healthcare Bluebook.”

Members pay their medical expenses upfront (or set up a payment plan), then submit copies of bills to the Samaritan office for review. Expenses deemed eligible (based on Samaritan’s published guidelines) are then “shared” with other members. Samaritan is unique among the big four HCSMs: members send money to each other directly — i.e., without any centralized system (such as CHM uses) or a common financial institution (the Medi-Share approach). Although the bulk of Samaritan sharing now occurs via individual PayPal accounts, many members continue to use the old-school method of sending fellow members paper checks in the mail — often accompanied by handwritten notes of encouragement.

Under Samaritan’s guidelines, pre-existing conditions are not covered unless a condition seems to have been cured and 12 months have passed without symptoms, treatment, or medication.

See the Samaritan Ministries table below for information about unshareable amounts under the Classic and Basic programs.

The Samaritan website is www.samaritanministries.org.

Click Table to Enlarge

Liberty HealthShare

[UPDATE: In February 2023, MinistryWatch — a watchdog site for Christian donors — published a detailed and unflattering report about Liberty HealthShare, “A Christian Health Charity Left Thousands in Debt as it Built a Family Empire.”

The article notes that following a $6.4 million legal settlement between the state of Ohio and former Liberty leaders in early 2022, the nonprofit "now has a new board of directors and new management." A separate class-action suit against Liberty and its former leaders, filed by a group of Liberty members, remains unresolved.]

Although Liberty HealthShare has been in existence since the mid-1990s, it didn’t start using that name until 2014. Initially, it was called the Gospel Light Mennonite Church Medical Aid Plan. Since rebranding and reorganizing, Liberty has experienced steady growth and now has more than 200,000 members.

Liberty says it is “specially tailored for individuals who maintain a Christian lifestyle, make responsible choices in regards to health, and believe in helping others.” To become a member, one must “strive to live in accordance with biblical principles,” including not abusing legal drugs and abstaining from the use of illegal drugs. Members also pledge to “exercise regularly and eat healthy foods that do not harm the body.”

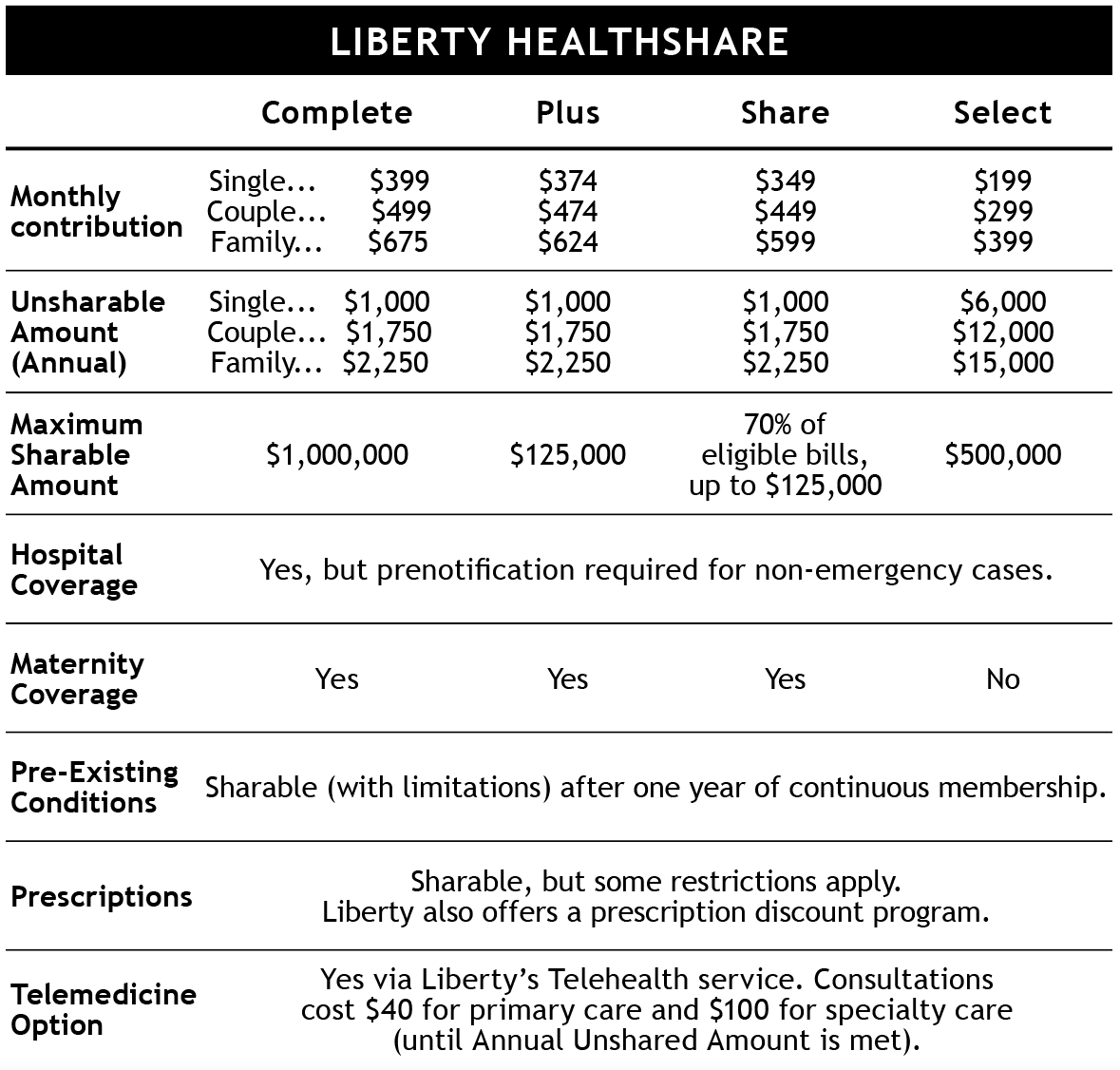

Liberty has four membership levels: Liberty Complete (the most comprehensive), Liberty Plus, Liberty Share, and Liberty Select (the least expensive month-by-month).

Liberty Complete shares medical bills up to $1 million per incident. Shareable amounts are significantly less — $125,000 per incident — at the Liberty Plus and Liberty Share levels. Interestingly, Liberty Select — the tier with the lowest monthly contribution — has a $500,000 maximum sharable amount.

As with other HCSMs, members have a deductible-like “Annual Unshared Amount” (see the table below).

Liberty membership includes annual wellness visits (covered at up to $400 per year and not subject to the Annual Unshared Amount). Most maternity and prenatal needs are sharable (except at the Select level). Immunizations are eligible for sharing, too.

During the first two months of membership, sharing is limited to expenses resulting from accidents, injuries, and acute illnesses. During the initial year of membership, a member may not share a need related to a pre-existing condition.

Liberty doesn’t steer members to a provider network. Members can select any provider they choose. Some providers submit bills directly to Liberty HealthShare. In other cases, it’s up to the member to do so.

Liberty’s sharing process is somewhat similar to that used by Medi-Share. Each member sends monthly shares to a “Sharebox” — a designated account over which Liberty has a limited power of attorney that allows it to move funds to another member’s Sharebox as needed. This arrangement facilitates member-to-member sharing, but Liberty itself never takes possession of the money.

Click Table to Enlarge

Other ministries

In addition to the four large ministries highlighted above, other broad-based HCSMs include Share Healthcare, Altrua Healthshare, OneShare Health, MCS Medical Cost Sharing, and Sedera Health. Because of state regulations, some groups do not operate in all 50 states.

Not perfect but helpful

We want to stress again that health care sharing is not health insurance. As one HCSM states in its published guidelines, “[We do] not assume any legal risk or obligation for payment of member medical expenses. Neither [the ministry] nor its members guarantee or promise that medical bills will be paid or shared by the membership.”

Even so, HCSMs — now with well over one million members — have a decades-long track record of sharing health-related expenses among people bound by a common Christian commitment. As noted by the Alliance of Health Care Sharing Ministries, “This moral, but not legal, obligation is the glue that holds HCSM communities together.”

As traditional health insurance costs continue to rise, health care sharing ministries fulfill a crucial role for families and individuals who can’t afford health insurance and those with moral objections to certain government-mandated benefits in traditional health plans.

Protecting against the financial fallout of an unexpected health issue is wise. Many Americans will continue to do so via traditional health insurance. But for others, that protection will take another form — one that is both ancient and timeless: “Bear one another’s burdens, and so fulfill the law of Christ” (Galatians 6:20)