In Monopoly, each player starts with the same amount of money. However, after just a few rounds of play, some players have gained more than others, sometimes substantially more.

A similar thing happens in your investment portfolio. Let’s assume you decided to implement SMI’s DAA strategy at the start of 2023. You divided your money according to our recommended target percentages — one-third in each recommended DAA fund. Since then, some holdings have performed better than others, so your portfolio has drifted from its original targets.

Of course, DAA made several fund changes during the year too, such as moving out of Cash and into U.S. Stocks back in April, so you’re not holding all the same funds that you had a year ago. But even if there had been no alterations in our lineup, the percentages you started with in January 2023 would have drifted as some funds and categories did better than others.

If you are among the many investors who implement more than one SMI strategy, this drift occurs in another way, too. The percentage allocated to each strategy changes because of performance variations as time passes.

These divergences in your portfolio are why we suggest “rebalancing” every so often, and this is a good time of year to do so. Rebalancing is like pressing a reset button that restores your portfolio to its original percentage targets (or at least reasonably close to them).

A word about asset allocation

As we discuss how to rebalance, remember that the most crucial characteristic of your portfolio — the factor most likely to influence your overall performance — is how you divide your money across asset classes.

An “asset class” is a broad category of investments that tend to have similar risk characteristics and respond similarly to market forces. The most common classes are stocks, bonds, real estate, commodities, and cash equivalents.

The starting point for our two Basic Strategies — Just-the-Basics (JtB) and Fund Upgrading — is to determine how much of your portfolio to allocate to “ownership” investments (stocks) and how much to allocate to “lending” investments (bonds). The more you invest in stocks, the greater the growth potential, but also the greater the risk. (As interest rates have risen over the past two years, the “interest-rate risk” bonds carry has been on full display! As interest rates rise, bond prices fall. Historically, however, bonds have been significantly less risky than stocks.)

Just-the-Basics and Fund Upgrading

Consider your goals and risk tolerance in determining your stock/bond percentages. We’ve provided step-by-step instructions to lead you through this process in the “Start Here” section of the SMI website. At the end of that process, you’ll have stock- and bond-allocation percentages based on your investment “time frame” — that is, how long before you must begin withdrawing your money for later life living expenses.

Any stock/bond allocation change should occur only in accordance with your long-term plan and only as a thoughtful response to changes in your circumstances (perhaps your age now puts you in a different “season of life” category, or you’re altering your financial goals). Beware of changing target allocations based on an emotional response to recent market activity.

SMI’s Just-the-Basics portfolio mix is permanently fixed, with the portfolio divided among three stock funds and (for some investors) one bond fund. The suggested percentage allocations are shown on the JtB Recommendations page.

After double-checking your optimal stocks-vs-bonds mix using the “Start Here” process described above, adjust your JtB holdings to roughly match that optimal mix. If your JtB portfolio includes bonds, rebalancing may involve selling some stock holdings and redeploying the money to bonds, or vice versa. You’ll also need to return your three Just-the-Basics stock funds to their target percentages.

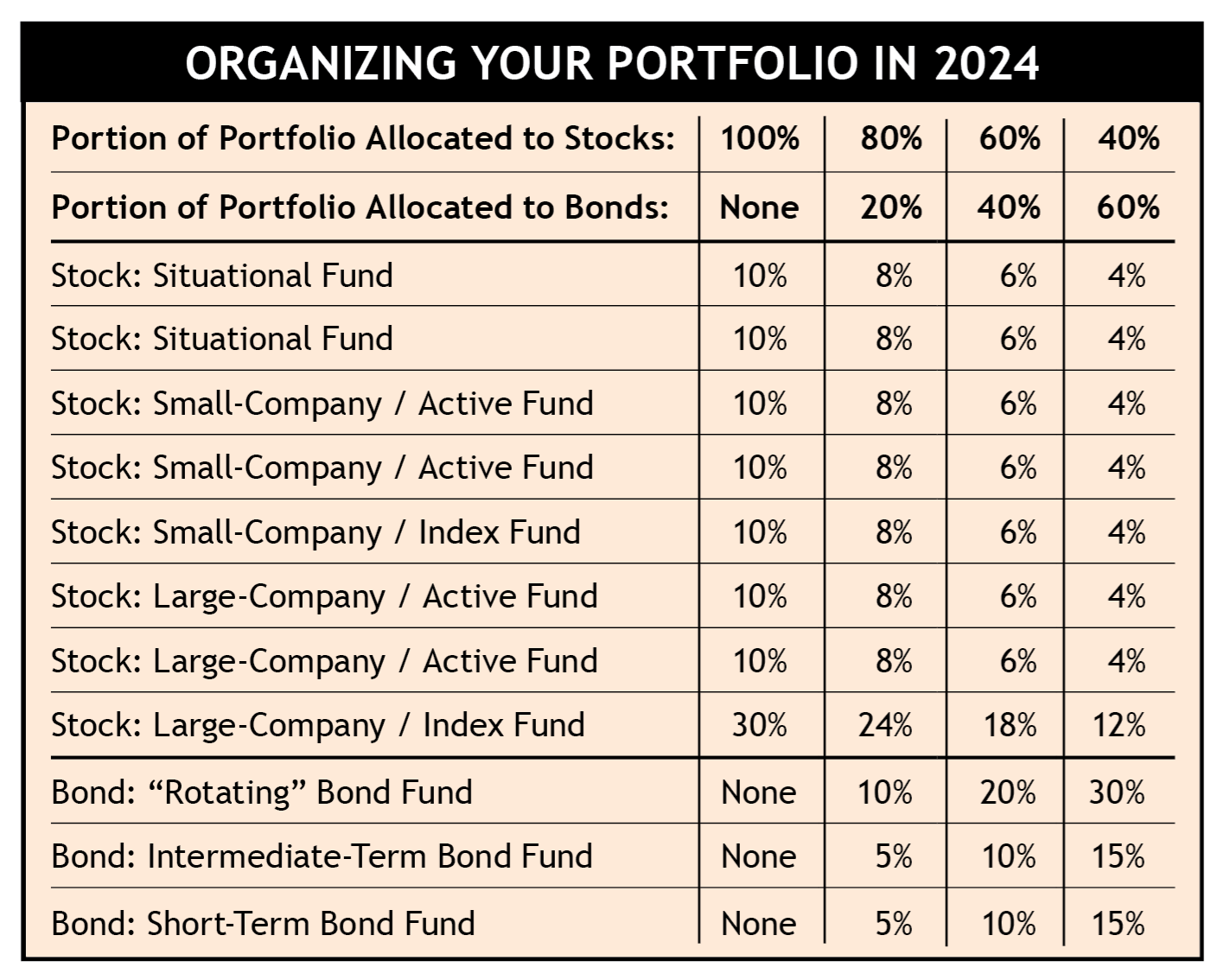

If you use SMI’s Fund Upgrading strategy, then — after re-checking your optimal stock/bond allocation — redistribute your investments across Upgrading’s stock categories and, if your asset allocation calls for it, across the strategy’s bond categories. The table below shows the target percentages for various asset-allocation approaches, ranging from 100% stocks to a 40/60 stock/bond portfolio.

Click to zoom

Note: At this point, we’re not altering the allocation percentages for any of the eight “slots” used in Stock Upgrading — i.e., the two holdings in the Situational category and the three each in the Large Company and Small Company categories. The current percentages are shown here. Stock Upgraders can rebalance to those suggested targets while also selling any funds being replaced and adding any new recommendations. (The target percentages for some Upgrading slots may change later in the year as the potential-recession situation becomes clearer.)

Rebalancing in DAA

Dynamic Asset Allocation, available to Premium-level members, skips the asset-allocation process because the strategy shifts the portfolio allocation automatically based on market trends. Still, a DAA investor should rebalance every so often to ensure that the three DAA holdings remain roughly equal.

The Dynamic Asset Allocation invests in three exchange-traded funds at any given time, each making up one-third of the DAA portfolio — at least at the beginning. Over time, the portfolio loses that roughly equal balance as funds are sold and the proceeds reinvested in different ETFs. Rebalancing restores equality to the three positions.

Of course, you can address an imbalance with DAA anytime a holding is replaced. So, while you can rebalance here at the start of the year if you want to, you may find it more convenient to do so at a time when you’re making DAA trades anyway.

Multiple strategies

For SMI members diversifying among two or more SMI strategies, an additional rebalancing task is necessary, as noted earlier: balancing among strategies. For example, an investor dividing a portfolio evenly between DAA and Fund Upgrading would need to rebalance so that roughly the same dollar amount is invested in each strategy as we begin 2024.

Close enough is good enough

The rebalancing task has become more challenging over the years as SMI has added strategy options, but don’t make the process overly complicated. A growing body of research suggests that the benefits of annual rebalancing are not as substantial as was once thought.

So, don’t stress out over trying to hit exact percentages. As long as you can get within a few percentage points of your allocation targets, that’s close enough, especially if trying to get closer would incur additional trading costs.