One of the central tenets of SMI’s investment philosophy is that trying to predict what the market will do next is a fool’s errand. While there are a host of "gurus" who have become famous based on a particular market prediction they made, there are very few (if any) that have a consistent track record of making such calls.

From time to time, we’ve run articles pointing out how poorly "expert forecasts" actually do in predicting the future. Whether it’s the direction of the stock market, interest rates, or virtually any other signal, the track record of the prediction crowd is dismal.

However, even more shocking than the fact that so few seem to be able to predict the future are the studies showing how little value even accurate predictions of the future would present. That’s hard for most of us to accept because it seems so counterintuitive.

SMI has written about this idea in the past as well, most recently a couple years ago in The Surprisingly Small Benefit of Perfect Market Timing. That article showed that making new annual contributions at the exact low point of the market every single year only beat monthly dollar-cost averaging by about 1% annualized over multiple recent 20-year periods. Not only is this type of perfect timing impossible, it wouldn’t move the needle very much anyway. Thus our emphasis on "time in the market, not market timing."

’The Investment Clock’

I was reminded of this listening to a recent episode of The Market Huddle podcast where hedge fund manager Jim Leitner was interviewed (link starts about 20 minutes in).

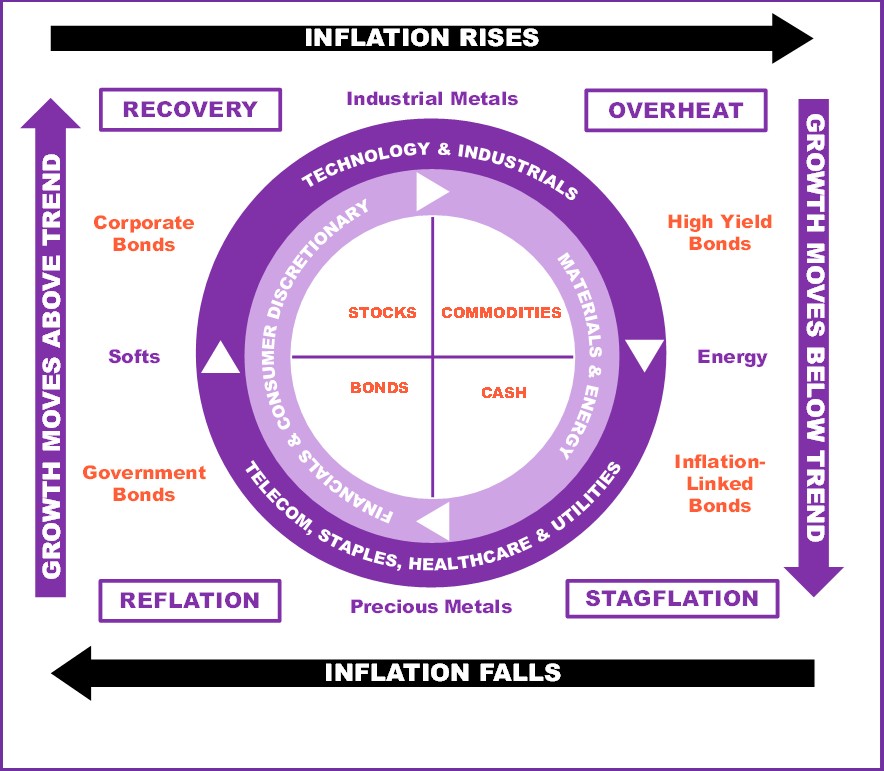

Leitner recounted research done in the 1990s on the so-called "Investment Clock" — a methodology, developed by British investment strategist Trevor Greetham, that divides the investment landscape into four quadrants based on whether economic growth and inflation are accelerating or decelerating. The combination of these two variables each moving in two possible directions gives four possible combinations — Growth & Inflation both accelerating, both decelerating, or moving in opposite directions.

Click Graphic to Enlarge

Greetham went back through history and identified that different types of assets excel under each of these four different economic regimes.

SMI doesn’t use the investing clock per se, but it’s the same type of information we write about often. For example, earlier in the year when I wrote that inflation is increasing, so interest rates are bound to go up, meaning long-term bonds are a bad place to be (but commodities should do great), that’s the type of "which asset class to own in each economic quadrant" information the investing clock provides.

Nothing particularly new so far — this idea has been widely applied and many investment approaches are built on this general framework. (SMI’s DAA strategy, for example, incorporates this thinking to a degree. We specifically chose DAA’s asset classes by thinking through what types of assets would excel under these varying economic conditions. Others use these "investing quadrants" more explicitly as the foundation of their investing process.)

What was fascinating was the second step Greetham took in his investment clock research, which I don’t remember ever hearing about before.

After identifying which asset classes an investor would have wanted to be in during each of the four quadrants, he went back through multiple decades to see how investing performance would have been affected if an investor had perfect foresight regarding those economic conditions three months in advance. In other words, if an investor had known exactly what quadrant to be in three months in advance and had positioned their portfolio that way, how would it have impacted their performance?

Surprisingly, the impact of perfect foresight was...significantly worse investing performance! The best portfolio outcome was to be positioned for the appropriate quadrant as the data came out (i.e., today). But even being three months late produced better performance than being three months early!

That’s counterintuitive, to say the least. We know the markets are constantly trying to look ahead and anticipate what’s coming next. So it seems perfectly natural that we should try to do the same thing. But Greetham’s investment clock research says that doesn’t work, even if you could do it perfectly.

Of course, I had to try to learn more about this, which led me to an extended interview Leitner gave in the 2006 book, Inside the House of Money: Top Hedge Fund Traders on Profiting in the Global Markets. Consider the following passage, explaining what they did next based on this insight:

We thought that it was a very interesting idea that being smarter than the market did not help you but following the market did. Our quant guys modeled the idea to test the assumptions, using a really simplistic approach.

Since we assume that we are not able to forecast what markets are going to do, we look back for six months, one year, and two years, giving a higher value to what happened recently....

The process is basically momentum following because it increases the weights of assets that have performed well recently. ...

A really important lesson in investing is that being either too far in front or too far behind is when you get hurt, whereas being right at the edge of the wave is where the money is made.

Hopefully, that approach sounds familiar because it’s essentially describing the momentum trend-following approach SMI’s strategies are built on.

It’s also really good news, because it means you don’t need to be able to predict what the future will hold. Consistently applying our momentum-driven strategies will keep your portfolio aligned with the markets, and if this research is to be believed, will do an even better job than if you could predict what was coming three months from now. Hard to believe, but Greetham and Leitner’s research both agree that it’s been true historically.