The money-market fund (MMF) is back. After years of minuscule yields, this once-popular choice for savers is back to offering respectable returns — in some cases, at least equal to the rates offered by online banks.

Money-market funds are sometimes confused with money-market accounts (MMAs), but they differ from MMAs in significant ways. Most importantly, MMFs are mutual funds. While they invest in what would seem to be ultra safe securities, such as U.S. Treasury bills and commercial paper (a bond-like instrument sold by large corporations to meet short-term obligations), some of these investments come with no guarantees.

Money-market accounts, on the other hand, do not carry investment risk. The Federal Deposit Insurance Corporation (FDIC) insures most banks that offer MMAs. At most credit unions, the National Credit Union Administration or American Share Insurance covers depositors.

Prior to the past decade, money-market funds offered yields that were clearly superior to those of money-market accounts. For example, Vanguard’s Prime money fund yielded a respectable 5% in 2007. Widely perceived as only marginally riskier than insured money-market accounts, the popularity of money-market funds soared.

That all changed during the Great Recession. First, the assumed safety of MMFs took a serious hit in September 2008. That’s when the $65 billion Reserve Primary Fund “broke the buck” (that is, the value of each share fell below the customary money-fund share price of $1.00), causing the first-ever losses for retail MMF investors. The fund held nearly $800 million in commercial paper issued by Lehman Brothers, which became worthless when Lehman filed for bankruptcy. While the losses for Reserve Fund shareholders were small, the illusion that MMFs were as “safe as cash” was shattered.

Fearing a run on other companies’ MMFs, the federal government stepped in, guaranteeing investors that the value of each MMF share would remain at $1. The government’s temporary guarantee program ended in September 2009.

Then the Fed’s interest-rate lowering QE initiatives took their toll on MMF yields. By 2010, the yields at most MMFs had plummeted to less than one-tenth of one percent, where they stayed through 2014. Only recently have they improved.

A new day

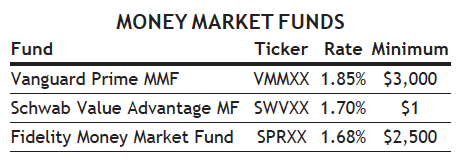

As the economy cycled through its recovery, and with the Fed now raising interest rates, MMF yields have headed northward. Vanguard’s Prime money market fund now yields more than 1.8%. MMFs offered by Schwab and Fidelity aren’t far behind.

As MMFs start appearing on the radar screens of savers in search of better yields, it’s natural to ask whether such funds are safe. On the one hand, the aftermath of 2008 brought new regulations to MMFs. They are required to take on less credit risk than before and to hold more cash to handle redemptions.

Also, as has long been the case, all SIPC-insured brokers protect customer assets against fraud, including those held in MMFs, up to $500,000. However, there is no protection against market loss, such as what happened with the Primary Reserve Fund in 2008.

What’s a saver to do?

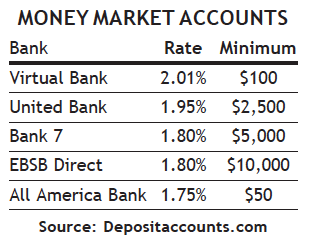

Right now, money-market fund yields are comparable to the interest rates being paid by online bank money-market accounts (and both are miles ahead of what you’re likely to earn at your local bank).

So, if you have money in a top online money-market account, there doesn’t appear to be a compelling reason to switch to a money-market fund. However, it would be worth checking to see where cash in your brokerage account(s) is being held. This is usually referred to as your core position, and you likely have more than one option.

At Fidelity, investors have three options: Fidelity Government Cash Reserves (currently yielding 1.38%), the Fidelity Government Money Market Fund (1.33%), and an FDIC-insured cash sweep account (0.19%). Neither of the first two options are Fidelity’s highest-yielding MMF (Fidelity Money Market Fund is, ticker SPRXX) yielding 1.68%. However, a Fidelity representative said customers could buy shares of SPRXX with the money in their core position, which may be worthwhile if you have a large cash position. Settlement funds, dividends, and other distributions would continue going automatically into your core position.

Money-market funds have come a long way from their years of near-zero yields. At this point though, the interest rates and safety offered by the top online money-market accounts are still a step ahead. That said, either option would be a significant upgrade from your local bank for your emergency-fund savings.