[UPDATE: In January 2023, the MoneyWise App was re-branded as the FaithFi App.]

Never ask of money spent

Where the spender thinks it went.

Nobody was ever meant

To remember or invent

What he did with every cent.

– Robert Frost

Personal financial management is challenging. Yet, despite the defeatist conclusions of the notable poet quoted above, tracking one’s outgo (and income) isn’t impossible! Indeed, SMI has written about several effective budgeting/cashflow systems. In this article, we highlight a new one: the MoneyWise App.

This recently released digital tool is based on the time-tested “envelope system.” Managing money via envelopes was common when people did the bulk of their spending with cash. Income was divided among a series of envelopes, each earmarked for a particular spending category. Predetermined amounts would go into a Groceries envelope, a Clothing envelope, a Miscellaneous envelope, and so on.

Using envelopes (an alternative version used Mason jars) made it possible to make spending decisions in advance, as the user set aside funds for specific types of expenditures. The system had the further virtue of holding the user accountable to those pre-made decisions. When the funds in a particular envelope (or jar) were all spent, there would be no more spending in that category until the following month!

A proven approach

A system that uses physical envelopes isn’t all that practical anymore, given electronic money flows and credit/debit spending. Still, the three concepts undergirding the system remain as applicable as ever: segregating money by its intended use, tracking expenditures by categories, and having a mechanism aimed at inhibiting spending when a category’s funds are exhausted.

If the “MoneyWise” moniker seems familiar, it’s because this app was developed in conjunction with MoneyWise, the daily national radio program hosted by Rob West (and formerly hosted by Howard Dayton). The purpose of the new tool is to “help people steward God’s money wisely and align their faith with their financial decisions,” says app developer Chad Clark.

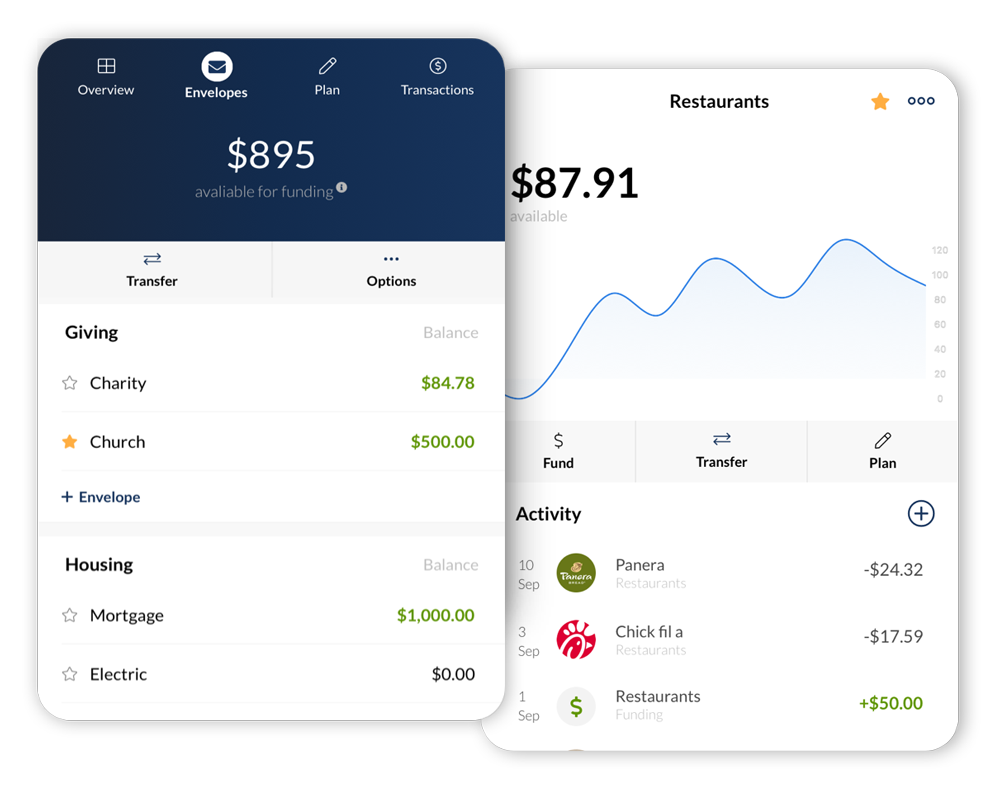

Two screen captures from the MoneyWise App (mobile version).

Envelope discipline in a digital age

The MoneyWise App employs “digital envelopes,” each funded with a user-determined amount each pay period. The app then tracks expenditures related to each envelope and alerts the user when an envelope has been depleted. This helps the user stay accountable to his or her self-imposed spending limits. When an envelope has no more funds, the user must transfer money from another envelope or wait until more income is received.

The “Basic” version of the app is free. It comes with pre-selected “envelope groups” (Giving, Housing, Food, etc.), as well as already-labeled envelopes (Mortgage, Restaurants, Fuel, etc.). The app’s “Pro” version ($6.99/mo or $60/yr) allows you to customize the names of groups and envelopes to your liking.

MoneyWise Pro has several other functionalities that aren’t in the free version, such as the ability to import transactions automatically via the third-party data aggregator Plaid. (Unfortunately for customers of Capital One Bank, Plaid refuses to supply transaction data for Capital One accounts because of a long-standing dispute between the two companies.) Of course, if you’d prefer to post your transactions manually, you can do that too — or you can choose to manually update some accounts and have data imported for others.

The Pro version can auto-categorize transactions too, speeding up the process of tracking where your money went and which envelope balances are affected.

Another feature of MoneyWise Pro is the ability to split transactions. This functionality comes into play when expenditures that fall into different categories are on the same receipt. For example, you may have purchased groceries and miscellaneous items at the same store. Splitting the transaction ensures that your spending matches up with the appropriate envelopes.

Making a plan

Although keeping tabs on spending is necessary, it’s only one aspect of good money management. An effective manager must also plan. The MoneyWise App helps there too, enabling you to guide where your money will go.

Using the Plan section of the app, you can input your projected income and then, based on your projected spending, divide the income among various digital envelopes. (With the Pro version of the app, you can choose to have your plan “auto-fund” envelopes on the dates you select. )

A stewardship emphasis

One thing SMI members will notice right away about the MoneyWise App is its stewardship emphasis. The main page of the mobile version, for example, features a “Weekly Wisdom” block that links to a stewardship-related video. In the app’s Envelopes section (in both the mobile and web-based versions), “Giving” is listed as the first envelope group, subtly reminding users that we should give “off the top” rather than from what’s left over.

Tapping the app’s Discover section leads to a wide-range of articles about money and Christian stewardship. The articles are supplied by “trustworthy partners,” such as Generous Giving, Compass–Finances God’s Way, the Christian Stewardship Network, and, yes, Sound Mind Investing.

The MoneyWise App also features a Community section in which users can post app-related inquiries and other questions and also receive help and encouragement from fellow users.

The mobile and web layouts for the MoneyWise App are similar, making for a smooth switchover from one version of the app to the other. (For example, you may want to do your initial setup of the app in the web version and then use the mobile version to track your daily spending.) Syncing across platforms is almost instantaneous.

Getting started and getting help

As with any app, there is a learning curve, so new users need to be realistic. Expect a time of trial-and-error as you figure out how to navigate the app and start to understand its approach to various types of money-management situations, from spending cash to paying off debt to setting funds aside for periodic (i.e., non-monthly) expenses.

Fortunately, the MoneyWise App includes a robust help guide and embedded training videos. In addition, users can access live online workshops and Q&A sessions.