As the calendar flipped from 2018 to 2019, few imagined the dramatic turn the financial markets were about to take. The stock market had fallen nearly -20% during the last quarter of 2018 and fear was palpable as 2019 began. But a dramatic shift in Fed policy — from nine interest rate hikes in 2016-2018 to three rate cuts in 2019, coupled with massive Fed stimulus late in the year that re-inflated the central bank’s balance sheet at a breathtaking pace — provided a steady dose of rocket fuel that propelled financial markets to new all-time highs.

JFK famously said, “A rising tide lifts all boats,” and that was certainly true of financial markets in 2019. Asset prices rose sharply across the board.

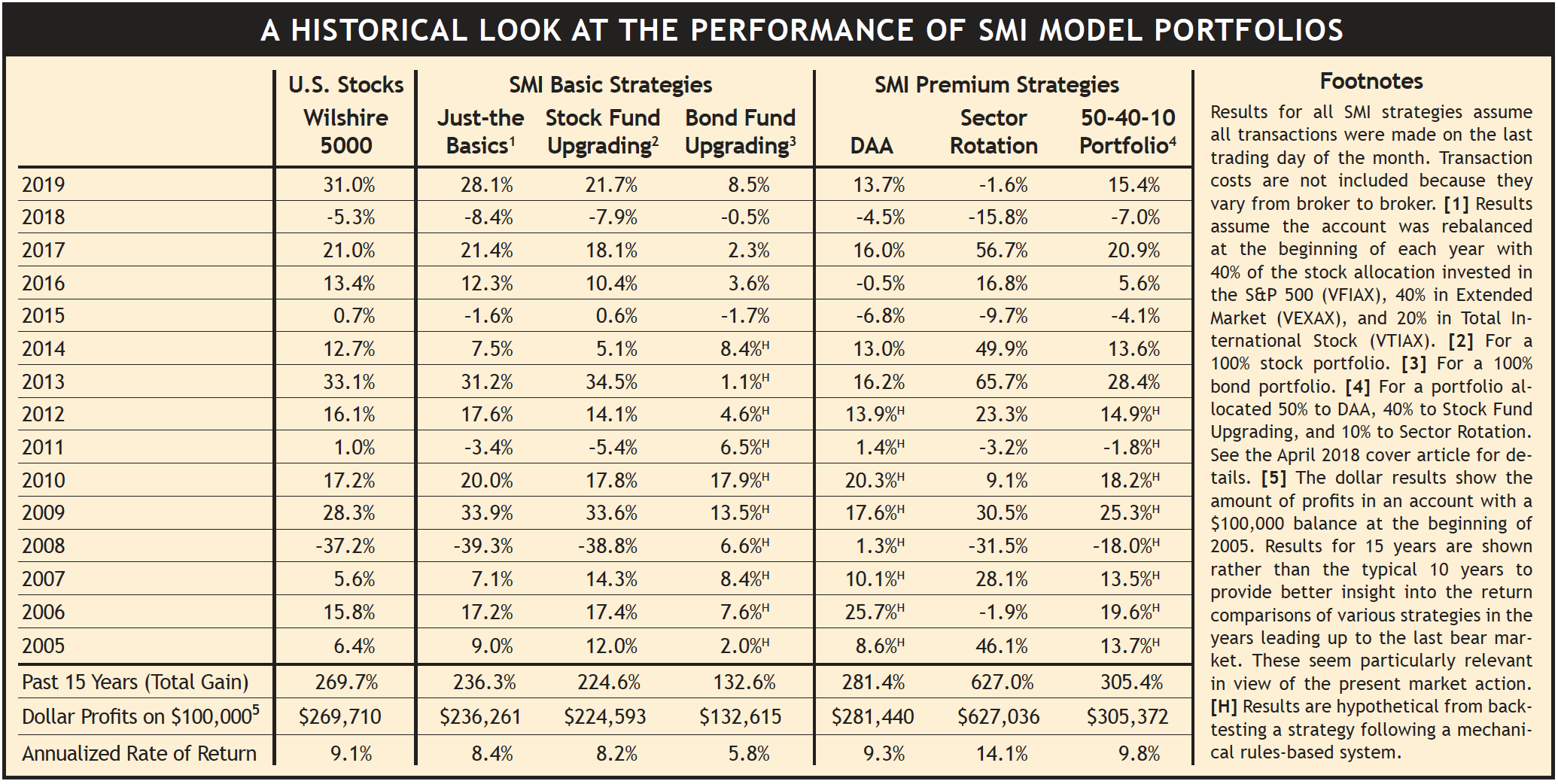

SMI’s model portfolios reflected these strong gains as well. Despite starting 2019 with very conservative allocations and fund selections (the result of following the rapidly falling market trend during the dismal fourth quarter of 2018), all of SMI’s model portfolios except one still managed to produce new all-time highs during the year. Ironically the one that did not, Sector Rotation, has been the standout performer throughout this long bull market — reinforcing the idea that little is predictable when it comes to investing. Hence, the best course is to diversify and maintain a long-term perspective!

Just-the-Basics (JtB) & Stock Upgrading

When the books closed on 2019, the Wilshire 5000 index was up a breathtaking +31.0%, the strongest year for stocks since 2013, and the third-best year of the past two decades. Of course, much of that shine comes off when the results of 2018’s fourth-quarter are included: the 15-month return falls to +12.3%. That’s still a solid return, but hardly the remarkable story 2019 appears to be without the context of the steep market correction that immediately preceded it.

As has often been the case in recent years, stocks of large domestic companies led the way higher in 2019. Within JtB, this is reflected in the fact that S&P 500 component (VFIAX) gained +31.5%, extended market component (VEXAX) gained +28.0%, and foreign component (VTIAX) gained +21.5%. Altogether, JtB gained +28.1% for the year.

Stock Upgrading’s returns were lower, though its gain of +21.7% was still fantastic in absolute terms. The first and last quarters of the year weighed on Upgrading’s performance relative to the market. The first quarter of 2019 saw Upgrading’s “2.0 defensive protocols” trigger in response to the rapid market breakdown at the end of 2018. Those first-quarter cash allocations, when the stock market was rebounding strongly, accounted for roughly half of the performance gap. The rest was mostly attributable to being positioned in relatively conservative funds when the Fed dramatically ramped up its liquidity push late in the year. The market spiked +9.1% during the fourth quarter of 2019, while Stock Upgrading was up “just” +5.9%.

While it’s always tempting to simply compare final strategy returns to the market benchmarks, the context of 2019’s Upgrading results is important. Following a decade-long bull market, in late 2018 Upgrading recognized the market’s trend was breaking down to a degree only witnessed a handful of other times in the past two decades — two of which led directly to market declines of -50%. As a result, Upgrading took defensive measures that would have dramatically limited our losses had a bear market ensued. Due to Fed intervention, that bear market was thwarted and the market rebounded strongly. Stock Upgrading was able to pivot quickly enough to still participate in the bulk of the market’s rise, gaining over +21% for the year — despite starting the year from an extremely defensive posture.

Naturally, we’d prefer not to have had Stock Upgrading start 2019 on the wrong foot. But we’re encouraged that the system was nimble enough to rebound so quickly given the market’s rapid about-face. As our past reporting on Upgrading 2.0’s defensive protocols has shown, eventually those measures are likely to save us a lot of money. This year they “cost” us in terms of additional gains we might have otherwise earned, but over the long-term we still believe they will add significant value to our portfolios.

Bond Upgrading

Interest rates were a huge driver of the financial market story in 2019. With investors increasingly concerned about a slowing economy, the Fed disappointed markets in December of 2018 by delivering the ninth interest rate hike of the cycle that began in late 2015. This was the immediate catalyst for the December 2018 stock market correction.

As signs of an economic slowdown around the globe became more evident, longer-term interest rates (which are determined by the bond markets) fell sharply. Eventually, the Fed joined in, making three cuts to the shorter-term Fed Funds rate.

Bond Investing 101 states that when interest rates fall, bond prices rise. So it was in 2019, as bonds of all types soared. Bond Upgrading gained +8.5% in 2019, a remarkable turnaround from the three years prior (2016-2018) when its total return was just +5.4%!

Dynamic Asset Allocation (DAA)

DAA started the year in its most conservative possible allocation. Despite the slow start, DAA still managed a gain of +13.7% for the year.

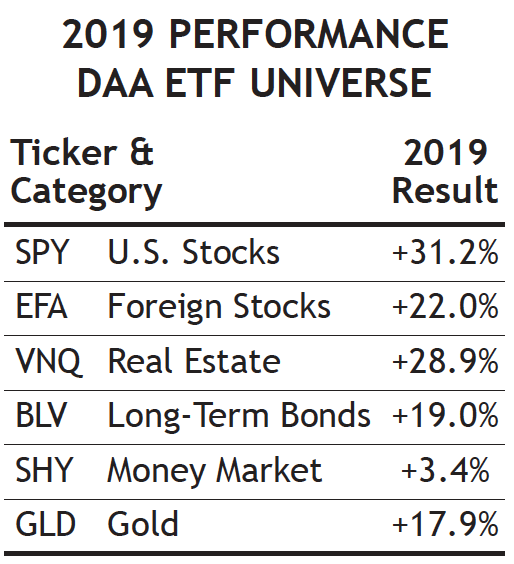

While the first quarter found most of SMI’s trend-following strategies conservatively positioned while the markets quickly reversed course and climbed higher, the one place where this helped rather than hurt our relative returns was DAA’s move into long-term bonds at the beginning of 2019. Long-term bonds would remain a DAA holding all year, paying off with a +19% gain. While bonds primarily are used to provide ballast and safety within SMI’s other model portfolios, this is an example of DAA opportunistically using these more volatile long-term bonds as a contributor of significant gains.

Ultimately, we don’t expect DAA to keep pace with the stock market during huge up years like 2019. Participating in a strong portion of the market’s gains — as DAA did this year — while providing the kind of protection the strategy was poised to deliver at the outset of the year, is what we’re looking for from this strategy.

Sector Rotation (SR)

The biggest surprise of 2019 was the significant underperformance of SR, which typically flourishes in environments such as 2019 provided. While SR finished the year with a strong +9.6% December gain to nearly even its books, it ultimately finished with an overall loss of -1.6%. Most of that was attributable to a particularly tough May, when it fell -14.3% as SR pivoted back into tech stocks just as the market took a dive. Despite the off year in 2019, the table below clearly shows that SR has been the strongest performer among SMI’s strategies for many years. Last year served as a reminder of SR’s volatility and the unpredictability of its year-to-year returns.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider.

The conservative nature of this portfolio was on full display early in 2019. Had the market continued to fall into a bear market, this portfolio’s defensive properties would have limited losses dramatically. That’s obviously not how 2019’s story turned out, but we know bear markets are inevitable, so at some point that will be the story. Knowing 90% of this portfolio should outperform an indexed portfolio during a deep market decline likely played a role in helping many investors stay invested in stocks in recent years — perhaps making possible 2019’s substantial gains for those who otherwise might not have been willing to stay invested in stocks to as significant a degree.

Gathering a significant portion of the market’s gains during rising markets while avoiding the worst of its losses during falling markets is a recipe for superior long-term returns — plus it provides the type of emotional stability so crucial to sustained investing success.

Click Table to Enlarge