The cost of buying and selling exchange-traded funds has been falling for years. But, in October, brokerage powerhouse Charles Schwab “went nuclear” (in the language of one trade publication), eliminating ETF commissions entirely. Competitors TD Ameritrade, E-Trade and Fidelity followed suit.

Below is a primer on ETFs, highlighting their growing advantages, plus a few remaining disadvantages.

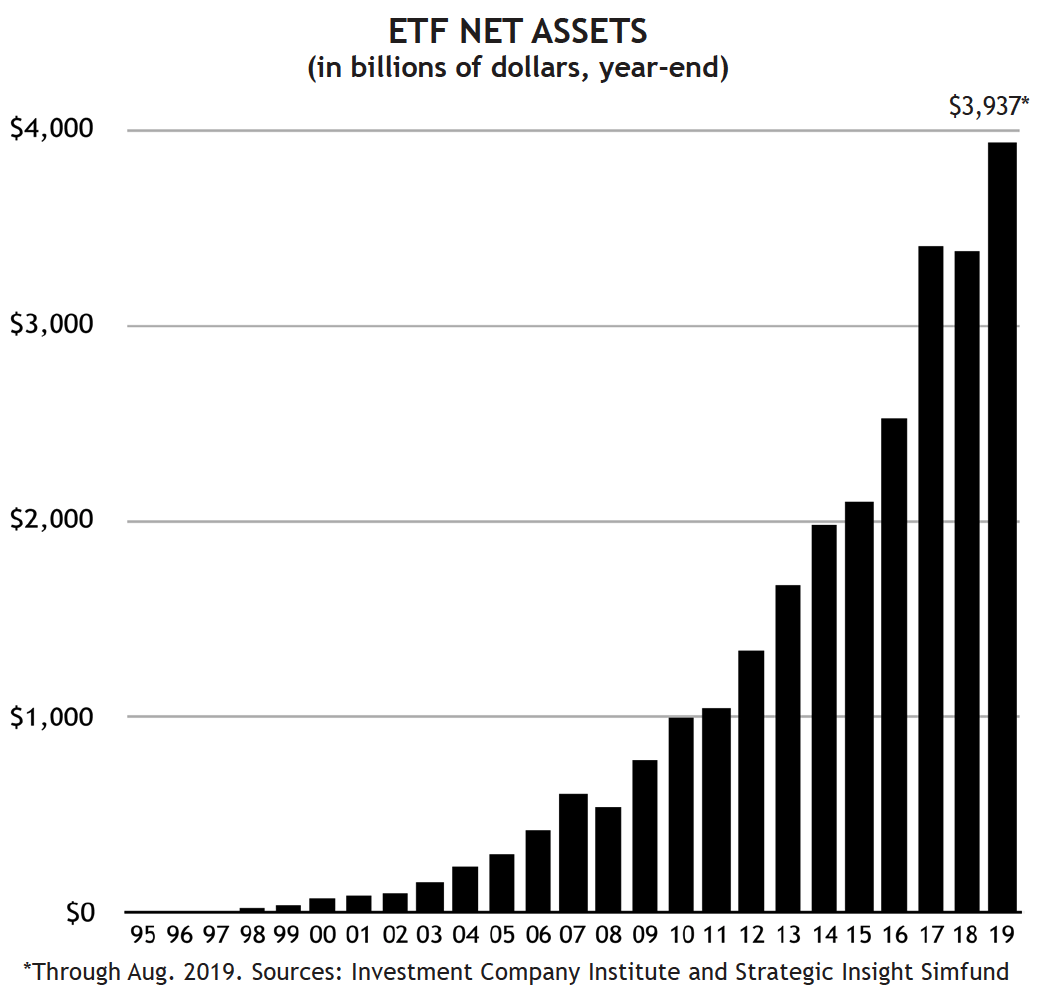

The first exchange-traded fund opened to investors in 1993, more than a quarter of a century ago. But as recently as 2011, more than six in 10 investors responded to a survey saying they didn’t invest in ETFs because they “don’t know what they are.”

Now, ETFs have gone mainstream. As of Aug. 31, 2019, U.S.-listed ETFs held a record $3.9 trillion in assets, according to the Investment Company Institute trade association — nearly four times the asset level of 2011. Exchange-traded funds now account for about 16 percent of the overall mutual-fund pie (excluding money-market mutual funds).

Today, more than 2,000 exchange-traded products are on the market, but that number obscures an important fact: The top 100 funds hold roughly 75% of all ETF assets. And, remarkably, just five exchange-traded funds account for nearly 20% of all ETF holdings! (Three of the five are funds that mirror the S&P 500 index.) So while the overall ETF marketplace has grown quite large, the number of “key” funds is still quite small.

What is an ETF?

The simplest way to understand an ETF is to think of it as a mutual fund that trades like a stock (more on that shortly). Like traditional mutual funds, exchange-traded funds offer a convenient way to invest in a pre-assembled basket of stocks.

Most ETFs are “index” funds — i.e., they are similar to traditional mutual funds that track the performance of a particular stock market index or sector of the economy. (Some ETFs are not index funds, but that’s a more complicated subject for another day.) The particular index or sector an ETF tracks may be broad and well-known, such as the aforementioned S&P 500, or it may be something extremely narrow that you’ve never heard of, like the price of goat cheese in Albania (okay, we’re exaggerating — but not by much).

But this is where the similarities end and the differences begin. Whether these differences make ETFs more (or less) attractive than traditional funds depends on the circumstances of each investor.

Here are ETF pluses as a typical investor likely would evaluate them.

Advantages of ETFs relative to traditional mutual funds

Advantage #1: ETFs trade like individual stocks.

As already mentioned, ETFs and traditional index funds are similar in how they are constructed but different in how they trade. A traditional mutual fund is priced once per day after the market closes when the prices of all the fund’s holdings are known. Therefore, each investor who buys into a particular traditional fund on the same day will pay the same price, which is called the NAV (net asset value).

An ETF, in contrast, is priced and traded continually throughout the day, in the same manner an individual stock is. Buying a particular ETF in the morning will likely garner a different price than buying the same ETF in the afternoon (or, for that matter, even buying it a few minutes or seconds later).

This greater flexibility is a key selling point of ETFs. A mutual fund that trades like a stock makes it possible for an investor to purchase a fund that is rising during a particular market session, or (as the case may be) to exit a falling position before the end of the trading day. Exchange-traded funds offer other “stock-like” attributes too: You can buy them on margin, short them, and use limit orders.

While these advantages are no doubt appealing to active traders and professionals, they are of less value to most “average” investors. Being able to get in or out of a fund based on what the market is doing on any given day, or to buy at different prices throughout the day, usually is of little importance to those following a long-term investing plan.Advantage #2: There’s an ETF for virtually anything you want to index.

The stock market is like baseball — there’s a statistical measurement for everything that happens. As a result, there are many different stock indexes, each measuring a slightly different slice of the market. As ETFs have become popular, the companies that create them have responded by designing ETFs to track almost any index available (and creating new indexes that track things they want to create an ETF for!). Therefore, it’s easier to invest in certain market niches with ETFs than via traditional index funds, simply because in some cases there aren’t any index funds following the less- prominent market segments.

But, again, for the average investor, the relevant question is how finely do you need to slice the market? For most investors, the huge variety in ETFs is overkill.Advantage #3: ETFs are more tax-efficient than traditional funds.

This isn’t a huge distinction relative to traditional index funds, which are tax efficient because they rarely sell stocks from their portfolios. However, relative to actively managed funds, the tax efficiency of ETFs can yield quite a cost savings. Most traditional funds must distribute capital gains to shareholders as the fund sells holdings at a profit. ETFs, due to structural differences, don’t.

For example, while most traditional funds distributed capital gains to shareholders in 2018 (despite the end-of-year decline), 95% of the roughly 350 iShares-brand ETFs had no distributions. In short, ETF owners generally pay taxes only when they sell the ETF, whereas owners of traditional mutual funds often are taxed on distributions from funds they still own. Again, this is largely an “indexing vs. active-management” issue, but it’s one in which ETFs come down on the more advantageous side.Advantage #4: ETFs require no minimum investment.

This aspect of ETFs is especially attractive for investors who want to diversify across funds but don’t have a large amount of money to invest. Of course, many traditional funds can be purchased with a low minimum investment, but this is still an area where ETFs have a clear advantage.Advantage #5: Short-term redemption fees are rare.

With traditional funds, buying a fund and then selling it quickly (within, say, a month or two) can sometimes trigger a short-term redemption fee charged by the fund company. In addition, brokerage firms impose a fee if a traditional fund isn’t held for a certain number of days (broker policies vary, ranging from 60 days to 180 days). With ETFs, however, fund companies don’t charge early redemption fees, and among our recommended brokers, only E-Trade requires a 30-day holding period for an ETF. Since our strategies never hold a fund for less than 30 days, you’ll never encounter a short-term redemption fee for an ETF, even if you’re an E-Trade customer.Advantage #6: ETF expenses are slightly lower.

As expense ratios have fallen for traditional funds, this particular advantage has almost disappeared. Today, the expense difference between an ETF and a comparable traditional index fund is negligible in many cases. For example, the expense ratio on Vanguard’s S&P 500 ETF (ticker VOO) is 0.03%, as compared with 0.04% for the company’s traditional Vanguard 500 fund (ticker VFIAX). On a $10,000 investment, that’s a difference of only $1 per year.

Disadvantages of ETFs relative to regular mutual funds

While there is much to like about ETFs, they aren’t without a few remaining disadvantages. Consider:

Disadvantage #1: ETFs trade like individual stocks.

That’s right, the top advantage of ETFs is their primary disadvantage as well. While the flexibility of being able to buy and sell any time during the trading day sounds like a plus, the trade-anytime aspect of ETFs fosters a trading mentality that works against the “slow and steady” long-term approach we think is best for most investors. And now that the major brokers have moved to a commission-free ETF model, the temptation to trade may be even greater. Don’t let free ETF trading take you off your long-term game.Disadvantage #2: Buying and selling ETFs is more complicated.

Since ETFs are traded continuously on the open market, buying and selling them isn’t as simple as buying and selling traditional funds (see the section titled "How to Buy or Sell an Exchange-Traded Fund" below). This diminishes one of the chief virtues of mutual-fund investing: simplicity. Investors in traditional mutual funds know that everyone buying on a particular day gets the same price, calculated based on the value of the underlying stocks at the end of the day. Not so with ETFs, where you pay a fluctuating “market price” rather than one based solely on the value of the portfolio.Disadvantage #3: You can’t buy fractional shares in an ETF.

Unlike traditional mutual funds, ETFs must be purchased in “whole share” amounts. With traditional mutual funds, if you want to invest exactly $500 in a particular fund, you can (unless the fund has a higher required minimum). You’ll get a certain number of whole shares, and (likely) a fractional share — the total value being $500. But with ETFs, you can’t invest exactly $500 in a fund unless you encounter a rare situation in which $500 is precisely divisible by the price per share! More likely, you will have to purchase somewhat less than $500 worth of shares and have money left that you can’t invest immediately. This inability to purchase fractional ETF shares, and thereby invest specific dollar amounts, makes using a dollar-cost averaging approach a little messier with ETFs than is the case with traditional funds. (Dollar-cost averaging involves investing a set amount at a predetermined time interval — e.g, $300 per month.)Disadvantage #4: ETFs aren’t available in most company retirement plans.

If you want to make use of ETFs in your 401(k) or 403(b), you probably can’t. Only a small number of employer-based retirement plans offer ETFs. One reason is that company plans are especially suited for dollar-cost averaging, therefore traditional mutual funds, which allow for the purchase of fractional shares, are a better fit. (Disadvantages #3 & #4 may change soon, as Charles Schwab has announced that they hope to make trading fractional ETF shares possible in the future. But at this point, that capability isn’t available yet.)Disadvantage #5: ETFs are vulnerable to pricing glitches.

A final concern is that ETFs seem vulnerable to intraday price anomalies, such as occurred in the May 2010 “flash crash.” Granted, the flash crash was an unusual occurrence, but there have been subsequent disturbing episodes, such as the glitch in August 2015 that caused dozens of ETFs to briefly trade at prices far below their NAV.

ETFs and the SMI strategies

In the past, commissions charged when buying and selling ETFs acted as a significant obstacle to SMI investors, especially those making regular contributions and/or investing smaller amounts. Just a decade ago, ETF commissions averaged about $13 per trade! In recent years, that average dropped to about $5 per trade. But now we live in a world in which the “big four” brokers — Fidelity, Schwab, E-Trade, and TD Ameritrade — have eliminated commissions entirely for online ETF trades. For its part, investor-owned Vanguard still charges commissions for a handful of ETFs, but it offers a huge slate of exchange-traded funds (about 1,800) commission-free. All of this is great news because it makes employing ETFs in SMI strategies more cost-efficient than ever.

Just-the-Basics.

JtB is SMI’s strategy that uses index funds and it is especially suitable for newer investors and those using taxable accounts. Although our “official” recommendations are Vanguard-branded traditional funds, we include Vanguard’s equivalent ETFs as well, particularly with newer investors in mind. Using Vanguard’s ETFs rather than its traditional funds enables newer investors to set up their investing plans without being hampered by the investment minimums Vanguard requires for its traditional mutual funds. (Instead of using ETFs, investors seeking lower minimums could choose comparable traditional funds offered by companies other than Vanguard.)

For JtB investors who are clients of Schwab, Fidelity, E-Trade, or TD Ameritrade, the latest ETF pricing changes mean you now have easy access to all of JtB’s recommended Vanguard ETFs without paying a commission.Fund Upgrading.

For several years now, the bond portion of our Upgrading strategy has used Vanguard ETFs exclusively. Schwab, Fidelity, E-Trade, and TDA clients can now get commission-free trades on those bond ETFs (as can Vanguard customers, of course). As for stock-fund Upgrading, about 20% of the funds we’ve recommended over the past four years have been ETFs. With most ETFs now trading commission-free, and with a growing number of stock-based ETFs that meet the diversification criteria for Upgrading, exchange-traded funds are becoming an increasingly attractive choice for this strategy. (We will, of course, keep in mind that many Upgraders can’t access ETFs via their retirement plans.)Dynamic Asset Allocation.

DAA is an ETF-only strategy available to our Premium-level members. The no-required-holding-period for ETFs (or a very-short period, in some cases) is a key part of what makes this strategy possible. DAA sometimes sells a holding after owning it for only a month or two. With traditional funds, selling quickly would trigger broker-assessed short-term redemption fees (and perhaps fees assessed by fund companies themselves).

Now, all six ETFs used in DAA (the strategy invests in three funds at any given time) can be traded commission-free at Vanguard, Schwab, Fidelity, E-Trade, and TD Ameritrade.Sector Rotation.

Although this strategy (available to SMI Premium-level members) typically employs traditional mutual funds, we occasionally recommend an ETF. In the past, ETF commissions may have been a roadblock to some investors, especially those investing smaller amounts. With that roadblock now cleared, employing ETFs in SR will become more attractive.

How to buy or sell an exchange-traded fund

Go to your broker’s website.

Open the Stock and ETF trading page, rather than the usual Mutual Funds trading page.Get a price quote.

Each broker’s process is different, but there’s likely a “Quote” or “Symbol” box available somewhere on the screen. Entering the ticker symbol should produce a quote that shows the price at which the last trade took place.Determine how many shares to buy.

Let’s say you have $5,000 to invest in an ETF and the quoted “Ask” price is $60.46. You would divide $5,000 by $60.46. (Brokerage websites typically have dollars-to-shares calculators on their order pages.) This results in an answer of 82.7 shares, so you’ll round down to 82 shares. Enter that in the “number of shares” field.Choose the type of order.

Choices are normally “Market” (the trade will be filled right away at the next available price), “Limit” (the trade will be made at a specified price, or better, within a specified time frame), or some variation of “Stop” (the trade will be made when the security’s price surpasses a certain point). In most cases, a Market order is fine, but when the market is particularly volatile, a Limit order may serve you better. (For more, see "Recent Market Correction Exposes ETF Vulnerabilities.”)

Understand “the spread”

While commission-free ETF trades are definitely investor-friendly, it’s important to be aware of the less-apparent cost created by ETF “spreads.” The spread is the difference between the best available “bid” and “ask” prices for a security. The bid is the highest price a buyer is willing to pay, and the ask is the lowest price a seller is willing to accept.

When you place a “market” order for an ETF (or a stock), you typically will bear the cost of at least part of the spread, and possibly the whole amount. This will be “built in” to the price you pay. Think of this as a “convenience fee” for getting your entire order filled immediately.

Alternatively, you can enter a “limit” order where you specify the price you are willing to pay. As a buyer, you can set your limit price at the current bid price and avoid paying any of the spread — if your order gets filled. The danger is that by limiting the price you are willing to pay, the price of the security you’re trying to buy may move higher, causing your order to go unfilled. So using a limit order may save you a bit of money, but it comes with the risk of having to spend even more — both in money and in time — to chase the price higher.

Spreads tend to be narrow (typically just a penny) on the biggest, most liquid ETFs that SMI suggests in its strategies. On an ETF with substantially lower trading volume, the spread may be wider and the hidden costs higher.

Here’s an example. In SMI’s Dynamic Asset Allocation strategy (DAA), one of the occasionally recommended funds is the largest ETF of all — the SPDR S&P 500 ETF (SPY). A recent quote for SPY showed a bid price of $291.09 and an ask price of $291.10. Paying the full spread would result in a trade that “costs” an extra $0.01 per share.

An investor wishing to purchase $30,000 of SPY would divide that dollar amount by the ask price ($291.10) and determine that $30,000 would purchase 103 shares. At a penny per share, the overall cost of the spread on this trade would be $1.03 (103 shares multiplied by $0.01).

Now, suppose the investor wanted to substitute a similar S&P 500 ETF, such as Vanguard’s VOO, and it was trading with a five-cent spread — a bid price of $267.25 and ask price of $267.30. (This is an actual bid/ask spread for VOO that occurred briefly on Oct. 9, 2019.) Dividing the $30,000 investment amount by the ask price would show that 112 shares could be purchased. Because of the five-cent bid-ask spread, the total spread cost on this trade would be $5.60 (112 shares multiplied by $0.05), more than five times greater than the $1.03 cost of buying SPY.

Some market observers think it would be wise for investors to pay even more attention to spreads now that we’re in a world of commission-free trading. After all, brokerage firms still want to make money on the ETF part of their businesses and spread costs are one way to do so. As the financial publication Barron’s recently noted, “To make up for revenue lost from commissions, brokerages could route trades in a way that leads to wider spreads.”

We hope that won’t be much of a concern for SMI investors. While it is always wise to be aware of the bid/ask spread when investing in an exchange-traded fund, we expect that most of the ETFs SMI recommends will have very narrow spreads.

Conclusion

Exchange-traded funds will continue to play a growing role in SMI’s strategies. Not only have ETFs become cheaper to buy, many of them now have extended performance histories to compare against traditional funds.

We remain cautious about smaller ETFs that are thinly traded, but if you stick with larger, higher-volume funds, there’s much to like. ETFs offer great flexibility at rock-bottom prices. That’s a tough-to-beat combination, making exchange-traded funds an increasingly useful tool in your investing toolbox.