If you have coverage under Medicare, the health insurance program for older Americans, a time of decision is at hand: Do you want to choose different — or perhaps additional — Medicare coverage for 2021? Medicare’s “Annual Coordinated Election” (open enrollment) period is from October 15 through December 7.

During open enrollment, you can:

switch from “Original” Medicare to a market-oriented Medicare Advantage plan or vice versa;

move from one Medicare Advantage plan to another;

enroll in Part D (prescription coverage) for the first time;

switch from one Part D plan to another, or drop Part D.

If you like your current arrangement, you don’t need to do anything. You’ll be automatically re-enrolled for 2021.

A Medicare refresher

Original Medicare, launched in 1965 — and little changed since — consists of hospital insurance (Part A) and medical insurance (Part B). Many users also opt for Medicare-approved prescription coverage (Part D), available via private insurance carriers.

Further, about a third of participants enrolled in Original Medicare supplement the program’s hospital and medical coverage via private “Medigap” policies that cover deductibles, co-payments, and certain other expenses not covered by Medicare. If you want to add a Medigap supplement plan, you must contact a company that issues such policies. (Be aware that supplement plans are identified by letters too, such as “Plan A” and “Plan B.” Don’t confuse them with Parts A and B of Medicare.)

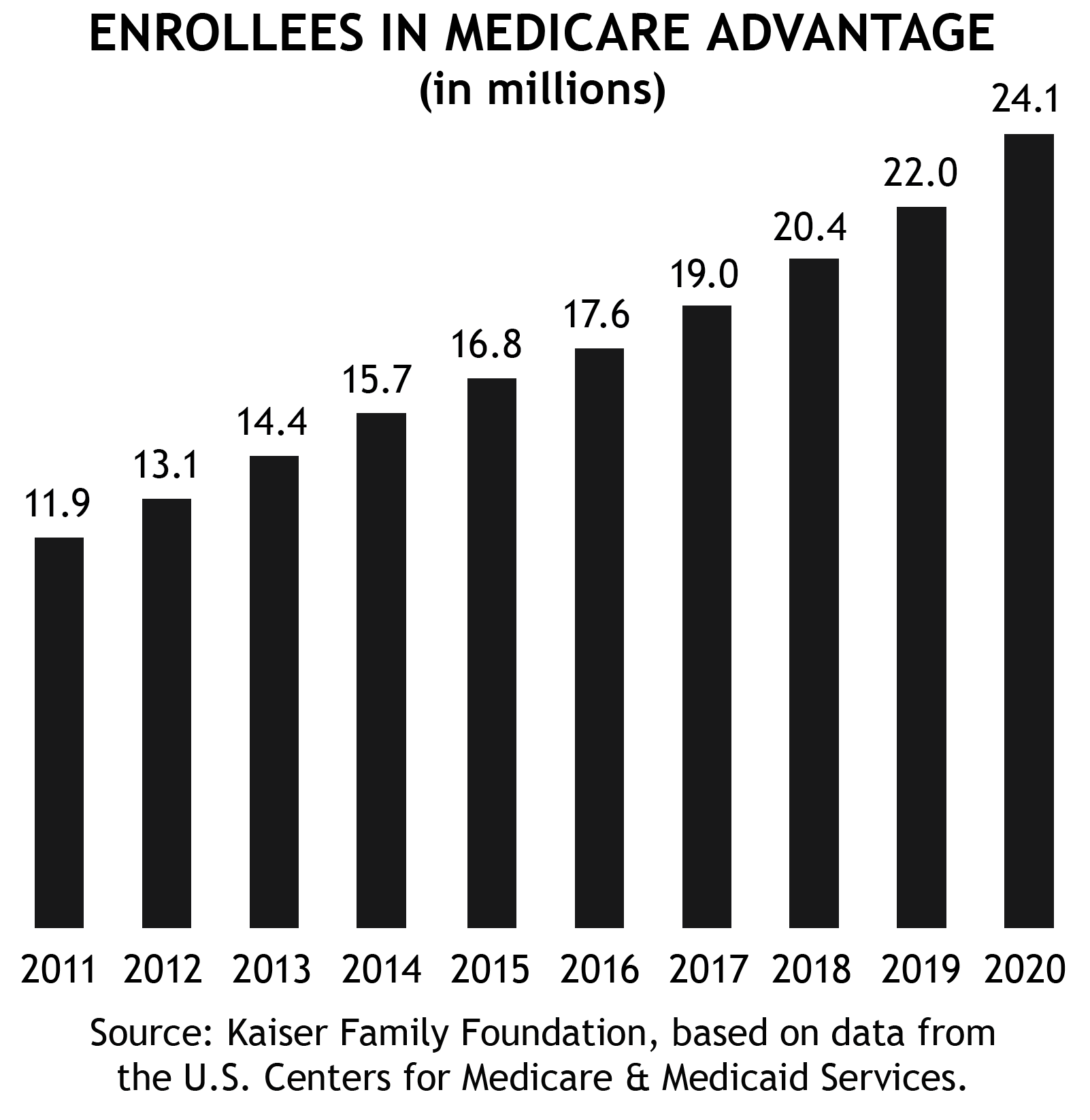

Finally, an increasing percentage of Medicare users are moving to Medicare Advantage plans (also known as Part C), created by Congress in 2003 as an alternative to Original Medicare.

Such plans, offered by private insurance companies, are all-in-one offerings that mirror the benefits of Parts A and B, while also (in most cases) including prescription coverage. Some Medicare Advantage plans add dental, vision, hearing, and fitness benefits as well. Nearly 40% of Medicare’s 62 million participants now choose an Advantage plan.

Satisfied? Shop anyway

Even if you’re happy with your current coverage, it may be worth the effort to take a second look. You might save money, and get more benefits to boot, by switching from Original Medicare to a Medicare Advantage plan. Or, if you have an Advantage plan already, you may find out that another plan has “in-network” doctors and facilities that are more convenient to where you live or work.

It’s especially important to compare plans if your health has changed. Perhaps you’ve been diagnosed with a health condition, and your doctor has prescribed a new medication. Ensuring that you have the right prescription-drug coverage (via a Part D policy or an Advantage plan) could save you money.

The Medicare website has a plan-comparison section (www.medicare.gov/plan-compare) that can help you find a prescription-drug plan or a Medicare Advantage plan that meets your needs. You also can use the site to shop for supplemental (Medigap) policies available in your area. A popular privately run site for comparing various Medicare options is www.PlanPrescriber.com. To speak with someone about choosing a plan, contact your state’s health insurance assistance program (SHIP).

You can make changes to your coverage via www.Medicare.gov or by calling 1-800-633-4227 (1-800-MEDICARE). To contact the Medicare Advantage plan of your choice, use the contact information found on the comparison sites mentioned above.

If you miss the October 15-December 7 open-enrollment season and you’re dissatisfied with your Medicare Advantage plan, you’ll have another opportunity to make changes early in 2021. The annual Medicare Advantage Open Enrollment Period period runs from January 1 to March 31. During those months, you can switch from one Advantage plan to another (even if you just signed up for an Advantage plan during the October-December enrollment period). You also can switch from an Advantage plan back to original Medicare, while also picking up a Part D prescription-drug plan if desired.

A final word of advice. Be on guard against scam artists. In one common scam, someone claiming to represent Medicare will call stating that they are updating your coverage details and need your Social Security number to finish processing your file. Don’t fall for it!

Learn more

For more details about Medicare, including a summary of benefits, coverage options, and answers to the most frequently asked questions about the program, download the 2021 edition of the Medicare & You handbook at www.Medicare.gov/publications.