The investment world is buzzing — with increasing volume — about Bitcoin and all things crytpo. By now, many investors have heard the terms and seen amazing — and sometimes alarming — reports about cryptocurrency investing. (And a lot of us have seen an abundance of crypto commercials featuring the likes of Tom Brady and Matt Damon!)

Still, few investors understand the cryptocurrency sphere — or know how to approach investing in such products. In this overview, we explain crypto’s key concepts and offer a few thoughts regarding these still quite new technologies.

Tell me if you’ve heard this one before: A unique new technology is created. Over the next decade or so, it develops and grows among a small group of passionate enthusiasts. Outsiders start to hear about it but don’t really understand much, partly because it’s so technical but also because it’s tough to imagine how this new tech is relevant to their lives. Eventually, however, the balance tips, and all of a sudden (seemingly), everyone is using it.

That general outline describes any number of technological breakthroughs. Personal computers in the 1980s, the Internet in the 1990s, mobile computing since then. These are relatively recent examples. History is filled with other technological innovations that have followed this same pattern: the telephone, radio, television, nuclear power (Einstein himself said it was impossible!), and so on.

Which brings us to cryptocurrencies — Bitcoin and the like. You’ve almost certainly heard of them. You probably even know someone who is “into” them. But we’re still early enough in the adoption curve that most people don’t understand them — or know what the fuss is about.

Of course, a key question for investors is whether this new tech frontier — one that is attracting massive amounts of investment capital and many of the best and brightest minds in computer science — is a transformational new technology or not. And, as investors, we’d like to know if it’s possible yet to start picking winners and losers in this space.

To help us arrive at some answers, we need first to get the lay of the land. This article attempts to explain — as simply as possible — the fundamental concepts of this expanding technology. This will only be a surface-level exploration. Entire articles and books could be (and have been) written on each topic we’ll explore. For our purposes, a functional understanding of the main ideas will do. We’ll discuss the promise seen by the optimists, the concerns raised by the pessimists, and ultimately offer our perspective regarding the investment implications as we see it today.

In the beginning...

This article uses “crypto” as shorthand to refer to the entire cryptocurrency space. The ultimate promise of crypto is tied to creating a new, digital financial system — a new kind of money if you will. (The topic is broader than that because, rather than being limited to specific financial goals, crypto innovations involve a new approach to computing. But let’s start with money, something we’re all familiar with.)

While people have thought about the concept of “decentralized” money for a long time, the crypto movement began with a whitepaper (PDF) issued in 2008. An anonymous person (or perhaps a group) known as Satoshi Nakamoto outlined a new digital currency called Bitcoin. This vision of a peer-to-peer currency outside the control of any government was brilliant in its design and elegant in its simplicity (the entire paper is only nine pages long). Since then, cryptocurrency has captured the imagination of millions of people.

The Bitcoin idea checked all of the boxes of functional money: durability, portability, fungibility, scarcity, divisibility, and recognizability. And in direct contrast to the inflationary monetary policies that gave rise to crypto (such as we’re experiencing in the U.S. at present), Bitcoin was designed to be “sound money.”

Unlike traditional currencies, which governments have devalued by printing money without limit, Bitcoin is bound by the number of units that can be created. It has a fixed cap of 21 million Bitcoins that can ever be produced. (These are not actual coins but computer entries, as explained below.) Bitcoin’s fixed supply provides the sound-money appeal that has long underpinned the case for gold. A popular way to understand Bitcoin has been to think of it as “digital gold” — useful for many of the same reasons people like gold but with potentially enhanced utility. (“Bitcoiners” and “gold bugs” may disagree about which option is better, but they share many beliefs and concerns, which is what typically has led them to one of these two “sound-money” alternatives in the first place).

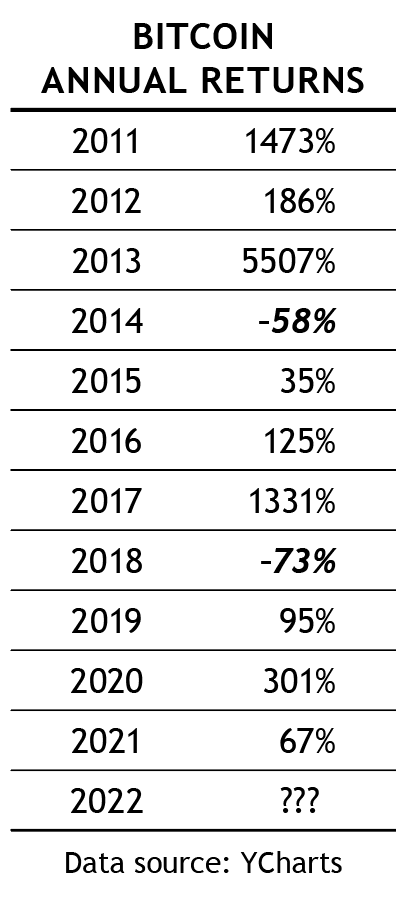

There’s no question that Bitcoin has been an incredible success in terms of attracting people to its cause. As the table on the right shows, the value of Bitcoin has raced ahead at an astonishing pace since the first digital Bitcoin was produced (or “mined”) in January 2009. As more people have bid for the slowly growing supply of available Bitcoins, the price has risen dramatically (though, as we’ll explore later, this growth has been accompanied by staggering volatility).

Notably, Bitcoin has become many things to many people. To the people of El Salvador, it’s now legal tender, usable for anything they would otherwise use their national currency for. To many in wealthier nations, Bitcoin is a store of value against inflationary policies and monetary debasement. And let’s be real: based on the returns shown in the table, it’s also been a speculative investment for many.

Often overlooked is the appeal of Bitcoin (and the rest of crypto that we’re about to explore) to the world’s middle and lower classes. Upper-class Americans are over-banked: we throw away unopened offers for new credit cards and loans and may lament that the new building going up nearby is yet another bank branch. Most of the world isn’t like that. Bank services aren’t available to much of the world’s population. Therefore, a digital currency that can be sent instantly across the globe at minimal cost is an incredible breakthrough for someone now paying 10-15% of their income to send remittances to family in another country — to cite just one example.

This is one reason why, despite Bitcoin having an estimated 76 million owners already, proponents expect its explosive growth to continue. With a global population of nearly 8 billion people and the real-world applications for Bitcoin only beginning to be explored, there’s much room for optimism.

We’ll explore the other side of that coin (so to speak!) in a moment, but first, let’s explore a few more critical aspects of the crypto world.

...was the blockchain.

Blockchain is the first big idea to understand in crypto. A blockchain is a record of transactions updated and maintained by a decentralized network of computers. Let’s contrast this with the ledger system of your local bank.

Your bank has a centralized record of all its customers’ balances and transactions. Your banking data exists in that centralized record. You trust the bank to interact with other banks, accurately update all the transactions and balances, and safeguard this centralized database.

In contrast, a blockchain uses a decentralized network to create and maintain a record of transactions. When transactions occur, these changes update all of the distributed copies of this record so they are kept in sync. Cryptography — a means of encoding/decoding information — is used to process batches of new entries (the new blocks added to the chain) and to secure the blockchain.

In this way, blockchains are designed to be trustless, immutable, and decentralized. These properties stand in contrast to our earlier example of your bank, which is centralized, requires your absolute trust in that institution (both to be competent and act as they should), and where there’s nothing strictly keeping their records from being altered (either accidentally or for nefarious reasons).

There’s much here that could be unpacked in greater detail. But the basic idea is that instead of a centralized network running the whole system, a blockchain enables a decentralized group of many individuals/computers to create a network to accomplish similar purposes. With computer code running the show, this can be accomplished without a traditional company or CEO directing the process (at least once it’s up and running).

Let’s talk risk

It’s easy to get caught up in the excitement of this new technology, as millions have done. However, at this stage of development, cryptocurrencies are more of a speculation than an investment. Consequently, crucial warnings should accompany any discussion of their suitability for most investors.

Volatility in crypto is unlike anything most investors have ever experienced. Bitcoin, which is among the tamest corners of the crypto universe, is at least four times as volatile as the stock market. Other parts of crypto are easily 10 times as volatile, depending on how one measures it.

Consider the Bitcoin performance table again (the one included above). Bitcoin’s gain of +67% in 2021 looks pretty amazing. But that gain masks the fact that it fell –31% in January, dropped –27% in a single day last May en route to a –55% summer swoon, then finished the year amid a separate decline that reached –50% in January. And that was a good year! Meanwhile, Ethereum — another popular cryptocurrency — sold off at least –5% on 37 separate days last year, or roughly once every other week.

This type of volatility is tough to deal with. As impressive as Bitcoin’s overall returns have been, it’s taken nerves of steel to achieve them. Since 2010, Bitcoin has dropped –30% 15 times,

–50% nine times, and –85% four times. That’s like four 1920s/30s Great Depression bear markets in the past 10 years! And that huge volatility wasn’t solely in Bitcoin’s earliest days: eight of those –30% drops have happened in the last five years.

In contrast, the S&P 500 has fallen more than –30% only one time since Bitcoin launched 13 years ago. That was two years ago in March 2020 — and most investors still remember what that felt like.These are still the early days of cryptocurrency and “go to zero” risk remains rampant. New-technology curves are exciting — partly because we can look back at prior cases and see the incredible potential of catching the next Microsoft, Apple, or Amazon in its earliest stages. What’s easy to forget is that each of those winners had a full slate of once-viable competitors that went out of business. It is almost inevitable that a large proportion of today’s crypto projects will suffer the same fate.

Even Bitcoin, the “safest” of crypto options, faces competitive and existential threats. Bitcoin fans may scoff at both, but there’s still the potential that a better option for a new alternative currency and/or store of value will emerge and steal share from Bitcoin. Further, the prospect of governments taking action against an innovative new system that threatens to undermine the benefits they receive from controlling their currencies hangs over Bitcoin’s future like the Sword of Damocles.

I view this “regulatory risk” as the biggest reason for caution. Many crypto protocols appear to be in the regulatory crosshairs (as unregistered securities). While I doubt Bitcoin will ever be “shut down” per se, if the U.S. government decided to make it arduous for investors here to interact with it, that wouldn’t be difficult to do.

Ethereum takes crypto to the next level

One of the most common (and valid) criticisms of crypto is that there are thousands of crypto options and most of them will ultimately fail. This is a place where switching our thinking from “financial” to “tech” terms can help.

Rather than thinking of these as competing currencies, most are better understood as independent tech projects/businesses, each having a unique coin (popularly referred to as “tokens”) used to interact with that particular project’s blockchain. It’s not that all these different cryptos are competing to be the “king of the hill” alternative to the dollar (few intend to be a broad currency like Bitcoin). Instead, there can be many crypto projects (and tokens) in the same way that it’s perfectly normal for there to be many technology companies. Some are competitors in a specific area, but most are working on completely different projects.

Ethereum is the second most valuable crypto, after Bitcoin, but it’s a different animal. Whereas Bitcoin arguably is competing for a role as a global currency, Ethereum is better thought of as a computer programming language that allows the development of new blockchain-based businesses and projects.

Interacting with a blockchain requires someone to record that network’s transactions in new “blocks” and add those to the blockchain (like adding pages in a ledger). Such blocks store permanent and unalterable data related to the network. Maintaining the ledger of a particular blockchain falls to the miners. In Bitcoin’s case, thousands of computers compete to solve difficult computational problems for the right to record a new block. If successful, they are rewarded with “newly minted” Bitcoin.

Other blockchains handle this process differently, but the point is there needs to be a mechanism to incentivize someone to maintain the blockchain. That’s why each crypto has its own token — these tokens are required to interact with that project’s blockchain. Generally speaking (which is dangerous because there’s so much variety among crypto projects!), the cost of interacting with a particular blockchain is paid in the project’s native token. A person may not think of it in those terms, but that’s what’s going on. That spending goes toward maintaining the blockchain by incentivizing someone to record the transactions and so forth.

Using Ethereum as an example, it is a programmable blockchain that allows other developers to build upon it. Nobody owns the Ethereum blockchain — it’s decentralized. But interacting with the programs and services built on this network requires computing power. That’s where Ethereum’s native token, called Ether (ETH), comes in. To use a program or service built on the Ethereum blockchain, I would need to get enough ETH to pay the fees associated with the task I want to accomplish.

A quick note on these tokens, since this is how much of crypto investment is done. As the popularity and use of a particular project rises, demand for its token increases, which typically causes the price to rise. So a person can invest (or speculate) in ETH, for example, if they expect the popularity of all the services built on Ethereum to increase. One doesn’t necessarily have to use the services to invest in the tokens.

Ethereum is the biggest of the “base layer” or “Layer 1” protocols that allow developers to build upon them. Others include Binance Smart Chain, Litecoin, Avalanche, and Solana. Think of these as competing programming languages, each vying with the others by providing varying combinations of decentralization, scalability (speed), and security. Frustratingly, this “trilemma” is such that these three ideals are always in opposition: improving on one almost by definition requires sacrificing on another. This fact explains why this isn’t necessarily a “winner take all” competition — there may end up being multiple Layer 1 blockchains emphasizing different strengths (speed vs. decentralization, for example).

The benefits of a Decentralized Finance system

If you’ve made it this far, you may be wondering what the point of all this is? What tangible benefit does anyone get by interacting with these various blockchains and tokens?

This brings us to the world of Decentralized Finance, or DeFi for short. The goal of Decentralized Finance is to recreate the current Traditional Financial (TradFi) system with decentralized alternatives. So any function now done within the Traditional Financial system — borrowing, lending, insuring, saving, investing, etc. — likely has multiple crypto projects competing to provide that same function using a decentralized blockchain.

Interestingly, financial services is one of the last major industries to be disrupted by the Internet. Sure, we all do financial transactions over the Internet today. But fundamentally, the services themselves are all run through centralized gatekeepers who extract tolls (fees) for interacting with the system.

Simply put, the object of Decentralized Finance is to replace those tollbooths with decentralized alternatives so that the massive amount of money that goes toward financial fees in the traditional model instead stays in the system for the benefit of those using the system. For example, imagine if, instead of depositing your savings at the bank and earning 0.01% while the bank makes loans at 3.25%, you could deposit money into a pool where you could earn 3% interest, and borrowers could borrow at 3.05%. I made those numbers up, but that’s the general idea — cut out the fee-takers and run the new financial system on digital, decentralized rails.

Crypto entrepreneur Mike Novogratz uses the example of the iPhone and the App Store to help illustrate all this. The first iPhone was essentially just a cooler version of what we already had: mobile phones that made calls. Many viewed the early iPhones as frivolous, expensive, and unnecessary.

But the iPhone was more than just a replacement phone. It was a platform that unleashed the creativity of thousands of developers who started building anything and everything on top of it. To use just one example, once GPS capability was unlocked, in short order we got Maps, then Uber, then DoorDash, and so on.

Blockchains are similar in that we’re in the early phases of seeing what can be built on top of them. Ethereum and other protocols enable the huge variety of projects being built within crypto today. As with apps in the App Store, many of these projects may turn out to be worthless. But just as an iPhone owner in 2007 couldn’t imagine the extent of today’s possibilities, crypto and its emerging uses hold a similar potential to disrupt the massive financial services industry — and more.

Investment applications

Given the cautions mentioned earlier about volatility and other risks (including regulatory risk), what should we make of crypto? First, we can’t overstate the importance of recognizing that crypto is still a speculation rather than a traditional investment. That may change as the space matures, but today this space needs to be approached with the same level of caution (or greater) as one would take with the riskiest pieces of a portfolio. Crypto is like an even riskier version of SMI’s Sector Rotation strategy. While we wouldn’t expect an SR fund to fall to zero, that possibility exists within crypto, especially as one ventures out into Decentralized Finance (or even more speculative areas such as NFTs — non-fungible tokens — a topic for another day).

Importantly, SMI readers don’t need to do anything with crypto now. Even if the optimists are right about crypto disrupting traditional finance, it won’t happen overnight. Instead, we’ll see it evolve over the next 10-20 years. Much as investing in the Internet didn’t require placing speculative bets in 1999, the same is true with crypto today. Approaching it this way won’t get you in “on the ground floor” of the next Amazon, but neither will you end up with a chunk of your capital evaporating along with a crypto equivalent of Pets.com (a company modeled on Amazon that went bankrupt less than a year after issuing stock).

For those who still want to engage with the space despite the significant risks, I’ll write soon about how one might go about that. Just be aware that it’s not easy to go beyond the most basic of investments — i.e., buying the biggest tokens, like Bitcoin or ETH, through a regulated U.S. crypto broker such as Coinbase.

Although the potential benefits of using Decentralized Finance are attractive (earning higher rates of interest on savings, etc.), the interfaces are difficult — and even dangerous — for most people to navigate. The computer code of many projects is new and relatively untested. As a result, there are occasionally security holes that allow hackers to steal money.

Simply put, the tech isn’t yet ready for prime time. The Decentralized Finance world may trumpet the opportunity to “be your own bank,” but do you really want that responsibility? Before it’s ready for general use, self-custody needs serious improvement in user interfaces and ease-of-use — especially given the finality of most crypto transactions where there’s no going back once actions are taken.

That said, this article should be interpreted more as an “it’s-still-early-so-be-careful” warning than as an indictment of the crypto space. Early tech cycles always take time to develop to the point where the general population can use them easily and safely.

I suspect few of us understand TCP/IP or any other Internet protocols we interact with every day. We just take out our phones or sit at our computers and accomplish whatever task we’ve set out to do. Eventually, interfaces and safeguards likely will emerge in the crypto world that allow similarly easy interaction.

Blockchains, tokens, and perhaps Decentralized Finance seem likely to cause significant changes to the financial world. It will take time, but there’s little question that disruption is coming to the financial services industry. One day, we’ll be using crypto-related services and evaluating a new slate of investing opportunities. But we’re not there yet. The risks remain high. Still, you can be sure we’re keeping a close eye on this emerging sector and will report further as appropriate.