What is risk?

In an investment context, risk means different things to different people. Because there is more than one type of risk, it’s easy for misunderstandings to result. Unfortunately, these misunderstandings create problems for investors.

Technical risk measurements

There are numerous methods investors use to measure risk. The most common measurements for investment risk typically focus on volatility. It’s important to recognize that when you see risk discussed in an investment context, what is usually being measured is the volatility of an investment.

Volatility is a statistical way to measure how much the return from an investment varies over time. An investment that produces a wide range of results from month to month is going to register higher volatility, and thus be considered more risky, than one that produces a lower range of returns.

The primary way to measure volatility is by using “standard deviation.” Without getting all wonky, this statistic measures how much an investment’s returns deviate over time from its historical average.

SMI uses standard deviation to calculate a different measurement of volatility we call “relative risk.” Relative risk compares the volatility of an investment to a common standard. For stocks, that standard is the S&P 500 index. So, a stock mutual fund with a relative risk score of 1.10 has been roughly 10% more volatile than the S&P 500 over the past three years, whereas a fund with a relative risk score of 0.95 has been roughly 5% less volatile. (For more detail on standard deviation and relative risk, see How SMI’s “Relative-Risk” Scores Alert You to Potential Losses.)

This brings us to our main point about the various technical definitions of risk. They are primarily useful as tools to compare competing investments. When you want to compare two different recommended funds within Upgrading, their relative risk scores can be extremely beneficial in alerting you as to which is likely to be more volatile. When we are doing portfolio research, such as that which led to our 50/40/10 blended portfolio recommendations, we can use standard deviation and relative risk to measure how various combinations of strategies or asset classes behave relative to other combinations.

These measurements of risk/volatility are important and helpful, but they’re not the end of the story. Relative risk scores may help guide us to good choices within each stock risk category, but they aren’t necessarily going to help us much with the decision of whether, or how much, we should have invested in stocks in the first place.

Focus on ranges rather than averages

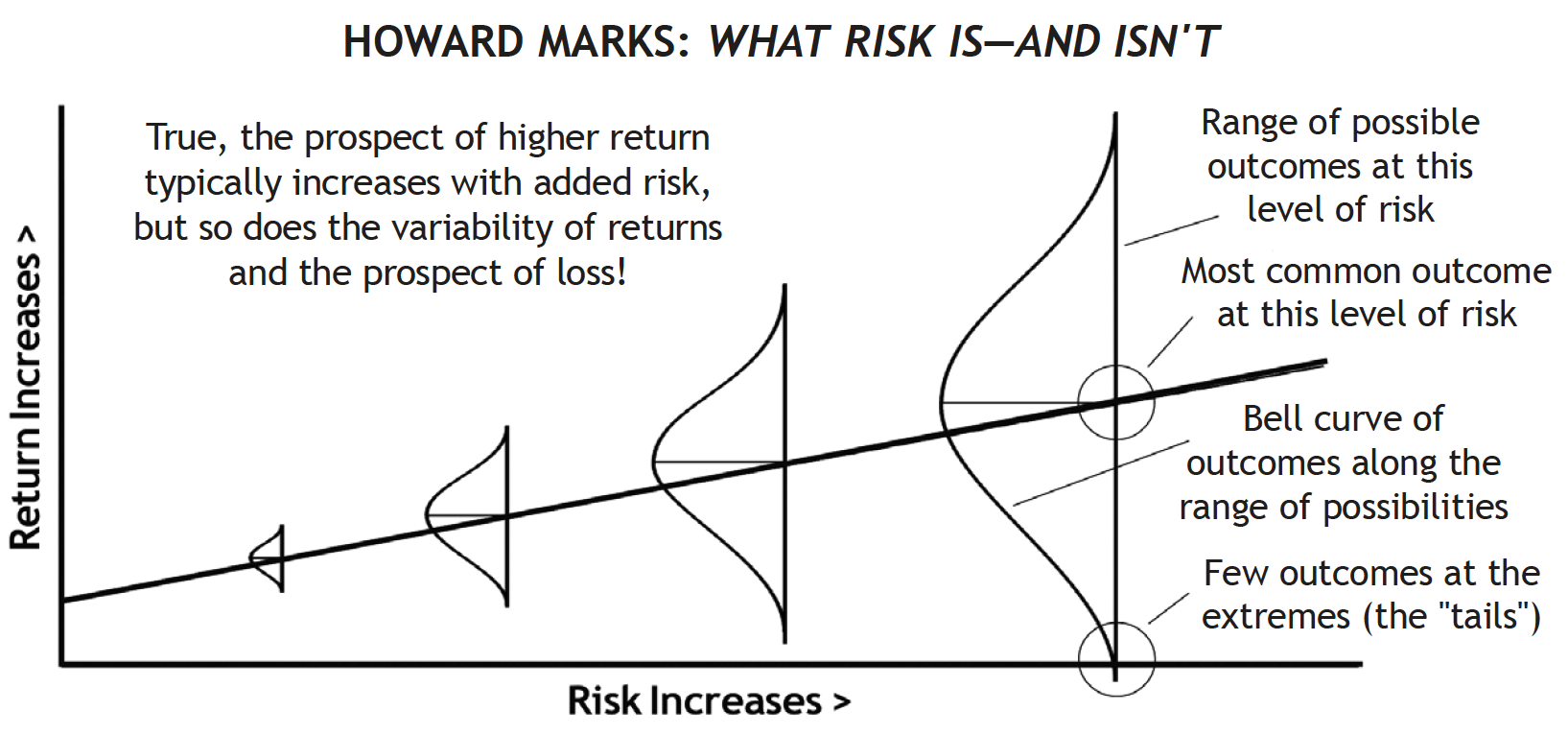

Relying mainly on statistical measurements of risk, researchers have established a body of investing knowledge that serves as the foundation of most modern investment approaches. For example, it’s widely accepted that as risk increases, so does anticipated return. (This is represented by the straight line running from lower left to upper right of the chart below.) Statistical risk measurements are also the basis of the Capital Asset Pricing Model, which serves either formally or loosely as the driver behind how various asset classes are blended within a portfolio to achieve the desired combination of risk and return for a given investor.

However, these technical measures of risk only take us so far and can cause us to become overconfident in our assessments of risk. Most investors tend to focus on the averages within an expected range of returns rather than the full range of potential outcomes.

This is illustrated brilliantly in the previously mentioned chart, taken from our June 2015 cover article by Howard Marks: What Risk Is – And Isn’t. Yes, it is true that as risk increases so does expected return — on average and over time. But vitally, the range of expected returns broadens as risk increases. While most investors typically focus on the average return at a given point along the risk curve (say for a 10-year period), it’s critical not to lose sight of the broader range of possibilities as well, even if the probability of those more extreme outcomes, up or down, usually is small.

Click Graphic to Enlarge

What risk is, really

In some respects, a better context for risk might be considering the likelihood of a permanent loss of capital. This is more of an idea than a precise measurement. But keeping in mind the potential a given investment has to cause deep losses can save investors from falling into traps that traditional risk measurement techniques might gloss over.

Within an SMI context, you can see this in the cautions we always mention in discussions of our Sector Rotation strategy. Yes, the long-term average returns of SR have been great. But so has the range of returns. With a strategy such as SR, it’s crucial never to lose sight of the fact that it is a strategy that can permanently break a portfolio through steep losses if used irresponsibly. Thus our cautions to limit SR to no more than 20% of your equity portfolio (and most investors should allocate less).

This concept of low probability “tail events” (a term used to describe extreme but relatively rare outcomes) is relevant in considering the current market situation. An individual investor’s time horizon should guide whether his or her primary focus should be on the market’s long-term average returns or the market’s range of potential outcomes. If you have decades of investing ahead, it’s easier (and wise) to focus primarily on the long-term averages. But if you’re planning to retire soon, or are already retired, it’s essential to let the range of likely outcomes balance your knowledge of the long-term averages, as you may not have time to recover from “worst-case” type losses.

History tells us that the worst stock market periods occur when bear markets are accompanied by economic recessions. With stock valuations currently high and economic signals mixed (at best), it’s wise to consider the full range of past stock market outcomes, rather than focusing only on its impressive long-term average returns. We’ve seen this mistake manifest over the years in stories of investors who have crossed their “finish line” more than once: first going forward as their portfolio grows during a long bull market (such as we’ve had the past decade), then again going backward when a bear market arrives and re-claims a large portion of those gains.

Of course, the desire to avoid loss must be balanced against still another form of risk — that of being so conservative that one fails to meet their long-term financial goals. That’s what makes investing so challenging!

All of this is why SMI encourages readers to regularly re-evaluate how much risk they need to take to reach their goals. This message becomes more urgent at times like the present when our portfolios have grown after a long bull market, but conditions are ripe for at least the potential of rougher seas ahead. If you can meet your goals with less risk, that’s generally a smart move to make.