To the average investor, the most important star in the investment sky is the stock market. While the behavior of the stock market is certainly important, it’s the shifting nature of the bond market that has driven investment behavior over the past decade. And it’s likely the bond market will hold the key to figuring out the coming decade as well.

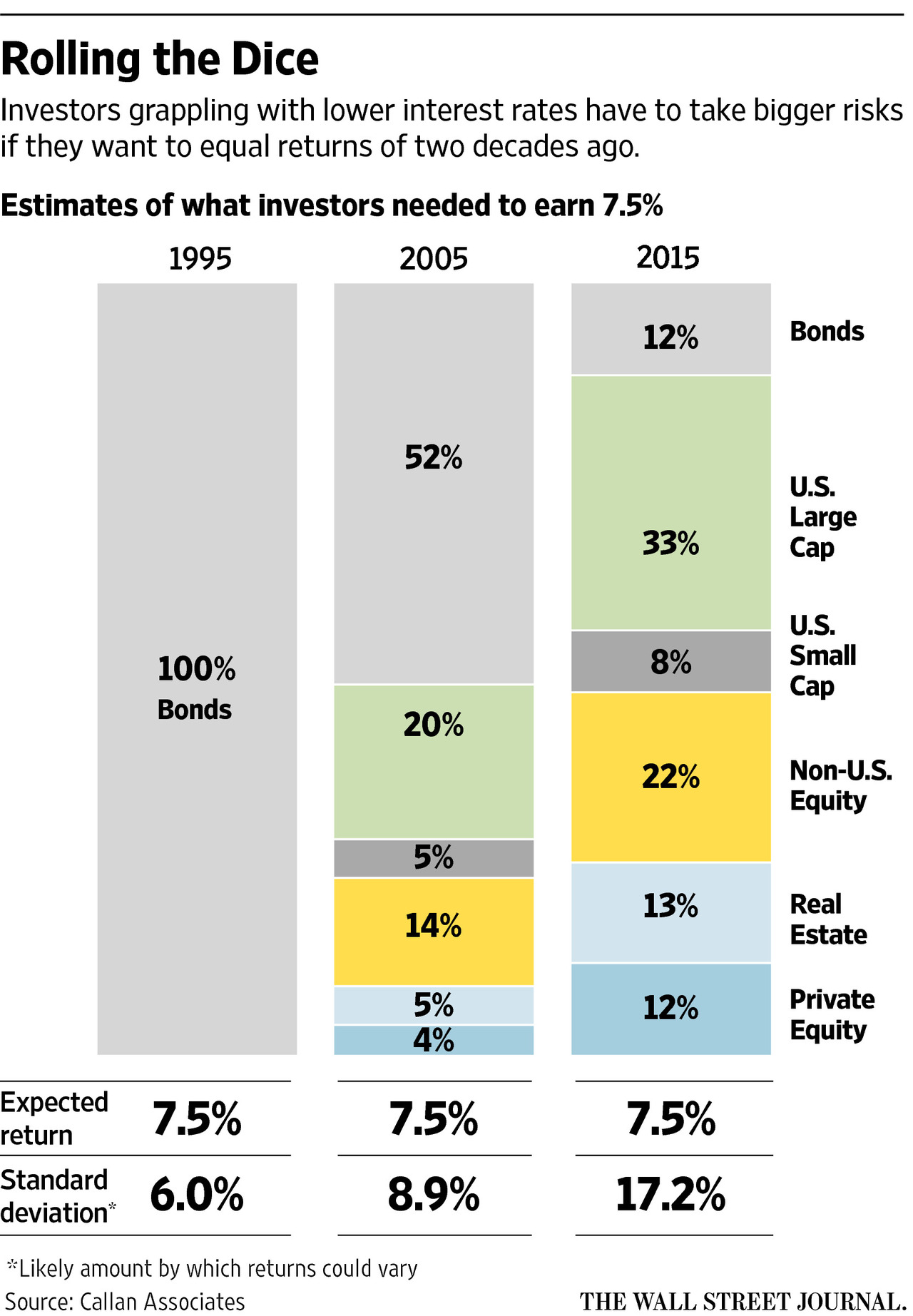

Consider the following graphic from The Wall Street Journal several years ago. It shows the increasing risk an investor has had to take to earn a 7.5% expected return as bond yields declined over two decades.

In 1995, a retiree could park their entire portfolio in bonds and earn that 7.5% return. As the years passed, the amount of risk required to earn the same return increased, and along with it, the volatility of those returns (bottom row of the chart). If it seems as if investing has gotten harder in recent years, it has.

Not to pour salt in the wounds, but this chart understates the problem, given that it’s from 2015. The benchmark 10-year Treasury yield spent most of that year in the 2.0%-2.25% range. Today, it yields just 0.7%. That’s a far cry from the 7.5% target rate investors are shooting for.

This lower-rate dynamic — which the Fed has stated it intends to try to keep intact for the next few years at least — has a ripple effect across the rest of the investment landscape. That’s because investment returns are largely relative to one another. Starting with the 30-day Treasury Bill, which is often referred to as the risk-free rate, all other investments are essentially priced in sequence: longer-term Treasuries typically yield more than the 30-day, investment-grade corporate bonds yield more than Treasuries, "blue chip" stocks are priced to return more than corporate bonds, and so on.

So when the Fed forces the "risk-free" rate down to essentially zero, the whole investment universe reprices in terms of expected returns. All across the investing spectrum, investors have to shift to riskier investments to earn similar returns to what they were expecting prior to the rate cuts.

What’s an investor to do?

SMI has been concerned about this dynamic for a long time now. It’s what caused us to dig into bond-alternative research way back in 2012, which led directly to the creation of our Dynamic Asset Allocation strategy as a way to decrease our reliance on bonds as the sole defensive mechanism within our portfolios. And we continue to look for creative solutions to The Retirement Challenge: Keeping Up With Inflation While Limiting Risk.

That isn’t to say bonds can’t still be useful. We’ve benefitted greatly from having bonds in our portfolios in 2020, as both Bond Upgrading (up +8.8% year-to-date through 9/30) and our bond holding within DAA (+8.2% on BLV between February-August) have produced outstanding returns.

But it does mean the days of simply parking a huge chunk of a portfolio in a low-risk bond fund over the long-term and expecting big returns are over. Investors will increasingly have to find alternatives, whether that’s taking on more risk or allocating to bonds more tactically as DAA does.

The bond market has spent the last 35+ years with a performance tailwind as yields fell from the all-time highs of the 1980s to all-time lows today. That’s such a long time that most investors can’t imagine the opposite scenario: a persistent period of rising bond yields (which would mean falling bond prices). Yet that’s almost certain to happen if central bankers have their way in engineering the "let inflation run hot" environment they’ve begun openly discussing throughout 2020. While there’s still skepticism about their ability to create that dynamic at this point, if there’s anything investors should have learned from the last decade it’s that when the Fed is telegraphing to investors that it wants something to happen, investors need to be careful about ignoring the message.

We’re not ready to start positioning our portfolios for inflation — yet. But we’re not idly ignoring the threat either. That’s why we’ve been writing about things like gold, the dollar, and commodities this year. These are some of the tools we’ll need to be ready to use if the data start to confirm this major cycle has shifted back the other way.

We loved the simple old days when we could tell investors to buy a handful of stock/bond index funds in JtB and forget it. Or invest 100% of their portfolio in Stock Upgrading and beat the market most years. We don’t relish the fact that investing has gotten more difficult, but that’s the reality of the situation. So we adapt and keep striving for "simple enough" solutions to keep SMI members ahead of the ever-changing landscape.