Despite the S&P 500 Index rallying to a new all-time high in July, the Federal Reserve and the bond market set the third-quarter market narrative.

Anticipating the first cut in interest rates since 2008 at the end of July, the stock market rallied to a new high on July 26. Five days later, the Fed followed through on the market’s expectation with a quarter-point rate cut. However, an immediate re-escalation of the U.S.-China trade war sucked any wind out of the stock market’s sails. Just six trading sessions after setting an all-time high, the S&P 500 index had fallen roughly -6%.

The large stock indexes would rebound in early September to finish the quarter modestly higher. Smaller stocks didn’t fare as well, with the Russell 2000 index down -2.4% during the quarter.

But the real story of the third quarter was the economy and interest rates. The Fed initially tried to pass off the July 31 rate cut as a “nothing to see here” mid-cycle adjustment. But weaker economic data, both at home and abroad, quickly scuttled that story. Sure enough, in September a second U.S. quarter-point rate cut quickly followed. The European Central Bank also joined in, lowering their already negative base interest rate and re-starting their Quantitative Easing program.

Just-the-Basics (JtB) & Stock Upgrading

The third quarter saw a significant disparity in the performance of large U.S. stocks, as reflected by the S&P 500 index (and the Wilshire 5000 index, which SMI uses as our measure of the market), and smaller stocks. Large stocks finished the quarter modestly higher, while smaller and foreign stocks both lost ground. This caused both JtB (-0.2%) and Stock Upgrading (+0.4%) to trail the Wilshire 5000 (+1.2%) by a small margin.

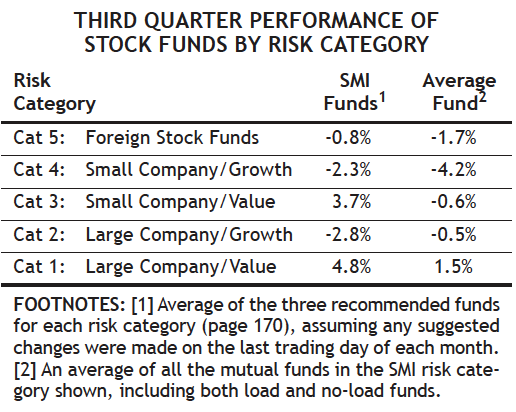

Within that broader context, the third quarter presented a new market wrinkle. Value stocks, which have consistently trailed growth stocks through most of the current bull market, suddenly asserted themselves and won the quarter handily. This can be seen in the risk category performance chart below.

For the second quarter in a row, Upgrading outperformed the average fund in four of the five stock risk categories. So while Stock Upgrading’s overall result trailed the major stock indexes slightly, that was clearly due to Upgrading’s diversification into small and foreign stocks, rather than the Upgrading process not working. Although diversification doesn’t always boost returns, it’s a time-tested risk-reduction practice.

Bond Upgrading

If the most important story of the third quarter was the Fed initiating a new rate-cutting cycle, the big story of 2019 as a whole has been the incredible performance of the bond market. While the Fed didn’t cut rates until July 31, longer-term bond yields have been moving lower all year, producing strong gains for bond investors.

The U.S. Bond Market gained +2.3% in the third quarter, roughly doubling the return of stocks. While stocks have a significant lead over bonds year-to-date, that’s mainly a function of the low point from which stocks started the year following their nearly -20% plunge at the end of 2018. Going back a full 12 months, bonds are up a whopping +10.3% over the past year, compared to only +2.9% for stocks.

Bond Upgrading’s returns are only slightly lower over both of those periods, which is surprising as we have opted to not own the riskier long-term bonds within our Upgrading portfolios, and they have earned the highest returns. (Most SMI investors already own a healthy allocation of long-term bonds via their DAA exposure, covered in the next section.) Bond Upgrading’s returns have still been strong: gains of +2.1% during the third quarter and +9.2% over the past 12 months, despite sticking with significantly safer short- and intermediate-term bonds.

Dynamic Asset Allocation (DAA)

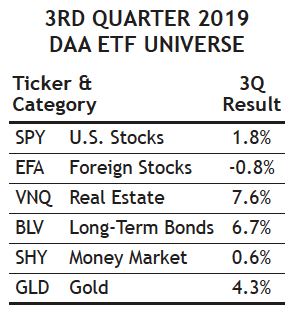

DAA had the best performance among SMI’s strategies during the third quarter, gaining +4.3% to beat both the stock and bond market returns and push our model DAA portfolio to a new all-time high in August. As previously discussed, long-term bonds contributed significantly to that strong performance, as did a solid quarter from gold. While DAA didn’t own real estate at the beginning of the quarter, adding it for September also provided a boost.

The level of market risk has increased substantially over the past year. This has been partially obscured by the fact that the most popular stock market indexes have notched new all-time highs as recently as July. But smaller-company stocks are currently well below their 2018 highs, and even the large-company indexes are only marginally above their levels of a year ago.

While stock prices are little changed from a year ago, the economic picture is significantly different. A year ago, expectations for economic growth were high — so high, in fact, that the Fed had already hiked interest rates nine times by the end of 2018 and anticipated 3-4 more rate hikes in 2019. But the facts on the ground have changed dramatically over the past year. Economic discussion has shifted from strong growth to whether the U.S. will be able to avoid recession over the coming quarters, while plans to hike rates have given way to a new cycle of rate cuts designed to prop up economic growth and keep the next recession at bay.

High stock valuations combined with stalling growth expectations create a potentially dangerous environment for the stock market. In light of these market dynamics, it’s reassuring to have DAA providing significant diversification to the stock-heavy portfolios most investors have today.

Sector Rotation (SR)

Sector Rotation was nearly unchanged during the third quarter, gaining +3.75% in July, only to give it all back in August and September to finish the quarter down -0.1%. That led to a new SR recommendation at the beginning of October, which hopefully will reignite the hot streak SR had been on over most of the past decade. The last year hasn’t been kind to SR, but its long-term track record remains excellent.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider. As we’ve seen repeatedly in recent years — and witnessed again during the third quarter — the markets can shift suddenly between rewarding risk-taking and punishing it, so a blend of higher-risk and lower-risk strategies can help smooth your long-term path and promote the type of emotional stability that is so important to sustained investing success. A 50/40/10 portfolio would have gained +2.3% during the third quarter, propelled mainly by DAA’s strong performance. That’s considerably better than the Wilshire 5000 index’s gain of +1.2%.

As we’ve discussed already, downside market risk is a real threat today. But with the Fed and other central banks once again actively pulling the levers that have consistently boosted stock prices over the past decade, running for the safety of the sidelines doesn’t seem like a smart option either. 50-40-10 investors can continue to participate in the market knowing they have the lion’s share of their portfolio protected via a combination of defensive protocols.

Like any type of insurance, we occasionally pay premiums for this protection — usually in the form of lower returns when markets rise. But over the full market cycle (bull and bear market), we remain confident that the performance of a 50-40-10 portfolio will be strong and the emotional toll of the journey will be significantly reduced. Whether you’re using this specific 50/40/10 blend or a different combination, we think most SMI readers would benefit from blending these strategies in some fashion.