Welcome to tax day, when most of those who owe money to the IRS need to make their payments, even if filing for an extension on the paperwork. If you’re among the two in three taxpayers who are owed a refund, you can check on its status online.

Tax facts

According to the Pew Research Center:

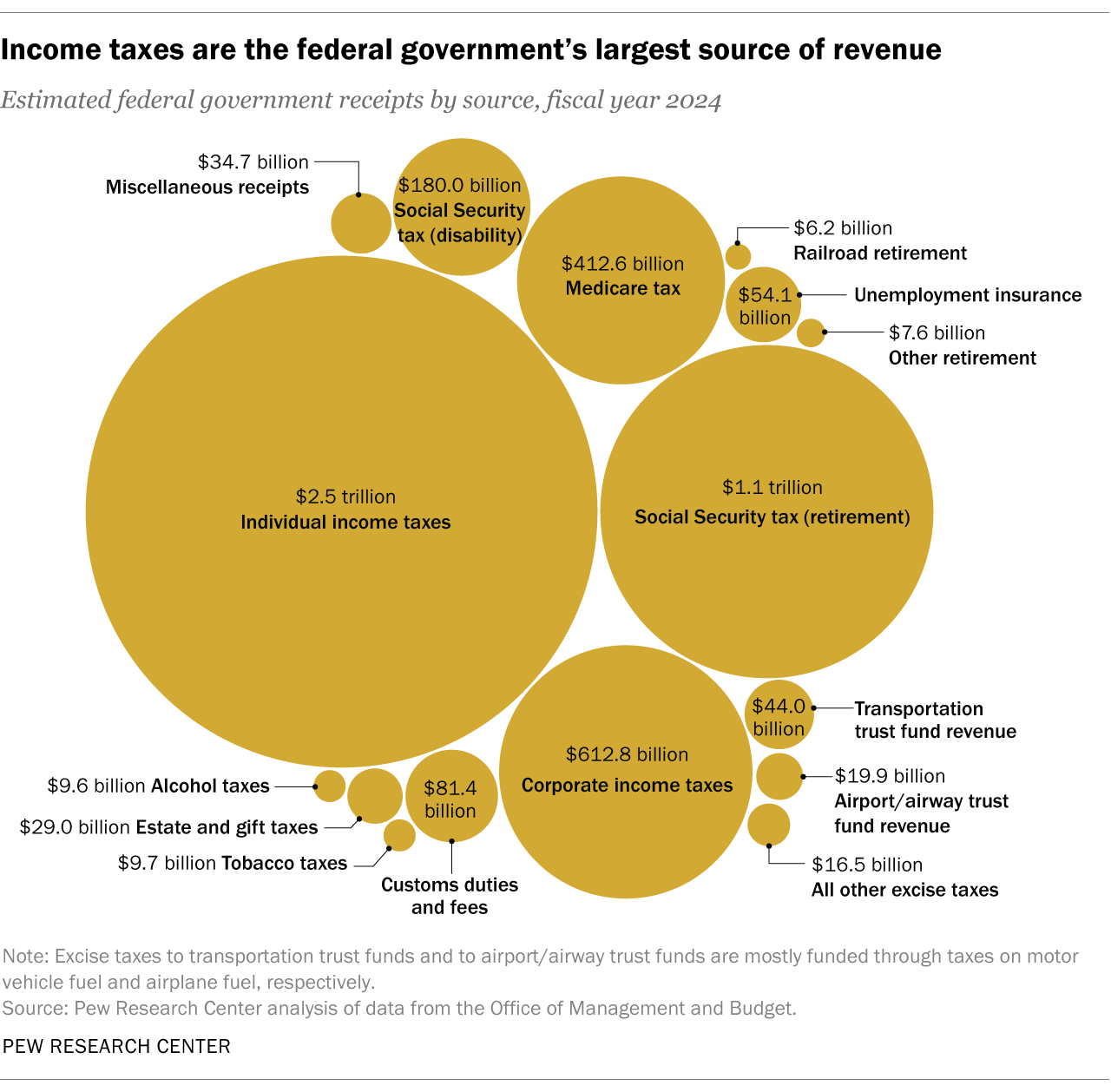

Personal income taxes are, by far, the U.S. government’s largest source of revenue, estimated to bring in some $2.5 trillion in fiscal 2024, or 49% of its revenue (see infographic below).

Most of the government’s tax revenue (66%) goes toward social services, such as Social Security, Medicare, other health-related programs, and others.

About 60% of Americans think corporations and wealthy people don’t pay their fair share of taxes, with a notable divide down party lines. More than 75% of Democrats think large businesses and the affluent should pay more vs. less than 50% of Republicans.

It’s not deductible

Due to relatively high standard deduction amounts, only 10% of filers itemize their deductions. But within that narrow band of taxpayers, some have made fairly aggressive attempts at passing off questionable expenses as deductible. Among them:

In a failed attempt at claiming an insurance settlement, one struggling business owner hired an arsonist to burn down his building, and then he tried to write off the arsonist’s fee as a business expense. Denied.

Owning a pet can be expensive, which is why several pet owners over the years have tried to claim their fury friends as dependents. Denied.

After a woman was advised by her doctor to get more exercise, she tried to write off the cost of a water aerobics class as a medical expense. Denied.

Similarly, a diabetic tried to write off the cost of artificial sweeteners and low-sodium foods as medical expenses. Denied.

After hosting an expensive wedding for his daughter, one man tried to write it off as an entertainment expense for his business, reasoning that many of his clients were invited guests. Denied.

Odd taxes

While April 15th is all about income taxes, there are all sorts of other taxes various people have to pay, and at the state level, things can get kind of strange. Consider the following:

Maryland has a “flush tax.” No, the state doesn’t put a meter on every toilet, but it does add an annual tax to people’s sewage bill, which helps pay for the modernization of the state’s sewage treatment plants.

In Kansas, hot air balloon riders are advised to pull up the stake. That’s because if you ride in a balloon that’s tethered to the ground, you’ll be hit with an amusement tax, whereas if it’s not tethered, it’s considered transportation, which is tax-free.

Growing old in New Mexico comes with financial benefits. Turn 100 there, and you’ll become exempt from state income taxes.

All couples headed to the altar will benefit from premarital counseling, but especially in South Carolina where completing a premarital preparation course within 12 months of obtaining a marriage license qualifies couples for a $50 tax credit.

If you aspire to raise sheep, you may want to avoid Virginia, which charges a tax of 50 cents for every sheep sold.

Are there any odd taxes where you live?