"People need to be reminded more often than they need to be instructed." – Samuel Johnson

For some investors, the last few months have been unsettling. After reaching an all-time high of 2,931 on September 20th, the S&P 500 has fallen 20%, closing at 2,351 on Christmas eve.

At times like this, it’s helpful to remember:

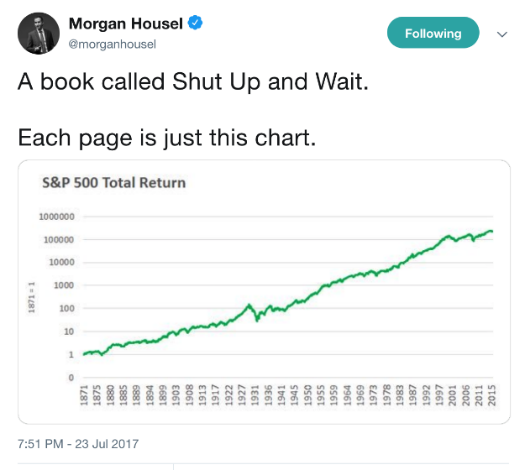

For a very long time, the market’s trend has been positive. (Read Investing With the Long-Term in Mind.)

One of the best tweets I’ve ever seen that makes this point so well is this one from Morgan Housel.

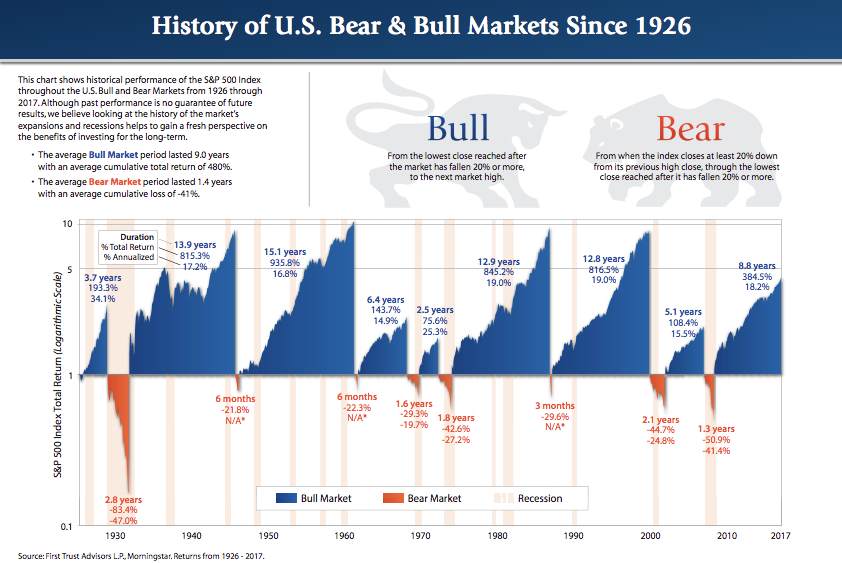

The market’s upward path has not been smooth. Instead, the stock market cycles between bull markets and bear markets. It’s just how the market works. And, while past performance doesn’t guarantee future performance, it is helpful to remember that bull markets have lasted longer than bear markets and they’ve added more value than bear markets have taken away.

Attempting to time the market is unwise, and unnecessary. (Read Resisting the Temptation of Market Timing.) Relying on hunches, intuition, or any other subjecive criteria to make changes to your portfolio is usually a recipe for financial and emotional pain. The objective signals built into Dynamic Asset Allocation and now Fund Upgrading 2.0 that tell you when to change asset classes (in the case of DAA) or move to cash with a portion of your portolio (in the case of Fund Upgrading 2.0) make such guesswork completely unnecessary.

Loss feels worse than gain feels good. (Read Learning to Accept Some Losses.) I don’t know why God designed us this way, but it’s a demonstrated fact that most people feel worse about losses than they feel good about wins. Keeping that in mind can help us feel the pain of a market downturn and keep moving forward with our plan.

Our investment portfolio is not the source of our security. (Read The Importance of Thinking Really Long-Term.)

At times like this, I take comfort — and I hope you do as well — by remembering:

That the market’s long-term trend has been positive.

That the market has achieved its long-term gains not by taking a smooth upward path, but by cycling between bull markets and bear markets.

That attempting to time the market is unwise, and unnecessary.

That it’s part of our human design to feel the pain of loss more acutely than the pleasure of gain.

And most of all, that for those who have placed their faith in Christ, our ultimate security is not found in our investment portfolio; it’s found in our relationship with Jesus. He assures us that He knows our needs and He promises to provide for us.

What have you found helpful in navigating the market’s recent volatility?