One of the greatest gifts we can give our kids or grandkids is a strong financial education. Such schooling should include solid training in biblical principles about money and plenty of real-world, hands-on experience putting those principles into action.

SMI’s managing editor Matt Bell has authored a new book on this topic from which the following article is drawn.

One morning, when our daughter, Annika, was about three, my wife, Jude, and I heard her getting dressed in her bedroom. Suddenly and with great delight, she exclaimed to no one in particular, “I have pockets!”

We hardly had time to laugh before she followed that with, “I want money in my pockets!”

Kids develop an awareness of and a curiosity about money at a surprisingly early age. Researchers say that children as young as two can begin to understand that money is a means of exchange. They wouldn’t use those words, of course, but when they’re with us at the checkout line in a store, they understand at some level that an exchange is taking place. This idea is probably clearer in their minds when we use cash than when we use something as abstract as a credit card or the tap of our phone, but our kids can see that we give the cashier something and we receive something in return — groceries or clothing or a new toy.

Class is always in session

But what are our kids learning about money, and who’s doing the teaching? If parents are not intentional about it, the consumer culture that surrounds us will be more than happy to be the teacher. In fact, that culture is teaching all of us all the time, and the lessons our culture has for us are anything but healthy.

Consider the fact that it’s normal for adults to have too much debt and too little in savings, too much financial stress and too little joy. And what about that constant nagging sense that if we just had something more we’d be so much happier? Where did that come from?

We have the opportunity to teach our children much better lessons about money, but we have to remember that there’s only so much time. As I write this, our kids are now thirteen, fifteen, and seventeen. In the blink of an eye, our oldest, Jonathan, went from Thomas the Tank Engine to taking the ACT, from coloring books to college visits. When he was born, people told us that time would fly, and now here we are.

While it saddens us to think about our children leaving home, it’s also exciting. From the moment they were born, Jude and I understood that our job was mostly to put ourselves out of a job — to prepare our kids to go out into the world and make good decisions on their own. To navigate life’s countless ups and downs with faith, perseverance, and wisdom — and have the impact God uniquely designed each of them to have.

The funnel

When Jude was pregnant with Jonathan, we took a parenting class led by the associate pastor at our church, Keith, and his wife, “Cag” (Caroline). They used the metaphor of a funnel to suggest a way of thinking about raising kids. Keith explained, “The basic principle is that you start very narrow in terms of what you expect of your kids and the freedoms you give them. During the early years, parents make most of the decisions for their kids — what they’ll eat, what they’ll wear, who they’ll hang out with. As kids get older and prove themselves more trustworthy and capable of making wise decisions, the funnel broadens. Eventually, the goal is for them to be making good decisions on their own.”

This principle can be seen in the parable of the talents, in which Jesus describes our relationships with God and money. In the story, a wealthy man entrusts his property to the care of three servants before leaving on a journey: “To one he gave five talents, to another two, to another one, to each according to his ability. Then he went away” (Matthew 25:15).

That’s interesting already, isn’t it? The master entrusted each of his servants with different talents — units of money — based on their current abilities. In the same way, the amount of money or responsibility we entrust to our children should be based on their current abilities.

“He who had received the five talents went at once and traded with them, and he made five talents more. So also he who had the two talents made two talents more. But he who had received the one talent went and dug in the ground and hid his master’s money. Now after a long time the master of those servants came and settled accounts with them” (Matthew 25:16-19).

The two who made something more of what was entrusted to them were strongly affirmed by the master. He told each of them, “Well done, good and faithful servant. You have been faithful over a little; I will set you over much. Enter into the joy of your master” (Matthew 25:21). But the servant who did not do anything productive with what was entrusted to him was roundly rebuked. The master even called him “wicked and slothful,” telling him that he should have at least deposited the money in a bank to earn a bit of interest (Matthew 25:26-27).

This parable contains some key principles of biblical money management. First, God owns everything. Anything in our possession has simply been entrusted to us by God to be managed according to His principles and for His purposes.

Second, God expects us to do something productive with what He has entrusted to us. We are to manage His resources well.

Third, as we prove ourselves faithful, God will entrust us with more. As we teach our kids about wise money management, and as they demonstrate their ability to faithfully manage what we entrust to them, we should entrust them with more. That’s how they will grow in ability and responsibility.

Learning to earn

After leaving office, president Jimmy Carter and his wife, Rosalynn, spent countless hours volunteering with Habitat for Humanity, helping build houses for needy families. At one such house, a reporter asked a little boy who was part of the family who lived there if he knew who built his house. Expecting him to credit President Carter, the little boy surprised him by happily exclaiming, “Jesus built my house!”

Whether it’s the job we do for a living or the work we do as a volunteer, wouldn’t it be wonderful if the world caught a glimpse of Jesus in the way we work? And wouldn’t it be great if we could instill such habits, attitudes, and motivations in our children?

Setting high standards — warmly

For many years, parenting styles have been under the microscope. What is the best way to raise kids? What do they really need?

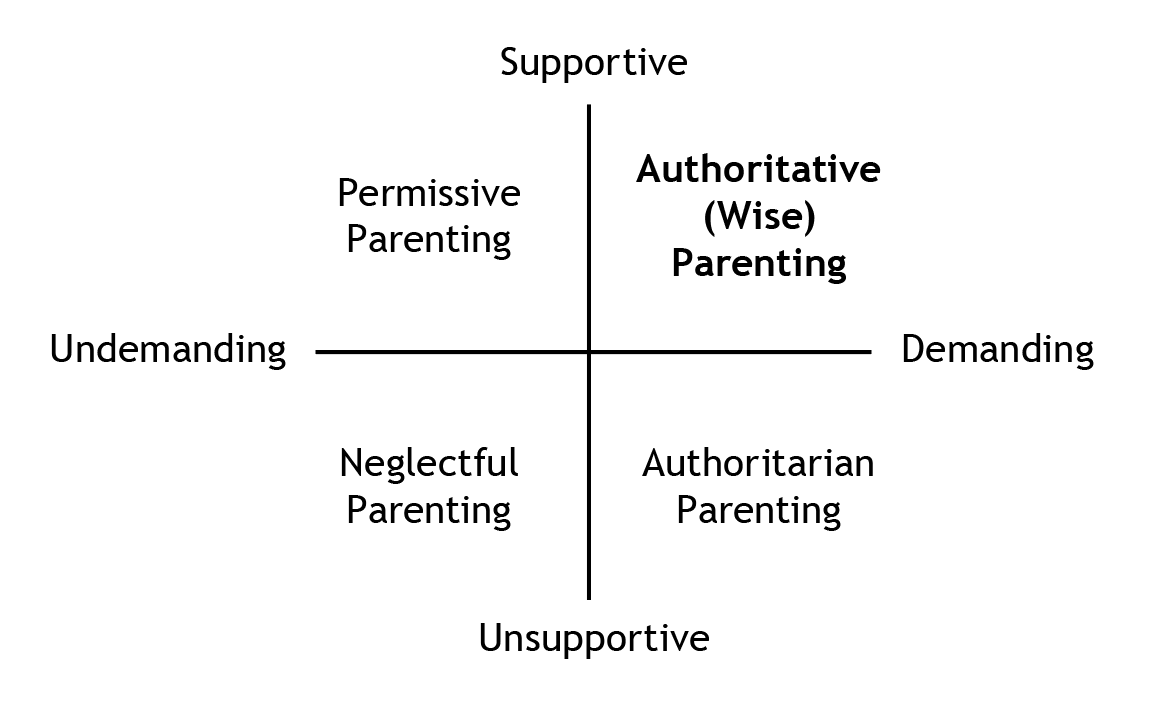

In 2001, the president of the Society for Research on Adolescence declared that no further study was needed. The benefits of “supportive and demanding” parenting were indisputable. Though commonly known as authoritative parenting, University of Pennsylvania psychologist Angela Duckworth prefers the term wise parenting in order to avoid confusion with authoritarian parenting. “Over the past forty years,” Duckworth says, “study after carefully designed study has found that children of psychologically wise parents fare better than children raised in any other kind of household.” As the graphic below conveys, wise parenting is about setting high standards for our kids within a warm, respectful environment.

This approach is similar to the advice given by Christian psychologist Henry Cloud. When a child pushes back because a job seems too difficult or a consequence unfair, he says, we should express empathy (a warm, supportive environment) and hold firm (high standards).

As an example, Cloud recalled an experience from his own childhood. When he was in the sixth grade, he missed a month of school due to an illness. When he returned, he was overwhelmed with how much work he had to do. One day, he told his mom he didn’t want to go to school.

He remembers her response: “‘Sometimes I don’t want to go to work either. But I have to go.’ Then she hugged me and told me to get ready for school.” Cloud says without her example of maintaining clear standards and boundaries, “my life would be full of half-done projects and unfulfilled goals.”

Everyone works

As soon as they are physically able, all kids should work. The earliest form of work is helping out around the house. As a member of the family, a child should understand that the family can only function well when everyone pitches in. And some of this work is to be done without pay.

James and Amanda maintain three lists of chores for their five children: those they must do and for which they are not paid (such as making their beds), those they must do but for which they are paid (such as clearing the dishwasher), and those they could do to be paid more (such as yard work).

“Lazy people want much but get little, while the diligent are prospering.”

Proverbs 13:4

The work-pay connection

The topic of allowances can get surprisingly contentious. Some parents don’t believe in the idea. They point out that in life no one is going to just give our kids money; they have to earn it. So they require certain chores of their kids for no pay and then they provide jobs their children can do if they want to earn money. Or, like James and Amanda, in addition to the chores their kids have to do for no pay, there are two levels of paid chores — mandatory and optional.

Pastor Keith and Cag raised their four kids on a no-allowance system where there were mandatory no-pay jobs and optional for-pay jobs. From a young age, their kids’ eagerness to earn prompted them to get outside-the-family jobs, such as delivering newspapers early in the morning before school. Cag credits this system for instilling within each of their kids a “massive work ethic.”

That’s been James and Amanda’s experience as well. “Our fifth grader will ask me, ‘Can I do this chore? I’m saving for something,’” James said. “That’s been great to see, as opposed to, ‘I’d like this. Can you buy it for me?’”

Keep the big picture in mind

There are a few interrelated learning experiences going on here: cultivating within our children a strong work ethic, bringing money into the equation to help them connect payment with a job well done, and giving them hands-on experience managing money

There is no single correct way to get money into our kids’ hands. Some families provide an allowance. For others, that word must never be spoken; the only way to receive money is to earn it. I know of kids raised under both systems who have turned out just fine. So don’t think that you have to choose the perfect approach. Instead, prayerfully decide with your spouse what sort of chore/money system you will set up. Then implement your plan and stay with it. Whatever you decide, here are some ways we can cultivate within our kids a God-honoring work ethic.

Learn the Skills

When teaching good work habits, the first jobs we give our kids are simple, like sorting socks or putting their clothes away. Over time, we widen the funnel, providing more training and raising expectations. By a certain age, our kids should know whose socks are whose. Eventually, they should be doing their own laundry.The process requires teaching kids how to do the job and then slowly backing off. Julie Lythcott-Haims, author of How to Raise an Adult, credits a friend with suggesting this progression: “First we do it for you, then we do it with you, then we watch you do it, then you do it completely independently.” (For ideas on how you can successfully establish a chore system in your home, Focus on the Family offers a helpful list of chores kids can handle at various ages.)

Do the Work Well

In helping our kids develop a strong work ethic, money can be used both as a reward and a consequence. Parents Leo and Natalie paid specific amounts of money for specific jobs. If a job wasn’t fully completed, there was initially grace. But if the issue persisted, on payday, their girls would get a bill.“We felt that giving them bills was more real-world than reducing their pay,” Natalie said. “We would tell them, ‘Now someone else has to do your job, so that’s going to cost more than if you had done it.’”

Do the Work Without Complaint

As we teach our kids the value of work done well, it’s important to help them understand the attitude that God expects of us — that we are to “do all things without grumbling or arguing” (Philippians 2:14).In James and Amanda’s household, their expectations for good attitudes has sometimes meant that mandatory work-for-pay jobs have become mandatory work-for-no-pay or work-for-less-pay jobs. According to Amanda, “For clearing the dishwasher, they might get one dollar if they work really hard or fifty cents if they complain about it.”

Finish the Work

Extracurricular activities can also be a good training ground for building a strong work ethic. In fact, Duckworth says, “There are countless research studies showing that kids who are more involved in extracurriculars fare better on just about every conceivable metric — they earn better grades, have higher self-esteem, are less likely to get in trouble, and so forth.”When our kids express an interest in a particular activity, we would be wise to help instill in them the discipline to stay with it. Zach vividly remembers the summer after his sixth-grade year when he joined his middle school football team. Even though he was one of the smaller kids on the team, the coach put him on the offensive line. From the start, things did not go well. One night after telling his parents he wanted to quit, they told him, “We finish what we start.”

The next morning, as he reluctantly prepared for practice, Zach found this note from his dad on the breakfast table:

Zach, read the following Scriptures this morning: Philippians 4:13 (strength), 1 Peter 4:10-11 (strength), 1 Peter 1:6-7 (perseverance). We are proud of you, and I am very confident you can see this through. Have a great practice. Love, Dad

With that encouragement, Zach finished out the season. Married and with a young child of his own now, Zach has kept his dad’s note all these years. It’s a life lesson he has leaned on several times since that summer after sixth grade, and he’s intent on passing it down to his son when he gets older.

Working for someone else

There is much value to having our kids work outside the home as well. Other leaders, whether they’re bosses, coaches, or music teachers, might be better at holding our kids to a high standard. In her book Grit, Angela Duckworth tells the story of a girl who was late to school “almost every day.” Then one summer, she got a job at a clothing retailer. On her first day, the manager said, “Oh, by the way, the first time you’re late, you’re fired.” The girl was stunned. No second chances? All her life, there had been patience, understanding, and second chances.

Duckworth said the girl’s father was amazed by the change she made. “Quite literally, it was the most immediate behavior change I’ve ever seen her make,” he said. Suddenly his daughter was setting two alarms to make sure she was on time, or early, to a job where being late was simply not tolerated.

“For the moment all discipline seems painful rather than pleasant, but later it yields the peaceful fruit of righteousness to those who have been trained by it.”

Hebrews 12:11

The roots of possibility

Children have amazing potential. If they start their career around age 21 or 22 with a $50,000 salary and earn a 2% raise each year, by the time they’re 70 they will have earned more than $4 million. That represents an incredible opportunity to provide well for their families and make significant Kingdom investments.

Of course, earning that kind of money is far from certain. There’s no such thing as guaranteed employment anymore, but there is something very close to guaranteed employability. The work habits and attitudes we’ve just discussed will always be in demand.

But there’s more at stake here. Through the quality of their work, the attitude they bring to it, and the motivation that drives them, our kids can glorify God, love others well, and make a great difference in the world. And the foundation for all that can be built when they’re young.

Spending smart

I don’t particularly like to shop. So, for most of my life, if you had asked me about the most emotional experiences I’ve ever had, it would not have occurred to me to recall any of the times that I’ve gone shopping. To me, shopping is about knowing what I’m after and then getting in and out of the store as quickly as possible.

So it surprised me to find myself in an Old Navy store with tears in my eyes as I watched two of our three kids, Annika and Andrew, browse through racks of clothing, choose some things they wanted (and could afford), and then approach the cashier with what they had picked out in one hand and an envelope of cash in the other. I was trying out an idea I learned from Mary Hunt in her book Raising Financially Confident Kids, where she tells the story of Uncle Harvey.

Mary and her husband knew that at the start of each year, Harvey would hand out a year’s worth of money to each of his four sons. The money was for clothing, snacks, entertainment — pretty much everything but housing and groceries. It was up to them to make it last. If they ran out of money before they ran out of year, too bad. And, the Hunts heard, each of Harvey’s kids became very good money managers.

We decided to try the idea with our kids’ clothing budget when they were nine, eleven, and fourteen. That’s what led to my Hallmark moment in Old Navy. We had budgeted $25 per month per child for clothing, so we gave them that money in cash each month, which they each kept in an envelope.

On our trip to Old Navy, Annika was in search of some jeans. Andrew had said that he didn’t really need anything. (But he likes clothing, so I wondered whether he could really go to a clothing store and not buy anything.) After trying on several pairs of jeans, Annika decided on one pair that was on a nice discount. Then we headed over to the deep-discount rack, where she found two tops for about $2 each.

At that point, Andrew said that he wanted to buy something after all. I reminded him that he had said he didn’t need anything. But he insisted that he could use a new sweatshirt. He picked one out that was 30% off but still seemed expensive to me and looked a lot like one he already owned.

Still, I backed off, wanting him to make his own decisions. I figured that if he later regretted the purchase . . . well, that’s part of what this is all about.

I can’t fully put into words the fascination and joy I experienced as I watched each one navigate this process. They were clearly thinking and making decisions about purchases in a way that was new to them.

Of course, they had bought things before, but there was something different about this. They were much more in charge, and it was all much more real. They had a finite amount of money in hand, which made the spending limit more tangible. Being the ones to hand over cash themselves is very different from having us buy the clothing with a credit card and manage a “kids clothing” budget on their behalf.

I think what made it so moving for me was seeing the funnel we talked about earlier in action. Our kids were growing up. As planned, the funnel was opening up. And they were stepping up to this new level of responsibility. Watching it all play out was wonderful, and more than a little bittersweet. We really were putting ourselves out of a job.