As the banking crisis roiled markets in March of this year, few anticipated a spirited stock market rally was just around the corner. Yet that’s exactly what happened during the second quarter, as the broad market indexes (S&P 500 and Wilshire 5000) roared off the March lows and marched steadily higher.

SMI has written about the extremely narrow complexion of this year’s rally a number of times before, so we won’t belabor the point other than to remind readers that the majority of the first half’s gains were concentrated in the seven largest tech stocks.

The stock market rally finally began to broaden a bit in June, but the contrast between the large- (S&P 500) and small- (Russell 2000) company indexes is stark. The S&P 500 reached mid-year at 52-week highs, while the Russell 2000 index still hadn’t conclusively broken its downward trend. That is based on it still exhibiting a pattern of “lower highs” — i.e., its current level is still below its February peak, which was lower than its August 2022 peak, which was lower than its March 2022 peak, which was lower than its January 2022 highs.

The SMI strategies had responded to this divergence as you might expect — by adding money back to our large company stock allocations while leaving our small-company allocations in cash (until this month). It certainly helps that cash now yields an attractive rate (assuming it is invested in a money market fund or similar). But our heavy cash allocation has caused SMI returns to lag the headline indexes so far in 2023.

Big picture, we arrived at mid-year with a mismatch between economic/market “fundamentals” and the market’s price action (at least as measured by the S&P 500 index). While we still think slowing economic data makes an eventual recession (and lower stock prices) the most likely eventual outcome, there is a point where the direction of market prices trumps that conviction. We’ve learned over decades of experience that when fundamentals don’t seem to match with what the market is doing, side with the market. So we’ve been following the SMI strategy signals to reduce cash and add stocks in recent months.

A brief overview of each strategy follows. But we’d like to also direct your attention to the latest strategy update video presentation.

Just-the-Basics (JtB) & Stock Upgrading

As already noted, large company stocks were the standout performers last quarter, powered by the largest tech stocks. Apple and Microsoft alone make up roughly 14.5% of the S&P 500 index, while the “Magnificent Seven” tech stocks (Apple, Microsoft, Amazon, Nvidia, Tesla, Alphabet/Google, Meta/Facebook) collectively comprise 27.4% of the index. So it’s easy to see that as these behemoths go, so goes the “broad” index.

Just-the-Basics rode this dynamic to an +8.7% gain in its large-company index component. The Russell 2000 small company index rose +5.2% during the second quarter, with all of that gain coming in June (it was down -2.7% in April/May). Foreign stocks lagged but were still positive, contributing +2.6% to JtB. Altogether, JtB’s +6.6% second-quarter gain was solid.

Stock Upgrading lagged considerably at +2.7%, which isn’t surprising given it was allocated 70% to cash. There were bright spots — our actively managed foreign fund gained +5.0%, considerably better than the foreign index’s +2.6%, and Upgrading successfully helped us avoid a -4.3% loss in commodities during the quarter. Overall, Stock Upgrading still made money, but less than it would have if it hadn’t been allocated so defensively.

Bond Upgrading

If levitating tech stocks was the main stock market story of the second quarter, the main economic story was the reversal of recession expectations and the corresponding impact that had on interest rates. The recognition that March’s bank crisis wasn’t going to spill over into an imminent recession, coupled with slowing-but-still-solid economic growth, caused interest rates to reset higher.

The two-year Treasury yield, which had dropped to 3.76% at the depths of the March crisis, ended June at 4.87%. That’s a significant adjustment in a short period of time, and not surprisingly bond prices fell during the quarter.

That said, starting conditions for bonds are much different today than they were during the first half of 2022, when rising rates caused dramatic losses for many bond investors. It’s not intuitively obvious, but a 1.1% increase in rates, as was seen during the second quarter, causes much less damage when the starting point is 3.76% than the same 1.1% increase does from a starting point of 0.5%, as was the case in late-November 2021. Today’s bond owners are earning significantly more income, which helps to offset capital losses incurred by rising interest rates.

As a result, Bond Upgrading was down just -1.0% during the second quarter, despite the sharp rise in yields. While rising rates remain a threat as the Fed keeps hiking short-term rates and the economy continues to exhibit solid nominal (not adjusted for inflation) growth, it is also a reminder that bonds have greater ability to protect our portfolios at today’s level of bond yields than they did a year ago when yields were much lower.

That’s a comforting fact, given our concerns about a future recession and the possible resumption of the bear market.

Dynamic Asset Allocation (DAA)

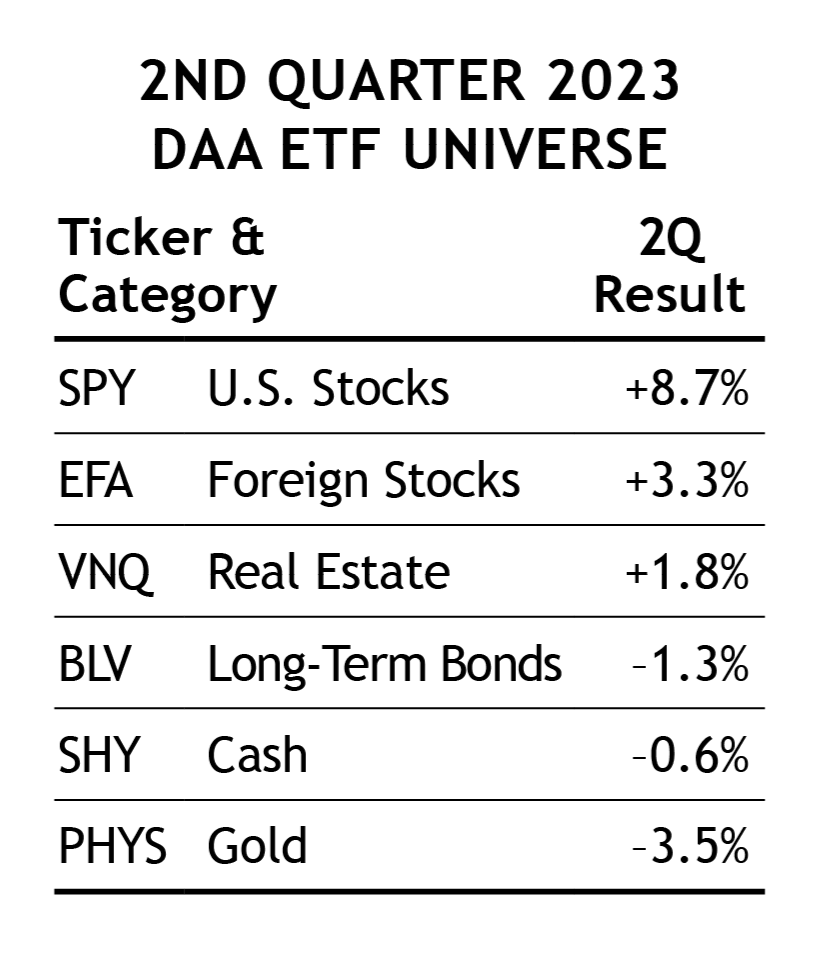

There was a clear divide among the DAA asset classes during the second quarter, with the stock market-oriented classes posting gains, while those most heavily influenced by interest rates lost ground as rates rose.

Fortunately, DAA had two-thirds of its allocation in stocks with the other third in gold. Gold’s loss of -3.5% limited DAA’s quarterly return to +2.7%, but in fairness, gold was the strongest first-quarter performer with a gain of +9.7%, making it a beneficial holding during the first half of 2023.

Sector Rotation (SR)

SR had a volatile quarter, pivoting into semiconductors just in time for a big April loss, then moving to home-building stocks and scoring a big June gain. Overall, SR was down -3.6% during the quarter, despite ending on an upswing.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider.

Similar to Stock Upgrading and DAA, a 50/40/10 portfolio was up modestly (+2.1%) during the second quarter. That’s not bad given SMI’s conservative positioning throughout the quarter, but it looks low compared to the tech-stock powered S&P 500 or Wilshire 5000 stock market indices.

Keep in mind though, the second quarter began just weeks after the March banking crisis flared up, and the SMI strategies have been getting incrementally more aggressive since that time, beginning with allocating one-third of DAA to U.S. Stocks (SPY — S&P 500 index) at the end of March. The reality is that any portfolio that wasn’t significantly invested in the “Magnificent Seven” tech stocks, via index funds or otherwise, lagged the index returns last quarter.

Conclusion

This spring’s Artificial Intelligence/tech mania, coupled with investors unwinding their bearish positioning from last year, resulted in an explosive move higher for a select group of stocks during the second quarter. While we never like to lag when the market is moving higher, if there was ever a rally we were likely to lag, it was this one.

The SMI strategies protected us significantly last year as markets fell. Earning positive, though lower, returns during a quarter like this is a reasonable tradeoff for the type of protection our portfolios have provided since the bear market began 18 months ago. It’s unclear whether the bear market is over, or whether we’re merely experiencing an “echo bubble” of investors piling into the familiar winners of the last cycle. It’s unusual for the big winners of a prior bull market to again be the leaders of the next one, but we can’t rule anything out given the unusual circumstances involved with every aspect of this COVID market cycle.

Ultimately, we trust that our trend-following and momentum signals will help us sort the signal from the noise and keep us aligned with the longer-term market trend. Market transitions are tricky, as we experienced after the 2020 COVID plunge. But as was the case then, after an initial adjustment, the trend eventually became clear and we were able to get positioned for the following extended period of market strength.

SMI entered 2023 expecting a recession to begin later than the consensus — most investors thought it was imminent, while we thought it was 2-3 quarters away. Now, it appears even our delayed forecast was too soon, as it increasingly appears recession may not arrive until Q4 or early-2024. That’s too long for us to fight the market’s trend, so we’ve been putting cash back to work in stock funds. However, if we’re correct that a recession is still coming, we could be revisiting these defensive positions again a few months/quarters from now.