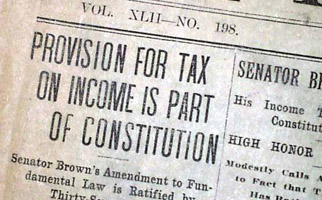

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration." – The Sixteenth Amendment to the U.S. Constitution, passed by Congress in 1909, ratified in 1913.

Happy Tax Day! Let’s pretend it’s 1909, and we’re in the visitor’s gallery of the U.S. Senate. We’re listening in on the debate surrounding a proposal to approve and implement a federal income tax.

The quotes are verbatim, but (and this is important if you’re to make sense of it all) the dollar amounts in this article have been adjusted for inflation so as to represent 2019 dollars. They will sound wildly out of whack — but therein lies the tale.

“The people who have incomes subject to tax under this law can not complain that we unduly burden them. The exemption of $128,000 leaves the man with an income of $256,000 to contribute only $3,900 [1.5%] to support the General Government...” – Sen. Joseph W. Bailey of Texas (D-Texas), one of the main sponsors of the bill.

“My desire is to relieve the incomes of men to the extent necessary to maintain their families, to support and educate their children, because I believe that they owe a higher duty to their families than they owe to the government.” – Sen. Albert B. Cummins (R-Iowa), another sponsor.

“The House framed its bill upon the theory that $103,000 was a reasonable amount, in its opinion, for an American family to live upon with a proper standard of living, and that a sum below that ought not to be taxed.” – Sen. John Sharp Williams (D-Miss.). (Note: This is from a later debate after the Amendment had been ratified.)

Can you get the drift of what’s happening? A debate is taking place as to how much of a family’s income ($103,000 or $128,000) should be completely exempted from taxation. In other words, should the first $103,000 or $128,000 of family income be tax-free? They wanted to structure the tax so it wouldn’t apply to the basic level of income needed to give every American family "a proper standard of living." The goal was to tax only "wealth and riches."

As finally formulated, the first tax provided an exemption of $103,000. That eliminated virtually everyone at the time but the super-rich. In 1916, only four families out of every 1,000 paid any income taxes at all. And even then, the rates sound unbelievably low to today’s tax-weary ears.

Consider the low tax rates in the original legislation, first in 1913 dollars and then adjusted for inflation (to the nearest $5,000) and shown in 2019 dollars:

Tax Rates in 1913 Dollars | Tax Rates in 2019 Dollars |

1% up to $20,000 | 1% up to $515,000 |

2% from $20,000 to $50,000 | 2% from $515,000 up to $1,285,000 |

3% from $50,000 to $75,000 | 3% from $1,285,000 up to $1,925,000 |

4% from $75,000 to $100,000 | 4% from $1,925,000 up to $2,570,000 |

5% from $100,000 to $250,000 | 5% from $2,570,000 up to $6,420,000 |

6% from $250,000 to $500,000 | 6% from $6,420,000 up to $12,840,000 |

7% over $500,000 | 7% over $12,840,000 |

Exemption for married couple: $4,000 | Exemption for married couple: $103,000 |

[Note: The 2019 dollars were determined using a federal government inflation-adjustment calculator.]

Do you think the majority of the American people would have approved amending the Constitution to give the federal government power to levy a new tax on them? Of course not. They approved it because they were led to believe an income tax wouldn’t affect them.

It wasn’t long, however, before it was discovered there were not enough "rich" to raise the revenues needed to fight World War I. Soon, exemptions were cut in half and the maximum rate raised from 7% to more than 70%! During subsequent peacetime, tax rates fell tax and brackets were adjusted (for a while), but they never again came close to those early tax-only-the-rich days of innocence.

We need something better

Romans 13:7 says, "If you owe taxes, pay taxes." Amen! But that doesn’t mean the current U.S. income-tax system is a good one. It is costly, inefficient, and mind-bogglingly complex. There is no conflict between obediently paying your taxes and hoping (even praying!) that someday the current system will be replaced with something better.

As the 2020 presidential campaign begins to take shape, we’re again hearing a lot about raising taxes on the "rich." Reality check: From a tax standpoint, the problem isn’t that there are too many rich people but too few. There is no way to pay for all the things politicians can dream up (or for the things they’ve already implemented) without taxing the middle class in a big way. Don’t believe that any new taxes won’t affect you.

Agree or disagree? Your comments are welcome. "Join the Discussion" below.

Related video: In 1995, the House Ways and Means Committee held a hearing on possibly replacing the federal income tax. Below, watch Rep. Christopher Cox, who once taught tax law at Harvard, describe the 1909 House debate over the Sixteenth Amendment, as well as the later implementation of the income tax.