This weekend, OPEC+ announced they will be cutting their production quotas, thereby reducing the amount of oil supplied to the market. It was the first surprise cut of this type that I can remember in many years.

While the cartel made adjustments in response to the unprecedented COVID situation a few years ago, if my minimal sleuthing is accurate, we haven't really seen OPEC try to influence energy prices through a production cut like this since the 2009 recession. (There were four production quota reductions between 2000-2010, and a number of us fossils remember when these quota shenanigans were fairly routine.)

Given this was the first surprise cut in nearly 15 years, admittedly my initial reaction to this being announced the same weekend we finally punted energy from SMI's Sector Rotation strategy was, "You've got to be kidding!" Predictably, the price of oil shot up about 7% immediately on the news, and it's held most of that gain through today's trading. Energy company stocks, which were hit pretty hard during March, rallied strongly today.

Not all that glitters...

While the timing was annoying, given what we had just announced for SMI portfolios, the reality is this is just further evidence of the slide toward recession we've been discussing for months. There's definitely bad blood between Saudi Arabia and the Biden Administration, and it probably wasn't a great idea to have Energy Secretary Jennifer Granholm publicly state last month (when oil was touching $64/barrel) that the U.S. actually wasn't going to be refilling the Strategic Petroleum Reserve this year, despite having previously said they would target the $68-$72 range to do exactly that. This apparently irritated the Saudis, who despite their own moral failings, apparently don't appreciate being lied to any more than anyone else does.

So yeah, there may have been a poke in Uncle Sam's (or at least Uncle Joe's) eye intended here. And it would be foolish to ignore the geopolitical winds blowing, which include last month's China-brokered deal to restore relations between Saudi Arabia and Iran. These two have been at each other's throats for decades, so to have that "officially" set aside — with China brokering the deal — isn't nothing. (Remember when the U.S. used to be the one to bring hostile leaders together to hammer out peace deals?)

But beneath all those shiny talking points, there's no way OPEC+ would cut production unless it thinks a cut is necessary to balance global oil supply and demand. That could be a reflection of softer-than-official data coming from China (who Saudi has been super friendly with lately), or just a general read of a slowing global economy. OPEC has historically been quick to cut production in the face of slowing economic growth.

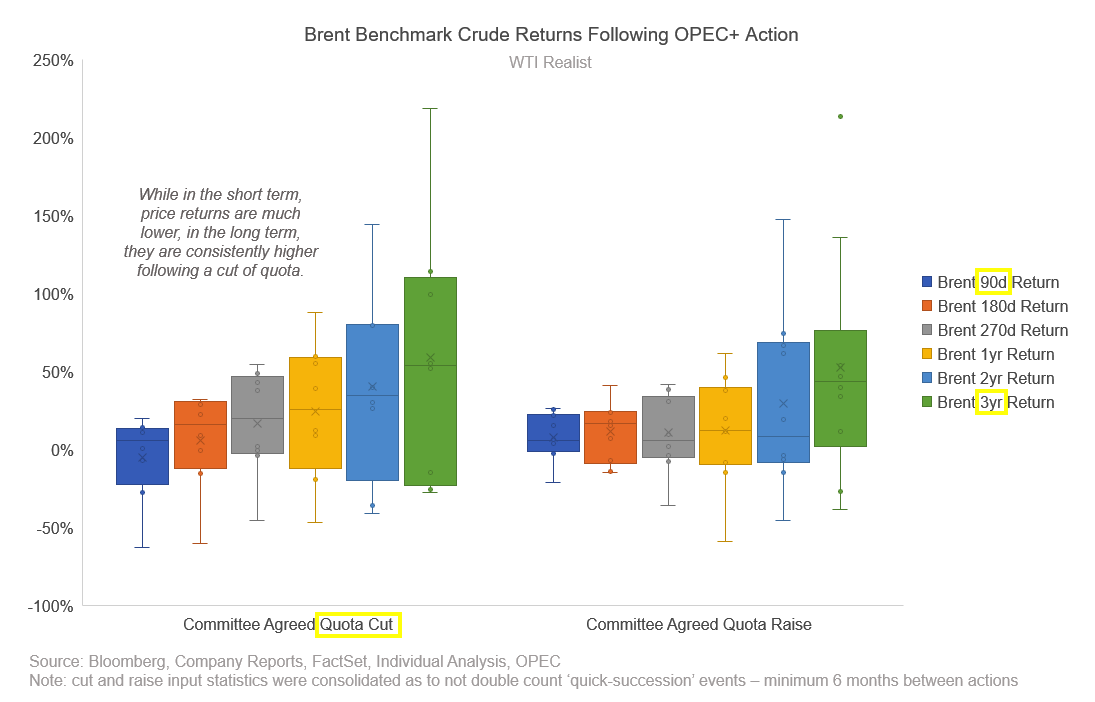

Energy writer WTI Realist pulled some interesting stats on what oil prices have normally done after past production-quota cuts. As I mentioned earlier, it's been a while since this has happened, so we're pulling from quite a while ago (i.e., it's difficult to know how reliable these patterns will be today). But the left side of the graphic below (ignore the right side) shows that oil prices have tended to move lower in the short term after such production cuts, before moving higher in the long term.

Click image to enlarge

This is perfectly consistent with the "long-term bullish, short-term nervous" point of view I expressed in this month's SR write-up. It's the view we've been discussing for quite a while actually, and it makes a lot of sense if a recession is coming. While the oil price is up today in the immediate aftermath of this surprise announcement, if a recession really is coming, that is not bullish for energy prices.

OPEC+ knows that, and to my eye, this looks like them trying to proactively address the potential of weaker demand clobbering the oil price in the not-so-distant future.

Overly optimistic investors

Optimistic stock investors and energy bulls may be making the same mistake right now. After over a decade of Fed stimulus and quick rescues when the markets faltered, investors have fond memories of the Fed stepping in to save the day and sending stocks ripping higher again. That is likely to happen again in this cycle...eventually.

Likewise, energy bulls see a future where impaired supply crashes against a surging wave of global demand. At its most basic, the world hasn't been investing in expanding energy supplies for a decade now, while an ever-greater proportion of the global population wants the same energy standard of living the West has long enjoyed. Something has to give, and the first thing to give will likely be energy prices as they rip higher.

But what both groups are overlooking is the valley of pain that separates them from their anticipated brighter future. Stock investors seem not to realize that the Fed isn't going to unleash the next bout of rate cuts and Quantitative Easing until the pain in markets has gotten so bad that they feel they have no other choice. Likewise, the energy supply/demand mismatch is likely to tilt the other way first — toward too much supply for cratering demand — if past recession precedents hold.

All of that to say, be careful interpreting this weekend's energy news and this week's initial market reaction to that news. I've been as bullish on energy as anyone, but I'm reading this OPEC+ action as a tacit admission that the economy is weakening and demand is either already declining or about to.