New data from Lifeway Research, a firm that studies church and culture, shows that about half of Protestant "churchgoers" — people who attend worship at least once a month — give 10% or more of their income to the church they attend.

In percentage terms, 31% were tithers (defined in the study as giving "one-tenth"), while 19% gave beyond a tithe.

Unfortunately, the percentage of tithers has dropped since Lifeway did similar research in 2017, falling six percentage points (from 37% to 31%) in the latest data (PDF), collected last September. However, those giving beyond a tithe rose slightly — from 17% to 19%.

In addition to tithers and beyond-the-tithe givers, the Lifeway study found that about one-sixth of respondents (16%) give regularly but less than a tithe, while 9% said their financial situation made it difficult to give on a regular basis.

Not surprisingly, the study found that people who attend church the most often (four times or more a month) were the most likely to give at least 10% of their income.

Viewing the giving data through a church affiliation lens, the study found that about 40% of Baptists tithe, followed by about a third of Presbyterian/Reformed and non-denominational churchgoers. They are followed by Lutherans (19% are tithers), Restorationists (Christian Church/Church of Christ, etc.) (17%), and Methodists (12%).

Changing methods

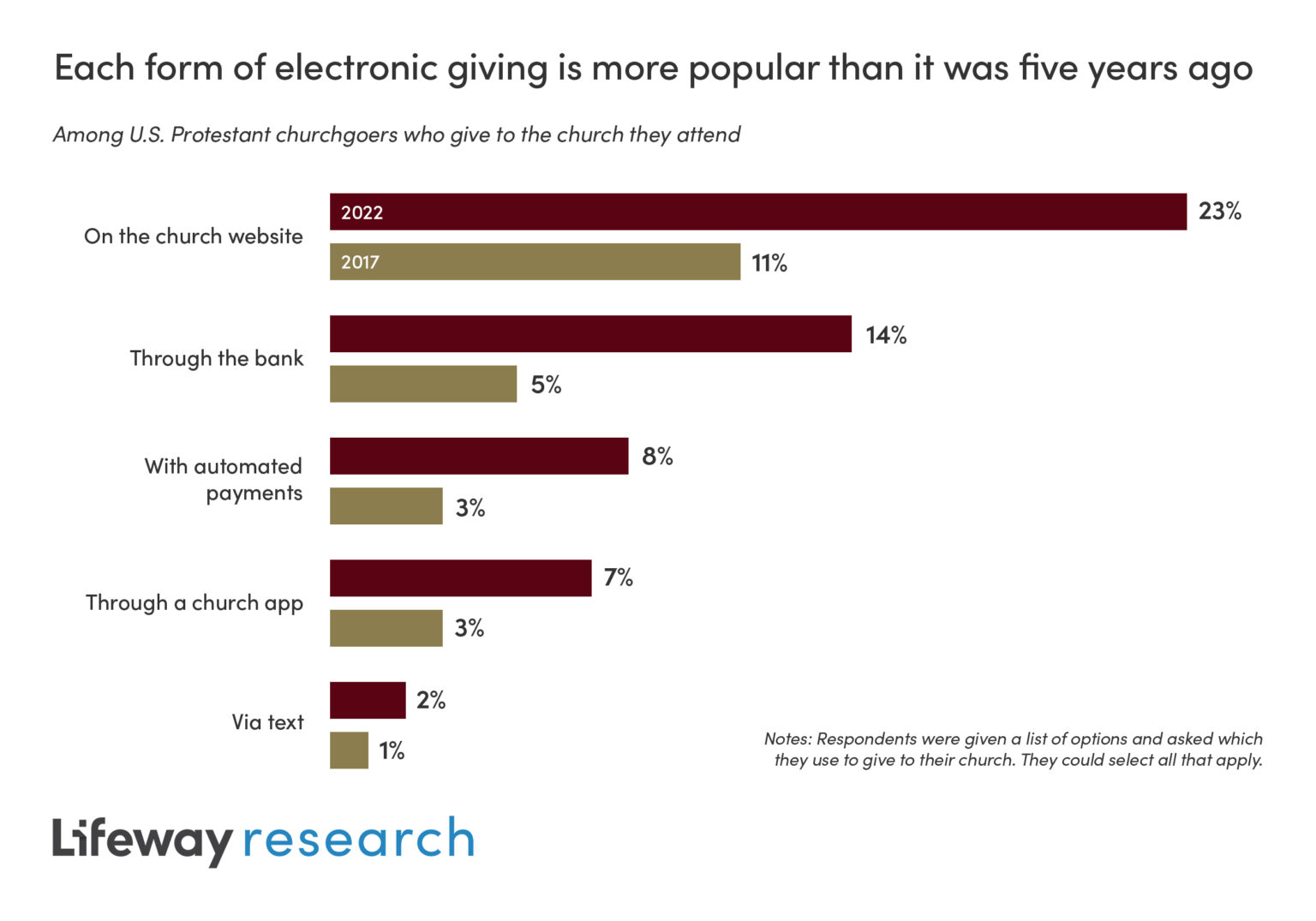

Since Lifeway's previous survey on giving and tithing in 2017, one finding has changed sharply: how people give. In 2017, nearly 60% of churchgoers were putting a check in the offering plate or basket. That figure has dropped by about half, to just 30%.

Meanwhile, the percentage of givers who "give electronically on the church website" has more than doubled, from 11% to 23% in the latest study. Giving "electronically through my bank" is also up sharply, growing from 5% of givers in 2017 to 14%. So is giving via automated payments" — up from 3% of givers to 8% in the new study.

Also up: Giving via a church-provided app — growing from 3% to 7% — and giving "via text," a method that has grown from 1% to 2% of givers since the last study.

As you may have guessed, those most likely to give via a digital method are in the 18-34 age range.

Click graphic to enlarge

You can learn more about Lifeway's methodology for the study here.

Unasked questions

Although these sorts of surveys yield helpful data (helpful to pastors and other church leaders), additional questions would make the results even more helpful when cross-tabulated with giving behavior.

Here are my suggested questions (along with a few from my colleague Matt Bell):

Do you participate in a church-based small group?

Apart from worship services, are you regularly involved in any church-based ministry?

Have you ever taken a class, at church or elsewhere, on personal financial management?

Do you use a written budget (or spending plan) to manage your money?

If you have a budget, do you keep it up-to-date?

If you have a budget, do you use a computer-based (or app-based) budgeting system (such as the FaithFi App, Mint, Tiller, EveryDollar, You Need a Budget, etc.)?

If you have children, do you intentionally teach them about managing money/possessions?

When your children earn money or receive cash gifts, do you encourage them to give from what they receive?

If you give as a percentage of your income, do you use your net income ("take-home pay") as your starting point or your gross (before taxes) income ?

Do you consider overall personal money management — i.e., not just giving — an important aspect of Christian discipleship? Choose from these options:

a) Not really important

b) Somewhat important

c) Important only for people who have plenty of money

d) Important for all believers

Over to you

Do any of the findings in the Lifeway study surprise you?

And if you were designing a giving-related survey, what questions would you ask?