The market is cheering this morning's GDP report, which showed the U.S. economy grew at a 2.9% annualized rate in the fourth quarter of 2022. But was this actually a report worth cheering? We don't talk about the devil much here at SMI, but if we did, he'd be in those details.

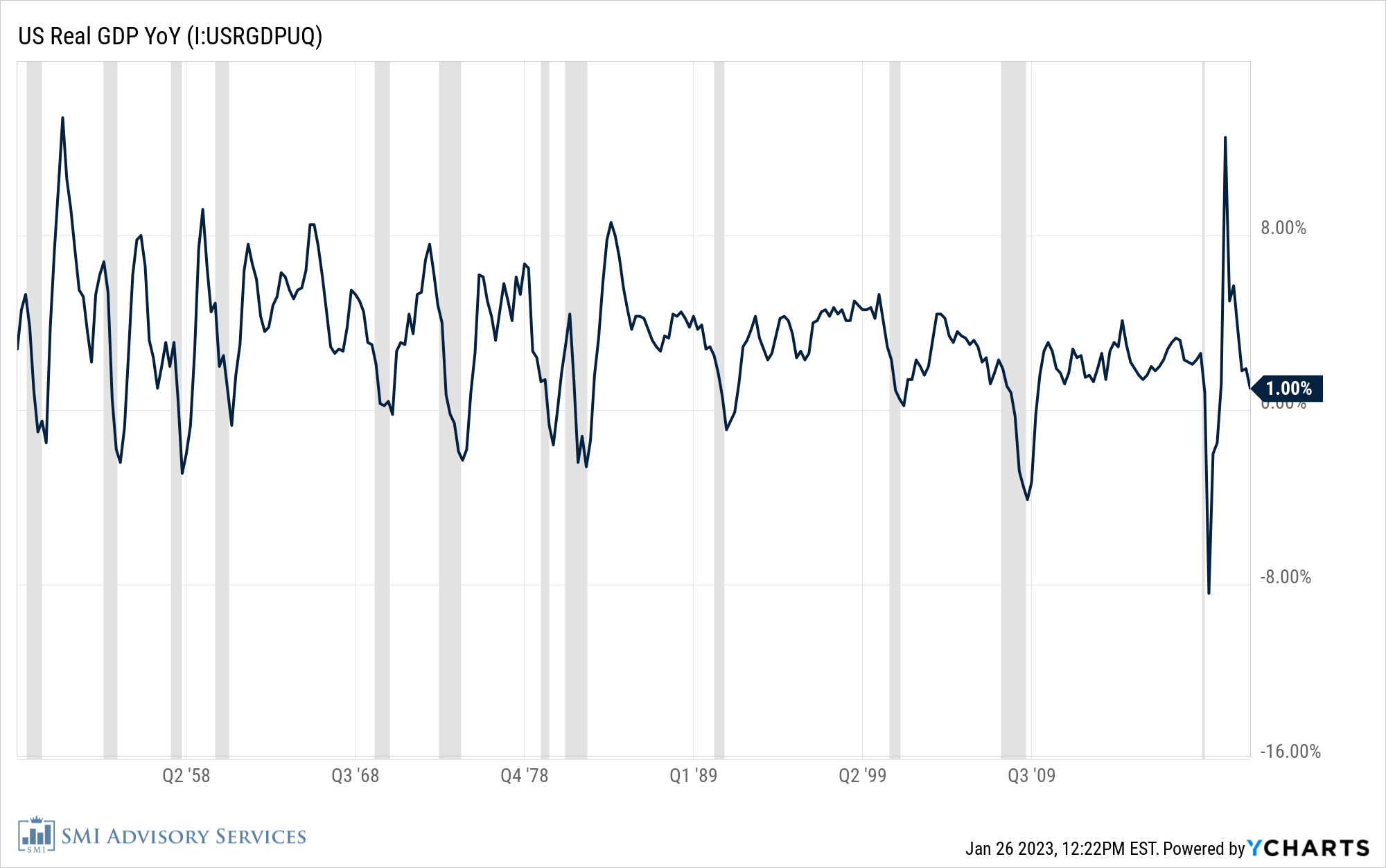

First, here's the back story. The COVID shutdowns and subsequent massive stimulus sent a bullwhip effect through a lot of the economic data we've seen over the couple years since, making it hard to get a good read on what's really happening out there. You can see that in the chart posted further down — the scale of the recent moves, both down and back up, are way out of proportion with "normal" moves. But things are starting to normalize as we get a bit further away from those events.

That's important context for understanding last year's GDP data. There was a lot of hand-wringing about the two consecutive quarters of negative GDP to begin 2022, because that has been historical shorthand for a recession in the past. But as many argued at the time, it didn't really seem to fit this time around, because a lot of the other things normally seen during a recession weren't present. And coming off the huge spike in GDP numbers caused by the COVID reopening and stimulus, the fact that those numbers were declining quarter-over-quarter as 2021 turned to 2022 seemed less of a relevant tell than usual.

Sure enough, GDP growth rebounded in the second half of last year, seeming to validate the idea that we weren't really in a recession a year ago after all. Third quarter GDP was +3.2%, setting the stage for this morning's report of +2.9% in the fourth quarter. Seems great, right?

Quarterly annualized vs. Year-over-year

This is where the methodology of the GDP calculation may obscure what's really happening in the economy a bit. The quarterly GDP figure everyone is cheering today is the increase in activity from last quarter to this quarter, annualized, after being seasonally adjusted (that final part being a process which I can't even begin to explain). Plus it's "real" — meaning after inflation, which we know is falling. In other words, there's a lot going on there, before we even get to the fact that these quarterly GDP numbers are often heavily revised in the future.

While there's nothing wrong with any of that per se, we get a completely different picture if we look at real GDP on a year-over-year, rather than quarterly annualized, basis.

Looking at GDP this way paints a very different picture. The recent trend of that real GDP line doesn't look like a robustly "above trend" growing economy. It looks like an economy sliding rapidly into a recession, if it's not already in one.

To avoid confusion with other things I've written recently, I don't think we're in a recession yet. But I think we're getting close. And the reason I say "if we're not already in one" is that if you look closely at the chart above, it looks to me like the dark blue line showing the GDP change was higher than 1.00% (the current level) at the start of every recession in the past 70 years (the gray bars in the chart). I haven't verified that, but that's how it looks just eye-balling it above.

Not to be Captain Obvious, but in case you missed it — past recessions were usually already underway by the time year-over-year GDP declined to the level we're at today.

Let's look at the recent quarterly GDP numbers, using this year-over-year metric:

Dec 2021 | 5.70% |

March 2022 | 3.70% |

June 2022 | 1.80% |

Sept 2022 | 1.90% |

Dec 2022 | 1.00% |

Given the declining rate of GDP from 5.70% a year ago to 1.00% last quarter, it doesn't take a particularly active imagination to imagine what Q2 and Q3 of this year might look like. Which is exactly the time frame SMI has been suggesting a recession is likely to start-emerge-become more obvious-pick your favorite description.

The precise timing isn't critical...at least to us

I'm going to wrap this up here, as tomorrow's February issue of SMI contains a further market commentary that picks up the story from here. But suffice it to say, I don't see anything in today's GDP report that makes me any less convinced that "Act Two" — the recession part of this bear market story — is getting closer.