U.S. government I-Bonds are about to be deposed as the undisputed king of the fixed-income hill.

Two years ago, I-Bond rates began an inflation-driven upward move that eventually (in May 2022) hit an annualized 9.62%(!) — a remarkable return for a virtually risk-free investment. Since November, the annualized rate has stood at a still-strong 6.89%.

But with inflation cooling (somewhat), I-Bonds are falling back to earth. The new I-Bond rate, to be announced May 1, won't be quite so attractive.

I-bonds are priced based on two factors: a variable rate based on six months of inflation data (from October through March) and a fixed rate that is less transparently calculated. The latest CPI numbers for March indicate that the variable rate is going to pan out at an annualized rate of 3.38%....

The current fixed rate is 0.4%, and it’s still unclear what the next one will be, but it’s unlikely to stray too far from that threshold.

If the composite annualized I-bond rate stays in line with predictions, it will come in [around 3.79%], making I-bonds less lucrative in the short-term than other comparable investments like Treasury bills, TIPS, CDs and even some high-interest savings accounts.

However, not all I-Bonds will experience a rate change on May 1. Any I-Bond purchased before the end of April will earn the current 6.89% annualized rate for the next six months. After that, such bonds will reset (for the next six months) to the new less-than-4% annualized rate.

[MAY 1 UPDATE: Much to the surprise of I-Bond observers, the May 2023 rate is 4.30%, which includes a 0.9% fixed rate.]

I-Bond Rates Are Announced Each May and November | |

May 2023 |

|

Nov 2022 | 6.89% (incl. fixed rate of 0.4%) |

May 2022 | 9.62% (fixed rate was 0.0%) |

Nov 2021 | 7.12% (fixed rate was 0.0%) |

May 2021 | 3.54% (fixed rate was 0.0%) |

Nov 2020 | 1.68% (fixed rate was 0.0%) |

May 2020 | 1.06% (fixed rate was 0.0%) |

Running the numbers

Because annualized rates are in effect only for six months (yeah, that's confusing), an annualized rate must be divided by two to calculate the rate earned over a semi-annual period.

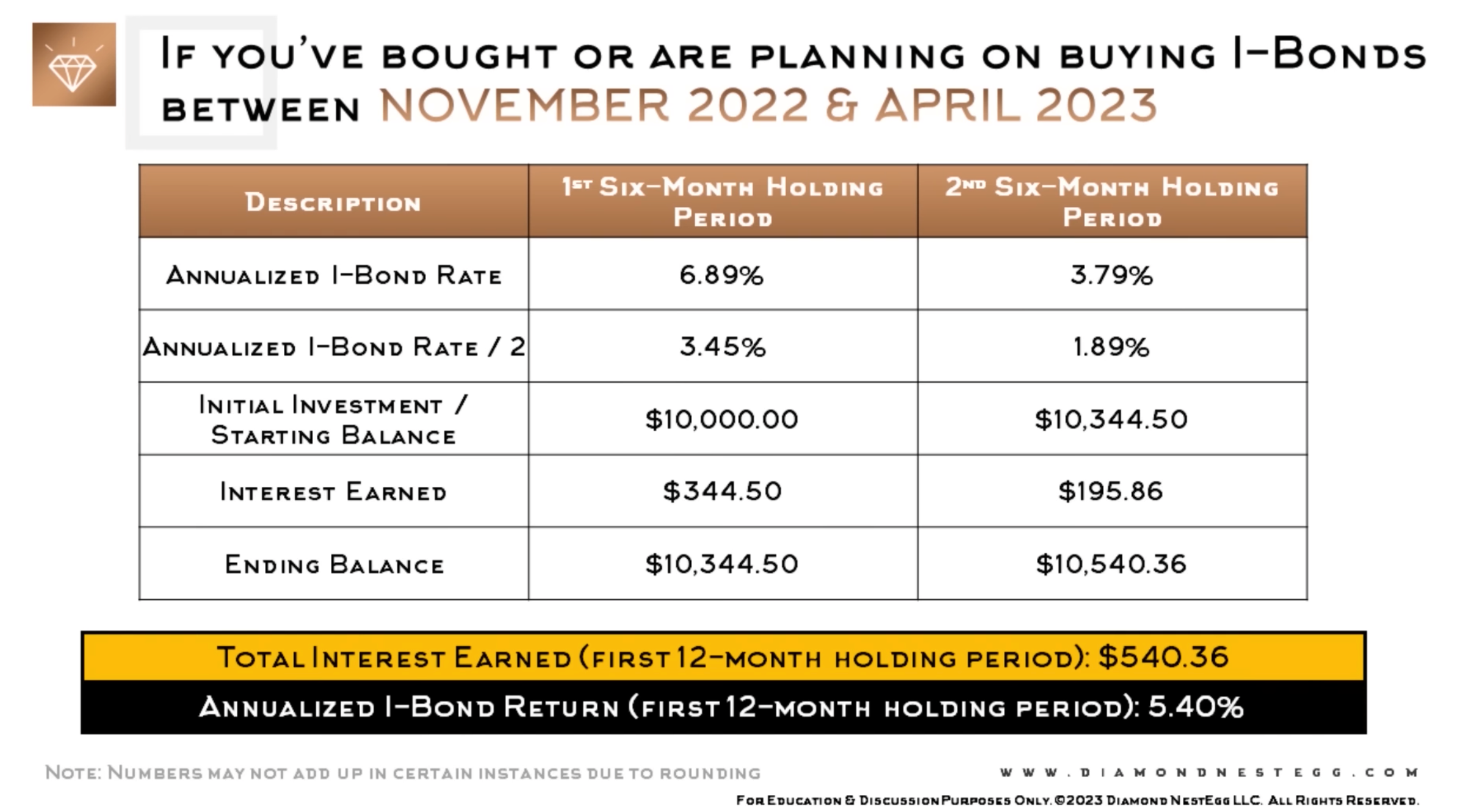

YouTuber Jennifer Lammer, a self-described "super saver," created a helpful graphic that shows how the current rate (6.89%) and the expected rate (3.79%) would result in a one-year dollar gain of more than $500 on a $10,000 investment.

As you can see, $10,000 invested now in an I-Bond would grow to $10,540.36 over 12 months — a return of 5.40%. That's not bad, but it won't make anyone enthusiastic at a time when some CDs are paying that much and without the restrictions that I-Bonds carry (see below).

That said, if you've already invested in I-Bonds, or plan to purchase some between now and the end of April, you'll still earn a decent return — and remember that I-Bonds are virtually risk-free. Further, depending on the course of inflation over the next six months, the rate could tick up again.

If you want to run your own I-Bond calculations, check out this specialized online calculator.

I-Bond restrictions

Direct purchase only. You can't buy I-Bonds within your retirement or brokerage account. You must open an account at Treasury Direct. However, the process isn't too painful, and the purchase money transfers from your bank account.

Holding period. I-Bonds must be held for at least 12 months, making them less liquid than some other fixed-income investments. If they are redeemed between one and five years, you will lose the last three months of interest.

Purchase maximums. In most cases, you can purchase only $10,000 of I-Bonds per calendar year per account holder. Therefore, a husband and wife can invest an annual maximum of $20,000. If you are due an income tax refund, that refund can be directed to purchase up to an additional $5,000 of I-Bonds. (It is also possible to buy I-Bonds as a gift. )