The coronavirus has forced rapid change, both within the financial markets as well as to our normal habits and routines.

Millions of people woke up this morning to dramatically different circumstances than just a week ago — kids out of school, perhaps working remotely from home, and so on. Many are wondering if their jobs are in jeopardy as businesses close, or at least scale back due to reduced demand. And most tragically, a small but growing number didn’t wake up this morning as a result of the virus. It’s a sobering and potentially scary moment.

And that’s before we even get to the financial markets, which came unglued last week. The stock market plunged from an all-time high on February 19 to official bear market territory last week, the fastest descent into a -20% bear market ever. Signs of stress have been everywhere, from traditional safe havens like gold falling sharply last week along with everything else, to even the U.S. Treasury market having liquidity trouble. When U.S. Treasuries — the safest security out there and the traditional "flight to safety" destination during chaotic periods — are having trouble trading and actually see their yields rising (and prices declining) on panic days like last Thursday, you know things have reached historic extremes. Volatility has been incredible, with the S&P 500 gaining or losing more than 4% each day last week, the first time that has happened since 1929.

With the one-two punch of "real world" and market concerns pounding relentlessly everywhere we turn lately, it’s easy to become fearful. Yet the Bible is clear that fear is not to be our response at times like these. I haven’t verified this, but I’ve read before that the Bible contains the charge "Fear not" 365 times — once for every day of the year. Whether that is precisely accurate or not, the idea that we are not to fear is clearly established by Scripture, so much so that the very existence of Sound Mind Investing is based on it:

2 Timothy 1:7 — For God has not given us a spirit of fear, but of power and of love and of a sound mind.

Over the past few weeks, I keep coming back to the comforting words of Philippians 4:6-7: Do not be anxious about anything, but in every situation, by prayer and petition, with thanksgiving, present your requests to God. And the peace of God, which transcends all understanding, will guard your hearts and your minds in Christ Jesus.

At times like these, it’s good to remind ourselves of things we know, yet are easy to forget in the moment. God was not surprised or caught off-guard by the coronavirus. He has given us a whole book of promises to assure us of His great love for us, that he has a Father’s heart toward us, and that He knows exactly what we need. His arm is not short and He is able to provide even when circumstances seem grim. We can trust Him completely.

Faith vs. caution

With fear clearly off the table as an acceptable response, how do we balance faith versus a healthy level of caution? I’m not going to delve too deeply on the spiritual side of this. But I think there are some obvious parallels to draw between our response to this virus in our "normal lives" and the way we should look at our financial response.

It’s not being fearful to follow the counsel of medical experts regarding how to prevent catching the coronavirus. Most of us accept that washing our hands, staying home as much as possible, and so forth are smart exercises of caution.

In the same way, there are certain financial "best practices" that will help us weather the current financial storm. Living below your means, having an emergency savings fund, minimizing debt — all of these are steps that you’ve hopefully been putting into practice so you have some financial flexibility to deal with any stresses the weeks ahead may present.

Let’s take this a step further to the investment realm. SMI’s prime directive is that you need to have a personal investing plan. Your plan may be different from everyone else’s. You may implement your plan on your own, or you may do it with the help of an advisor. But you must have a plan. Hopefully, you’ve got one already. If so, follow it! If you don’t have one, it’s time to dig in — either using the materials available as a do-it-yourself SMI member, or by getting a deeper level of help via SMI Private Client. If there’s anything this recent period should be driving home it’s that "winging it" doesn’t cut it — you need an investing plan.

Short-term vs Long-term

One of the tricky aspects to navigate during a bear market is the tradeoff between short-term and long-term thinking. As losses mount, the prospects for future returns improve. But the fact that the prospects of higher long-term returns is improving doesn’t necessarily mean that short-term risks are diminishing. This is where "faith" in improving long-term returns doesn’t necessarily negate caution regarding the short-term risks.

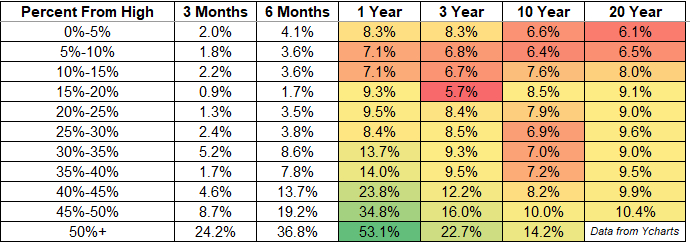

Let’s unpack this idea with the help of the following tables from Michael Batnick of The Irrelevant Investor blog. These tables look at bear markets since 1950, and this first table shows the average returns over various time intervals from various depths of stock market declines. For reference, as I write this mid-afternoon on Monday 3/16, the S&P is down a little more than -25% from its peak.

Click Table to Enlarge

One caveat needs to be mentioned before we dig into this. These returns are based on a relatively limited sample of three big bear markets plus several other smaller ones over the past 70 years. It’s good data and tells us some helpful information. But the bear market of the past few weeks has defied virtually all historical precedents to this point, so we need to hold loosely any conclusions we might draw from past data (like these charts).

With that said, note that the average market response following stock market declines is positive across the board. There are no negative returns to be found here.

Beyond that, it’s very interesting that there seem to be dividing lines at -30% and -40%, at least in terms of the 1-year and 3-year returns. That’s particularly interesting to SMI investors because the -30% and -40% levels are points at which changes happen within Upgrading 2.0 to make a re-entry into stocks happen faster. We didn’t have this data when designing those protocols, but this supports the idea that as we pass these "milestone" loss levels, we should feel an increasing urgency to get back into stocks from the standpoint of earning better returns over the following six months and beyond.

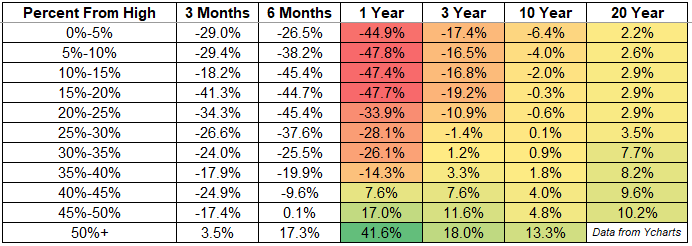

But those are just the average returns. During bear markets, we need to pay more attention to worst-case scenarios. Batnick recognizes this, supplying the following worst-case chart as well:

Click Table to Enlarge

Here’s where we need to balance the "faith" that longer-term rewards are improving with the caution about what may lie immediately ahead. As these worst-case numbers clearly show, from the -25% loss level where the market sits today, things can still look pretty ugly over the next 6-12 months. Even as losses cross the -30% and -35% levels, there can still be significant short-term pain before those longer-term positive returns are realized.

These worst-case numbers are the rationale behind Upgrading 2.0, which often doesn’t start shifting any holdings to cash until a decent amount of stock market damage has already been done. In spite of that late starting point (which is by design so as to avoid being whipsawed by shorter corrections, which are much more common than deep bear markets), Upgrading 2.0 can still be beneficial by providing protection against deeper bear markets.

Time to buy?

The current bear market has cut deeply enough that some people are starting to wonder if they should be buying at these lower prices. To a large degree this depends on what type of investor you are. For the individual investing in their 401(k) or other retirement plan, with many years of investing ahead and no desire to follow a more involved strategy like SMI’s DAA or Upgrading 2.0 strategies, the first table makes a strong argument for continuing to make their regular contributions. As we’ve written before, dollar-cost-averaging during bear markets can bring substantial benefits.

However, the second table illustrates why we’re not particularly optimistic that we’ve seen the lows of this bear market yet. This bear market has unfolded with incredible speed and there’s always the chance that it will conclude quickly as well. But given that the last two big bear markets lasted 18-30 months, we think the odds still lean toward this being a prolonged episode. If that’s the case, we’d encourage those willing to follow along with the SMI strategies to take their cues from those strategies, rather than guessing or trying to predict when the markets will turn. SMI’s trend-following approach does basically ensure that we won’t be heavily invested when the market hits bottom, so we’ll likely miss the first leg higher. But by waiting for some confirmation that the worst is over before shifting back into stocks, we can hopefully also avoid a substantial portion of the market’s late-bear declines. We’ve already seen DAA steer us almost completely out of harm’s way, and we think Upgrading 2.0 may still provide some benefit before this bear market is over, despite its late start kicking in.

Of course, these approaches don’t necessarily have to be mutually exclusive. Investors with at least a 5-10-year time horizon may choose to continue investing new contributions into index funds within one portion of their portfolio, while following the signals from DAA and/or Upgrading 2.0 in other portfolio allocations. We’re big fans of these "blended" portfolios that allocate money to multiple different strategies within a single portfolio. Much as we diversify among various types of assets, diversifying among strategies can also provide similar benefits to your portfolio.