A "tax threshold" is a point at which a taxpayer crosses from one level of taxation to another.

Something similar happens with Medicare. Above a certain level of income, the premiums charged for Medicare Part B go up. (Part B covers medical services, such as doctor visits, preventive services, and certain lab services. Some people have Part B premiums automatically deducted from their Social Security retirement benefit.)

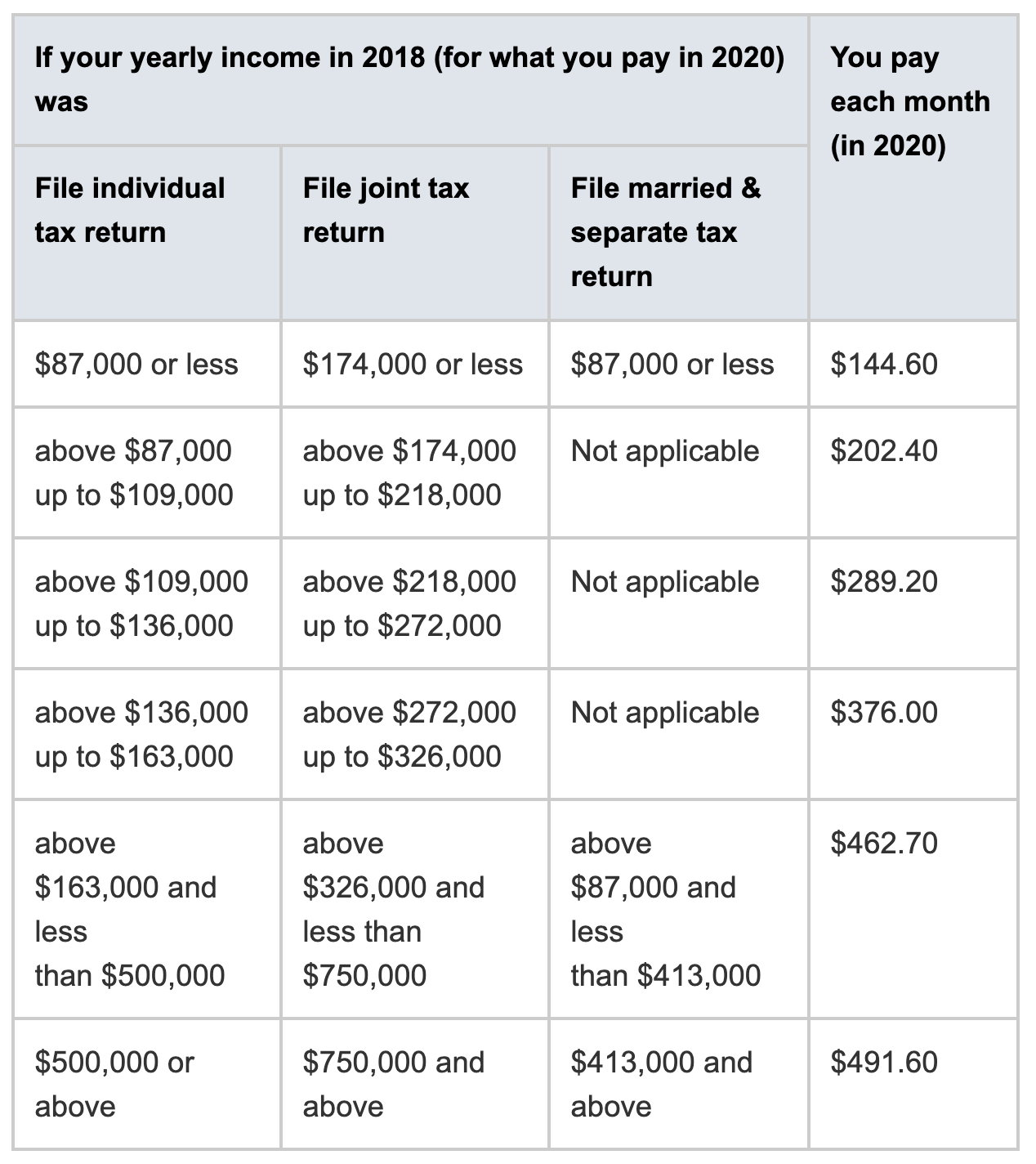

Here’s an example of how Medicare-premium math works. (We’re using 2020 premiums because 2021 premiums haven’t been announced yet.)

An individual with an adjusted gross income of $87,000 or less will pay the basic Medicare Part B premium, which this year is $144.60/month. A married couple with income up to $174,000 will pay $114.60 each, or $289.20/month. But once you cross the threshold — even by a fraction of a dollar — the monthly premium rises.

Source: Medicare.gov

If you’re thinking, "Those thresholds don’t affect me because I am in the lowest bracket," here is something to keep in mind: "Even if your income is in the lowest premium bracket as a married couple, it may be in a much higher one after your spouse dies and you are taxed as single," notes a recent article (paywall) in The Wall Street Journal.

The article offers an example of what could happen.

Suppose a couple had modified adjusted gross income of $170,000 from Social Security, pensions and required minimum distributions from their tax-deferred accounts. That’s under the limit for the standard Medicare premium, and the couple will each pay $144.60, or a total of $289.20, a month.

The picture changes dramatically when the husband dies. The smaller of their two Social Security checks stops, but the pensions and RMDs continue, and the wife now has income of $155,000 a year. That puts her into the third-highest Medicare bracket as a single taxpayer, where she must pay $376 a month for Medicare. She is paying 30% more to cover herself as a single person than she and her husband were paying to cover both of them.

And she will have to pay a $50.70 surcharge for her Medicare Part D drug coverage on top of that because of her income.

Avoiding higher Medicare premiums

Required Minimum Distributions from retirement accounts, which begin at age 72, are a common reason people get hit with higher Medicare premiums. Since Roth IRAs don’t have RMDs, converting money from a traditional to a Roth account can keep higher Medicare premiums at bay.

Another way to avoid crossing an income threshold is to make a QCD — a Qualified Charitable Distribution — from a non-Roth IRA. Doing so reduces your taxable income, helping ensure that you stay below a threshold, plus you’ll be helping a charitable organization at the same time.

Another important thing to bear in mind: The amount you pay for Medicare premiums usually is based on your income level from two years earlier. For example, 2020 premiums are based on 2018 income, as noted in the table above.

There is an exception. If you’ve had a "life-changing event" that caused a reduction in income, you can ask Medicare — using this form (PDF) — to base your premiums on current income.

Knowing the Medicare thresholds, and taking action to stay under them, is another way to manage your expenses wisely during your retirement years.