The economic and investing landscapes have been shifting rapidly, so I thought it might be helpful to walk through a few of the big recent events and show how everything is connected. This shouldn't cause you to run out and make a bunch of changes to your portfolio, but it will hopefully help you make sense of the recent moves and commentary you've been seeing from SMI.

Let's start with the big picture and drill down from there.

Recession expectations have rapidly receded

SMI members will likely recall our January cover article, Uncomfortable Regime Shifts, in which we laid out our expectation that the U.S. economic data would bottom in January or February, but that we would avoid recession.

This was uncomfortable for a couple of reasons. First, we had spent the prior two years looking for a recession and it's always hard to change your mind on a big idea like that. But second, it was uncomfortable because it was clearly not what investors broadly were expecting as of late last year — the market was pricing in 6-7 rate cuts for 2024, clear evidence that recessionary expectations were still dominant.

Fast forward to the present and it seems pretty clear our interpretation was accurate. There are any number of statistics or charts we could turn to as examples of the brightening economic landscape, but we've had two big reports come out in just the past week, so I'll focus on those.

On Monday, the U.S. PMI for March was released, and it was much stronger than expected. PMI stands for "Purchasing Managers Index" and is a measure of the strength in the manufacturing economy. In the U.S., this is a smaller slice of the economy than the "Services" portion, but it's manufacturing that has been in such a deep slump for the past year and a half, both in the U.S. and abroad.

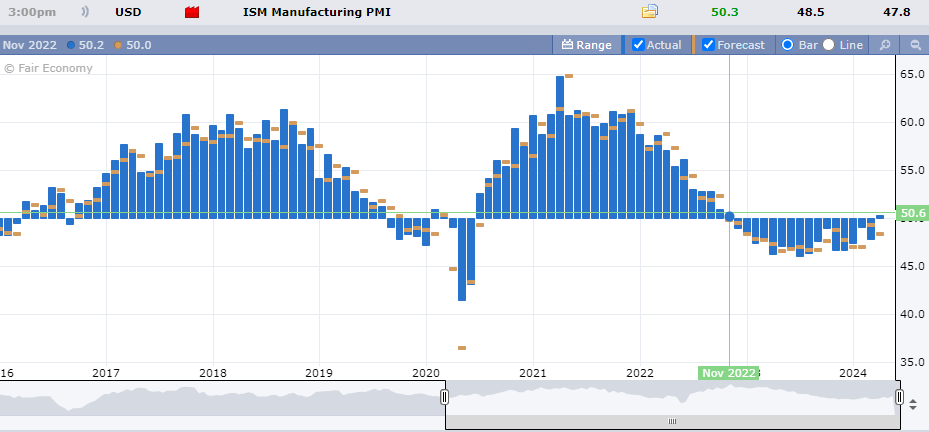

The following chart, from Blueberry Markets, shows the trend change well. The 50 level is the key to interpreting PMI values: anything over 50 indicates expansion, while anything under 50 signals contraction. U.S. PMI hadn't been above 50 for 17 months (November 2022), but unexpectedly surged over that level in March. More generally, the chart makes it easy to see the long slowdown and contraction in 2022-23, as well as the improvement back to above the 50 line last month.

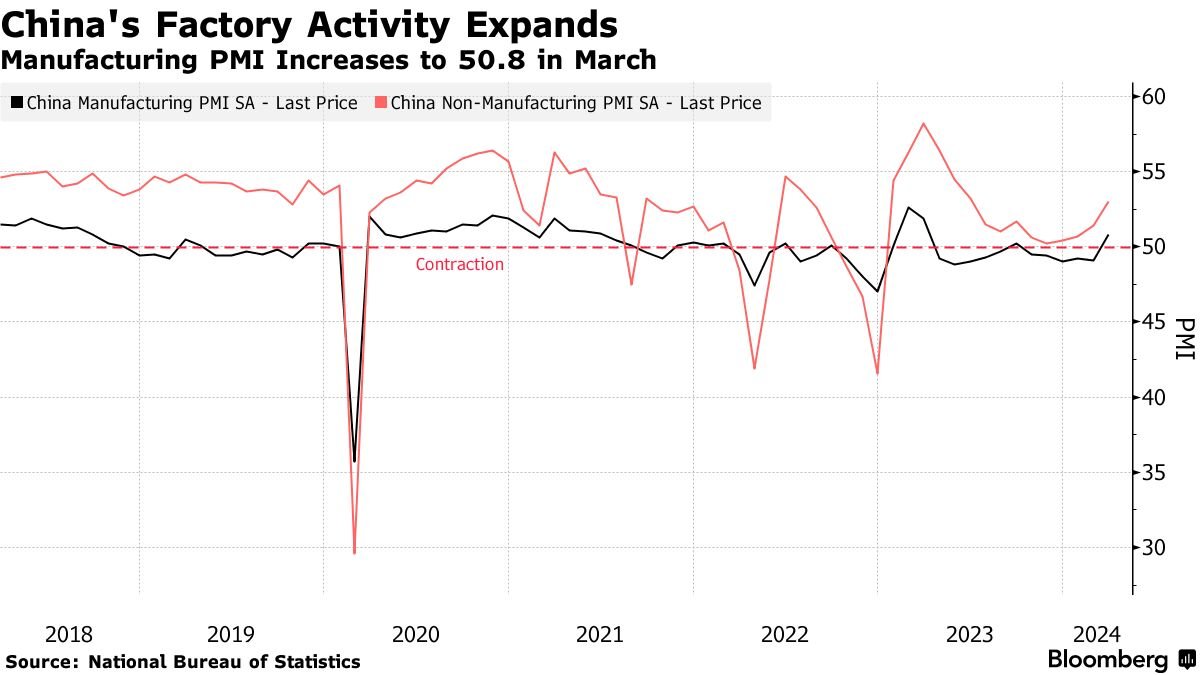

As I've written a few times lately, it's not just the U.S. economy that appears to be improving. Rather, there are signs that we are emerging out of a global recession. China, the #2 economy in the world, gave us a strong confirming signal of this at the end of March when its PMI also rose above 50 to hit its highest level in a year. Again, the point is simply to notice the general upswing in recent months (the far right of the chart).

The point of showing both of these charts is just to visually convey how the downward economic trends of the past 12-18 months appear to have bottomed out, both domestically and internationally, and are now showing improvement. That's not to say the economy is roaring or hot — it's not. But the trend has shifted from slowing/recessionary to improving/expansion and that's a big deal as far as markets are concerned. Simply put, the global economy is pulling out of a long period of contraction and showing signs of shifting back into growth mode.

Focus turns back to inflation

This economic improvement is definitely good news. However, as everyone is well aware, a global battle with inflation has been underway for the past few years. Even before the economy had started to improve, central bankers were struggling to meet their inflation targets.

The other reason why I focused specifically on the manufacturing part of the economy via PMI in the charts above is that it's the manufacturing economy that tends to use raw materials to produce tangible things. So as the manufacturing economy has started to show "green shoots" and early signs of growth, not surprisingly, we've seen a surge in commodity prices.

Bonds too are especially sensitive to both economic growth projections and inflation. As recession odds have diminished in 2024, the 6-7 rate cuts investors expected at the start of the year have gradually been priced back out of the market, resulting in higher interest rates.

For the most part, investors have largely shrugged off these rising 2024 interest rates. That began to change this week though. With the breakout PMI report on Monday, investors have gotten nervous about stock prices, causing a bit of a pullback. This isn't surprising, as it was rising rates that were directly responsible for the bear market in stocks that unfolded over the first 10 months of 2022, and again caused a sharp correction from August-October of 2023.

One significant difference

Investors are right to be nervous about rising rates potentially throwing a speed bump in front of a stock market that has gone virtually straight up over the past five months, particularly given its already rich valuations. However, there is one huge difference between conditions today vs. when those earlier rate-induced selloffs occurred in 2022 and 2023.

Simply put, higher rates in the context of an expected imminent recession — as was the case in 2022 and 2023 — is a completely different situation than today. Investors today no longer expect a recession to begin soon.

This could be misguided, but there are actually good reasons for investors to be thinking this way. For starters, the Fed has been openly looking for an excuse to cut interest rates since December, the opposite of their hiking posture during the prior rate-induced stock market selloffs. If the markets stumble to even a minor degree, they're going to cut rates, which should be supportive of asset prices. Historically, rate cuts that occur during non-recessionary soft landings tend to be very good for markets.

Second, it's pretty easy to make the argument that much of the globe, along with the U.S. manufacturing part of the economy, have already experienced a recent recession. That's not to say we couldn't roll over into a broader recession, or a credit crisis couldn't unfold that causes a lot of pain. There are always risks lurking.

But to summarize, when rates were rising in 2022 and 2023, there were very good reasons to expect those rate hikes were going to turn into an imminent recession. Given that likely outcome, investors were right to be fearful (even though it didn't end up happening).

Today, rates are rising again and stocks have wobbled a bit this week in response. But with the threat of imminent recession vastly reduced (which the data is clearly confirming), it's not nearly as scary a proposition.