“Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.” – Market legend Bob Farrell

One’s perception of “the market” in 2023 has everything to do with what exact segment is being measured. We’ve covered at length the outsize impact the “Magnificent Seven” stocks (Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta/Facebook) have had on the market-capitalization weighted indexes (Wilshire 5000, S&P 500, Nasdaq, etc.) this year. But it’s still striking to see the numbers laid out:

The +11.4% YTD return of the S&P 500 index looks quite good (top row). But as the bottom lines of the table show, the “Magnificent Seven” had gained an average of +82.1% this year, while the remaining “S&P 493” stocks were, on average, down for the year! All of the S&P 500’s gain in 2023 has come from those seven stocks, and the further away from that group, the worse the results.

The rest of the table shows how the equal weight version of the S&P 500 was down -1.7%, similar to the -3.4% decline of the Russell 2000 small cap index. Even worse, the Russell micro-cap index was down -12.6% YTD. There has been no help from bonds either, as the Bloomberg U.S. Aggregate Bond index lost -3.1%, as it heads for an unprecedented third annual loss in a row.

So while the Main Street financial press pushes a narrative about “the market” bouncing back from a tough 2022 with a strong rebound in 2023, the reality is somewhat less encouraging. The seven stocks at the center of the artificial intelligence excitement — who not coincidentally produce massive cash flows that insulate them from the rapidly rising cost of credit — have excelled. Virtually everything else, stock and bond alike, has struggled.

Just-the-Basics (JtB) & Stock Upgrading

Narrowing our focus from YTD to just third quarter performance, there wasn’t much difference between the Wilshire 5000’s return of -3.3% and JtB’s -3.4%. That’s because after peaking at the very end of July, even the Magnificent Seven pulled back considerably in August and September. It’s definitely too early to say their run is over, but it’s interesting to note that as this is being written on Oct. 18, the Mag 7 have dropped -3.8% over the past week, while the “other 493” are flat. (Tesla’s earnings miss the evening of Oct. 18 sent its stock price tumbling more than –10%.) As investors who remember the 2000s will attest, these types of massive performance disparities can, in fact, cut both ways.

Stock Upgrading’s third-quarter performance (-4.3%) was slightly worse. Unfortunately, Stock Upgrading had the bad luck of buying the market peak with its final small-company purchases at the end of July. That hurt performance as everything pulled back in August and September. We had resisted adding small-company stocks, but their trend improved enough over the summer that the system forced our hand. Given that the small-company “buy” signal only triggered at the very peak of their recovery in late July, their subsequent decline quickly reversed that signal and we already started reducing small-company exposure last month (at the end of September). That move continues this month.

Adding commodities back to the Stock Upgrading lineup at the end of July was a net positive, as it gained +1.1% through the end of the third quarter. Commodities dipped considerably in early October before recovering sharply as the Israel-Gaza situation unfolded. As with the rest of the current market, there are a number of cross-currents blowing that make it hard to get a definitive read on the longer-term trend. Especially at times like this, our mechanical trend-following signals are incredibly useful.

Bond Upgrading

While stocks typically command most of investors’ attention, the real story has been in bonds over the past two years. It was the dramatic increase in interest rates throughout the first half of 2022 that was the primary catalyst for last year’s bear market in stocks (as well as creating the worst year in bonds in decades). And after recession fears and a mini-bank crisis temporarily reversed the rise in interest rates early this year, the upward march resumed in earnest during the third quarter.

If you haven’t reviewed the October Private Client market-update video (made available to Premium-level SMI newsletter members), we encourage you to do so. It contains helpful background explaining how the explosive rise in government borrowing in 2023 is concerning bond investors. That concern is sending longer-term yields soaring.

Fortunately, Bond Upgrading has effectively limited our losses throughout this three-year bond bear market. During the third quarter specifically, Bond Upgrading’s loss of -1.4% was much better than the broad bond market’s loss of -3.2%. This pattern has been consistent, as evidenced by the fact that as of mid-October, Bond Upgrading is slightly positive for the year while the bond index is down -2.6%.

One way Bond Upgrading has limited our losses has been by avoiding longer-term bonds. As this month’s article on duration explains, there’s a direct correlation between the degree of a bond’s gain/loss when interest rates move and the term (or length) of those bonds.

Throughout the past 18 months, investors have repeatedly tried to anticipate a coming recession by buying longer-term bonds, only to incur significant losses when rates ultimately rose instead of falling. While we too have been on recession watch throughout 2023, we’ve avoided that pitfall by waiting to actually see evidence of a durable trend change in interest rates before shifting our bond mix. In fact, as discussed here, we’re shortening (not lengthening) Bond Upgrading’s duration this month.

Dynamic Asset Allocation (DAA)

DAA has been SMI’s strongest performer in 2023, but its performance during the third quarter (-4.1%) was similar to the other SMI strategies. That makes sense, given it was invested two-thirds in stocks and one-third in gold, while all three holdings produced returns in line with the prominent U.S. large-company stock indexes.

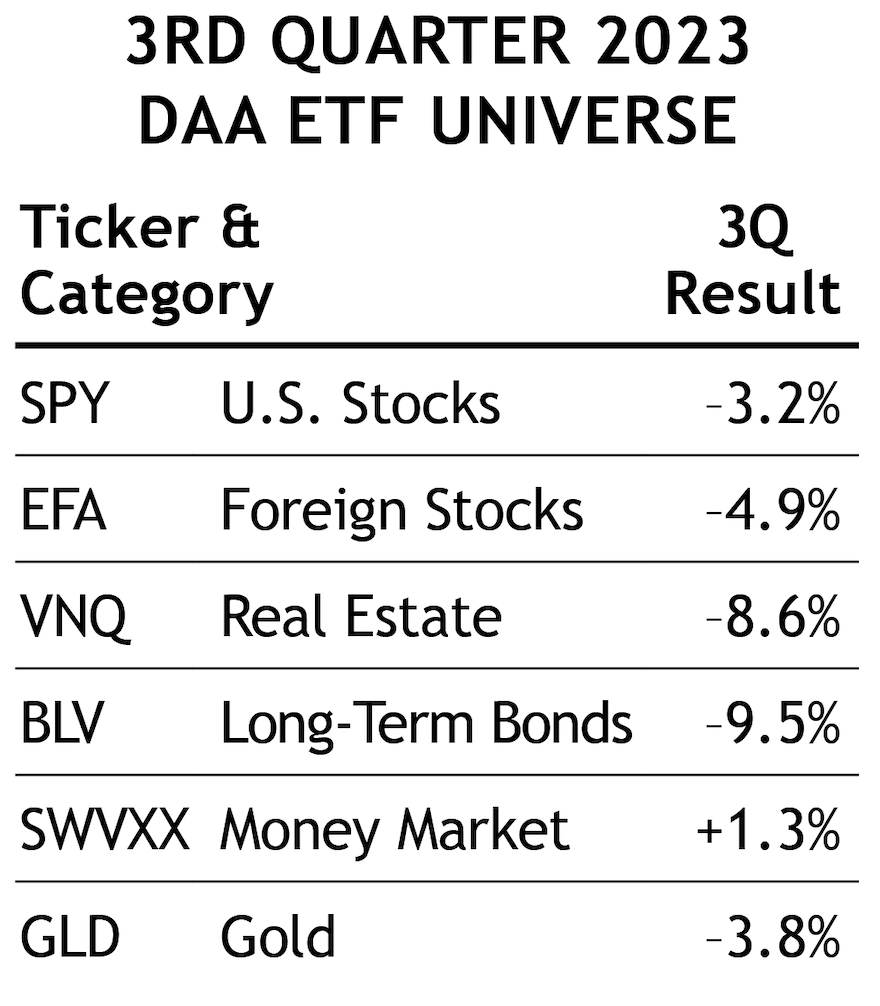

As the nearby table shows, the real story of the third quarter was what DAA avoided, namely the interest-rate sensitive Bond and Real Estate asset classes, both of which were down sharply.

Sector Rotation (SR)

Following a whopping +16.9% gain in June (and a smaller gain in July), SR fell in August and September, ending the third quarter with a loss of -8.0%. All of those returns came from home builder stocks, but the third quarter declines were enough to finally cause that holding to be replaced at the end of September. (See the recent SR monthly updates for more details.)

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider.

A 50/40/10 portfolio would have dropped -4.5% in the third quarter. Whether you’re using this specific 50/40/10 blend or a different combination, we think most SMI readers can benefit from blending these strategies in some fashion.

Conclusion

Following the “crisis” driven bear markets in 2020 (COVID) and 2008 (Financial Crisis), investors have understandably been conditioned to expect rapid market deterioration when trouble strikes, followed by quick Fed interventions and dramatic market recoveries. There’s ample evidence of this in 2023 investor positioning, as demonstrated by the fact that investors have spent much of the year anticipating a recession, yet have responded to that risk by pushing valuations of the Magnificent Seven stocks to extremes and loading up on long-term Treasury bonds! Neither of those are traditionally defensive actions.

It’s hard to remember that non-crisis, (i.e., normal) economic cycle bear markets take a long time to unfold. First interest rates go up. Then the economy gradually responds. Then asset prices fall. Then rates get cut and eventually the recovery begins. The full cycle takes years, not weeks or months.

That was true in 2000-2002, when following an initial market drop in 2000, things seemed “not that bad” throughout most of 2001, only to finally roll over in 2002. Once they did, the damage to richly valued stocks was substantial, despite the accompanying recession being quite mild by historical standards.

We think a repeat of that 2002 experience is still a strong possibility as we move into 2024. While much of the U.S. economic data continues to be surprisingly resilient, there are plenty of cracks forming as the massive savings consumers built up in 2020-21 dissipates. Meanwhile, government stimulus programs are being scaled back or removed, and economic growth continues to deteriorate globally.

In short, while we can’t say for certain that a recession is coming, there are still plenty of warning signs to keep us on high alert. In such an environment, the unbiased trend-following signals generated by the SMI strategies are an invaluable tool in sorting through the noise and keeping us from being caught on the wrong side of dangerous market breakdowns.

Remember, the top priority during bear markets is making it through with our capital intact so we can take advantage of the generational opportunities that present themselves on the other side. Bull markets are relatively “easy” to invest in, but in order to take maximum advantage of that advantageous environment, we have to do the hard work of slogging through periods such as we’ve experienced this year.