As the new year began, investors were largely pessimistic on the economy, but, given their high expectations of multiple rapid Federal Reserve rate cuts ahead, optimistic regarding markets. These views weren’t unwarranted, given that the Fed clearly signaled in December that they were pivoting toward a rate-cutting bias. As often happens, though, investors took the Fed’s guidance for three 2024 rate cuts and rather quickly put on rose-colored glasses and decided that actually meant the Fed would cut 1.50%-1.75% in 2024 (i.e., six or seven rate cuts).

SMI didn’t share that view, as we relayed in our January cover article, Uncomfortable Regime Shifts. While bonds were rallying on all the rate cut optimism, we warned that the economy was likely to bottom sooner than was broadly expected — without tipping into the recession most investors anticipated. By extension, the market was likely overdoing it on the rate cut enthusiasm.

That’s roughly how the first quarter turned out. U.S. economic growth started showing signs of improvement by the end of the quarter, accompanied by similar “green shoots” of growth from a number of economies that did tip into recession in 2022/23 — notably China, Europe, and Japan. These more robust growth prospects (and receding recession risks) kept stocks rising throughout the quarter.

On the fixed-income side, the Federal Reserve reacted to improving economic data by holding short-term rates steady rather than following through on the anticipated rate cuts. The clearly declining recession risk caused investors to reverse course on bidding rates lower, resulting in higher yields across the bond spectrum. As SMI investors know, higher bond yields mean lower bond prices, so not surprisingly, it was another weak quarter for bonds.

The final big takeaway from the first quarter was the reassertion of inflation and its corresponding impact on the prices of real assets, such as commodities and precious metals. Commodities, in particular, had been weak for the past 18 months or so, as demand typically falls during recessions, and most investors believed a recession was coming. With recession becoming less likely and signs of economic growth appearing, commodity prices have taken off, and right along with them, inflation concerns are picking back up.

Just-the-Basics (JtB) & Stock Upgrading

Combining the very strong first-quarter results for stocks with the weak results for bonds produced a solid gain of roughly +5.7% for a portfolio allocated 60% to stocks (Wilshire 5000 Index) and 40% to bonds (Bloomberg U.S. Aggregate Bond Index).

However, a closer look at the components of a JtB portfolio shows that the largest U.S. stocks (S&P 500 index, +10.4%) outperformed smaller stocks (VXF, +6.9%) as well as foreign stocks (VXUS, +4.4%). As a result, an all-stock JtB portfolio gained +7.8% during the first quarter. That’s a great quarterly result, even if a bit less than the S&P 500 index itself.

Stock Upgrading performed better, gaining +9.4%. This was despite having 10% of its portfolio in cash until the end of the quarter when we got the signal to buy commodities again. While small company stocks started the year slowly, the market rally gradually broadened out to the point that large, small, and foreign stocks all earned similar returns in March.

Bond Upgrading

Bonds are typically the best performers during recessions, as lower economic growth prospects generally translate to lower inflation and yields (which pushes bond prices up). This dynamic was on display in late 2023 and early 2024 as investors front-ran the anticipated recession. But as it became clearer that recession wasn’t coming swiftly, if at all, yields reversed and started moving substantially higher.

The final first-quarter returns for Bond Upgrading show a loss of -1.0%. That’s a bit worse than the Bloomberg U.S. Aggregate Bond Index’s loss of -0.8%, but it’s also a bit misleading — the index’s losses were accelerating while Bond Upgrading’s happened early in the quarter before pivoting to safer holdings. By late-April, Bond Upgrading had turned that -0.2% year-to-date deficit into a +0.4% advantage over the index.

Of course, quibbling over tenths of a percent is silly when the bigger issue is that bonds of all types have been such poor performers since rates started climbing substantially three years ago. While we don’t have any easy answers in terms of specific bond investments to switch into, it’s worth pointing out that a primary reason for SMI developing Dynamic Asset Allocation years ago was to reduce our reliance on set bond allocations. We could foresee the likelihood of bond trouble ahead. As a result, most SMI investors have substantially smaller bond allocations than investors following a more typical “60/40” or similarly constructed approach.

Dynamic Asset Allocation (DAA)

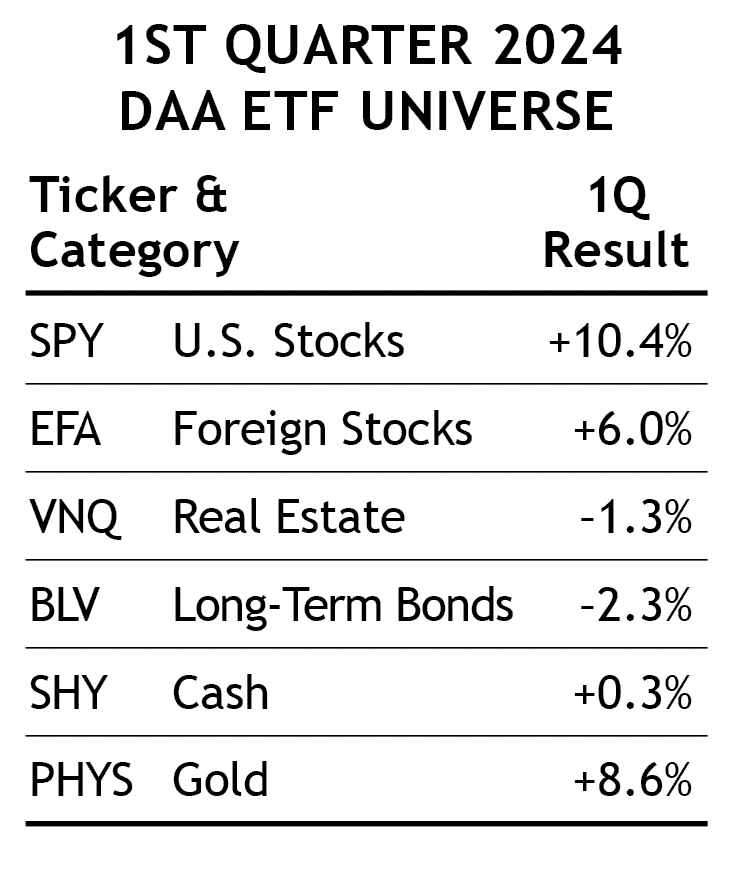

DAA had a solid quarter, gaining +6.0%. This was driven by the strong gains in stocks, both U.S. (SPY, +10.4%) and International (EFA, +6.0%). DAA’s third holding pivoted from Real Estate to Bonds and finally to Gold, as momentum turned from favoring yield-sensitive assets at the beginning of the quarter to fleeing from them by the end.

Gold deserves a special note, as it caught fire in March (PHYS, +9.6%) and would tack on another +6% before finally pulling back in mid-April. Gold is breaking many of the “normal” rules, rallying in the face of a stronger dollar and rising interest rates.

It’s worth noting that the level of assets in the gold ETFs that are so popular with Western investors continue to decline. In contrast, global central-bank buying and physical gold purchases from Eastern investors have been insatiable. If Western investors ever get their interest piqued by rapidly escalating all-time-high gold prices, it could really rip higher.

Sector Rotation (SR)

SR started 2024 strong with a double-digit gain in its Uranium holding, but unfortunately gave that gain right back in February before exiting Uranium. Biotech took its place and promptly fell -3.6% before it too was replaced. Altogether, it was a disappointing loss of -3.75% for SR during the first quarter.

50/40/10 (with 60/40 stock-bond Upgrading)

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our article, Higher Returns With Less Risk, Re-Examined. For 2024, we’ve started reporting this portfolio using a 60/40 split between Stock & Bond Upgrading within the Upgrading allocation. This is a reasonable reflection of how most SMI investors utilize such a “whole portfolio” blend and is a great example of the type of diversified portfolio we encourage most SMI readers to consider.

This version of a 50/40/10 portfolio gained +4.7% during the first quarter of 2024. That’s in line with the +4.4% a well-diversified 60/40 JtB portfolio would have earned and just a bit less than a pure 60/40 Upgrading blend (+5.2%). We’re trying to give a better perspective in these reports of how various responsibly diversified portfolios would have performed, instead of focusing so much on the headline indexes that aren’t really a great reflection of how most investors should invest.

Conclusion

Again, the big story of the first quarter was the rapid shift away from recession worry and into re-inflation. It may not be obvious how well prepared for this transition SMI portfolios are, given that they generally performed in line with very strong markets during the first quarter rather than exceeding them. Part of this is a function of needing to wait for trends to first shift and then momentum to confirm these changes, which happened during the quarter.

For example, one of the best holdings during the inflationary episodes of the past few years has been commodities, which having been added as an option within Stock Upgrading accounts in 2021, are currently being recommended. DAA investors have sizable gold holdings, which have been soaring on the rising inflationary tide. Bond Upgrading is as well-positioned as it can be for inflation by virtue of its first-quarter pivot out of longer-duration bonds toward shorter-term bond funds.

Most importantly, we need to avoid getting too caught up in the comparison game when we’re earning quarterly gains in the neighborhood of +5%! That type of gain compounds to over 20% annually, which is spectacular.

During quarters such as this, the main thing is being invested. SMI portfolios were in the thick of the action and earned solid returns as a result.