More than half of respondents in a just-released Charles Schwab survey say they are living "paycheck to paycheck." That’s one finding in the "Modern Wealth Index," Schwab’s annual online survey covering four areas of money management:

Planning and goal setting;

Saving and investing;

Staying on track;

Confidence in reaching financial goals.

Among other things, Schwab asked a "demographically representative as possible" sample of 1,000 people — ranging in age from 21 to 75 — to give a "personal definition" of wealth. The top answer (from 28% of respondents): "living stress-free/peace of mind."

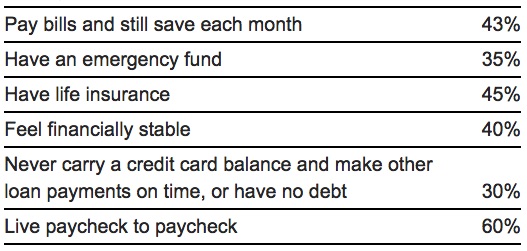

Unfortunately, other results from the survey suggest most respondents are experiencing a high degree of financial stress and don’t have much peace of mind. That’s an inference, based on the fact that fully 60% said they "live pay to paycheck." Only 40% felt "financially stable." Only 1 in 3 (35%) had an emergency fund.

Most respondents said they had no written plan for saving and investing, although Millennials (people now in their 20s or 30s) were slightly more likely to have a plan (31%) than either Gen-Xers (20%) or Baby Boomers (22%). Put another way, younger people were more likely to have a plan than older people.

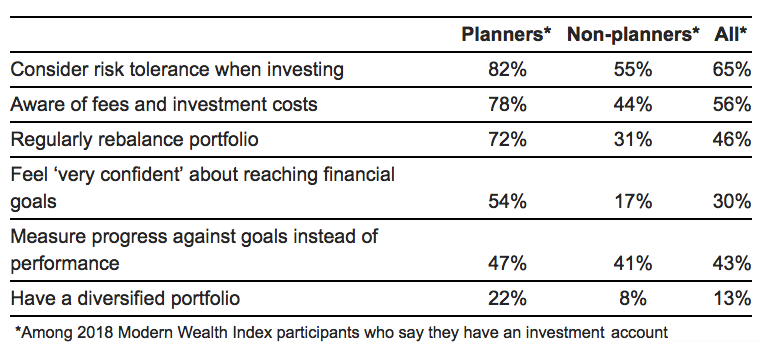

Here is a table showing stark differences in investing understandings/behaviors between respondents who have a plan and those who don’t.

Here are three takeaways from Schwab’s Modern Wealth Index:

Most people are "living on the edge" (no financial margin or cushion);

Developing a plan is a key to financial progress;

People who create and follow a plan for improving their financial situation are rather rare.

As we noted in our January 2018 issue, "the major obstacle that keeps people from getting on the road to financial freedom is inertia — i.e., ’a tendency to do nothing.’ Don’t let that describe you."

If you don’t yet have a plan, read the articles linked in the right column above and put them into practice. Doing so will put you on the pathway to less money-related stress and greater financial peace of mind.