Market analysts are feeling gloomy. A recent “Market Perspective” from Schwab noted, “A sustained [market] drop may weaken both consumer confidence and...spending power — further dampening consumer demand and economic growth.” Morgan Stanley told investors, “We advise taking caution ahead,” noting that “11 of the 14 Fed tightening cycles since 1950 have resulted in recession.”

Among the many negatives confronting the stock market are Russia’s war against Ukraine; the persistence of the pandemic in some places; rising interest rates; and high inflation — with escalating prices for gasoline, groceries, and so much more wreaking havoc on household budgets.

The bears are betting all this will lead to further stock market declines from current levels. The bulls are betting that the concerns are exaggerated. They stand by their contention that the long-running “secular” bull market still has legs.

I hope you’re not betting at all, that you’re dealing with market risk by being diversified — and that you’re willing to be patient. The market will do what it has always done — go up, go down… and then go up again.

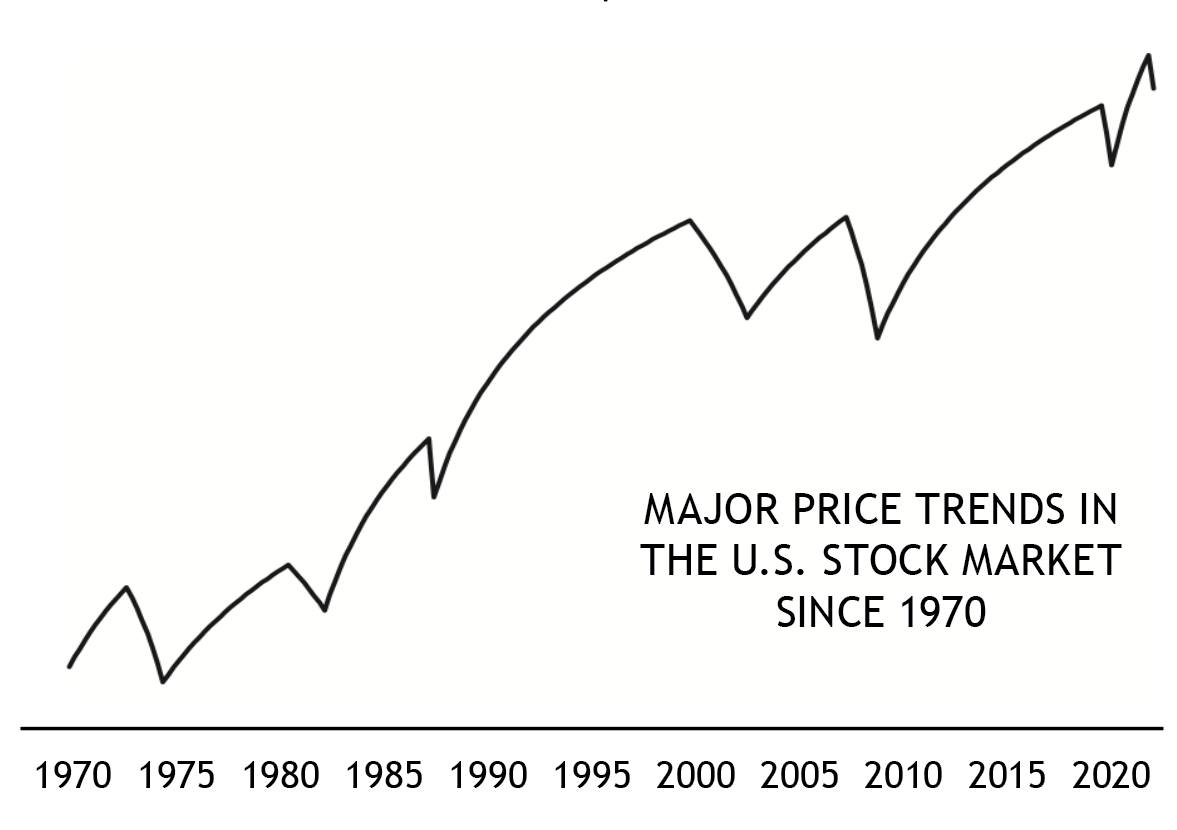

The logarithmic graph to the right provides a picture of how stock prices, as measured by the S&P 500 index, have moved over the past 50 years. It shows the last seven times prices have declined 20% or more, including this year’s selloff. (So far, this year’s decline doesn’t qualify as a “technical” bear market. The S&P 500 index dipped below the -20% threshold on May 20 but has yet to close there. But since the Nasdaq (technology) and Russell 2000 (small-company) stock indexes are down more than -25% already, we’ve included it in the chart.)

But tell the truth — that chart doesn’t look all that bad, does it? It shouldn’t. The S&P 500 index is still roughly 80% higher than at its March 2020 low!

If this is a new bear market and its length of decline matches the average of the prior six bear markets, we wouldn’t expect it to end until sometime in mid-2023. (The last six bear markets declined an average of 16 months. Two were brief: 1987’s bear lasted three months and 2020’s lasted only 1 month. The other four averaged 22 months.)

I’m not saying we’re facing a long bear market. But if we are, are you prepared? Prepared to take advantage of it, that is.

First, are you prepared financially?

If you haven’t been investing with borrowed money, you can survive any bear market. Just maintain your strategy and wait it out. But that’s looking at it negatively. Lower stock prices, if they come, are bad for people who have to sell, but they offer temporary bargain prices for people who have the money to buy. Will you be in a position to add to your holdings, either by initiating or maintaining a dollar-cost averaging strategy? Or perhaps simply in a position to buy again when the SMI strategies say it’s time?Second, are you prepared psychologically?

That is, do you have a positive mental attitude? Yes, we have problems in the short term, but the long-range outlook is positive. Years from now, stock prices will likely be far higher than they are now. It is through the down phase of market cycles that we are given an opportunity to buy at lower prices so we can sell later at higher prices (see page 87). When adequately prepared for, bear markets can be more of an advantage than a disadvantage for investors with a longer time horizon. For them, a bear market in stocks is an opportunity, not a threat.

The stock market has few set rules, but certain truisms have stood the test of time. One is that bad market periods are followed, in time, by good market periods. You’re happy to take advantage of seasonal half-price sales at clothing stores, aren’t you? You should have the same “opportunity is knocking” attitude about stock prices if and when they “go on sale.”

Investment success, for the most part, comes from developing a practical, personalized strategy that focuses on quality investments, and then having the wisdom to wait for the markets to do what they have always done in the past — reward the patient investor.