New SMI members are sometimes confused by an apparent disconnect between what our articles seem to be saying and what our investment portfolios are actually doing.

This typically happens because all of SMI’s portfolios run based on mechanical strategies, yet we continually try to keep members informed regarding the current state of the markets.

It’s a delicate balance at times, but a necessary one. On the one hand, there’s the very real need to protect ourselves from ourselves, as reflected in the following Tweet.

“It doesn't matter how smart you are, you still need a process and you still need a checklist.

— Ted Seides (@tseides) November 13, 2019

There's all sorts of ways you can self-sabotage and not realize it, forget things along the way, and even ignore cognitive biases.”

- Jason Karp (FM, EP.12)

Our mechanical strategies keep our investing on track when our emotions would otherwise get the better of us. These imposed disciplines are a huge part of SMI’s long-term success. Without them, we’d be as prone to making horrible investing decisions as the heavyweights who have predicted doom for the current bull market at every step along its decade-long path.

From MarketWatch this morning:

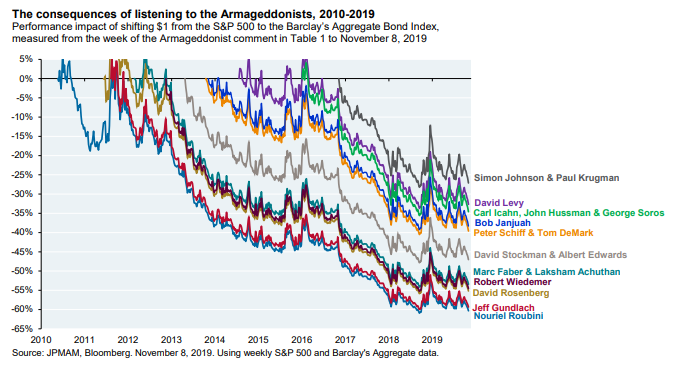

Michael Cembalest, the chairman of market and investment strategy for J.P. Morgan Asset Management, rounded up apocalyptic predictions from a range of commentators, including famed investor George Soros, bond-market giant Jeffrey Gundlach, activist Carl Icahn and New York Times columnist Paul Krugman.

He then calculated the consequences of shifting $1 from the S&P 500 stock market index to the Barclays Aggregate Bond Index, from the time of those “Armaggedonist” predictions.

While SMI’s portfolios are governed by mechanical processes, we are also keenly aware that investing is largely a psychological battle and that having appropriate expectations is one of the most important keys to long-term investing success. We constantly try to proactively manage the emotional side of the investing journey for SMI members, because our own 30 years of experience confirms what the investing research is increasingly saying — investing success is more about managing our own emotions than it is anything else.

So we strive to keep SMI members informed regarding the current status of the market and our interpretation of what that means for the future. This often takes the form of "leaning against the prevailing wind" — encouraging members when they’re afraid and acting as a brake when they’re potentially feeling overconfident.

It’s this latter condition that we’ve been experiencing the past year or two. The stock market is at all-time highs, yet by most historic measures there’s a lot of risk there. That’s true whether you focus on stock valuations, earnings, economic conditions, etc.

Given that, I was struck today by the following blog post by Lance Roberts of Real Investment Advice:

Not surprisingly, whenever I discuss the potential of a market correction, it is almost always perceived as being “bearish.” Therefore, by extension, such must mean I am either all in cash or shorting the market. In either case, it is assumed I “missed out” on the previous advance.

If you have been reading our work for long, you already know we have remained primarily invested in the markets, but hedge our risk with fixed income and cash, despite our “bearish” views. I am reminded of something famed Morgan Stanley strategist Gerard Minack said once:

“The funny thing is there is a disconnect between what investors are saying and what they are doing. No one thinks all the problems the global financial crisis revealed have been healed. But when you have an equity rally like you’ve seen for the past four or five years, then everybody has had to participate to some extent.

"What you’ve had are fully invested bears.”

While the mainstream media continues to misalign individual’s expectations by chastising them for “not beating the market,” which is actually impossible to do, the job of a portfolio manager is to participate in the markets with a preference toward capital preservation. This is an important point:

“It is the destruction of capital during market declines that [has] the greatest impact on long-term portfolio performance.”

It is from that view, as a portfolio manager, the idea of “fully invested bears” defines the reality of the markets that we live with today. Despite this understanding, the markets are overly bullish, extended, and overvalued and portfolio managers must stay invested or suffer potential “career risk” for underperformance. What the Federal Reserve’s ongoing interventions have done is push portfolio managers to chase performance despite concerns of potential capital loss.

Managing portfolios for both risk adjusted returns while protecting capital is a delicate balance...

A winning long-term formula

"Fully invested bears" captures a lot in just three words. In SMI’s case, it’s important to note that "fully invested" doesn’t mean 100% exposed to stocks, and "bears" doesn’t mean we’re convinced the next downturn is imminent. Rather, our Dynamic Asset Allocation strategy has dramatically limited our stock exposure recently. And our "bearish" outlook on the market is tempered by a healthy dose of "nobody knows" regarding the timing of the next bear market.

Yes, the stock market is richly valued, earnings have been slumping, and the economic signals have been getting weaker throughout 2019. And yet, when the Fed announced it was restarting Quantitative Easing roughly five weeks ago, the stock market turned on a dime and has been climbing again ever since. We’ve seen this movie too many times over the past decade to not at least respect the possibility that there’s another move higher happening.

Eventually, the Fed and the rest of the world’s central bankers are going to reach into their bag of tricks for a rabbit and come up empty. Bull markets always transition to bear markets this way, with the Fed trying to stop the bleeding and the markets ignoring them completely. Until then, we’ll trust our mechanical processes to keep us engaged with the market and participating in its continued upside, while relying on the defensive protections built into those systems to shift us out of harm’s way before the next bear market really gets rolling.

Don’t lose sight of the big picture. SMI’s blend of strategies works by helping us capture a large portion of the returns from the market’s bull phases, while helping us avoid some of the downside of the bear phases. To be successful over time, we don’t have to perfectly match the market index’s returns during the bull years, nor do we have to completely sidestep the bear phases.

If our performance stays close during the bull phase and avoids even a portion of the losses during the bear phase, that’s a winning long-term formula, and one that investors will find much easier to stick with over the long-term than being exposed to the full brunt of the market’s whims.