The two most common methods for getting debt-free evoke snow scenes: the debt snowball and the debt avalanche.

Just as building a snowman requires starting small — rolling a relatively tiny snowball over and over in the snow until it grows large — the “snowball” approach to paying off debt starts small, too. It focuses on eliminating your smallest debt first.

Then, the positive cash flow made available by paying off that first debt is “rolled over” and applied to the next smallest debt. You continue to roll over freed-up money as you pay off each debt, going from smallest to largest. Eventually, you have all your debts paid in full.

The “avalanche” approach (sometimes called “debt stacking”) starts with a different idea. Just as avalanches of snow begin high up on a mountain, the debt avalanche starts high, too. Rather than tackling the smallest debt first, its initial focus is the debt carrying the highest interest rate (since high-interest debt is the most costly debt).

So, is the snowball approach better or the avalanche? As we’ll explain shortly, it depends on the criteria used to judge them.

Set yourself up for success

Before deciding on a repayment strategy, get a clear overview of your debt situation. List all your non-mortgage debt, such as credit cards, car loans, student loans, and personal loans. Include the total balance, interest rates, and current minimum payments.

Next, find out if you can get a lower interest rate on any of your debt. Call your current credit card lenders and ask if they will reduce your rate. Sometimes, companies will do so for loyal customers.

Another common practice is to transfer a credit card balance to a card that offers a promotional zero-percent interest rate. Such cards typically are available only to people with good-to-excellent credit scores, but if you qualify, you may be able to convert high-interest debt into zero-interest debt for 15 to 21 months (promotional periods vary by card).

Transferring a balance does carry an upfront cost, usually 3% to 5% of the transferred amount. Further, if you miss a payment, the promotional rate could be revoked, meaning you’ll gain little or nothing from having made a transfer. (Promotional-rate cards also tend to offer regular enticements to make additional purchases using the card. Ignore those enticements to avoid going further into debt.)

Ready, set, go

Once you’re clear about how much you owe on each debt and the interest rates and minimum payments, you can plot your strategy. Whether you choose the snowball or the avalanche, the initial step is the same: Calculate a realistic amount — beyond the total of your required minimum monthly payments — that you can commit toward debt payoff until all your non-mortgage debt is paid in full.

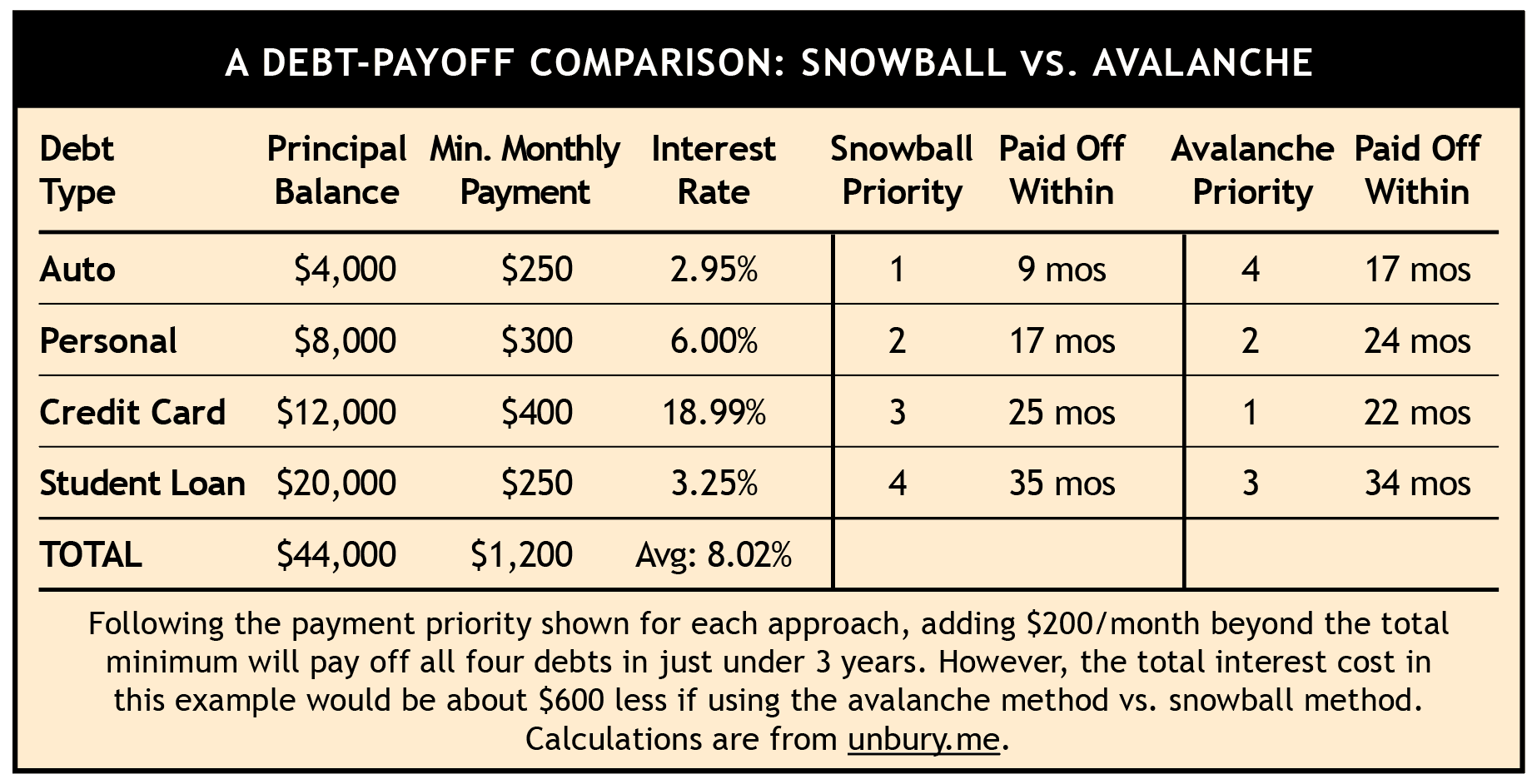

Let’s assume it’s $200. With either the snowball approach or the avalanche, you will make the minimum monthly payments on each debt except one. For that one — either the smallest debt (snowball) or the one with the highest interest rate (avalanche) — you will accelerate the payoff by applying the extra $200 a month in addition to paying the minimum.

Once that initial debt is paid in full, allocate the freed-up cash flow toward the next debt on your list.

Pros and cons

From a mathematical standpoint, the avalanche approach is more efficient than the snowball. Because it attacks higher-interest debt first, the avalanche will result in less interest being paid overall.

However, the snowball approach provides a crucial benefit the avalanche doesn’t — namely, a sense of accomplishment that begins earlier in the process. By targeting the smallest debt first, then moving to the next smallest, and so on, the snowball typically racks up one or more “paid in full” victories well before the avalanche does.

In the example shown in the table below, the snowball wipes out the first debt in just nine months, as compared to 17 months with the avalanche method. Such early victories can help sustain the motivation to stick with a debt-payment plan.

Whether the snowball approach or the avalanche is better for you depends on several factors, including the type and number of debts you’ve accumulated and whether you’re able to “restructure” some of those debts by transferring them to a zero-rate card (and how long the zero-rate period lasts). Other factors include your level of personal discipline and how much “discretionary” money you have available to start attacking your debt.

Before choosing whether to use the snowball or the avalanche, SMI suggests testing each scenario using the free calculator at unbury.me. The calculator will provide a snowball/avalanche comparison based on the debt details you enter.

Whichever debt-repayment plan you use, the key is to commit to it — month in and month out. Eventually, just as winter snowdrifts are melted by springtime sunshine and warmer temperatures, your debt will melt away.