The most significant driver of the financial markets over the past 13 years has been the relentless effort of the Federal Reserve and other global central banks to push down interest rates. These near-zero short-term rates have had profound ramifications. Prices of other assets (such as stocks) have risen as investors have moved out of traditional safe havens into riskier investments searching for better returns.

Retirees have arguably been the group hardest hit by this extended near-zero interest-rate policy. Traditional savings products (such as money-market funds and bank CDs) yield very little, eliminating one traditional safe haven. Bonds performed well as interest rates declined (bond prices rise as yields fall), but with rates now at rock-bottom levels (and potentially poised to rise), future bond prospects are very much in question.

In their search for alternative sources of current income, some retirees have turned to dividend-paying stocks. For the most part, this has worked out well. Stocks have risen dramatically since 2009, interrupted occasionally by brief corrections along the way.

The current yield landscape

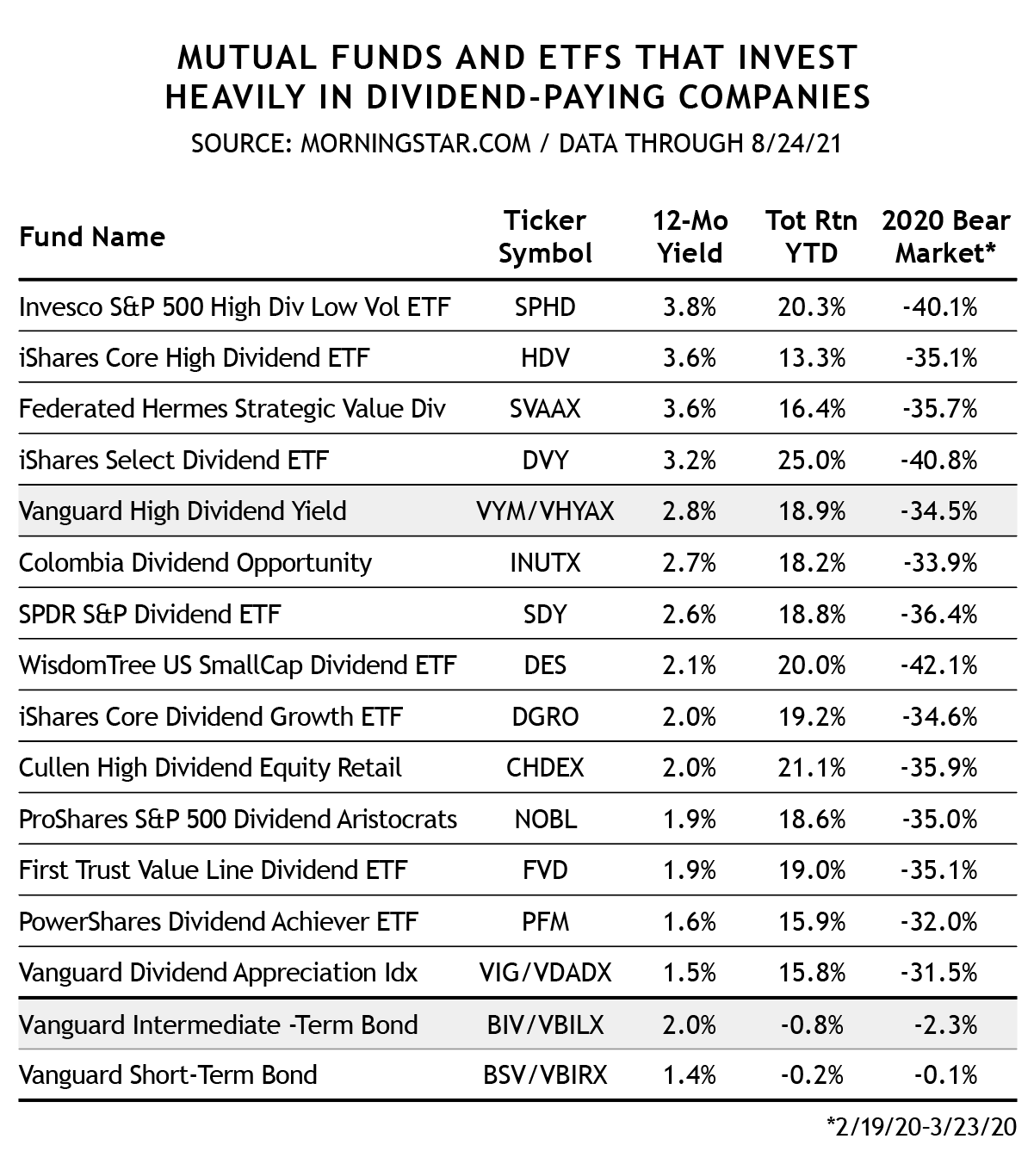

It’s easy to understand the appeal of exchanging bonds for dividend-paying stocks when the recent statistics of both are considered. As the table below shows, in early August the Vanguard Intermediate-Term Bond Fund (shaded second line from bottom) yielded 2.0%. But its total year-to-date return for 2021, including its yield, was -0.8%, indicating that the value of its holdings has declined this year, offsetting the income earned. In contrast, the stock-based Vanguard High Dividend Yield fund (shaded fifth line from top) yielded 2.8%, with a strong year-to-date total gain of +18.9%.

With the dividend-paying stock fund boasting a higher yield and higher year-to-date returns than the bond fund, it’s understandable why one might consider switching some bond money into such funds. But there’s more to this story than just yield and return — there’s also the matter of risk.

Click Table to Enlarge

Dividend stocks are still stocks

Nothing drives home the point of the relative risks of stocks vs. bonds than looking at what happens to their total returns during sharp downturns. Note the “2020 Bear Market” column of the table: all of the dividend-stock funds and ETFs experienced losses of –31% to –42%.

In contrast, there are two numbers in that column that stand out sharply from all the others: the two bond funds that lost just -2.3% and -0.1%. While dividend stock funds lost a third or more of their value (in a month!), bonds held up remarkably well. In fact, since 2008, the worst annual loss experienced by the Vanguard Intermediate-Term Bond Index Fund was just -3.4%. (In 2008, when stocks fell -37%, BIV gained more than +5%.)

As an investor, it’s important to keep one eye firmly fixed on risk at all times. The exceptionally strong stock market returns of the past 16 months shouldn’t necessarily cause someone to pull back from their normal stock allocation, but it definitely should make one cautious about taking money out of their bond allocation to put into stocks. Make no mistake, whenever the next period of significant market weakness arrives, dividend-oriented stock funds will almost certainly suffer significantly greater losses than bond funds. In terms of short-term downside risk, there’s simply no comparison between stocks and bonds.

Options among dividend funds

So, to be perfectly clear, SMI does not think it’s a good idea for most readers to take money from their bond allocation to invest in dividend-paying stock funds today. That said, there may be readers who understand the risks, but want to identify the better dividend-paying funds and ETFs in order to build a portfolio that will produce a certain amount of current income.

For these readers, here’s a brief overview of how to navigate the dividend-focused fund/ETF landscape.

Dividend funds and ETFs can be fairly easily divided into two groups. One emphasizes current high yield, and isn’t as focused on how long that high dividend payout can be sustained. The other focuses on companies that are growing their dividends (or are the least likely to cut or suspend their dividend during an economic downturn), even if that means the current yields are lower. This is why when you look at dividend funds/ETFs, you may see some with yields as high as nearly 4%, while others yield less than half that.

While it’s tempting to reach for the higher current yields of the first group, it’s important to recognize that the latter group is a significantly safer option. These “dividend growers,” which are often easily identified by their use of “dividend growth” or “dividend appreciation” in their names, typically are much more resilient in down markets. Their focus on companies with the strength and financial wherewithal to withstand negative events and bad market conditions gives them a bit of a cushion. Many of these funds use screens to select only companies that have maintained or grown their dividends every quarter for the past 10 years, which keeps weak companies out of the portfolio. Focusing on these dividend-growth/appreciation type funds takes at least a partial step toward mitigating the higher risks inherent with these being stock investments.

The table above is a good starting point in identifying strong dividend funds and ETFs, though it’s hardly an exhaustive list. The most important thing to understand is the tradeoff between yield and risk. If you find a fund/ETF with a particularly high yield, it likely will be more vulnerable to losses when the stock market turns lower.

The pair of Vanguard dividend funds in the table illustrates this well. While neither is an extreme example of their respective groups, Vanguard High Dividend Yield sports a much higher yield than Vanguard Dividend Appreciation (2.8% vs. 1.5%). On the risk side, however, we can see that High Dividend Yield lost -34.5% in early 2020, whereas the Dividend Appreciation loss was a bit milder at -31.5%. This is the sort of tradeoff you typically see on the yield/risk spectrum with these dividend-oriented funds, so be wary of funds with too-good-to-be-true yields — they likely come with higher risk.

Conclusion

Dividend-paying stock funds can be a helpful tool in creating a portfolio that generates current income. But investors should understand the dramatic step up in risk if they substitute stock funds for bond funds in pursuit of that income. “Dividend growth” funds that focus on high-quality payers won’t necessarily pay the highest yields, but should compensate with better performance during market downturns. Still, even the best of this group will be significantly riskier than most bond funds.

While we occasionally recommend dividend-oriented stock funds in Upgrading when the momentum rankings call for it, we don’t see them as a particularly great substitute within the normal SMI framework. Even so, they can be used outside the normal SMI framework by individuals with specific current income needs, as long as these cautions and tradeoffs are understood.