For several years now, I've been an online giver. It's convenient to donate with a few clicks, rather than having to write a check, address an envelope, and find a stamp.

But online giving has a downside: Every transaction involves fees that effectively reduce the donation amount.

Earlier this month, I donated $250 to a ministry that I have supported several times. Just before clicking the "Submit" button, I noticed a small checkbox that said, "Optionally add $9.92 to cover processing fee."

$9.92? That seemed steep to me. I did a little research and discovered that the processing fee was a percentage fee — i.e., the more a person gives, the higher the dollar amount of the fee.

In this case, the processing fee was about 4%. I could add $9.92 to cover the fee or about 4% would be subtracted from my $250 donation, meaning the organization to which I was giving would get only 96% of what I intended to give. I decided to pay the add-on processing fee. (Similar fees, by the way, are built into the price of everything you and I buy — we just don't see them.)

Church giving

For decades, I did my church giving via a check dropped into the offering plate. But a couple of years ago, I started making my church donations online. The reason was practical. I sing in the choir and the offering plate doesn't come our way. Sometimes I would forget to put my check in the plate before the service started, so donating online seemed like a good option.

But after my online-giving experience a couple of weeks ago, I began to wonder: How much does it cost my local church when I tithe online using a debit card? I contacted the church's Director of Stewardship. She told me each transaction carries two fees: a 1.95% base fee plus a $0.15 (15 cents) transaction fee.

So, for example, on a $500 contribution, the related fees would total $9.90 ($9.75 + $0.15). Not terrible, but still, it means nearly 2% of every online donation to my local church is going to something other than what the donor probably intended.

Further exploration

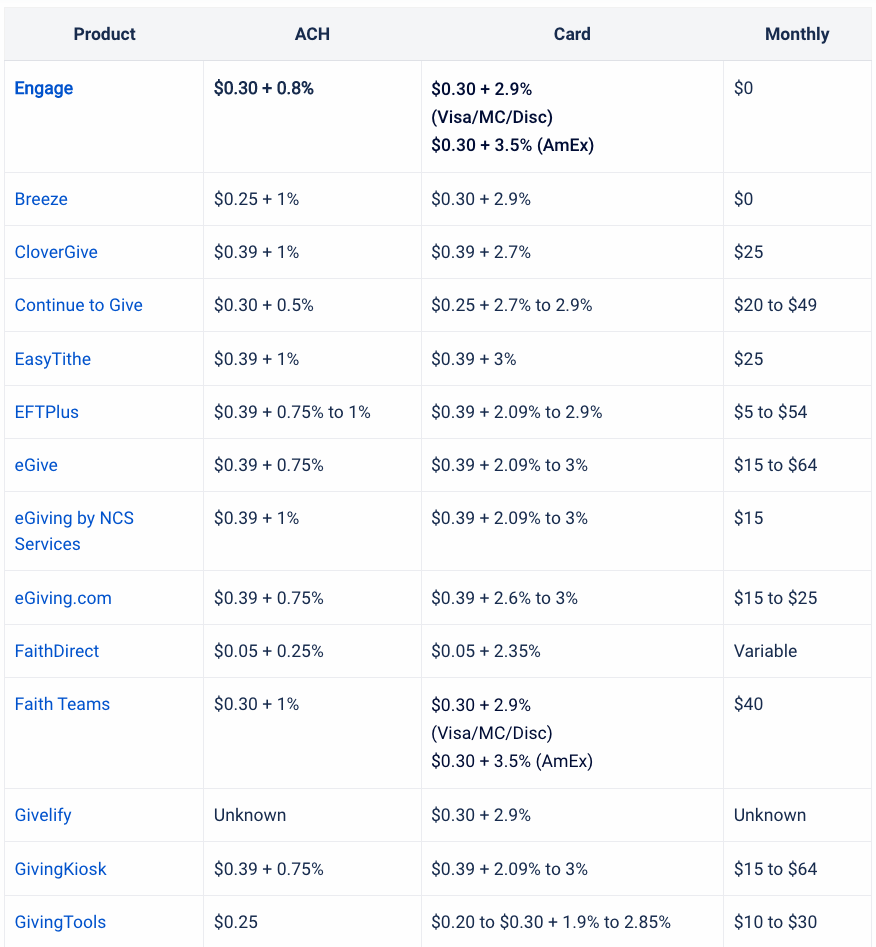

A data company called Suran — which runs a giving platform called Engage — has compiled a database of the fee schedules for many of the companies that facilitate church/ministry giving.

You can see the data below. Some explanation: The "ACH" column shows "Automated Clearing House" fees associated with electronic transfers made directly from a donor's bank account. Credit card companies charge "Card" fees (typically higher than ACH fees) for processing online credit or debit card donations. "Monthly" fees are those that churches/ministries pay to have access to an online-donation platform.

Click Table to Enlarge

Rethinking my approach

This post isn't intended to complain about companies that facilitate online giving. They provide a useful service (including donor-management tools and analysis). Even so, when it comes to giving to my local church, I have decided to resume in-person giving (by check). By doing so, I'll effectively donate almost 2% more than I otherwise would.

I'll also resume mailing checks to other ministries I support — if that's still an option. (Some ministry websites have dropped information about donating by mail.) At the very least, I'll try to use lower-fee ACH transactions rather than credit or debit card transactions.

I realize that moving money from Point A to Point B always involves a cost. But when making donations, I want to keep those money-movement costs as low as possible so that more of my giving dollars get to where I want them to go. So from here on, I'm going "old school" whenever possible.

How about you? How do you handle the add-on costs of donating online? Do you accept those costs as part of "life in the 21st century," or do you take another approach? Let us know in the comments section below.