It’s been 100 days since the WHO officially declared COVID-19 to be a pandemic. I’ll leave the medical/political sides of that to others, but it seems like an appropriate time to update some big picture thinking about the state of the financial markets.

In true forward-looking fashion, the financial markets had nearly completed the panic phase of their declines by the time the official "pandemic" declaration was made. As surprising as that bear market plummet was, the rebound has arguably been even more so, far surpassing the levels anyone imagined.

While the stock market ran into a brief hiccup last week, falling -6% last Thursday in a reminder that we’re not out of the volatility woods just yet, the past three months have been almost exclusively positive for financial assets. The Nasdaq index briefly hit a new all-time high last week before pulling back, while the S&P 500 index sits about -8% below its February high. The small-cap Russell 2000 index has actually rallied almost as much as the Nasdaq from the lows (+48% vs +50%), but remains the furthest of the three indexes from its highs at -16.7%.

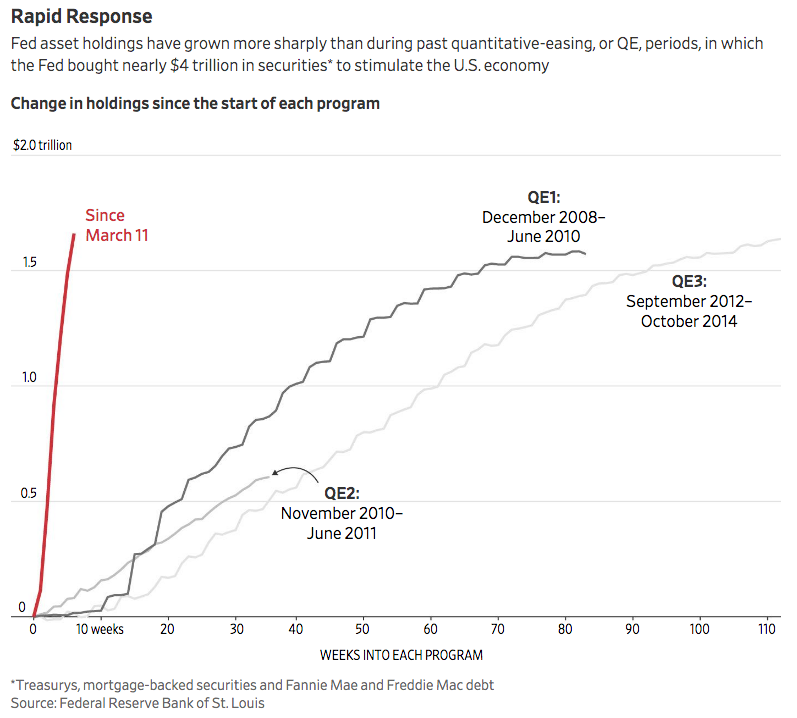

This amazing rally has been driven by two primary forces. First, the response from governments and central banks around the world has been unprecedented in both scale and speed. As I noted last week, the equivalent of nearly 25% of global GDP has already been mobilized, and the chart below from our May DAA update illustrates the incredible speed at which these assets were deployed — truly unlike anything markets have ever seen before.

From "The Federal Reserve Is Changing What It Means to Be a Central Bank,"

The Wall Street Journal, April 27.

More recently, the markets have gotten a fresh push from the economy re-opening. The very first data points are coming in now from that process and most of it has been interpreted positively. Today’s unemployment data was a bit disappointing, but the prior report had been much better than expected. And we saw a "great" retail sales number come in this week, which suggested a stronger re-opening than many had expected.

However, it’s important to interpret these incoming data points accurately. Many of these indicators are reported on a month-over-month basis, which after the most devastating declines ever in March and April, almost had to rebound strongly by definition. So when we look at this week’s retail sales figure for May, for example, it’s great that it was +17.9% better than April’s dismal reading. That tells us important information — it’s a solid indication that the recession likely ended in April. In other words, the decline in the economic trend likely stopped and turned higher.

But we also need to note that this retail sales figure was still -6% lower than the year prior (May 2019). While the month-over-month numbers tell us the shape (the V-shaped recovery everyone is hoping for), the year-over-year figures tell us about the scale. It’s still early in the re-opening process, so we wouldn’t expect the rebound to have reached pre-COVID levels yet. How long that process takes, and how far below the prior trend the economy remains, are two of the more important questions for markets as we move forward.

The Fed is still nervous

Given the huge rebound in financial markets and seemingly positive re-opening economic data, one would expect the Fed to be taking a victory lap, right? Yet in both their testimony over the past week and their curious actions again this week, that’s not at all what’s on display.

Last week’s short, but strong, pullback in stocks was set up by a surprisingly sober view of the economic recovery, delivered in remarks by Fed Chair Jerome Powell. Then this week, the Fed followed that up by expanding its plans to lend directly to U.S. corporations. The markets loved that — more drugs! — but it did raise questions.

Why kick that off now, expanded beyond the original scope of the April 9 announcement? The bond market is clearly not in any significant distress at this point. In fact, by the end of next week, it’s expected that U.S. corporations will have issued more new debt in just half-a-year of 2020 than they did in all of 2019. Last month set a record high for new issuance. With most corporations having no trouble borrowing right now, it’s curious that the Fed would be doubling down with a new, expanded lending program.

In an interview this week, Steph Pomboy of Macromavens suggested a couple of reasons why the Fed is still aggressively intervening in the credit markets. The first is that while they’ve been successful in getting things moving for the larger, higher-rated firms, digging a bit deeper shows that the weakest links of the credit chain are still breaking. Levered loans are defaulting at the highest rate since 2014, and the 1,200+ high-yield credit downgrades so far in 2020 are already more than occurred in all of either 2008 or 2009.

This suggests potential trouble ahead if the right side of the "V" recovery comes up short in the second half of this year (as we discussed last week). In that event, this story extends well beyond 2020, as companies further down the credit food-chain currently are facing rates much higher than before the crisis began. Understand that many (most?) of the companies that have taken on debt over the past decade need to periodically roll that debt over into new debt. The old bonds come to maturity and rather than pay them off, the plan all along is typically to just keep rolling that debt forward. Which works great as long as rates stay low and credit remains available.

If the V-shaped recovery stalls or turns into a "W", there’s no way many of these CCC- and BB-rated high yield companies are going to be able to handle the dramatically higher financing costs they would face.

Second half risks

This also becomes a potential problem further upstream with the investment-grade group if profits don’t re-materialize by next year. This is where the duration, rather than just the shape, of the "V" recovery becomes so serious. With the unprecedented nature of the COVID shutdown, companies just stopped issuing earnings guidance when they reported their first-quarter earnings. The market accepted that, because really, how could anyone guess what the future was going to look like at that point? With the total absence of corporate earnings information, the market became even more focused on every sliver of central-bank or government news, as well as obviously any information regarding the fight against the virus itself.

That dynamic is going to begin to shift now that companies are opening back up. When second-quarter earnings begin to be announced, the market will get its first real look at just how damaging the shutdown was, as well as what prospects look like going forward. There likely will be some grace for the near-term, but at some point, if the longer-term prospects don’t begin to clearly improve, a stock market priced for a quick V-shaped recovery may find itself being repriced by investors for something else.

Finishing the thought regarding the credit markets, this is where the rubber could hit the road for investment-grade corporations as well. As long as they begin earning profits again in the third or fourth quarter of 2020, they likely won’t have trouble rolling their own financing forward. The bond markets certainly adore them right now, and the Fed clearly has their back. But the dynamic changes completely if those profits don’t materialize again. As we’ve previously discussed, there are precious few firms out there that can remain profitable — and continue to service the massive debts they’ve accumulated over the past dozen years — if their top-line sales revenue rebounds to only 90% of pre-shutdown levels. That’s the on-ramp to the "doom loop" of lower revenues leading to more layoffs, which leads to lower consumer spending, which leads to lower revenues and more layoffs, etc.

It’s important to realize that the market isn’t "just" dealing with COVID and the shutdown today. There were pre-existing conditions, specifically the massive debt splurge by corporate America over the past decade, that put the market in a much shakier position than would have been the case if COVID had come along at a healthier point in the economic cycle. Those pre-existing conditions create the potential for this ultimately to turn into a solvency event — a longer, grinding process of finding out quarter-by-quarter who can continue to pay their debts and who can’t.

The good news is that’s only a potential path, not a pre-ordained outcome. However, there are definitely risks ahead. It appears that a significant percentage of the newly unemployed have, to this point, been earning more from expanded unemployment benefits than they were previously earning working. That is scheduled to change at the end of July (though expanded unemployment benefits could be extended). Likewise, many mortgage lenders have extended forbearance — i.e., mortgage payments have been suspended and simply tacked onto the end of the note. As Michael Lebowitz noted yesterday on Twitter, it’s not difficult to imagine the May retail sales numbers might have looked quite different without expanded unemployment benefits and 4.3 million people (one estimate of mortgage forbearance) paying their mortgages rather than spending those dollars elsewhere.

The point of this isn’t to scare anyone, but merely to suggest that this market event may not be over yet, despite the huge "relief rally" since late-March and current economic re-opening. It’s important that we continue to re-calibrate to new information as it comes in because the market is clearly in uncharted waters here. It’s not something that can be forecast either, because we simply don’t know what the virus path looks like, how people will respond, and what the ultimate impact of those two factors on the economy will be.

It’s easy to forget that there have been "double-dip" recessions before, and I’d argue "double-dip" bear markets too. In fact, while most people consider the dot-com bust to have been a single bear market that lasted from March 2000 - October 2002, some will break that into two separate bear markets that occurred virtually back-to-back, with a very short bull market in-between. It’s possible that history could look similarly on the current event — an initial bear market, a short-lived bull-market recovery that lasted a few months to a few quarters, and then a second bear market. Depending on the timing, it’s easy to imagine that all being lumped into a single "COVID bear market" by future historians just as the 2000-2002 bear has been tagged as a single bear.

But as I said, that’s just one potential path forward. Another is a stronger-than-expected recovery with no return of the virus in the Fall. Or, even if there is further economic trouble ahead, perhaps the global commitment of central banks to "whatever it takes" sends us down a different path altogether — a path where stock prices don’t fall significantly, but keep rising on debased dollars as inflation returns for the first time in a few decades.

It’s impossible to know, and that’s why SMI doesn’t play the prediction game. I have significant concerns about the market today and the risks it faces in the second half, and I think it makes sense to be cautious as this recovery plays out. But you know what? I had significant concerns in early 2009 too, and that market took off and didn’t look back. That’s why I’ll continue to advocate staying true to the SMI process as it eventually leads us back into (and perhaps back out of!) stocks. None of us is going to figure this out in advance, so we’ll need to strike a balance: being disciplined yet flexible, cautious yet willing to take action.

We all prefer clear-cut straight answers, but this market doesn’t look ready to provide them just yet.