The deep global recession is unleashing the type of policy responses from global governments and central banks that have triggered significant moves higher for gold in the past. SMI’s approach to investing in gold shifted radically in 2013 with the introduction of the Dynamic Asset Allocation strategy.

Here’s a recap of this system’s impressive track record with gold, as well as a detailed discussion of the best ways to take advantage of what is shaping up to be a potentially profitable run higher for this notoriously volatile asset class.

Few financial topics elicit such strong opinions as gold. This is nothing new, as it was nearly 100 years ago that British economist John Maynard Keynes famously called it “a barbarous relic.” There has been a long line of proponents and detractors ever since, with the debate over gold’s importance and utility only escalating as governments over the last century have gradually freed themselves of the discipline gold imposed.

Whenever the value of “fiat money” (government-backed but without intrinsic worth) is called into question, interest in gold understandably soars. We saw this happen because of double-digit inflation in the 1970s, which deeply eroded the dollar’s purchasing power. We’ve seen it in each of the past two big recessions. In 2008, as again today, the response of the world’s central banks to deep economic trouble has been to vastly expand the money supply through liquidity measures. The response of governments the world over has been to add huge volumes of new debt. Against these currency-debasing actions, investors have turned to gold for its long-term track record as a hedge against inflation.

SMI’s position on gold has shifted over the years. During the 1990s, we tended to ignore gold because it was largely in decline. That became harder during the 2000s as gold’s price began rising sharply. This was part of a broader rise in commodities, which we were content to participate in second-hand through our Fund Upgrading selections. The mutual funds that deftly navigated this commodities trend rose in our momentum rankings, and those holdings helped propel the excellent results our Upgrading strategy produced from 2000-2008.

Following the financial crisis in 2008-09, however, it was no longer possible to ignore gold or handle it second-hand. We wrote a fair amount about gold at that time, primarily because of reader interest, but also because the inflation scenarios evoked by money-supply expansion and massive government stimulus seemed plausible. SMI’s counsel was to limit gold to a small portion of your portfolio, and we wrote on how to best purchase and store gold.

Our thinking regarding gold shifted further — dramatically, in fact — with the extensive research that went into the creation of SMI’s Dynamic Asset Allocation (DAA) strategy, which debuted in 2013. Ironically, DAA’s origins stem from the work of gold “perma-bull” Harry Browne, who advocated a static 25% position in gold. While a large fixed allocation to gold held no appeal for us, the research process did open our eyes to the value of tactically allocating to gold during certain portions of the economic/market cycle. Once we developed the approach of dynamically shifting between asset classes, we finally were able to “settle” the question of how to optimally interact with gold.

It’s crucial to understand that gold is highly cyclical and volatile. Though generally thought of as a “conservative” investment, gold is prone to huge spikes and collapses, as well as long periods when the price doesn’t move much at all. Indeed, gold can be so volatile that when we researched SMI’s Sector Rotation strategy nearly 20 years ago, we had to remove the precious-metals funds from our universe of potential investments because their extreme volatility was messing up the process — of our most volatile strategy!

So we were excited when DAA provided us with a disciplined approach that enabled us to safely interact with gold on more than a “keep a small allocation at all times” basis. Our backtesting revealed that DAA reliably provided signals to buy gold when conditions dictated it was wise to do so. But better yet, DAA’s strict selling discipline got us completely out of gold when its performance faltered.

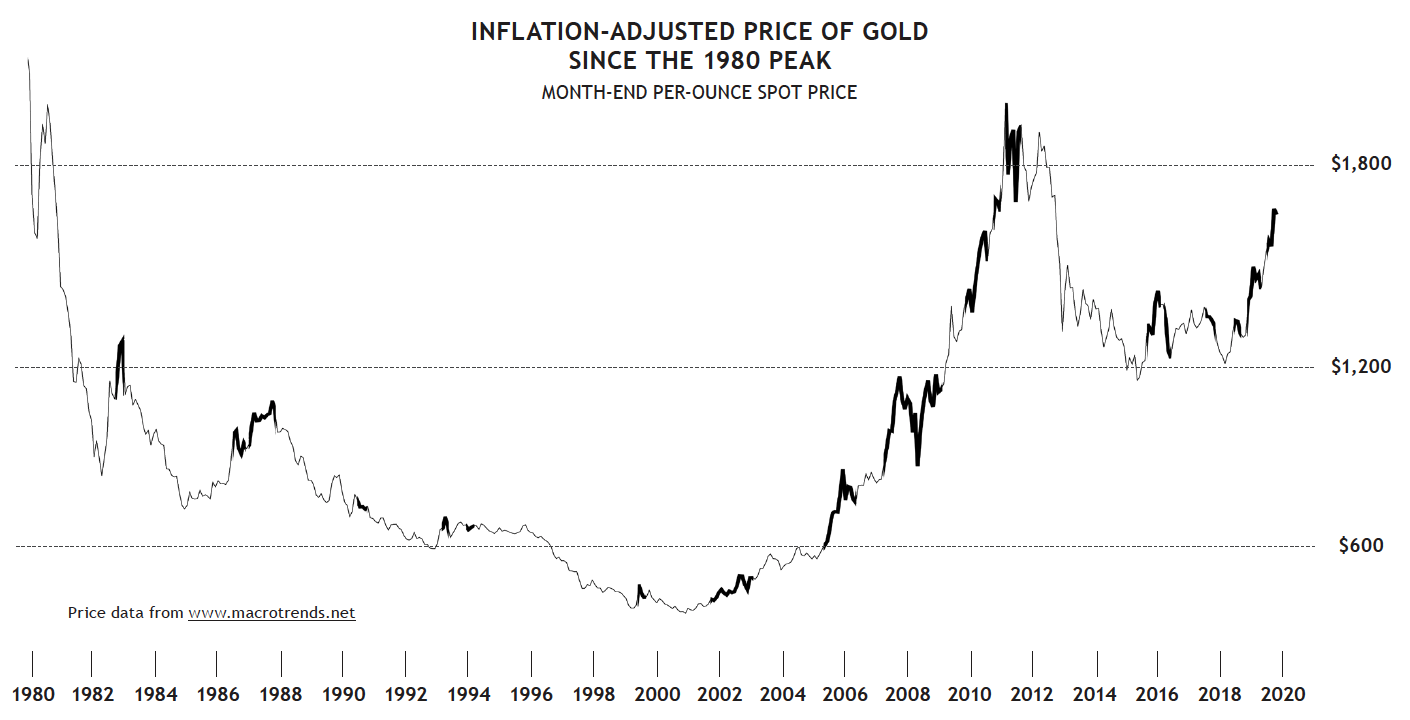

A picture worth 1,000 words

The graph below illustrates how effectively DAA’s mechanical signals would have navigated the gold market over the past 40 years. It shows the monthly price action of gold going back to its peak in January 1980, but the prices are adjusted for inflation. That means that the older prices are represented in today’s dollars. For example, when gold peaked in 1980, the actual price was $850/oz. After adjusting that amount for the inflation that has occurred since then, our chart shows that price at over $2,000/oz. This is a crucial adjustment, because it makes clear that even after the 11-year bull market in gold from 2000-2011, gold’s price never recovered to its previous high! Given that a primary selling point of gold is that it is an excellent long-term store of value, that’s a pretty important point to be clear on.

The darker bolding on the up-and-down price-action line denotes the periods when DAA would have been invested in gold for at least three consecutive months. (There were times when DAA called for gold, only to sell it a month or two later. The nature of the chart makes those blips too short to see clearly.)

Click Graph to Enlarge

Observing DAA’s interaction with gold is instructive. As you can see, DAA would have steered us clear of nearly every significant decline in gold’s price over the past 40 years, with the primary exception being the 2008 financial crisis, when other asset classes were falling even more than gold. In light of DAA’s mantra of “winning by not losing,” as well as given the severity of some of gold’s declines, this ability to steer around cyclical price declines in gold is crucial.

DAA’s interaction with gold when prices have been rising has been good as well. The strategy would have helped us capture a significant portion of gold’s rising periods while still avoiding most of the declines. That’s why we think DAA’s tactical approach to gold ownership is superior to a fixed allocation to gold.

SMI’s “keep it simple” recommendation = GLD

Not surprisingly, then, we think SMI members are wise to rely on DAA’s signals for the bulk of their precious-metals investing. The amount of that exposure will vary, based on how much of their total portfolio is allocated to DAA, as well as whether DAA is invested in gold at the moment. For a typical SMI member with roughly half their portfolio allocated to DAA, a gold allocation could range from as little as 0% (no gold recommended in DAA) to as much as ~16.7% (one-third of DAA, if DAA is 50% of the total portfolio).

The gold exposure in DAA consists of “paper gold” in the form of the exchange-traded fund, GLD. This is the largest and most liquid of the gold ETFs, with a long track record of closely tracking the price of gold. It enables us to move in and out of gold based on the DAA signals, with minimal hassle (and at zero cost now that ETFs trade commission-free at most brokers). GLD is a reliable vehicle for our primary purpose within DAA, which is gaining easy exposure to changes in the price of gold.

Diversifying beyond GLD

While the GLD ETF is a great, easy way to get exposure to changes in the price of gold, other gold investment options do exist. If the gold price moves significantly higher over the next few years, as many expect, there are ways to potentially profit to a greater degree than merely riding along with the price of gold in GLD. In addition, for those investing in gold within a taxable account (i.e., not an IRA or other tax-advantaged retirement account), there may also be ways to reduce your tax bill by using other vehicles.

Before exploring these alternative ways to invest in gold however, we want to be clear: For most SMI investors, using DAA to direct your gold investments using GLD is easy and effective. There’s no need to go beyond that.

Still, some members may be interested in branching out from GLD, either to invest a bit more aggressively or to take advantage of a better tax situation. The options that follow are listed from least risky (physical gold) to most risky (mining stocks).

Physical gold

The reason a person might prefer to buy physical gold rather than use an ETF like GLD is to hedge against potential risks presented by the modern financial system. As we saw in 2008 with the collapse of Bear Stearns and Lehman Brothers — two large investment banks that had been around for many decades — it is possible for big banks and financial institutions to get overwhelmed by a crisis. The argument against using a vehicle such as GLD for one’s gold exposure is that ETFs are part of the same financial system gold is trying to hedge against. If the parties behind a particular gold ETF run into trouble, the owners of that ETF might be let down at precisely the moment their gold holdings are supposed to be providing crisis insurance.

There are strongly held feelings on both sides of how realistic and dangerous a threat this is. But it’s hard to argue with the idea that holding a physical piece of gold in your hand feels different from having your gold holdings simply represented by an entry in an online portfolio.

For those who desire to take physical possession of some portion of their gold holdings, bullion coins generally are the easiest to buy at a reasonable markup over gold’s spot price. Gold coins are reasonably easy to store in small quantities. An individual could easily keep a few dozen in either a home safe or bank safe deposit box. “Junk silver” bags — pre-1965 U.S. coins that are 90% silver — offer some of the lowest markups over the spot price of any precious metal, but they are also bulkier and require more storage space. (For more on the purchase and storage of physical precious metals, including “digital gold” services that store gold for you, see A Primer on Buying Gold Bullion.)

Importantly though, buying physical gold is a better option for long-term accumulation than it is for a trading strategy like DAA. The markups involved in buying/selling physical gold are too steep to make this a practical option for following DAA, which is why that strategy uses GLD instead.

Pursuing higher gold returns

While the first option below is similar in risk to GLD, options 2-4 are higher risk. As such, SMI isn’t suggesting they are appropriate for all members. Rather, consider them as options to research further if you desire to boost the risk/reward profile of your gold holdings within DAA.

Physical Gold Surrogates

Straddling the middle ground between the ease-of-use of a gold ETF and the security of holding your own physical gold is the Sprott Physical Gold Trust (PHYS). This fund looks and trades like a regular ETF, but it is a closed-end mutual fund (technically an “exchange-traded vehicle”). That has some regulatory implications, but the most practical impact is that PHYS doesn’t track the gold price as closely on a daily basis as the other gold ETFs. Over longer spans of a month or more, however, PHYS has tracked GLD pretty closely.

The appeal of PHYS is it owns “fully allocated” gold bars in its custodian vaults. Put another way, PHYS owns specific gold bars held in particular vaults. In contrast, gold ETFs such as GLD have a non-specific claim on a certain dollar amount of the custodian’s total gold holdings, a concern among the counterparty-risk crowd. Illustrating the “you own it” aspect, if you own enough shares of PHYS ($600k or more at today’s prices), you can arrange to take physical delivery of your own gold bar(s).

While PHYS gets you a half-step closer to owning physical gold, it’s still as easy to interact with as any ETF. Ironically, while the main appeal of PHYS is its stronger claim to possess your own gold, it is taxed at the lower 15% securities rate if held for more than one year. In contrast, GLD gets the higher collectibles rate of 28% on long-term holdings.Gold Royalty/streaming Companies

This is the first step into the gold-mining stocks. Royalty/streaming companies, however, are significantly less risky than the true miners. Instead of owning and operating mines, these companies provide up-front money to develop mines — in exchange for either a percentage of ongoing profits or some other specific arrangement. That makes investing in these companies safer than investing in mines, but also with less upside.

There are three main players in this space: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), and Royal Gold (RGLD). As an example of how these stocks can move relative to the gold price, consider that since gold bottomed out in September 2018, GLD is up +45%. In contrast, FNV is up +137%, WPM +163%, and RGLD +75%. But what goes up also goes down: from the market peak in February through the lows in March, GLD lost -8.5%, while these three each fell close to -25%. The tax treatment of these stocks can get a little complicated when owned outside a retirement account, so check with your tax preparer. But it appears that FNV at least typically gets the 15% rate on long-term holdings.Large Mining Stocks

The precious metals mining stocks are a volatile bunch so this represents a serious step out on the risk curve. However, there appears to be significant opportunity here. Mining stocks were tremendously beaten down during the 2011-2018 bear market in gold. Today, a basket of the large miners can be bought for the same price they traded for back in 2006, about half that of their 2011 peak (though they’ve roughly doubled already from their 2018 lows).

These mining stocks are notably cyclical, so owning them at the right times (i.e., when DAA calls for gold) is crucial. But in an environment such as we’re in now, with strong tailwinds for gold prices and a huge decline in energy prices (which make up 20-25% of mining production costs), these stocks could move powerfully higher. Consider that over the past 50 years, the Barron’s Gold Mining Index has experienced eight recoveries from similarly “oversold/cheap” conditions. Those eight instances produced gains ranging from 180%-1,200% over the following 12-42 months. So although the miners are already up 100% from their September 2018 lows, their still-reasonable valuations and the potential trajectory of gold over the next few years seems to indicate significant remaining potential.

This is an area where non-professional investors shouldn’t try to pick winners and losers. Thankfully, you don’t need to. GDX is an ETF of the largest gold miners (which also includes large positions in the three royalty companies mentioned earlier). Limit your exposure, however. GDX briefly fell by nearly half during the February-March panic earlier this year, before quickly recovering. We could see another drop if this bear market in stocks deepens. That would be painful for current owners, but might also produce an excellent buying opportunity for those looking to start a position in this ETF.Small Mining Stocks

Everything just written about the large miners applies double to the junior miners. They’re even more volatile, and their current valuations are even more depressed after even worse performance over the past decade! These are high risk, but also tend to provide the biggest returns when gold enters prolonged bull-market stretches. Also, current low valuations in the mining industry make it cheaper for larger firms to expand mining capacity by acquiring smaller miners than by starting new mines. It wouldn’t be surprising to see buyouts here, which should be good news for the prices of junior mining companies.

As with the large miners, this is a great place to use a diversified ETF — GDXJ is the main junior mining company version. Both GDX and GDXJ are treated like any other equity investment for tax purposes, meaning they get the lower 15% long-term rate if held longer than one year.

Conclusion

While the setup for gold seems quite bullish, don’t lose sight of the fact that gold is a notoriously streaky asset class. That’s why we strongly advocate using the DAA signals to keep you on the right side of its longer-term trend.

A decade ago, we saw the combination of massive central bank liquidity and government borrowing send gold soaring in 2009-2011. Today, we’re seeing the same playbook again, only the amounts are much larger. The U.S. Treasury is planning to borrow $3 trillion this quarter alone! That’s five times as much as any quarter during the 2008 financial crisis.

The lone exception to the strong bullish setup for gold is that, historically, gold has performed better with a weak U.S. dollar. We expect the dollar, which has been strong throughout this crisis so far, may strengthen further relative to other currencies that are in even worse shape than ours (which is basically all of them). But while the dollar may strengthen relative to other currencies, we expect it to lose ground relative to the fixed measure that gold represents. That seems to be taking place already, as the debasing of the dollar inherent in massive central banks liquidity and government borrowing has been propelling gold higher, despite the strong dollar.

Keep in mind that in 2008, as well as in the March selloff this year, we watched the price of gold fall sharply alongside stocks as investors liquidated any profitable investment holdings to raise needed cash. If this bear market persists, that could happen again. The silver lining for gold investors is that further stock market losses will drive more of the very behavior by governments and central bankers that eventually will light a fire under the gold price.

SMI doesn’t recommend a permanent, physical allocation to gold, but we’re also not against a person owning a small amount of physical gold if they desire. The markups in physical gold make trading it via the DAA signals impractical, so any physical gold you buy needs to be a long-term allocation. All of the other gold alternatives discussed in this article, however, should be treated like GLD and sold immediately when DAA calls for it. Don’t lose sight of the fact that it’s DAA’s strict selling discipline that protects us from the vicious sell-offs that gold (and all of these gold alternatives) regularly experiences.

We recommend keeping your total gold holdings — how ever they’re invested — limited to roughly the portion of your portfolio that DAA says to invest in gold. Recognize that replacing any portion of your GLD holding with these alternatives, other than physical gold or PHYS, will increase the risk level of your portfolio. So if you’re inclined to branch out, consider replacing GLD with these alternatives in small increments of just 1-2%, rather than swapping your whole DAA gold allocation.

Gold appears poised for strong gains in the months (and likely, years) ahead — though it may come with substantial volatility first. Enjoy the ride, and rely on DAA to stay safe!

For more on this topic, watch A Conversation About Gold.