With 30-year mortgage rates rising to nearly 5% by late 2018, many homeowners thought they had missed the opportunity to refinance. But then rates crested and began an unexpected and rapid descent. By April 1, 30-year rates in some areas had plunged below 4%. The average rate for a 15-year mortgage plummeted to near 3.5%, falling from a November high of 4.3%.

The surprising downswing means anyone holding a higher-rate mortgage has another opportunity to replace an existing loan with a new one that has more favorable terms.

Although many people use refinancing as a means to borrow more money, this article focuses on refinancing to either lower monthly payments or speed up the process of getting out of debt. (In some instances, you may be able to accomplish both.)

The factors involved

Whether refinancing makes sense in your case depends on your current interest rate, the balance remaining on your existing loan, the term (i.e. length) of both your existing loan and the new loan, and how long you plan to be in your current house. Another factor is the cost of refinancing — covering an updated appraisal, attorney fees, related documents, etc. This cost can run into several thousand dollars. It can be paid up front or rolled into the loan amount (meaning the fees added to the loan and will incur interest over the life of the mortgage).

Let’s suppose you took out your existing mortgage — a $250,000, 30-year loan — near the end of 2008 at a rate of 6.0%. After making principal-and-interest payments of $1,498.88 for more than a decade, your remaining balance is $206,463. If you could get a new loan at 4%, that would reduce your payment to $988.70, a monthly savings of more than $500 — but you’d start the 30-year clock all over again! Fortunately, that’s not the only alternative.

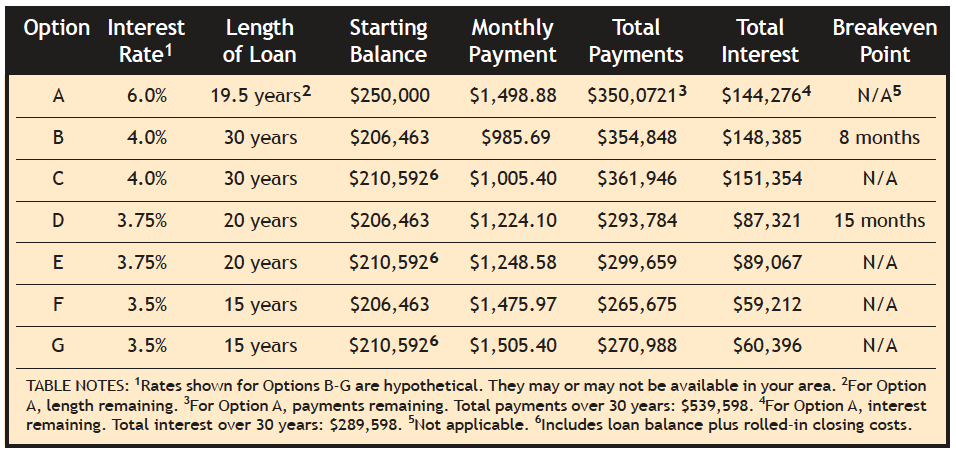

The table below presents seven options:

(A) Staying with the original loan;

(B) Taking out a new 30-year loan with refinancing costs paid upfront;

(C) Getting a 30-year loan with refinancing costs rolled into the mortgage;

(D) Obtaining a 20-year loan with costs paid up front;

(E) Getting a 20-year loan with costs rolled in;

(F) Choosing a 15-year mortgage with costs paid up front; and

(G) Getting a 15-year loan with refinancing costs rolled in.

For each new loan, refinancing costs are estimated to be $4,129, i.e., 2% of the $206,463 loan applied for. Actual costs may be higher or lower and will affect the “breakeven point” shown in the final column. (Refinancing costs can vary greatly from lender to lender. Shop around!)

30 years

Government-sponsored lender Freddie Mac notes that 75% of refinances are from one 30-year loan to another. As you can see by looking at Options B and C below, even though the monthly payment declines substantially with this kind of refinancing, you won’t save on total interest vs. the original loan. Even at the lower rate, a new 30-year loan will require more to be paid interest than if you hadn’t refinanced at all. Also consider that while reducing your monthly payment may seem attractive, what if it comes at the cost of carrying the refinanced mortgage well into your retirement years?

The one positive aspect of Option B is that the substantially lower monthly payment means the estimated upfront cost would be recouped quickly — you’ll “break even” within eight months. (With Option C, the refinancing cost is spread over the full 30 years of the loan.)

20 years

Next, consider Options D and E. These involve refinancing to a 20-year mortgage. Since the existing 30-year loan (Option A) has 19.5 years remaining, moving to a 20-year loan will add a mere six months to the loan-payout term — a reasonable trade-off for cutting overall interest costs, reducing the amount of total payout (relative to the original loan), and lowering the monthly payment (by $250-$275). And with Option D, upfront refinancing costs will be recouped within 15 months.

15 years

Options F and G illustrate refinancing from the original 30-year loan to a 15-year loan. As you can see from the table, the monthly payment for the new mortgage remains roughly the same as for the original loan. Overall interest, however, declines sharply, as does the amount of the total payments.

Because the monthly outlay stays almost the same (relative to the original loan), the upfront refinancing cost of Option F won’t be recouped by a lower payment. However, the interest savings over the term of the loan are substantial and will more than compensate for the refinancing cost.

A faster payoff

Whatever the length of your loan, you can always accelerate your payoff by making prepayments. Suppose you refinanced for 20 years at 3.75% (as in Option D) but you want to pay off the loan in just 17 years. A prepayment calculator will show that to shave three years off your 20-year loan, you would need to add $146.15 to each monthly payment.

Other considerations

Although it may be necessary under some circumstances to refinance simply to lower monthly payments, don’t make that decision in isolation. A lower payment is good, but would refinancing require you to stretch your mortgage debt longer — potentially into your retirement years? Further, if you lower your payment, have you decided what you will do with the money you free up? The best use for it may be to make prepayments on the new mortgage so you can retire the loan as soon as possible.

The most important thing is to determine in advance what you’ll do with the freed-up money. That way you can ensure that “lifestyle creep” doesn’t consume that extra cash flow, leaving you with little to show for refinancing your mortgage.