Ah, that new car smell! Ugh, that new car price.

According to Kelley Blue Book, the 2019 average selling price for a new car is $37,185. No wonder nearly 9 out of 10 new vehicles are financed (the average amount borrowed is $32,590). The length of a new-car loan? The average is just shy of six years.

Not surprisingly, having a monthly car payment is one of the most common roadblocks to achieving financial stability and progress. Here are nine keys to steering clear of car debt and controlling your overall auto expenses.

Break the cycle of financing.

If you’re making payments on a car or truck, determine that this will be the last vehicle you finance. Once your loan is paid off, keep making payments — but send them to a savings account instead of to a lender! Resolve to keep your current vehicle as long as it takes to save enough to buy your next car with cash.Buy the most reliable vehicle you can afford.

An “affordable” car is one you can purchase with cash while still leaving enough in savings for an adequate emergency fund. That likely means you’ll be buying a used vehicle, but it doesn’t necessarily mean you’ll have to sacrifice quality or safety. Well-maintained late-model used cars are widely available, including many that carry a dealer (or even a manufacturer) warranty. A starting point for finding a dependable vehicle is Consumer Reports’ annual “Best Used Cars for Under $20,000” report.Research market pricing and availability online.

Reliable sources of vehicle-value information include kbb.com, nadaguides.com, and edmunds.com. For availability, you can search offerings (from both dealers and private sellers) at cargurus.com, autotrader.com, ebaymotors.com, and craigslist.com. Also check truecar.com (pricing information from 16,000 “certified dealers”) and costcoauto.com (pricing from 3,000 dealers). If you prefer no-haggle pricing, visit carmax.com and carvana.com.

Buyer beware: To pique your interest, some used-car dealers may advertise prices online that are substantially less than prevailing market values. Actual contract prices, however, may include an assortment of fees running into the hundreds or even thousands of dollars. If you’re interested in a car that’s listed at a price that seems significantly lower than market value, send the dealer an email asking for an itemized list of all charges that would be included in the sales contract. Be prepared to walk away from any deal that’s padded with questionable add-on charges.To keep future maintenance costs down, consider a “certified pre-owned” car.

CPO cars, available only from automaker dealerships, are reconditioned late-model vehicles that are still under factory warranty. CPO vehicles tend to cost more than other used cars, but they have relatively low mileage and are typically less than five years old.

“Dealer certified” cars are another option. As with CPO vehicles, these cars are reconditioned and inspected but carry a dealer or third-party warranty (a “vehicle service contract”) rather than a manufacturer warranty.Investigate a vehicle’s history.

A report from Carfax or AutoCheck will tell you if a vehicle has been in an accident or if it’s been used as a rental. (To get a report, you’ll need to supply the car’s license number or Vehicle Identification Number). Some dealers will provide a vehicle-history report for free, or you can purchase one from Carfax for $40 or from AutoCheck for $25.

The website of the National Insurance Crime Bureau has data on whether a car has been reported stolen, damaged, or deemed a total loss by an insurance company that paid a claim on it. Also check with the National Highway Transportation Safety Administration to find out if a vehicle has been subject to any recalls.If buying from a private party, take nothing for granted. Buying a used vehicle from an individual lowers your upfront cost but raises your risk. It’s strictly an “as is” deal with no guarantee, certification, or warranty. To protect yourself, ask to look at all repair records and arrange for a mechanic to inspect the vehicle. Companies such as LemonSquad and Wrench will send a mechanic to where the car is. Expect to pay about $150-$200 for such an inspection.

Consider all the costs.

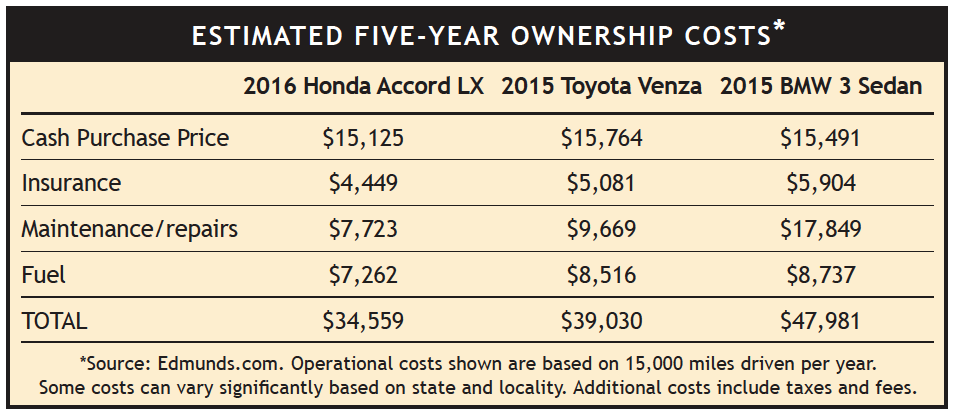

The purchase price is only one part of the car-buying equation. As the nearby table shows, similarly priced vehicles can vary widely in “operational” costs.

Edmunds.com has a “True Cost to Own”® tool that provides projections of ongoing costs. For more-refined insurance estimates, you may want to contact your insurance agent. For additional fuel-efficiency information, go to fueleconomy.gov.

Once you buy a vehicle, keep it maintained. If taken care of, today’s vehicles can last a long time. Budget for regular maintenance ($125-$175 per month is a good ballpark figure) and spend the money to prevent more-costly repairs down the road. Two websites that can help you remember when maintenance is due are repairpal.com and driverside.com.

Conduct a personal attitude check.

For many people, owning a certain make-and-model of car is a source of pride and a badge of “success.” The Christian, however, should find satisfaction not in what he owns but in the One who owns it all. We must always hold the things of this world loosely, viewing them as tools, not treasures. So prayerfully consider what a car means to you.

As you do, keep in mind that high car-buying and ownership costs can slow your progress toward saving for retirement, increasing your giving, and achieving other financial goals. By putting the brakes on car costs, you can accelerate toward more important things.