We’ve updated SMI’s Personal Portfolio Tracker and monthly Fund Performance Rankings with performance data through Feb. 28, 2021.

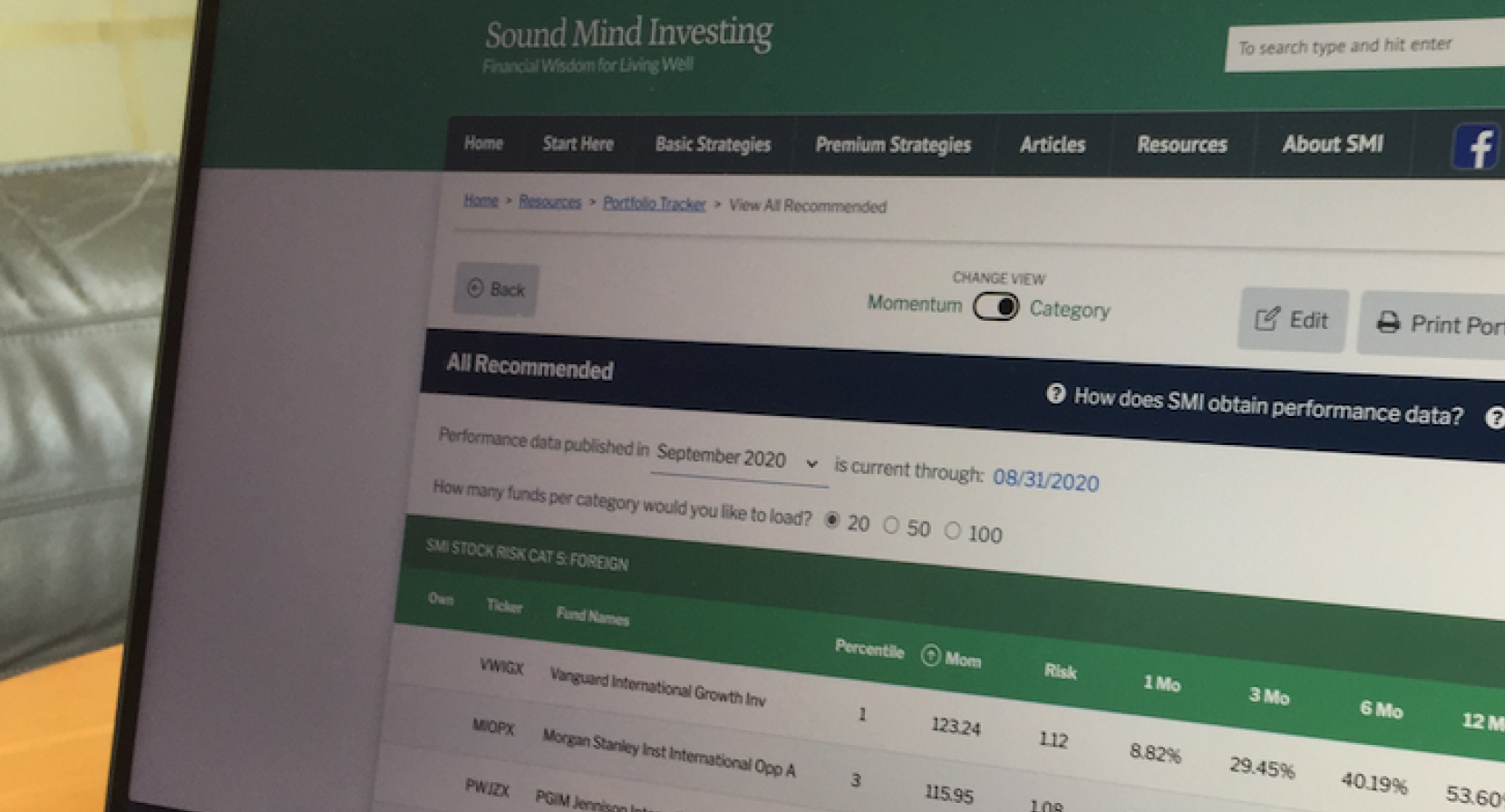

• The Personal Portfolio Tracker: SMI’s fund-performance database tracks the monthly returns of more than 25,000 traditional mutual funds and ETFs. The Tracker can filter that large amount of data and produce a concise report covering only the funds available in your work-based retirement plan, thus making it easier to apply our Fund Upgrading strategy to a 401(k), 403(b), or similar plan.

The SMI newsletter’s Upgrading formula for domestic funds now guides users toward either growth or value funds as appropriate, rather than maintaining both growth and value allocations at all times. Accordingly, the newsletter uses only two domestic categories: Large Company and Small Company.

Tracker portfolios, however, classify holdings according to four domestic stock-fund categories: Large/Growth and Large/Value plus Small/Growth and Small/Value.

This helps members who are using alternatives to our "official" fund recommendations easily gauge (based on the Tracker’s percentile-ranking column) how each fund they own is performing relative to its same-category peers. Upgrading calls for selling a fund when it drops below the 25th percentile, so having a clear view of a fund’s relative performance is important to maintaining that selling discipline.

Also, unlike the newsletter, Tracker portfolios show a separate Foreign category. In the newsletter, Foreign is a subset of the "Situational" category.

Note: Any fund that doesn’t fit within the five categories mentioned above (Large/Growth, Large/Value, Small/Growth, Small/Value, and Foreign) will be displayed by the Tracker in a category labeled "Other Funds."

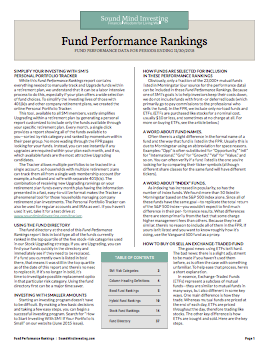

• Fund Performance Rankings (FPR): The FPR report is a 38-page downloadable PDF file containing performance data and SMI’s momentum rankings for more than 1,600 no-load traditional funds and ETFs.

The funds included in the FPR are selected based on asset size, brand familiarity, and brokerage availability.

The Fund Performance Rankings report displays the bulk of domestic stock funds (both traditional funds and ETFs) across these categories: Large/Growth, Large/Value, Small/Growth, Small/Value. Like the Tracker, the FPR also uses the Foreign category. Other FPR categories include Bond funds, Target-Date funds, and Sector funds.

Check page 2 to learn how to use the FPR report. Page 3 includes an overview of the 70+ risk categories that will help you compare "apples to apples." In response to member requests, we have added hyperlinks to Page 3 to make it easier to jump from that page to specific sections within the rankings. Page 4 of the FPR has explanations of the various data-column headings.

End of preview. Please subscribe to read more.

Already a subscriber? Log in here.

Continue reading plus get access to our

objective, time-tested investing strategies.

Get access to Sound Mind Investing’s articles and investing

strategies RISK FREE for 60 days

Not Quite Ready to Become a Member? No Problem, We Still Have Something for You!

Watch our FREE 20-minute video workshop

and learn how to secure profits and achieve

peace of mind, even amidst market volatility.

What You'll Learn:

Start securing your future today.

This free workshop is the perfect place to start.